What Is The Inheritance Tax In Pa

The Inheritance Tax in Pennsylvania is a tax imposed on certain individuals who receive property from a decedent's estate. This tax is separate from the federal estate tax and is unique to the state of Pennsylvania. Understanding the intricacies of the Inheritance Tax is crucial for individuals who are beneficiaries of an estate or executors responsible for distributing assets. Let's delve into the details of this tax to provide a comprehensive guide for those navigating the estate planning and administration process in the Keystone State.

Inheritance Tax Basics in Pennsylvania

The Pennsylvania Inheritance Tax is a state-level tax that applies to transfers of property, whether it’s real estate, personal belongings, cash, or investments, from a decedent’s estate to the beneficiaries. This tax is not based on the overall value of the estate but rather on the specific value of the property inherited by each beneficiary.

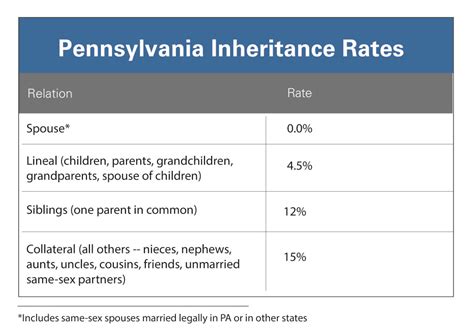

It's important to note that not all beneficiaries are subject to the Inheritance Tax. The tax rate varies depending on the relationship between the beneficiary and the decedent. This unique feature of Pennsylvania's Inheritance Tax makes it essential for beneficiaries to understand their specific tax obligations based on their familial connection to the deceased.

| Relationship to Decedent | Tax Rate |

|---|---|

| Spouse | 0% |

| Descendants (children, grandchildren) | 4.5% |

| Ascendants (parents, grandparents) | 4.5% |

| Siblings | 12% |

| Other Relatives and Non-Relatives | 15% |

For example, if a child inherits a property worth $500,000 from their parent's estate, they would owe an Inheritance Tax of $22,500 (4.5% of $500,000). However, if a sibling inherits the same amount from their brother or sister, they would owe $60,000 (12% of $500,000). This illustrates the importance of understanding one's relationship to the decedent when calculating the Inheritance Tax liability.

Who Pays the Inheritance Tax in Pennsylvania

The responsibility of paying the Inheritance Tax in Pennsylvania typically falls on the beneficiary receiving the property. However, there are situations where the executor or personal representative of the estate may be responsible for paying the tax on behalf of the beneficiaries. This is particularly common when the estate itself lacks sufficient funds to cover the tax liability.

In such cases, the executor might need to sell assets from the estate to generate the funds required to pay the Inheritance Tax. This can be a complex process, especially if the estate includes unique or hard-to-value assets. Professional appraisers or valuation experts might need to be engaged to ensure an accurate assessment of the property's worth for tax purposes.

Exemptions and Reductions

Pennsylvania offers certain exemptions and reductions that can help reduce the burden of the Inheritance Tax. These include:

- A $3,500 exemption for all beneficiaries, regardless of their relationship to the decedent.

- A spousal exemption, which means that a surviving spouse is not subject to the Inheritance Tax on property inherited from their deceased spouse.

- A charitable deduction, which allows for a reduction in the tax liability when property is transferred to a qualified charitable organization.

- A farm transfer deduction, which provides a reduced tax rate for the transfer of agricultural land.

These exemptions and deductions can significantly impact the overall tax liability, so it's crucial for beneficiaries and executors to carefully review their options to maximize tax savings.

Inheritance Tax Filing and Payment Process

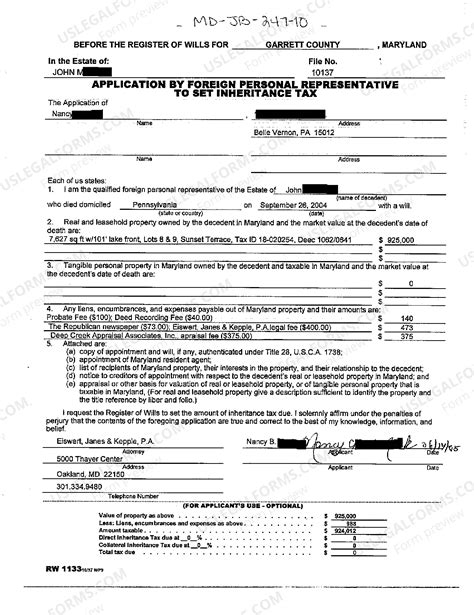

The Pennsylvania Inheritance Tax is due within nine months of the decedent’s death. The executor or personal representative of the estate is responsible for filing the appropriate tax forms and making the payment on time. Late filings or payments may result in penalties and interest charges.

The forms required for filing the Inheritance Tax depend on the circumstances of the estate. The most common forms include:

- Form PA-400, Inheritance Tax Return, for estates with a total value of $50,000 or more.

- Form PA-401, Inheritance Tax Return for Estates Under $50,000, for estates with a total value of less than $50,000.

- Form PA-402, Inheritance Tax Return for Small Estates, for estates with a total value of $15,000 or less.

The executor should carefully review the instructions for each form to ensure they are filing the correct one and providing all the necessary information. It's also advisable to consult with a tax professional or an attorney specializing in estate planning and administration to ensure compliance with the state's regulations.

Inheritance Tax Payment Options

The Inheritance Tax in Pennsylvania can be paid through various methods, including:

- Electronic payment options, such as credit card, debit card, or e-check, which offer a convenient and secure way to make the payment.

- Paper checks or money orders, which should be made payable to the Pennsylvania Department of Revenue and mailed to the appropriate address specified on the tax form instructions.

- Wire transfers, which might be necessary for larger tax liabilities or when the executor prefers a more secure method of payment.

The payment method chosen should consider factors such as the executor's preference, the size of the tax liability, and the time constraints for making the payment.

Impact of Inheritance Tax on Estate Planning

The Inheritance Tax in Pennsylvania can significantly affect an individual’s estate planning strategy. It’s crucial for individuals to consider this tax when creating their estate plans to ensure that their assets are distributed efficiently and effectively.

Strategies to Minimize Inheritance Tax

There are several strategies that individuals can employ to minimize the impact of the Inheritance Tax in Pennsylvania. These include:

- Gifting: Gifting assets during one's lifetime can reduce the value of the estate and, consequently, the Inheritance Tax liability. However, it's important to consider the federal gift tax, which may apply to larger gifts.

- Life Insurance: Purchasing a life insurance policy can provide a tax-free benefit to beneficiaries, which can be used to cover the Inheritance Tax liability or other estate expenses.

- Trusts: Establishing a trust can offer flexibility in estate planning and allow for more control over how assets are distributed. Certain types of trusts, such as charitable remainder trusts, can also provide tax benefits.

- Joint Ownership: Holding assets jointly with rights of survivorship can avoid Inheritance Tax since the property passes directly to the surviving joint owner without going through probate.

- Estate Planning Documents: Creating a comprehensive estate plan, including a will, trust, and power of attorney, can help ensure that assets are distributed according to one's wishes and can also reduce the overall tax liability.

It's essential to consult with an estate planning attorney and a tax professional to determine the most suitable strategies based on individual circumstances and goals.

Estate Planning Considerations for Non-Residents

Non-residents of Pennsylvania who own property in the state may also be subject to the Inheritance Tax. The rules for non-residents are slightly different, and it’s crucial for them to understand their obligations.

In general, non-residents are taxed at the highest rate (15%) for property located in Pennsylvania, regardless of their relationship to the decedent. However, there are exceptions and special considerations for non-residents, such as the Pennsylvania Resident Spouse Election, which allows a non-resident spouse to be taxed at the same rate as a resident spouse.

Non-residents should carefully review the Pennsylvania Inheritance Tax regulations and consult with professionals to ensure they comply with the state's requirements and minimize their tax liability.

Future Implications and Reforms

The Inheritance Tax in Pennsylvania has been a subject of debate and potential reform in recent years. While it remains in effect, there have been discussions and proposals to modify or eliminate the tax altogether.

Proponents of reform argue that the Inheritance Tax is a burden on families, especially those who are already grieving the loss of a loved one. They suggest that the tax can discourage people from saving and investing, as it reduces the value of the estate that can be passed on to heirs. Additionally, critics point out that the tax can be particularly harsh on smaller estates, where the tax rate can consume a significant portion of the inheritance.

On the other hand, supporters of the Inheritance Tax believe that it serves as a crucial source of revenue for the state, helping to fund essential services and programs. They argue that the tax is necessary to ensure that everyone, regardless of their wealth, contributes to the state's financial well-being.

As of now, the Inheritance Tax remains in place, and it's important for individuals to stay informed about any potential changes or reforms that may impact their estate planning strategies. Keeping abreast of legislative developments and consulting with professionals can help individuals navigate the evolving landscape of estate planning in Pennsylvania.

Conclusion

The Inheritance Tax in Pennsylvania is a complex and nuanced aspect of estate planning and administration. Understanding the tax rates, exemptions, and filing requirements is essential for beneficiaries and executors to navigate the process effectively. By exploring strategies to minimize the tax liability and staying informed about potential reforms, individuals can make informed decisions to protect their assets and ensure a smooth transition of their wealth to future generations.

How does the Inheritance Tax in Pennsylvania differ from the federal estate tax?

+The Inheritance Tax in Pennsylvania is a state-level tax imposed on beneficiaries who receive property from a decedent’s estate. It is based on the value of the property inherited and varies depending on the relationship between the beneficiary and the decedent. On the other hand, the federal estate tax is a tax on the overall value of the estate and is imposed on the estate itself, not on individual beneficiaries. The federal estate tax has a much higher exemption threshold, meaning that only estates with a value exceeding a certain amount are subject to the tax.

Are there any ways to reduce the Inheritance Tax liability in Pennsylvania?

+Yes, there are several strategies to minimize the Inheritance Tax liability. These include gifting assets during one’s lifetime, purchasing life insurance policies, establishing trusts, holding assets jointly with rights of survivorship, and creating comprehensive estate planning documents. It’s important to consult with professionals to determine the most suitable strategies based on individual circumstances.

What happens if the Inheritance Tax is not paid on time in Pennsylvania?

+Late payments of the Inheritance Tax in Pennsylvania may result in penalties and interest charges. It’s crucial for executors and beneficiaries to adhere to the filing deadlines and make timely payments to avoid additional financial burdens.

Are there any changes or reforms proposed for the Inheritance Tax in Pennsylvania?

+Yes, there have been ongoing discussions and proposals to reform or eliminate the Inheritance Tax in Pennsylvania. While the tax remains in effect, it’s important for individuals to stay informed about any potential changes that may impact their estate planning strategies.