Nyc Car Sales Tax

When it comes to purchasing a vehicle in New York City, understanding the tax landscape is crucial. The New York State Sales and Use Tax applies to most tangible personal property, including cars, and it's essential to navigate this tax system to ensure a smooth and financially sound transaction. This article aims to provide an in-depth analysis of the NYC car sales tax, offering insights into rates, exemptions, and strategies to manage this aspect of the car-buying process effectively.

Understanding the NYC Car Sales Tax Landscape

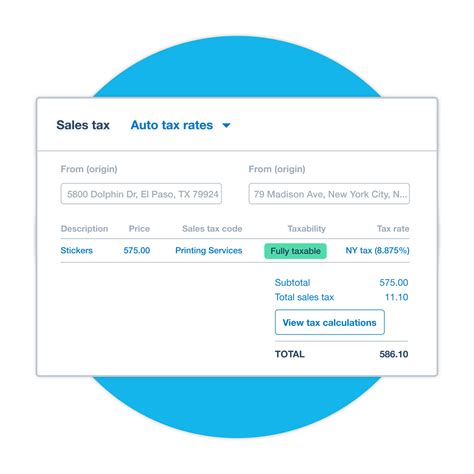

The NYC car sales tax is a complex topic, encompassing various taxes and fees. At its core, the tax is levied on the purchase price of the vehicle, but it’s not as simple as a flat rate. The tax rate can vary depending on several factors, including the type of vehicle, its value, and the location of the dealership.

For instance, the New York State Sales Tax is a flat rate of 4%, but this is just the starting point. Additional taxes and fees can apply, such as the New York City Sales Tax, which varies by county within the city. Manhattan, for example, has a sales tax rate of 4.5%, while other boroughs like Staten Island have a slightly lower rate of 4.375%.

Beyond these base taxes, there are also other fees and surcharges to consider. One notable example is the Metropolitan Commuter Transportation District (MCTD) Surcharge, which is an additional 0.375% tax applied to car purchases in New York City and certain counties in the region. This surcharge funds public transportation improvements.

Furthermore, the type of vehicle can impact the tax calculation. Electric vehicles (EVs) and alternative fuel vehicles often enjoy tax incentives or rebates, making them a more attractive option for environmentally conscious buyers. On the other hand, luxury vehicles or those with high retail values may face additional luxury taxes.

Breaking Down the Tax Components

Let’s delve into the specific taxes and fees that make up the NYC car sales tax:

| Tax/Fee | Rate | Description |

|---|---|---|

| New York State Sales Tax | 4% | A state-wide tax applied to most tangible personal property purchases. |

| New York City Sales Tax | Varies (4.375% - 4.5%) | A local sales tax that varies by county within NYC. |

| Metropolitan Commuter Transportation District (MCTD) Surcharge | 0.375% | An additional tax to support public transportation improvements. |

| Luxury Tax | Varies | Applies to vehicles exceeding a certain retail value threshold. |

| Registration Fees | Varies | Fees for registering the vehicle with the Department of Motor Vehicles. |

| Title Fees | Varies | Fees associated with transferring the vehicle's title. |

Navigating Tax Exemptions and Incentives

While the NYC car sales tax can be complex, there are certain exemptions and incentives that can alleviate the financial burden. Understanding these opportunities can significantly impact the overall cost of your vehicle purchase.

Tax Exemptions for Certain Buyers

Some individuals or organizations may be eligible for tax exemptions when purchasing a vehicle. These exemptions can vary based on factors such as the buyer’s status, the vehicle’s intended use, or the organization’s nature.

For example, individuals with disabilities may qualify for tax exemptions on certain vehicle modifications. Non-profit organizations often have exemptions for vehicles used exclusively for their charitable purposes. Additionally, some government entities and educational institutions may be exempt from certain taxes.

Incentives for Environmentally Friendly Vehicles

New York State and NYC encourage the adoption of environmentally friendly vehicles by offering tax incentives and rebates. These incentives can significantly reduce the overall cost of purchasing an electric vehicle (EV) or a vehicle that runs on alternative fuels.

The Clean Pass Incentive is one such program. It provides a $2,000 tax credit for the purchase of a new electric vehicle, making these eco-friendly options more affordable. Additionally, there are federal tax credits available for EV purchases, further reducing the financial burden.

Luxury Tax Exemptions

While luxury vehicles often face additional taxes, there are scenarios where these taxes can be avoided. For instance, if the vehicle is purchased for business purposes and will be primarily used for business travel, it may qualify for a luxury tax exemption.

Furthermore, some states offer luxury tax exemptions for certain vehicle types. For instance, New York State provides a luxury tax exemption for hybrid vehicles, making them a more appealing option for cost-conscious buyers.

Strategies for Managing NYC Car Sales Tax

Navigating the NYC car sales tax landscape can be challenging, but with the right strategies, it’s possible to minimize the impact on your wallet. Here are some tips to help you manage this aspect of the car-buying process effectively.

Research and Compare Dealers

Dealer prices and tax rates can vary, so it’s crucial to shop around and compare. Research multiple dealerships, both within NYC and in nearby areas, to find the best deal. Remember, while tax rates may differ, the savings on the vehicle price can offset any tax differences.

Consider Trade-Ins and Negotiate

Trading in your old vehicle can help reduce the overall cost of the new car. Dealers often offer trade-in incentives, which can be especially beneficial when combined with tax savings. Negotiate the trade-in value to get the best deal, and don’t be afraid to shop around for the highest offer.

Utilize Tax Exemptions and Incentives

As discussed earlier, tax exemptions and incentives can significantly reduce the financial burden of purchasing a vehicle. Make sure to research and understand which exemptions or incentives you may be eligible for, and don’t hesitate to ask the dealership about these opportunities.

Plan Your Purchase Timing

The timing of your vehicle purchase can impact the taxes you pay. For instance, some dealerships offer tax-free weekends or holidays, where certain taxes are waived. Planning your purchase around these events can result in significant savings. Additionally, consider the end of the month or quarter, as dealerships may offer better deals to meet sales quotas.

Explore Financing Options

Financing options can impact the overall cost of the vehicle. Some dealerships offer financing with tax benefits, such as tax deductions on interest payments. Explore these options and compare them with traditional financing to find the most cost-effective solution.

Stay Informed and Seek Professional Advice

The NYC car sales tax landscape can be intricate, so staying informed is crucial. Keep up-to-date with tax changes and new incentives. If you’re unsure about your eligibility for certain exemptions or the best financing option, consider seeking professional advice from a tax consultant or financial advisor.

Conclusion: A Well-Informed Approach to NYC Car Sales Tax

Navigating the NYC car sales tax is a complex but manageable process. By understanding the tax rates, exemptions, and incentives, you can make informed decisions that minimize the financial impact of your vehicle purchase. Remember, every aspect of the car-buying process, from dealer selection to timing, can influence the taxes you pay.

Stay vigilant, research thoroughly, and don't hesitate to seek expert advice. With a well-informed approach, you can ensure that your dream car purchase is not only a joy to own but also a financially sound decision.

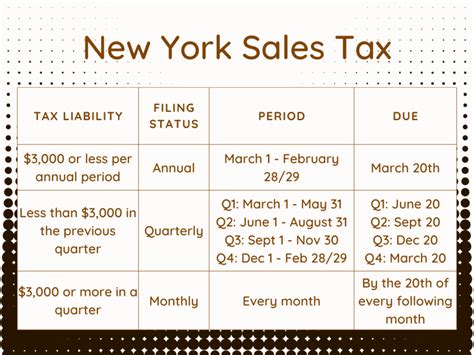

What is the current NYC car sales tax rate?

+The current NYC car sales tax rate varies based on the location of the dealership. It includes the New York State Sales Tax (4%) and the New York City Sales Tax, which ranges from 4.375% to 4.5%. Additionally, there is a Metropolitan Commuter Transportation District (MCTD) Surcharge of 0.375%.

Are there any tax incentives for buying an electric vehicle in NYC?

+Yes, New York State and NYC offer tax incentives and rebates for the purchase of electric vehicles (EVs) and alternative fuel vehicles. The Clean Pass Incentive provides a $2,000 tax credit for new EV purchases, and there are also federal tax credits available.

Do I qualify for any tax exemptions when buying a car in NYC?

+Certain individuals and organizations may be eligible for tax exemptions. This includes exemptions for individuals with disabilities, non-profit organizations, and vehicles used exclusively for business purposes. It’s important to consult the official guidelines to determine your eligibility.

How can I minimize the impact of NYC car sales tax on my purchase?

+To minimize the impact of NYC car sales tax, research and compare dealers, negotiate trade-ins, utilize tax exemptions and incentives, plan your purchase timing (e.g., tax-free weekends), explore financing options, and stay informed about tax changes and new incentives.

Where can I find the most up-to-date information on NYC car sales tax rates and regulations?

+For the most current and accurate information on NYC car sales tax rates and regulations, refer to the official sources such as the New York State Department of Taxation and Finance. They provide detailed guidelines and updates on tax rates, exemptions, and incentives.