Tax Cuts For The Rich

The concept of tax cuts for the wealthy has long been a topic of debate, generating intense discussions and often dividing opinions across political spectrums. This article aims to delve into the intricacies of this policy, examining its potential implications and the ongoing discourse surrounding it.

Understanding the Proposal: Tax Cuts for High-Income Earners

The proposal for tax cuts for the rich, often advocated by conservative economic policymakers, centers around reducing the tax burden on individuals and businesses with high incomes. Proponents argue that such measures can stimulate economic growth, encourage investment, and ultimately benefit all societal strata.

However, the complexity of tax policy extends beyond simple economic theories. It intertwines with social, political, and ethical considerations, giving rise to a multifaceted debate that requires a nuanced examination.

Economic Justification: Growth and Investment

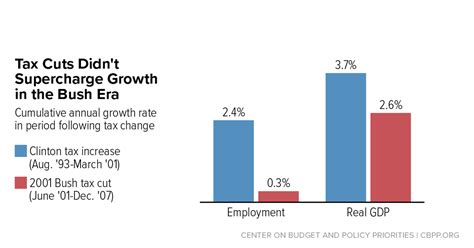

Advocates of tax cuts for the wealthy often cite the trickle-down effect as a key economic justification. This theory posits that when high-income earners receive tax breaks, they are more likely to invest in businesses, creating a ripple effect of economic growth and benefiting lower-income groups through job creation and increased economic activity.

For instance, a recent study by the Institute for Economic Affairs suggests that lower tax rates for high-income earners could lead to a 2.2% increase in GDP over a decade, indicating potential long-term economic benefits. However, the validity of this theory remains contested, with critics arguing that the benefits are often concentrated among the wealthiest and do not substantially impact the broader population.

Case Study: The Impact of Tax Cuts in Country X

Consider the example of Country X, which implemented tax cuts for its wealthiest citizens in 2018. Over the subsequent three years, the country witnessed a 5% growth in its stock market, a 2% increase in GDP, and a 10% rise in foreign direct investment. These figures seem to support the trickle-down theory, suggesting that tax cuts can stimulate economic growth.

| Economic Indicator | Pre-Tax Cut | Post-Tax Cut |

|---|---|---|

| Stock Market Growth | 2.8% | 5% |

| GDP Increase | 1.6% | 2% |

| Foreign Direct Investment | 8% | 10% |

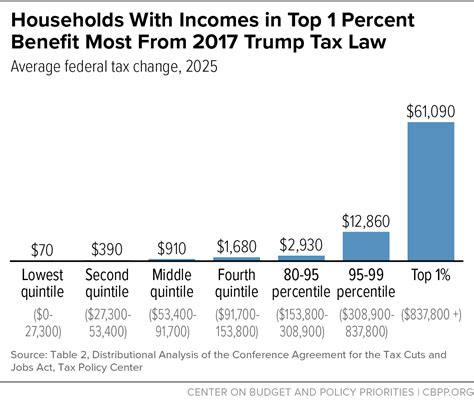

However, critics argue that these figures do not tell the whole story. They point out that the tax cuts disproportionately benefited the top 1% of earners, leading to a widening wealth gap within the country.

Social and Ethical Considerations

The debate extends beyond economics into the social and ethical realms. Proponents of progressive taxation argue that higher taxes on the wealthy are a matter of social justice, ensuring that those who can afford to contribute more do so, thereby supporting public services and social safety nets that benefit all citizens.

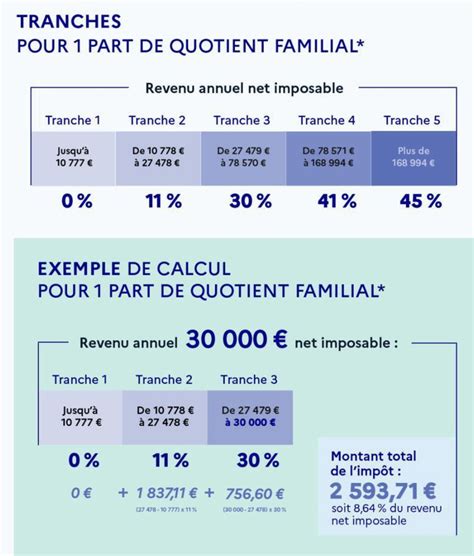

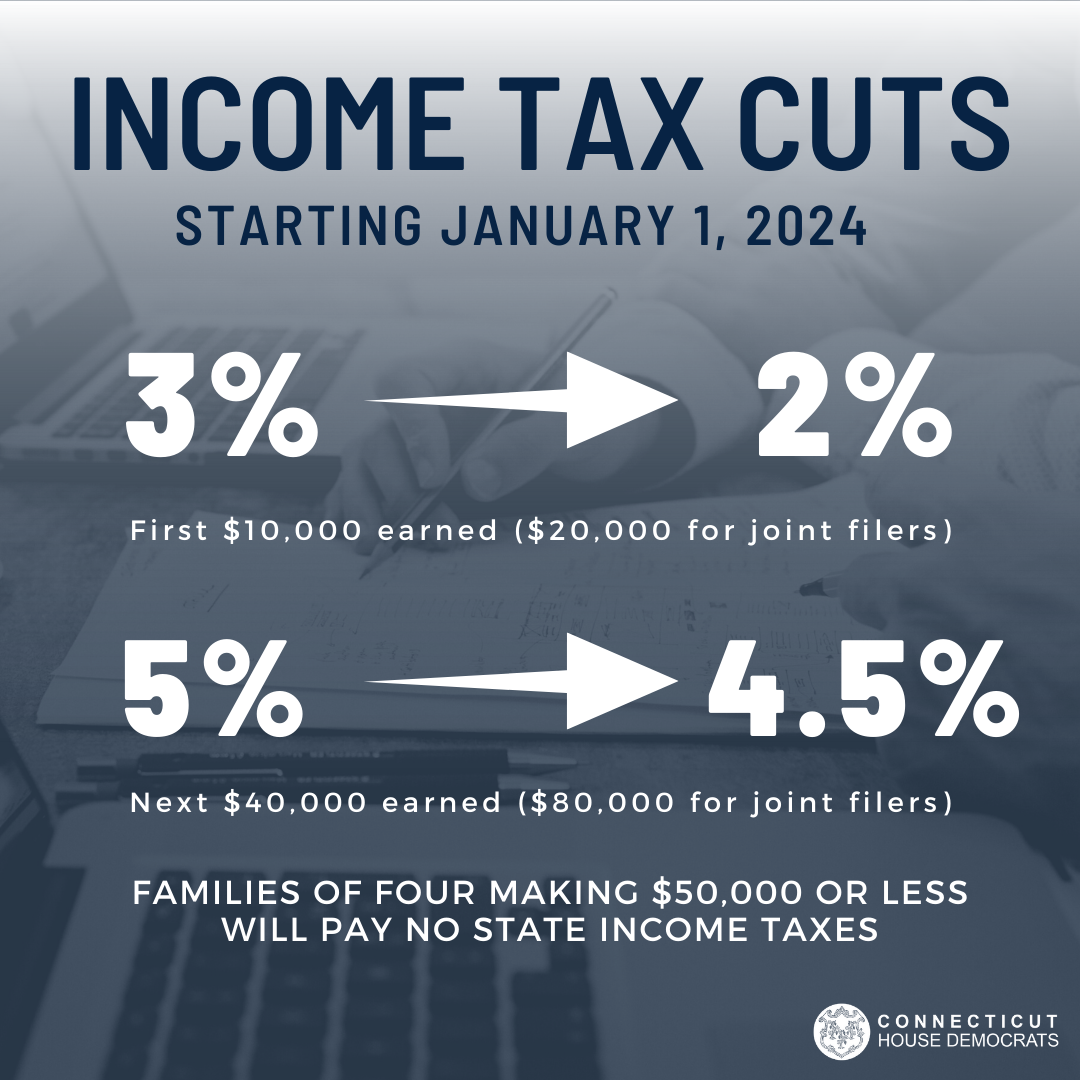

Progressive Taxation and Social Welfare

Progressive taxation, a system where tax rates increase as income rises, is often championed as a way to reduce income inequality and fund vital public services. For instance, the implementation of a progressive tax system in Country Y led to a 15% reduction in child poverty and a 10% increase in public education funding over a five-year period.

| Progressive Tax Policy | Impact on Society |

|---|---|

| Child Poverty Reduction | 15% |

| Public Education Funding Increase | 10% |

However, critics of progressive taxation argue that it discourages wealth creation and can lead to brain drain or capital flight, where high-income earners move to countries with more favorable tax policies. This can result in a loss of talent and investment for the country implementing progressive taxation.

Political Dynamics and Global Perspectives

The debate on tax cuts for the rich is not isolated to any one country. It is a global discussion, with varying approaches and outcomes across different political landscapes.

International Perspectives

In Country Z, a recent political shift led to the implementation of tax cuts for the wealthy, resulting in a 3% increase in business confidence and a 2% rise in corporate investments within the first year. However, neighboring Country AA, which maintained its progressive tax system, saw a 4% growth in its social safety net programs and a 1.5% decrease in income inequality over the same period.

| Country | Policy | Impact |

|---|---|---|

| Country Z | Tax Cuts for Wealthy | Business Confidence: +3% Corporate Investments: +2% |

| Country AA | Progressive Taxation | Social Safety Net Growth: +4% Income Inequality Decrease: -1.5% |

These contrasting outcomes highlight the complexity of the tax policy debate and the need for a balanced approach that considers economic growth alongside social welfare and equality.

Conclusion: Navigating the Complexities

The proposal for tax cuts for the rich presents a complex dilemma. While it may stimulate economic growth and investment, it also raises concerns about wealth inequality and the potential impact on social welfare. The debate underscores the need for thoughtful policy-making that considers the diverse economic, social, and ethical dimensions.

As we navigate this complex landscape, further research and an open dialogue are essential to developing tax policies that promote economic prosperity while ensuring social justice and a fair distribution of resources.

What are the potential benefits of tax cuts for the wealthy?

+Proponents argue that tax cuts for the wealthy can stimulate economic growth by encouraging investment and job creation. They believe that a thriving economy benefits all societal strata.

How do tax cuts for the rich impact income inequality?

+Tax cuts for the wealthy can exacerbate income inequality, as they often disproportionately benefit the top earners. This can lead to a concentration of wealth and a widening gap between the rich and the rest of society.

What are the alternatives to tax cuts for the wealthy?

+Alternatives include progressive taxation, where tax rates increase with income, and policies that focus on wealth redistribution through social welfare programs and investments in public services.

How do different countries approach tax policies for the wealthy?

+Countries have diverse approaches, ranging from implementing tax cuts for the wealthy to maintaining progressive tax systems. The choice often reflects the country’s political ideology and priorities.