State Of Utah Tax Rates

The state of Utah, nestled in the western United States, has a unique tax system that contributes significantly to its economic landscape. Understanding Utah's tax rates is crucial for businesses and individuals alike, as it impacts financial planning, investment strategies, and overall economic growth. This article delves into the intricacies of Utah's tax system, offering a comprehensive guide to help navigate its complex structure.

Unraveling Utah’s Tax Landscape

Utah’s tax system is characterized by a balanced approach, aiming to provide a stable revenue stream for the state while encouraging economic growth and individual prosperity. The state operates on a progressive income tax system, corporate tax, sales tax, and various other taxes, each playing a distinct role in funding essential state services and infrastructure.

Income Tax Rates: A Progressive Approach

Utah’s income tax structure is designed to be progressive, meaning that as income increases, so does the tax rate. This system ensures that higher-income earners contribute a larger share of their income to state revenue, promoting fairness and economic equity.

| Tax Rate Bracket | Tax Rate |

|---|---|

| 0% - $4,600 | 0% |

| $4,601 - $8,200 | 3.00% |

| $8,201 - $11,800 | 4.00% |

| $11,801 - $23,600 | 4.75% |

| Over $23,600 | 5.00% |

These rates are applicable for both single and married individuals filing jointly. It's worth noting that Utah also offers tax credits and deductions, which can significantly reduce the overall tax liability for individuals and families.

Corporate Tax: Attracting Businesses

Utah’s corporate tax rate stands at 4.95%, which is relatively competitive compared to other states. This flat rate applies to all corporations, regardless of their size or revenue. The state’s corporate tax structure aims to attract businesses and promote economic development, offering a stable and predictable tax environment.

Additionally, Utah provides various incentives and tax credits for businesses, especially those involved in research and development, manufacturing, and job creation. These incentives can significantly reduce the effective tax rate for eligible businesses, making Utah an attractive destination for corporate investments.

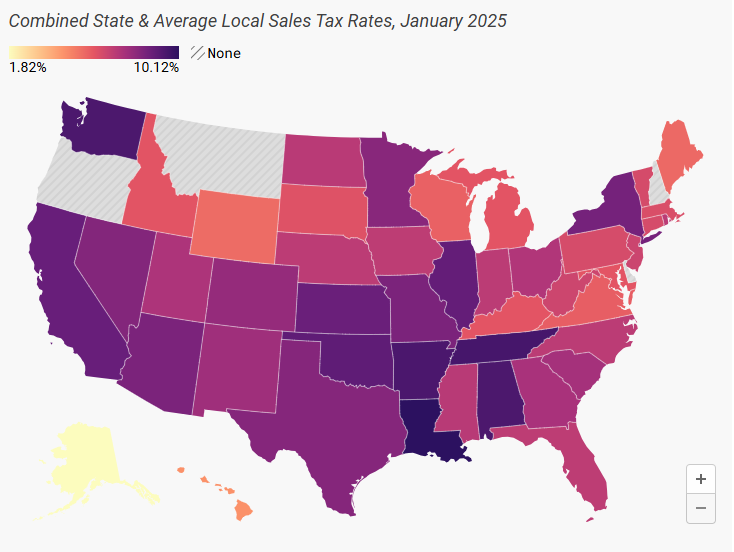

Sales and Use Tax: A Broad Base

Utah’s sales and use tax is a significant source of revenue for the state. The base rate for sales tax is 4.70%, with local option taxes adding up to an additional 1.25% in some areas. This results in a total sales tax rate that varies across the state, ranging from 5.95% to 8.30%.

The state's sales tax applies to most tangible personal property and some services. However, there are several exemptions and special provisions, such as for groceries, prescription drugs, and certain manufacturing inputs. These exemptions aim to reduce the tax burden on essential goods and services, benefiting both consumers and businesses.

Other Taxes and Fees

In addition to the taxes mentioned above, Utah levies various other taxes and fees to fund specific services and infrastructure projects. These include:

- Property Tax: Utah has a uniform property tax rate of 0.006484%, which is one of the lowest in the nation. This rate is applied to the assessed value of real and personal property.

- Gasoline Tax: The state imposes a tax of 24.5 cents per gallon on gasoline and diesel fuel, which funds road and infrastructure maintenance and development.

- Tobacco Tax: Utah's tobacco tax is 69.5 cents per pack of cigarettes, with additional taxes on other tobacco products.

- Hotel and Motel Tax: A 7.75% tax is applied to the cost of hotel and motel rooms, which is used to promote tourism and support cultural and recreational facilities.

- Alcohol Tax: Utah has a complex tax system for alcohol, with varying rates depending on the type of alcohol and its alcohol content.

The Impact of Utah’s Tax Rates

Utah’s tax system has a profound impact on the state’s economy and its residents. The progressive income tax structure ensures that higher-income earners contribute a larger share, promoting economic fairness. The competitive corporate tax rate, coupled with incentives, makes Utah an attractive destination for businesses, leading to job creation and economic growth.

The state's sales tax, while variable, provides a stable revenue stream for essential services and infrastructure development. Meanwhile, the low property tax rate makes Utah an affordable place to own property, benefiting both residents and businesses.

Economic Growth and Investment

Utah’s tax system has been a key factor in the state’s impressive economic growth. The combination of a competitive corporate tax rate, incentives for businesses, and a skilled workforce has attracted numerous companies, leading to a thriving economy. This has resulted in increased investment, job opportunities, and a high quality of life for residents.

The state's focus on economic development and a business-friendly environment has paid dividends, with Utah consistently ranking among the top states for business and economic growth.

Funding Essential Services

The revenue generated from Utah’s tax system is vital for funding essential state services. These include education, healthcare, public safety, transportation, and social services. The progressive income tax structure ensures that the state has the resources to invest in these critical areas, benefiting all residents.

Additionally, the sales tax revenue is used to fund infrastructure projects, improve roads and highways, and enhance public transportation systems, contributing to the state's overall development and attractiveness.

Future Implications and Potential Changes

As with any tax system, Utah’s rates and structures are subject to change. The state regularly reviews its tax policies to ensure they remain competitive, fair, and effective. Future changes could include adjustments to tax rates, the introduction of new taxes, or the modification of existing incentives to adapt to economic shifts and emerging industries.

Furthermore, as Utah continues to attract businesses and population growth, the state may face increased demands on its infrastructure and services. Balancing these demands with the need for a competitive tax environment will be a key challenge for policymakers.

Conclusion

Utah’s tax rates and system play a pivotal role in shaping the state’s economic landscape. The state’s balanced approach to taxation, with a progressive income tax, competitive corporate tax, and a broad-based sales tax, has contributed to its economic success and high quality of life. Understanding these tax rates is essential for businesses and individuals making financial decisions in Utah.

As the state continues to evolve, its tax system will likely adapt to meet the changing needs of its residents and businesses. Staying informed about these changes will be crucial for effective financial planning and strategic decision-making.

How does Utah’s tax system compare to other states?

+Utah’s tax system is generally considered more favorable for businesses and individuals compared to many other states. The state’s competitive corporate tax rate, progressive income tax structure, and low property tax rate make it an attractive destination for economic activity. However, it’s important to note that each state has its unique tax landscape, and a comprehensive comparison would consider various factors beyond just tax rates.

Are there any tax incentives for specific industries in Utah?

+Yes, Utah offers a range of tax incentives and credits to attract and support specific industries. These incentives are designed to encourage job creation, research and development, and economic diversification. Industries such as technology, manufacturing, and film production often benefit from these incentives, making Utah an appealing location for businesses in these sectors.

How does Utah’s sales tax vary across the state?

+Utah’s sales tax rate varies depending on the location. The base rate is 4.70%, but local option taxes can add up to an additional 1.25%, resulting in a total sales tax rate that ranges from 5.95% to 8.30%. This variation is due to local governments having the authority to impose additional sales taxes to fund specific projects or services.