Tax Rate For Switzerland

Welcome to this in-depth exploration of the tax landscape in Switzerland, a country renowned for its stability, prosperity, and unique tax system. Switzerland's taxation policies are diverse and vary significantly depending on the canton, municipality, and the specific circumstances of the taxpayer. This article aims to provide a comprehensive understanding of the tax rate structure in Switzerland, offering valuable insights for individuals and businesses considering a move to this captivating country.

Understanding Switzerland’s Tax System: A Complex Yet Advantageous Structure

Switzerland’s tax system is a complex interplay of federal, cantonal, and municipal laws, resulting in a diverse and often advantageous tax environment. The country’s tax rates are generally competitive, offering attractive opportunities for businesses and high-net-worth individuals. Here’s a detailed breakdown of the key aspects of Switzerland’s tax system.

Federal Taxation

The federal government levies taxes on income, value-added tax (VAT), and various other taxes. The Federal Act on Direct Federal Tax governs the federal income tax, which is applied at a flat rate of 8.5% on corporate profits. However, this rate can be reduced through various tax incentives and deductions.

| Federal Tax Rate | Income |

|---|---|

| Corporate Tax | 8.5% |

The Federal Act on Value-Added Tax mandates a VAT rate of 7.7% for most goods and services. However, certain goods, such as basic foodstuffs, books, and newspapers, are subject to a reduced rate of 2.5%, while some services are exempt from VAT.

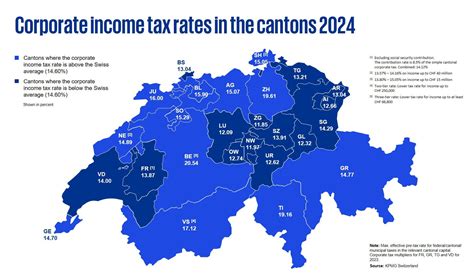

Cantonal and Municipal Taxation

Switzerland’s 26 cantons and over 2,000 municipalities impose their own taxes, leading to a wide range of tax rates and incentives across the country. This cantonal and municipal taxation system allows for significant variation in tax burdens, making certain regions more attractive for businesses and individuals.

| Cantonal Tax Rates | Income |

|---|---|

| Highest Rate | 24.1% |

| Lowest Rate | 10.5% |

The Cantonal and Municipal Tax Act governs the taxation of individuals and corporations at the cantonal and municipal levels. Cantonal tax rates can vary significantly, with the highest rate reaching 24.1% and the lowest at 10.5%. Municipal tax rates further add to the complexity, with some municipalities offering attractive tax rates to attract businesses and residents.

Tax Incentives and Deductions

Switzerland offers a range of tax incentives and deductions to promote business growth and attract high-net-worth individuals. These include:

- Research and Development (R&D) Deductions: Corporations can benefit from a 150% tax deduction for R&D expenses, making Switzerland an attractive hub for innovative businesses.

- Holding Company Regime: This regime offers favorable tax rates for holding companies, making Switzerland a popular choice for international corporations.

- Mixed Company Regime: This regime allows certain companies to benefit from reduced tax rates, provided they meet specific criteria.

- Cantonal Tax Incentives: Cantons often provide tax incentives to attract businesses, such as reduced tax rates or tax holidays, making certain regions particularly appealing for startups and established companies.

The Impact of Switzerland’s Tax System on the Economy

Switzerland’s unique tax system has had a profound impact on its economic landscape. The country’s low corporate tax rates, coupled with its stable political and economic environment, have made it a hub for multinational corporations and high-net-worth individuals. Here’s a closer look at how Switzerland’s tax system has influenced its economic growth.

Attracting Foreign Investment

Switzerland’s competitive tax rates, particularly at the cantonal and municipal levels, have made it an attractive destination for foreign investment. Multinational corporations are drawn to the country’s stable economy, efficient infrastructure, and favorable tax environment. The flexibility offered by cantonal tax rates allows corporations to negotiate advantageous tax deals, further enhancing Switzerland’s appeal as an investment hub.

Promoting Innovation and R&D

Switzerland’s generous R&D tax deductions have fostered an environment conducive to innovation. By offering a 150% tax deduction on R&D expenses, the country has encouraged businesses to invest in research, leading to significant advancements in various industries. This has not only boosted the economy but has also positioned Switzerland as a leader in innovation and technology.

Enhancing the Wealth Management Sector

Switzerland’s reputation as a safe haven for wealth has been bolstered by its favorable tax rates for high-net-worth individuals. The country’s privacy laws and stable financial system, combined with competitive tax rates, have made it a top choice for wealth management. The wealth management sector in Switzerland has thrived, attracting international clients seeking discreet and efficient wealth management services.

Supporting Small and Medium Enterprises (SMEs)

Switzerland’s tax system has been designed to support SMEs, which form a significant portion of the country’s economy. By offering reduced tax rates and various incentives, the government has encouraged the growth of SMEs, creating jobs and contributing to the country’s overall economic prosperity. This support for SMEs has fostered a dynamic business environment, promoting entrepreneurship and innovation.

The Future of Switzerland’s Tax System: A Balancing Act

As Switzerland navigates the evolving global economic landscape, its tax system is poised to adapt and evolve. Here’s an analysis of the potential future directions and challenges facing Switzerland’s tax system.

Addressing International Tax Reforms

With the ongoing global push for tax transparency and the implementation of initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project, Switzerland will need to adapt its tax system to align with international standards. This may involve revisions to its tax treaties and a shift towards more transparent tax practices.

Maintaining Competitiveness

Switzerland’s tax system has been a key factor in its economic success, but maintaining its competitiveness in a rapidly changing global economy will be a challenge. The country will need to carefully balance its tax rates and incentives to continue attracting foreign investment and talent, while also ensuring that its tax system remains fair and sustainable.

Promoting Sustainable Development

As the world moves towards more sustainable practices, Switzerland’s tax system may need to evolve to support and encourage sustainable development. This could involve tax incentives for green technologies, renewable energy, and sustainable business practices, aligning the country’s tax policies with its commitment to environmental stewardship.

Ensuring Social Equity

While Switzerland’s tax system has largely benefited businesses and high-net-worth individuals, there is a growing focus on ensuring social equity. The country may need to address issues such as wealth inequality and the fair distribution of tax burdens to ensure that its tax system remains socially just and supports the well-being of all its citizens.

Conclusion

Switzerland’s tax system is a complex yet advantageous structure, offering a wide range of benefits to businesses and individuals. The country’s low corporate tax rates, coupled with its stable political and economic environment, have made it a top destination for foreign investment and wealth management. However, as the global economic landscape evolves, Switzerland will need to adapt its tax system to remain competitive, promote sustainable development, and ensure social equity.

For those considering a move to Switzerland, understanding the country's tax system is crucial. With a deep dive into the tax rates, incentives, and potential future developments, this article provides a comprehensive guide to navigating Switzerland's unique tax landscape. Remember, the tax environment can vary significantly depending on your specific circumstances, so it's essential to seek professional advice to ensure you're optimizing your tax position.

What is the average tax rate for individuals in Switzerland?

+

The average tax rate for individuals in Switzerland can vary significantly depending on the canton and municipality. The cantonal tax rate can range from 10.5% to 24.1%, while municipal tax rates further add to the variation. It’s important to consider these variations when planning your tax strategy.

Are there any tax incentives for startups in Switzerland?

+

Yes, Switzerland offers a range of tax incentives to attract startups. These include reduced tax rates, tax holidays, and various cantonal programs designed to support innovation and entrepreneurship. These incentives can significantly reduce the tax burden for startups, making Switzerland an attractive hub for new businesses.

How does Switzerland’s tax system impact its reputation as a financial hub?

+

Switzerland’s tax system, particularly its privacy laws and competitive tax rates, has contributed significantly to its reputation as a financial hub. The country’s ability to offer discretion and favorable tax conditions has made it a top choice for wealth management and international banking. However, with increasing global pressure for tax transparency, Switzerland is also adapting its system to align with international standards.