Taxes In Denmark

Denmark, often praised for its high quality of life and progressive policies, has a tax system that plays a significant role in funding the country's renowned social safety net and public services. This comprehensive overview aims to unravel the intricacies of Danish taxation, shedding light on its structure, rates, and unique features, and exploring how it contributes to the nation's economic and social landscape.

Understanding the Danish Tax System

The Danish tax system is a cornerstone of the country’s economic framework, known for its simplicity and progressive nature. It consists of various taxes, each designed to fund specific aspects of the country’s welfare state, from healthcare and education to social security and infrastructure development.

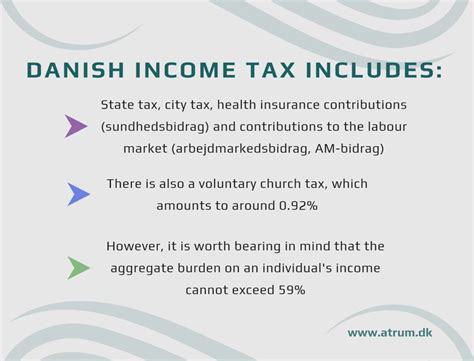

Income Tax

Income tax forms the backbone of Denmark’s tax revenue. It is levied on individuals and businesses, with rates varying based on income brackets. For the tax year 2023, the marginal income tax rate for individuals ranges from 38.5% to 54.9%, depending on the level of income. This progressive tax system ensures that higher earners contribute a larger portion of their income to the public purse.

In addition to the income tax, there's a wealth tax, applicable to individuals with assets exceeding a certain threshold. This tax is levied on assets such as property, savings, and investments, with rates varying from 0.5% to 1.5% depending on the total value of the assets. This tax aims to promote equality and provide a more equitable distribution of wealth.

Value Added Tax (VAT)

Denmark imposes a Value Added Tax (VAT) on most goods and services, similar to many other European countries. The standard VAT rate in Denmark is currently set at 25%, one of the highest in the EU. However, reduced rates of 10% and 0% apply to specific goods and services, including food, books, and healthcare services.

The Danish VAT system is designed to be efficient and transparent, with a focus on minimizing administrative burdens for businesses. The tax is collected at each stage of the production and distribution process, with the final amount paid by the end consumer. This system ensures a fair distribution of tax obligations and provides a stable source of revenue for the government.

Other Taxes

The Danish tax system also includes various other taxes, such as the municipal tax, church tax, and registration tax. The municipal tax, ranging from 23% to 30%, is used to fund local services and infrastructure. The church tax, a voluntary contribution, supports the Danish National Church, while the registration tax applies to certain transactions, such as property sales.

| Tax Type | Rate/Bracket | Applicable To |

|---|---|---|

| Income Tax | 38.5% - 54.9% | Individuals, Businesses |

| Wealth Tax | 0.5% - 1.5% | Individuals with assets over DKK 1,200,000 |

| VAT | 25% (standard), 10% (reduced), 0% (exempt) | Goods, Services |

| Municipal Tax | 23% - 30% | Residents |

| Church Tax | Varies by region | Voluntary, Members of the Danish National Church |

| Registration Tax | Varies by transaction type | Property sales, certain transactions |

The Impact of Danish Taxation

The Danish tax system has a profound impact on the country’s economic and social landscape. The substantial tax revenue collected funds a robust welfare state, which provides Danes with universal healthcare, high-quality education, and a comprehensive social safety net. This, in turn, contributes to Denmark’s consistently high rankings in global quality of life and happiness indices.

Economic Effects

While high taxes can sometimes be a deterrent to foreign investment, Denmark’s tax system has been designed to encourage business activity and innovation. For instance, the country offers a range of tax incentives for research and development, as well as for environmentally friendly investments. These incentives, coupled with a skilled workforce and a stable political environment, have helped Denmark attract significant foreign investment and foster a thriving business environment.

Social Benefits

The tax revenue collected by the Danish government is instrumental in financing the country’s extensive social welfare system. This system includes free universal healthcare, with low co-pays for medications and specialist treatments. It also provides generous parental leave benefits, affordable and high-quality childcare, and a comprehensive pension system. Additionally, Denmark’s unemployment benefits are among the most generous in the world, ensuring that those out of work can maintain a decent standard of living while they seek new employment.

Equality and Redistribution

Denmark’s progressive tax system plays a key role in promoting social equality. By taxing higher incomes and wealth at higher rates, the government aims to reduce income disparities and create a more equitable society. The wealth tax, for instance, helps to ensure that individuals with substantial assets contribute a fair share, thereby reducing the concentration of wealth in the hands of a few.

Challenges and Future Outlook

Despite its many strengths, Denmark’s tax system faces several challenges. One of the primary concerns is the potential burden on businesses, particularly in the face of international competition. High tax rates can make it challenging for Danish companies to remain competitive in the global market. To address this, the government has implemented various tax incentives and reforms aimed at supporting businesses and encouraging investment.

Another challenge is the increasing complexity of the tax system, particularly with the introduction of new digital services and platforms. The government is working to simplify the tax system and enhance its digital capabilities to better accommodate these changes. Additionally, there is ongoing debate about the balance between taxation and public spending, with some advocating for lower taxes to stimulate economic growth, while others emphasize the importance of maintaining a strong welfare state.

Looking ahead, Denmark's tax system is likely to continue evolving to address these challenges and adapt to changing economic and social landscapes. The government will need to carefully navigate the delicate balance between funding public services and maintaining a competitive business environment, while also ensuring that the tax system remains progressive and equitable.

What is the average income tax rate in Denmark?

+

The average income tax rate in Denmark varies based on income brackets. For the tax year 2023, the marginal income tax rate ranges from 38.5% to 54.9% for individuals. The average rate an individual pays depends on their income level and other factors such as deductions and credits.

Are there any tax incentives for businesses in Denmark?

+

Yes, Denmark offers various tax incentives to encourage business activity and innovation. These include tax deductions for research and development, tax breaks for environmentally friendly investments, and reduced tax rates for specific industries or sectors.

How does Denmark’s tax system compare to other European countries?

+

Denmark’s tax system is characterized by its progressive nature and relatively high tax rates, particularly for income and VAT. While it shares similarities with other European countries, such as the use of VAT and progressive income tax, Denmark’s rates are often higher. However, this is balanced by the country’s robust social welfare system and the various tax incentives offered to businesses.