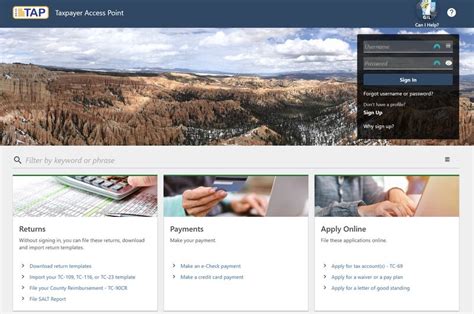

Tap.tax.utah

Welcome to an in-depth exploration of Tap.tax.utah, a crucial online resource for Utah residents and businesses navigating the state's tax landscape. As a knowledgeable guide, I will delve into the platform's features, its impact on tax compliance, and the benefits it brings to the community. Let's uncover the intricacies of this digital tax solution and its role in streamlining tax processes.

Empowering Utahns with Digital Tax Solutions

In the digital age, where efficiency and convenience are paramount, Tap.tax.utah stands as a beacon of innovation. This online platform, developed by the Utah State Tax Commission, has revolutionized the way taxpayers interact with the state’s tax system. With a user-friendly interface and a wealth of resources, it has become an indispensable tool for individuals and businesses alike.

The journey of Tap.tax.utah began with a vision to simplify the complex world of taxation. By leveraging advanced technology, the platform offers a seamless experience, guiding users through various tax-related tasks with ease. From filing returns to making payments, the process is streamlined, reducing the burden on taxpayers and promoting timely compliance.

Key Features and Benefits

At the heart of Tap.tax.utah lies a suite of features designed to enhance the user experience and facilitate efficient tax management. Here’s a glimpse into some of its standout capabilities:

- User-Friendly Interface: The platform boasts an intuitive design, making it accessible to taxpayers of all technical backgrounds. Navigation is straightforward, ensuring a smooth journey from start to finish.

- Secure Online Filing: Users can file their tax returns electronically, enjoying the convenience of remote access. The platform employs robust security measures, safeguarding sensitive information and ensuring data privacy.

- Payment Flexibility: Tap.tax.utah offers multiple payment options, including credit cards, e-checks, and direct debit. This flexibility accommodates various financial preferences and ensures timely tax settlements.

- Real-Time Updates: Tax laws and regulations are dynamic, and the platform stays up-to-date. Users can access the latest information, forms, and guidelines, ensuring compliance with current tax requirements.

- Personalized Dashboard: Each user receives a dedicated dashboard, providing a centralized view of their tax activities. This feature simplifies record-keeping and allows for efficient monitoring of tax obligations.

Beyond these core features, Tap.tax.utah goes the extra mile by offering comprehensive resources. Taxpayers can access educational materials, FAQs, and step-by-step guides, empowering them to make informed decisions and navigate the tax landscape with confidence.

| Feature | Description |

|---|---|

| Tax Calculator | An interactive tool to estimate tax liabilities based on income and deductions. |

| E-Signature Support | Users can digitally sign tax forms, eliminating the need for physical signatures. |

| Tax Alerts and Reminders | Customizable notifications keep users informed about upcoming deadlines and important tax dates. |

Enhancing Tax Compliance and Community Benefits

The impact of Tap.tax.utah extends beyond individual convenience. By fostering a culture of tax compliance, the platform contributes to the overall economic well-being of the state. Let’s explore how it achieves this:

Simplifying Tax Obligations

One of the platform’s primary goals is to simplify the tax filing process. By breaking down complex procedures into manageable steps, it demystifies taxation for users. This simplicity encourages timely filing, reducing the likelihood of penalties and late fees.

Moreover, the platform's educational resources empower taxpayers to understand their rights and responsibilities. This knowledge fosters a sense of financial literacy, enabling users to make strategic decisions regarding their tax obligations.

Promoting Economic Stability

Efficient tax collection is vital for a state’s economic health. Tap.tax.utah plays a pivotal role in this aspect by facilitating smooth tax payments. With various payment options and a secure online system, taxpayers can fulfill their obligations promptly, contributing to the state’s revenue stream.

The platform's success in promoting compliance has a ripple effect on the economy. A steady tax revenue stream allows the state to invest in critical infrastructure, education, and social programs, benefiting the entire community.

Easing the Burden on Taxpayers

Traditional tax filing processes can be time-consuming and complex. Tap.tax.utah addresses this challenge by offering a streamlined experience. Users can complete their tax tasks in a fraction of the time, reducing the stress and hassle typically associated with tax season.

Additionally, the platform's personalized dashboard and real-time updates ensure that taxpayers stay organized. This level of organization helps prevent missed deadlines and reduces the need for last-minute scrambling, contributing to a more relaxed tax experience.

Environmental Impact

In today’s environmentally conscious world, Tap.tax.utah also contributes to sustainability efforts. By encouraging electronic filing and reducing paper usage, the platform minimizes its environmental footprint. This eco-friendly approach aligns with the state’s commitment to responsible practices.

| Environmental Benefit | Impact |

|---|---|

| Reduced Paper Consumption | Fewer trees are cut down, leading to a decrease in deforestation. |

| Lower Energy Usage | Electronic filing requires less energy compared to traditional paper-based processes. |

| Minimized Waste | Digital records reduce the need for physical storage, cutting down on waste generation. |

Future Outlook and Innovations

As technology continues to evolve, so does Tap.tax.utah. The platform is committed to staying at the forefront of digital tax solutions, ensuring it remains a reliable and innovative resource for Utah taxpayers.

Integration and Expansion

Looking ahead, the platform aims to integrate with other state services, creating a seamless ecosystem for users. This integration could include linking tax information with other government departments, streamlining processes for businesses and individuals alike.

Additionally, Tap.tax.utah plans to expand its reach by offering more specialized services. This may involve introducing features tailored to specific industries or tax scenarios, further enhancing the platform's versatility.

AI and Machine Learning

The integration of AI and machine learning technologies is on the horizon. These advancements could enhance the platform’s ability to provide personalized recommendations and improve user experiences. For instance, AI-powered tools could offer tailored tax strategies based on individual financial profiles.

Mobile Accessibility

Recognizing the importance of mobile accessibility, Tap.tax.utah is working towards optimizing its platform for mobile devices. This move will ensure that taxpayers can access their accounts and complete tax-related tasks on the go, further enhancing convenience.

Community Engagement

The platform’s developers understand the value of community feedback. Ongoing engagement with taxpayers will continue to shape the platform’s development, ensuring it remains responsive to user needs and preferences.

Conclusion

In conclusion, Tap.tax.utah is more than just a digital tax platform; it’s a transformative tool that empowers Utah taxpayers. By offering a user-friendly, secure, and efficient experience, it has become an essential resource for individuals and businesses alike. As the platform continues to evolve, it will undoubtedly play a pivotal role in shaping the state’s tax landscape, fostering compliance, and contributing to the overall prosperity of the community.

How secure is Tap.tax.utah for storing personal information?

+Tap.tax.utah employs advanced security measures, including encryption and two-factor authentication, to protect user data. The platform adheres to strict data privacy standards, ensuring your information remains secure.

Can I file my taxes using Tap.tax.utah if I’m a non-resident of Utah?

+Yes, Tap.tax.utah is accessible to non-residents with Utah-related tax obligations. The platform provides the necessary tools for non-residents to manage their tax responsibilities efficiently.

What if I encounter technical issues while using Tap.tax.utah?

+The platform offers a comprehensive help section and a dedicated support team to assist with any technical challenges. You can reach out via email, phone, or live chat for prompt assistance.