Tax Quotation

Welcome to a comprehensive guide on the intricate world of tax quotations. In this article, we will delve into the depths of tax quotations, exploring their significance, practical applications, and the impact they have on businesses and individuals alike. Tax quotations are an essential aspect of financial planning and management, providing valuable insights into the potential tax liabilities and obligations. With the right understanding and strategic approach, tax quotations can be a powerful tool for optimizing financial strategies and ensuring compliance with tax regulations.

Understanding Tax Quotations: A Fundamental Overview

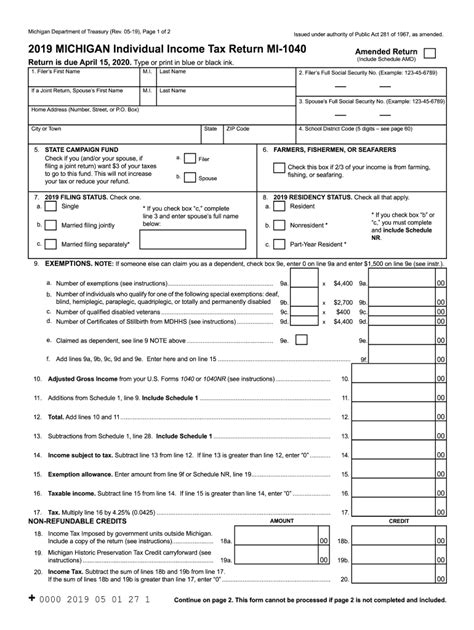

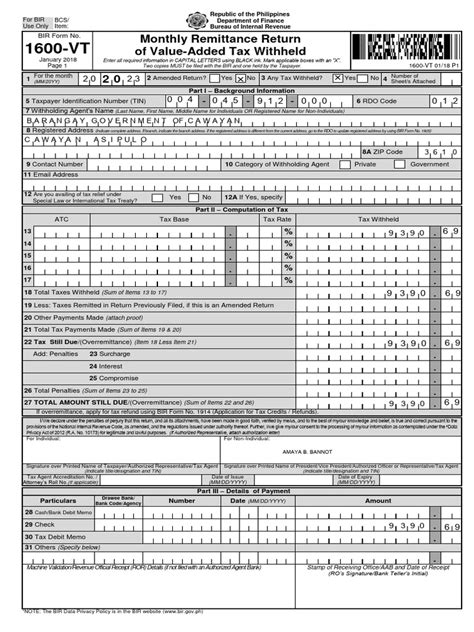

Tax quotations, often referred to as tax estimates or quotes, are professional evaluations of an individual’s or a business’s potential tax liability for a specific period. These quotations are generated by tax professionals, such as accountants or tax advisors, based on a thorough analysis of financial data and applicable tax laws. They serve as a predictive tool, providing a realistic estimate of the taxes that will be due at the end of a fiscal year or a specific tax period.

The process of tax quotation involves a meticulous examination of various financial factors, including income sources, deductions, credits, and applicable tax rates. By considering these elements, tax professionals can provide an accurate and tailored estimate of the tax liability. This estimation process is crucial for individuals and businesses as it allows them to plan their financial strategies, budget effectively, and ensure timely tax payments.

Key Components of a Tax Quotation

A well-structured tax quotation typically includes the following key components:

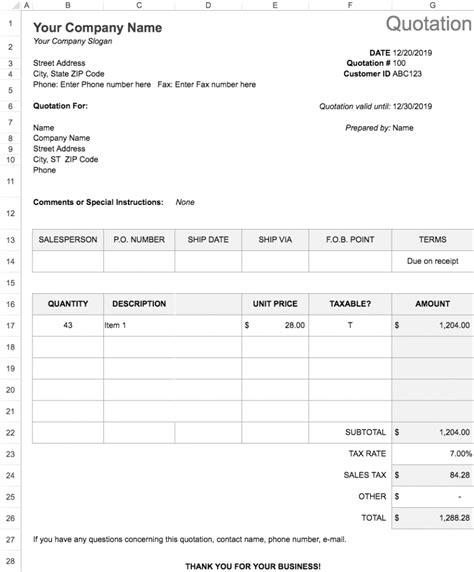

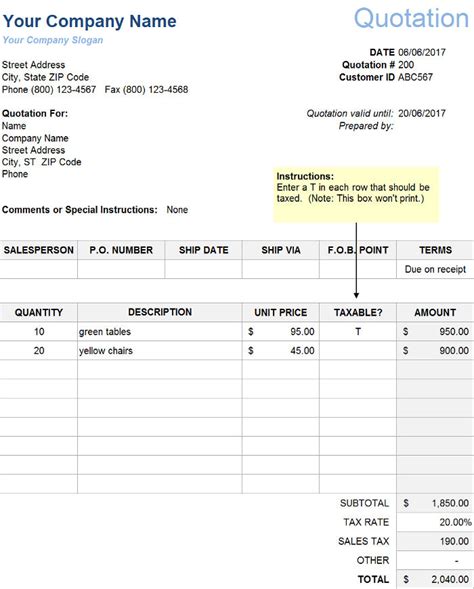

- Taxable Income: This refers to the income subject to taxation, which may include salaries, wages, business profits, investment earnings, and other relevant sources.

- Deductions and Credits: Tax quotations take into account allowable deductions and credits, such as business expenses, charitable contributions, and personal exemptions, which can reduce the overall taxable income.

- Applicable Tax Rates: Tax professionals consider the tax rates applicable to different income brackets and tax jurisdictions, ensuring an accurate estimate of the tax liability.

- Tax Calculations: The tax quotation provides a detailed breakdown of the tax calculations, including the application of tax rates, deductions, and credits, resulting in an estimated tax amount.

- Payment Options: Tax quotations often include suggestions for payment methods and timelines, helping individuals and businesses plan their tax payments efficiently.

| Tax Component | Description |

|---|---|

| Income Tax | Tax levied on personal income, with varying rates depending on income brackets. |

| Corporate Tax | Tax imposed on the profits of corporations, often calculated as a percentage of net income. |

| Sales Tax | Tax applied to the sale of goods and services, typically calculated as a percentage of the selling price. |

| Property Tax | Tax levied on real estate and personal property, based on the assessed value of the property. |

| Estate Tax | Tax on the transfer of assets upon an individual's death, often applied to large estates. |

The Practical Applications of Tax Quotations

Tax quotations serve a multitude of practical purposes, benefiting both individuals and businesses in their financial management and strategic planning. Here are some key applications of tax quotations:

Financial Planning and Budgeting

Tax quotations provide a clear picture of potential tax liabilities, allowing individuals and businesses to allocate their financial resources effectively. By understanding the estimated tax burden, they can budget accordingly, ensuring sufficient funds are available for tax payments without compromising other financial obligations.

Strategic Tax Planning

With tax quotations in hand, tax professionals can guide individuals and businesses in optimizing their tax strategies. This may involve identifying opportunities for tax deductions, credits, or deferrals, all of which can reduce the overall tax liability. Strategic tax planning can lead to significant savings and improved financial outcomes.

Compliance and Avoidance of Penalties

Tax quotations help ensure compliance with tax regulations. By providing an accurate estimate of tax liabilities, individuals and businesses can avoid underpayment penalties and interest charges. Timely and informed tax payments, guided by tax quotations, contribute to maintaining a good standing with tax authorities.

Cash Flow Management

For businesses, tax quotations are essential for effective cash flow management. By understanding the timing and magnitude of tax payments, businesses can plan their cash flows, ensuring they have sufficient liquidity to meet tax obligations while maintaining operational activities.

Decision-Making and Forecasting

Tax quotations offer valuable insights for decision-making processes. Whether it’s evaluating the financial implications of a business expansion, considering investment opportunities, or assessing the impact of personal financial decisions, tax quotations provide a reliable basis for forecasting and strategic decision-making.

The Process of Obtaining a Tax Quotation

The process of obtaining a tax quotation typically involves the following steps:

- Gathering Financial Information: Tax professionals require detailed financial records, including income statements, expense records, and relevant tax documents. This information forms the foundation for the tax quotation.

- Analysis and Evaluation: Tax experts analyze the financial data, applying their expertise in tax laws and regulations. They identify relevant deductions, credits, and tax rates to provide an accurate estimate.

- Calculation and Estimation: Using specialized software and their professional knowledge, tax professionals calculate the estimated tax liability. This calculation takes into account the unique circumstances of the individual or business.

- Review and Refinement: The tax quotation is reviewed with the client, ensuring accuracy and clarity. Any adjustments or clarifications are made based on the client’s feedback.

- Finalization and Delivery: Once approved, the tax quotation is finalized and delivered to the client, often accompanied by recommendations and guidance for tax planning and compliance.

Future Implications and Trends in Tax Quotations

The field of tax quotations is evolving alongside advancements in technology and changes in tax regulations. Here are some future implications and trends to consider:

Automation and Technology

The use of automated tax software and artificial intelligence is expected to streamline the process of tax quotations. These technologies can enhance accuracy, speed up calculations, and provide real-time updates, making tax quotations more efficient and accessible.

Changing Tax Landscapes

Tax regulations are subject to frequent updates and amendments. Tax professionals must stay abreast of these changes to provide accurate quotations. As tax landscapes evolve, tax quotations will need to adapt to reflect new deductions, credits, and tax rates.

Global Tax Considerations

In an increasingly globalized world, individuals and businesses often face complex tax situations across multiple jurisdictions. Tax quotations will need to address these complexities, providing guidance on international tax obligations and potential tax savings opportunities.

Sustainable Tax Strategies

There is a growing emphasis on sustainable and ethical tax practices. Tax quotations may incorporate considerations for environmental, social, and governance (ESG) factors, guiding individuals and businesses toward tax strategies that align with their sustainability goals.

Conclusion: Navigating the Complex World of Taxes

Tax quotations are a vital tool in the financial toolkit, offering a glimpse into the complex world of taxes. By understanding the process, practical applications, and future trends in tax quotations, individuals and businesses can make informed decisions, optimize their tax strategies, and navigate the tax landscape with confidence. With the guidance of tax professionals and a strategic approach, tax quotations can be a powerful asset in achieving financial success and compliance.

What is the difference between a tax quotation and a tax estimate?

+While both terms are often used interchangeably, a tax quotation typically refers to a more formal and detailed evaluation provided by a tax professional. It includes a comprehensive analysis of financial data and tax laws, resulting in a precise estimate of tax liability. On the other hand, a tax estimate may be a more informal assessment, providing a general idea of tax obligations without the depth of a quotation.

How often should I seek a tax quotation?

+The frequency of seeking tax quotations depends on your financial circumstances and the complexity of your tax situation. As a general guideline, it is advisable to obtain a tax quotation annually, especially before filing your tax returns. However, significant life events, business changes, or major financial decisions may warrant more frequent quotations to ensure accurate tax planning.

Can tax quotations be used to reduce tax liabilities?

+Absolutely! Tax quotations are an essential tool for strategic tax planning. By understanding your potential tax liabilities, you can work with tax professionals to identify deductions, credits, and tax-saving strategies. These strategies can help minimize your tax burden and maximize your financial outcomes.

Are tax quotations legally binding?

+No, tax quotations are not legally binding. They serve as estimates and guides for tax planning purposes. However, it is crucial to work with reputable tax professionals who provide accurate and reliable quotations. While tax quotations are not binding, they can significantly influence your tax obligations and should be treated with care and consideration.