Tax Express

In the fast-paced world of modern finance, efficient and streamlined tax solutions have become essential for both businesses and individuals. The rise of digital platforms and automation has led to a revolution in the way we approach tax management, offering unparalleled convenience and accuracy. Among the numerous options available, Tax Express has emerged as a prominent player, offering a unique and innovative approach to tax services.

This article aims to provide an in-depth exploration of Tax Express, delving into its features, benefits, and the impact it has on the tax landscape. By examining its functionality, real-world applications, and user experiences, we will uncover why Tax Express is a game-changer in the realm of tax preparation and filing.

Revolutionizing Tax Services: An Introduction to Tax Express

Tax Express is a cutting-edge tax preparation and filing platform designed to simplify the complex world of taxation. Developed by a team of experienced tax professionals and tech experts, it combines advanced algorithms, machine learning, and intuitive design to offer a seamless and efficient tax management experience.

Unlike traditional tax services that often involve tedious paperwork and lengthy processes, Tax Express operates on a digital platform, leveraging the power of technology to streamline tax-related tasks. Its user-friendly interface and comprehensive features make it accessible to a wide range of users, from small business owners to individual taxpayers.

The platform boasts an impressive array of tools and functionalities, including automated data retrieval, intelligent tax calculation, and secure online filing. With Tax Express, users can navigate the intricacies of tax laws and regulations with ease, ensuring accuracy and compliance while saving valuable time and resources.

Key Features and Benefits of Tax Express

Tax Express offers a multitude of features that set it apart from conventional tax services. Let's explore some of its standout capabilities:

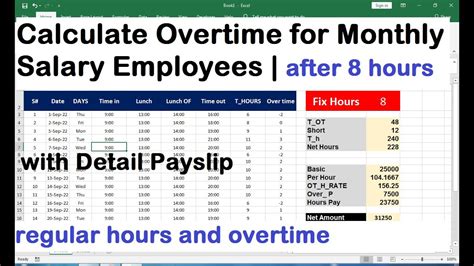

- Intelligent Tax Calculation: Tax Express employs advanced algorithms and machine learning to analyze user data and provide accurate tax calculations. By considering various factors such as income sources, deductions, and tax credits, it generates precise tax estimates, minimizing the risk of errors.

- Automated Data Retrieval: One of the most time-saving features of Tax Express is its ability to automatically retrieve user data from various sources. It seamlessly integrates with banking institutions, investment platforms, and other financial entities, gathering the necessary information to populate tax forms accurately.

- Real-Time Tax Updates: Staying up-to-date with the latest tax laws and regulations can be a challenge. Tax Express addresses this issue by providing real-time updates, ensuring that users have access to the most current tax information. This feature keeps users informed about any changes that may impact their tax obligations.

- Secure Online Filing: Security is a top priority for Tax Express. The platform utilizes robust encryption protocols to safeguard user data during online filing. With end-to-end encryption, users can rest assured that their sensitive information remains protected throughout the filing process.

- User-Friendly Interface: Tax Express prioritizes user experience, offering an intuitive and easy-to-navigate interface. The platform is designed with simplicity in mind, making it accessible to users with varying levels of technical expertise. Its straightforward layout guides users through the tax preparation process, providing clear instructions and helpful tips.

Real-World Applications: How Tax Express Transforms Tax Management

Tax Express has proven to be a game-changer for businesses and individuals alike, revolutionizing the way they approach tax management. Let's delve into some real-world scenarios where Tax Express has made a significant impact:

Small Business Owners

For small business owners, tax management can be a daunting task, often requiring significant time and resources. Tax Express simplifies this process, enabling business owners to focus on their core operations. With its automated data retrieval and intelligent tax calculation, Tax Express eliminates the need for manual data entry and reduces the risk of errors. Business owners can quickly generate tax reports, track deductions, and stay compliant with ease.

| Feature | Benefit |

|---|---|

| Automated Data Retrieval | Saves time and reduces manual errors |

| Intelligent Tax Calculation | Ensures accuracy and compliance |

| Real-Time Tax Updates | Keeps business owners informed |

Individual Taxpayers

Tax Express empowers individual taxpayers to take control of their tax obligations. Its user-friendly interface and step-by-step guidance make tax preparation accessible to everyone. Individuals can easily input their income details, deductions, and tax credits, receiving instant feedback on their tax liabilities. Tax Express simplifies the process of filing tax returns, making it a stress-free experience.

Complex Tax Scenarios

Tax Express is not limited to straightforward tax situations. It is designed to handle complex tax scenarios, such as multiple income streams, business expenses, and investment gains. By analyzing user data and applying advanced tax calculations, Tax Express provides accurate results, ensuring that taxpayers maximize their deductions and minimize their tax liabilities.

User Experiences: The Impact of Tax Express

The success of Tax Express is evident in the positive feedback and testimonials from its users. Here are some real-world experiences shared by individuals who have embraced Tax Express:

"Tax Express has been a lifesaver for my small business. The automated data retrieval feature saves me hours of manual work, and the intelligent tax calculation ensures I'm getting the most out of my deductions. It's like having a tax expert at my fingertips!" - John, Small Business Owner

"As a busy professional, I don't have the time or patience for complicated tax software. Tax Express made filing my taxes a breeze. The user-friendly interface and clear instructions made the process effortless. I highly recommend it to anyone looking for a hassle-free tax experience." - Sarah, Working Professional

Future Implications and Continuous Innovation

Tax Express continues to evolve and innovate, staying at the forefront of tax technology. The platform's developers are committed to enhancing its capabilities and addressing emerging tax challenges. By leveraging the latest advancements in machine learning and data analytics, Tax Express aims to provide even more accurate and efficient tax solutions.

In the future, we can expect Tax Express to integrate with emerging technologies such as blockchain and artificial intelligence, further streamlining the tax management process. Additionally, the platform may expand its services to cater to specific industries or tax scenarios, ensuring tailored solutions for diverse user needs.

Conclusion: Embracing the Future of Tax Management with Tax Express

Tax Express represents a significant leap forward in the world of tax services, offering a modern and efficient approach to tax management. Its combination of advanced technology, user-centric design, and accurate calculations has transformed the way businesses and individuals approach their tax obligations.

With its ability to automate data retrieval, provide real-time tax updates, and offer secure online filing, Tax Express has revolutionized the tax landscape. By embracing this innovative platform, users can streamline their tax processes, save time and resources, and ensure compliance with confidence. As Tax Express continues to evolve, it promises to play a pivotal role in shaping the future of tax management, making it more accessible and efficient for all.

Is Tax Express suitable for businesses with multiple locations or complex tax structures?

+Absolutely! Tax Express is designed to accommodate businesses of all sizes and complexities. Its advanced tax calculation capabilities and data retrieval features make it an ideal solution for businesses with multiple locations or intricate tax scenarios. By centralizing tax management, Tax Express streamlines the process and ensures accurate reporting.

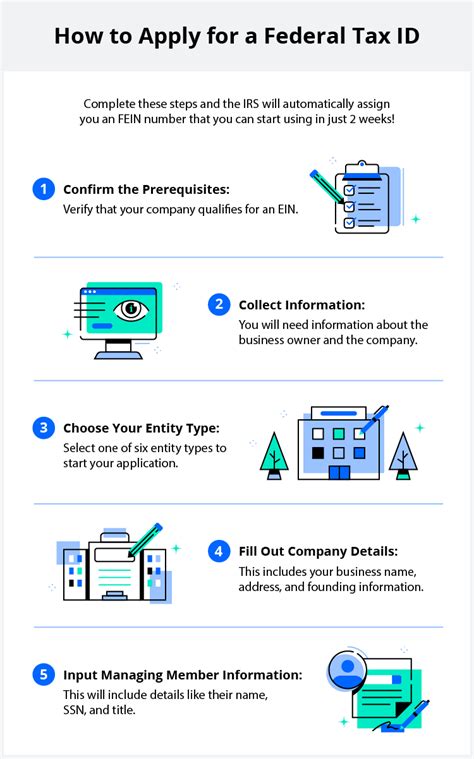

How does Tax Express ensure data security during online filing?

+Tax Express prioritizes data security by employing industry-leading encryption protocols. All user data is protected with end-to-end encryption, ensuring that sensitive information remains secure throughout the online filing process. Tax Express follows strict data privacy standards to safeguard user information.

Can Tax Express assist with tax planning and strategy development?

+Yes, Tax Express goes beyond tax preparation and filing. It provides valuable insights and analytics to assist users in tax planning and strategy development. By analyzing historical data and tax trends, Tax Express offers recommendations to optimize tax positions and maximize deductions. This feature empowers users to make informed tax decisions.