Tax Attorneys In Raleigh

Raleigh, the vibrant capital city of North Carolina, is a bustling hub for various industries and a thriving business landscape. With a robust economy and a growing population, the city attracts entrepreneurs, startups, and established businesses alike. As the business environment flourishes, so does the demand for specialized legal services, particularly in the field of taxation.

Navigating the complex world of taxes, especially for businesses, can be a daunting task. Tax laws and regulations are intricate and ever-evolving, making it crucial for individuals and enterprises to seek expert guidance. This is where tax attorneys in Raleigh step in, offering their expertise and knowledge to help clients manage their tax obligations effectively.

The Role of Tax Attorneys in Raleigh

Tax attorneys in Raleigh play a vital role in the city’s legal and business ecosystems. They are licensed professionals who specialize in tax law, offering a range of services to individuals, businesses, and organizations. Their expertise extends beyond simple tax preparation; they provide strategic advice, representation, and legal solutions to complex tax-related issues.

For individuals, tax attorneys can assist with personal tax planning, ensuring compliance with state and federal tax laws. They help maximize deductions, minimize tax liabilities, and offer guidance on estate planning and inheritance tax strategies. In cases of tax disputes or audits, these attorneys provide legal representation, defending their clients' rights and interests.

However, the primary focus of tax attorneys in Raleigh is often on serving the business community. They work closely with startups, small businesses, and large corporations to develop tax-efficient strategies. This includes advising on business structures, tax planning for mergers and acquisitions, and helping businesses navigate the complexities of international tax laws.

Key Services Offered by Raleigh Tax Attorneys

- Tax Planning and Compliance: Tax attorneys assist clients in developing comprehensive tax plans that align with their financial goals. They ensure businesses comply with tax laws, helping them avoid penalties and legal issues.

- Estate and Business Succession Planning: For business owners, tax attorneys provide guidance on estate planning, ensuring the smooth transition of assets and minimizing tax implications.

- Tax Dispute Resolution: In cases of tax audits or disputes with the Internal Revenue Service (IRS) or state tax authorities, tax attorneys represent clients, negotiating settlements and defending their rights.

- International Tax Services: With Raleigh’s growing global business presence, tax attorneys offer expertise in international tax laws, helping businesses navigate cross-border transactions and tax obligations.

- Tax-Efficient Business Strategies: They work closely with businesses to structure transactions and operations in a tax-efficient manner, optimizing tax liabilities and maximizing profits.

The tax landscape is dynamic, and tax attorneys in Raleigh stay updated with the latest legal changes and trends. They offer proactive advice to clients, helping them stay ahead of potential tax issues and capitalize on emerging opportunities.

The Tax Landscape in Raleigh

Raleigh’s tax environment is characterized by a mix of state and local taxes, each with its own set of regulations. Understanding these taxes is crucial for businesses and individuals alike.

State Taxes

North Carolina imposes various state taxes, including:

- Income Tax: The state’s income tax rate ranges from 5.25% to 5.75% for individuals and pass-through entities, while corporations are taxed at a flat rate of 2.5%.

- Sales and Use Tax: North Carolina has a state sales tax rate of 4.75%, with local governments adding their own rates, resulting in a combined rate of up to 7.5%.

- Corporate Income Tax: Corporations are subject to a franchise tax, which is based on their net worth, and a corporate income tax rate of 2.5%.

Local Taxes

In addition to state taxes, Raleigh and its surrounding areas impose local taxes, such as:

- Raleigh City Tax: The city of Raleigh levies a local income tax of 1% on individuals and pass-through entities.

- Wake County Tax: Wake County, where Raleigh is located, has a county sales tax rate of 2%, in addition to the state sales tax.

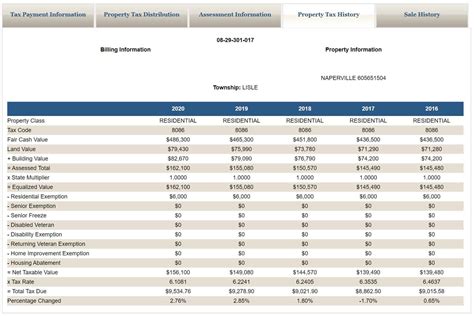

- Property Taxes: Property taxes in Raleigh are based on the assessed value of real estate and are used to fund local government services.

Navigating these various tax obligations can be complex, especially for businesses operating across different jurisdictions. Tax attorneys in Raleigh provide invaluable guidance, helping clients understand and comply with these taxes efficiently.

Choosing the Right Tax Attorney in Raleigh

With the abundance of tax attorneys in Raleigh, choosing the right one for your specific needs can be a challenging task. Here are some key factors to consider when making your decision:

Experience and Expertise

Look for a tax attorney with extensive experience in the specific area of tax law that pertains to your needs. For instance, if you require assistance with business tax planning, choose an attorney who has a proven track record in this field. Additionally, consider their expertise in handling complex tax issues and their familiarity with the latest tax laws and regulations.

Reputation and Client Feedback

Research the reputation of the tax attorney or the firm they are associated with. Check online reviews, testimonials, and ratings from previous clients. This will give you an insight into their level of service, responsiveness, and overall client satisfaction. A good reputation is often a strong indicator of the quality of legal services provided.

Communication and Accessibility

Effective communication is crucial when working with a tax attorney. Ensure that the attorney or the firm provides clear and timely responses to your queries. They should be accessible when you need them, especially during critical tax periods or in the event of an audit or tax dispute. Regular communication will help you stay informed and make informed decisions regarding your tax matters.

Fees and Payment Structure

Tax attorneys typically charge either by the hour or based on the complexity and scope of the work involved. Understand the fee structure and any potential additional costs before engaging their services. It’s essential to choose an attorney whose fees align with your budget and the value they provide. Some attorneys may also offer flexible payment plans or fixed fees for specific services, so don’t hesitate to discuss these options.

Specialized Services

Consider your specific tax needs and whether the attorney specializes in the areas that matter to you. For instance, if you require international tax services, choose an attorney with experience in cross-border transactions and international tax laws. Similarly, if you’re facing a tax audit or dispute, select an attorney who has a successful track record in handling such cases.

Personal Fit and Chemistry

Working with a tax attorney involves a certain level of trust and collaboration. It’s important to choose someone with whom you feel comfortable sharing sensitive financial information. Consider your personal preferences and the attorney’s approach to client relationships. A good fit will ensure a productive and collaborative working relationship.

The Impact of Tax Attorneys on Raleigh’s Business Community

Tax attorneys in Raleigh play a crucial role in supporting the city’s economic growth and business success. Their expertise helps businesses navigate the complex tax landscape, ensuring compliance and optimizing tax strategies. By providing strategic tax planning and legal representation, they contribute to the overall prosperity of the local business community.

For startups and small businesses, tax attorneys offer valuable guidance on tax-efficient business structures and strategies. They help these businesses establish a strong financial foundation, enabling them to focus on growth and innovation. In addition, tax attorneys assist businesses in securing tax incentives and credits, further boosting their financial health.

Large corporations, too, benefit from the expertise of tax attorneys. These professionals help corporations structure complex transactions, navigate international tax laws, and manage tax obligations across different jurisdictions. By minimizing tax liabilities and optimizing tax strategies, tax attorneys contribute to the overall profitability and success of these businesses.

Moreover, tax attorneys in Raleigh play a vital role in representing businesses during tax audits and disputes. Their legal expertise and knowledge of tax laws help businesses navigate these challenging situations, ensuring fair treatment and minimizing potential financial losses. By providing strong legal representation, tax attorneys protect the interests of their clients and maintain their financial stability.

The Future of Tax Law and Raleigh’s Role

The field of tax law is continuously evolving, with new laws, regulations, and tax reforms being introduced regularly. Raleigh, as a hub for innovation and business, is well-positioned to adapt to these changes and leverage them for its economic growth.

Tax attorneys in Raleigh will play a crucial role in helping individuals and businesses understand and navigate these changes. They will provide proactive advice and strategies to ensure compliance with new tax laws and take advantage of any emerging opportunities. By staying updated with the latest tax trends and developments, tax attorneys will continue to offer valuable guidance to their clients.

Furthermore, as Raleigh continues to attract businesses and investors, tax attorneys will be instrumental in shaping the city's tax landscape. They will work closely with local governments and policymakers to advocate for tax reforms that promote economic growth and business competitiveness. Their expertise will contribute to the development of tax policies that benefit the city's residents and businesses alike.

In conclusion, tax attorneys in Raleigh are vital professionals who provide essential services to individuals and businesses. Their expertise in tax law helps clients manage their tax obligations, optimize their financial strategies, and navigate complex tax issues. As the city's business landscape continues to thrive, the role of tax attorneys will only become more significant, contributing to Raleigh's economic success and growth.

How much do tax attorneys typically charge in Raleigh?

+Tax attorney fees in Raleigh can vary based on the complexity of the case and the attorney’s experience. Hourly rates typically range from 250 to 400, but some attorneys may offer flat fees for specific services. It’s best to discuss fees directly with the attorney to get a clear understanding of their pricing structure.

What are the benefits of hiring a tax attorney instead of using a tax preparer or accountant?

+Tax attorneys offer a higher level of expertise and specialization in tax law. They can provide strategic advice, represent you in tax disputes, and offer comprehensive solutions to complex tax issues. While tax preparers and accountants focus on tax compliance and basic tax planning, tax attorneys can offer a deeper understanding of the law and provide legal representation if needed.

Can tax attorneys help with international tax issues?

+Yes, many tax attorneys in Raleigh have expertise in international tax law. They can assist businesses and individuals with cross-border transactions, foreign investments, and compliance with international tax regulations. Their knowledge of international tax treaties and laws ensures that clients are well-prepared for global tax obligations.