Tax Lien Homes For Sale

Welcome to the fascinating world of investing in tax lien properties! Tax lien sales are an intriguing opportunity for real estate investors, offering a unique approach to acquiring properties with potential for significant returns. This comprehensive guide will delve into the intricacies of this niche market, providing you with an expert's perspective on the process, benefits, and considerations of purchasing tax lien homes.

The Basics of Tax Lien Sales

In the realm of real estate, tax lien sales are a specialized form of property acquisition. It is a process where a governmental entity, usually a county or municipality, sells a tax lien on a property to recover unpaid property taxes. The lien acts as a legal claim on the property, allowing the lien holder certain rights, including the potential to acquire the property if the original owner fails to redeem the lien.

The tax lien sale process is a powerful tool for governments to ensure tax compliance while also offering a unique investment opportunity. Investors have the chance to purchase these liens, which carry the possibility of becoming the new owner of the property if certain conditions are met.

Understanding the Timeline

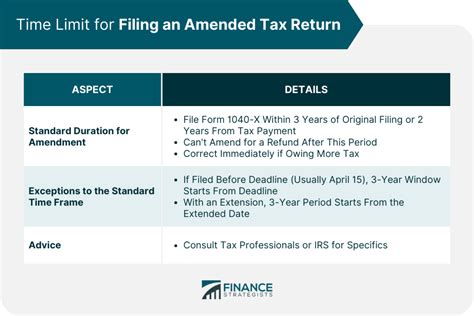

The tax lien sale timeline varies depending on jurisdiction but generally follows a structured path. It typically begins with the property owner failing to pay their annual property taxes. After a set period, usually a year or more, the governmental entity issues a Notice of Lien, officially placing a lien on the property. If the taxes remain unpaid, the property is then scheduled for a tax lien sale, where investors have the opportunity to purchase the lien.

At this point, the property owner still has the right to redeem the lien by paying off the taxes, interest, and any associated fees. If the owner does not redeem within a specified timeframe, the lien holder can initiate the process to become the new owner of the property, often through a tax deed sale or similar procedure.

| Jurisdiction | Lien Redemption Period |

|---|---|

| Florida | 2 years |

| Colorado | 3 years |

| Illinois | 1 year |

| Georgia | 18 months |

The Benefits of Investing in Tax Lien Homes

Investing in tax lien properties offers a range of advantages, making it an appealing strategy for certain investors.

Potential for High Returns

One of the most attractive aspects of tax lien investing is the potential for substantial returns. When a lien is purchased, the investor is essentially lending money to the property owner, with the property as collateral. If the owner redeems the lien, the investor receives their initial investment plus interest and penalties, often at a high rate. For instance, in Florida, investors can earn an annual interest rate of 18% on their investment.

If the owner fails to redeem, the investor has the opportunity to acquire the property, often at a significantly discounted price compared to its market value. This can lead to substantial capital gains when the property is resold or rented out.

Low Entry Barrier

Tax lien investing has a relatively low barrier to entry. Investors can often participate in tax lien sales with a minimal investment, sometimes as low as a few hundred dollars. This makes it accessible to a wide range of investors, including those who are just starting out in real estate.

Diversification

Adding tax lien investments to a real estate portfolio can provide diversification. Unlike traditional real estate investments, tax lien investing focuses on the legal process rather than the physical property. This means investors are not tied to the typical maintenance, repairs, or management associated with rental properties.

Stable and Predictable Process

The tax lien sale process is governed by state and local laws, providing a level of stability and predictability. Investors can rely on a well-defined legal framework, reducing the uncertainty often associated with real estate transactions. The clear timelines and procedures make it easier to assess the risks and plan strategies.

Considerations and Risks

While tax lien investing offers many benefits, it is essential to understand the potential risks and challenges.

Redemption Risk

The primary risk in tax lien investing is the property owner redeeming the lien. If the owner pays off the taxes and associated fees, the investor only receives their initial investment plus any accrued interest. This can limit the potential returns, especially if the investor had hoped to acquire the property.

Due Diligence

Conducting thorough due diligence is crucial in tax lien investing. Investors must research the property, its ownership, and any potential encumbrances. Failure to do so can lead to unexpected complications, such as discovering liens held by other investors or undisclosed mortgages.

Property Condition

When acquiring a property through a tax lien, investors may not have the opportunity to inspect the property beforehand. This can lead to surprises, such as discovering significant repairs or maintenance issues. It is important to budget for potential renovations and understand the local market to accurately assess the property’s value.

Expert Strategies for Tax Lien Investing

To maximize returns and minimize risks, investors can employ various strategies when participating in tax lien sales.

Research and Analysis

Conducting extensive research is crucial. Investors should familiarize themselves with the local tax lien laws, procedures, and timelines. Understanding the specific rules and regulations can provide a competitive edge. Additionally, researching the properties themselves, including their ownership history, tax assessments, and market value, can help identify the most promising opportunities.

Diversify Your Portfolio

Spreading your investment across multiple liens can mitigate risk. By diversifying, you reduce the impact of any single lien being redeemed. This strategy allows you to balance the potential for high returns with a more conservative approach.

Consider Redemption Periods

The length of the redemption period can significantly impact your strategy. In jurisdictions with shorter redemption periods, there is a higher likelihood of acquiring the property. Conversely, longer redemption periods may offer more time for the property owner to redeem, but they also provide more time for the property’s value to appreciate.

Collaborate with Professionals

Working with professionals, such as real estate attorneys or experienced tax lien investors, can provide valuable insights and guidance. They can help navigate the legal complexities, ensure compliance with regulations, and provide strategic advice tailored to your goals.

Conclusion

Investing in tax lien homes is a unique and potentially lucrative strategy in the world of real estate. It offers a blend of financial rewards, low barriers to entry, and the excitement of potentially acquiring properties at a discount. However, it also comes with risks and complexities that require careful consideration and strategic planning.

By understanding the process, conducting thorough research, and employing expert strategies, investors can navigate the tax lien market successfully. Remember, like any investment, tax lien investing requires a well-informed approach and a willingness to adapt to the dynamic nature of the real estate market.

What is the difference between a tax lien and a tax deed sale?

+A tax lien sale is the initial process where investors purchase liens on properties with unpaid taxes. If the property owner does not redeem the lien, the investor can initiate a tax deed sale, which is a separate legal process to acquire the property. In a tax deed sale, the investor becomes the new owner of the property, typically free and clear of any outstanding taxes or liens.

How can I find tax lien sales in my area?

+Tax lien sale information is typically published by the local government, often on their official website. You can also find listings through specialized tax lien investment platforms or by attending local tax lien sales events. It’s important to research the specific procedures and timelines for your jurisdiction.

Are there any tax benefits for investors in tax lien properties?

+Yes, investors in tax lien properties may be eligible for certain tax benefits. For example, in the United States, the interest earned on tax liens is often tax-free at the federal level. Additionally, if an investor acquires a property through a tax deed sale, they may be able to claim certain tax deductions related to the property ownership and maintenance.