City Of La Business Tax Renewal

For businesses operating within the vibrant metropolis of Los Angeles, the annual City of LA Business Tax Renewal process is a crucial administrative task. This process ensures that businesses remain compliant with the city's regulations and contribute to the local economy. Let's delve into the intricacies of this renewal process, offering a comprehensive guide to help business owners navigate this essential procedure with ease.

Understanding the City of LA Business Tax Renewal

The City of Los Angeles Business Tax is an annual requirement for most businesses operating within the city limits. This tax is not only a revenue source for the city but also serves as a registration process, ensuring that businesses are officially recognized and monitored. The renewal process is a critical step in maintaining the legality and legitimacy of your business operations.

The City of Los Angeles Department of Finance is responsible for administering this tax, and they provide a streamlined online platform for business owners to renew their registrations promptly and efficiently.

Who Needs to Renew Their Business Tax?

Any business operating within the city of Los Angeles that has a physical presence, including offices, warehouses, or retail spaces, is subject to the Business Tax. This tax applies to a wide range of entities, from sole proprietorships and partnerships to corporations and LLCs.

Even if your business operates primarily online and does not have a physical storefront, you may still be required to pay the business tax if your business activities are centered in Los Angeles. This includes businesses that:

- Rent office spaces or warehouses within the city.

- Employ workers who reside or work in Los Angeles.

- Generate a significant portion of their revenue from Los Angeles customers.

- Have a registered agent or headquarters in the city.

It's essential to note that certain businesses, such as those engaged in manufacturing, agriculture, or specific professional services, may be exempt from this tax. However, the exemption criteria can be complex, and it's advisable to consult with a tax professional or the City's official guidelines to confirm your eligibility.

Renewal Timeline and Deadlines

The City of Los Angeles operates on a fiscal year basis for business tax purposes, which runs from July 1st to June 30th of the following year. The renewal process typically opens in the spring, giving businesses ample time to complete the necessary steps before the deadline.

It's crucial to renew your business tax before the deadline to avoid penalties and potential legal issues. Late renewals may result in additional fees and could impact your business's standing with the City.

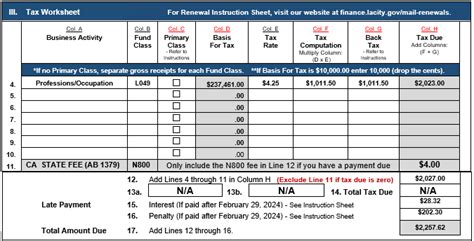

| Renewal Period | Renewal Deadline |

|---|---|

| April to June | June 30th |

During the renewal period, the City's Department of Finance will send out renewal notices to registered businesses. These notices will provide detailed instructions on how to renew your business tax online. It's essential to keep an eye on your inbox and ensure that your contact information is up-to-date with the City.

Online Renewal Process

The City of Los Angeles has made the business tax renewal process straightforward and accessible through its online portal. Here’s a step-by-step guide to help you navigate the process:

- Access the Renewal Portal: Visit the Business Tax Renewal Portal using the official link. This portal is secure and ensures the privacy of your business information.

- Log In or Create an Account: If you have an existing account, log in using your credentials. If you're a new user, you'll need to create an account. You'll be required to provide basic business information, including your business name, address, and tax ID.

- Renew Your Business Tax: Once logged in, you'll be guided through the renewal process. This typically involves selecting your business type, confirming your business details, and paying the applicable tax.

- Payment Methods: The City accepts various payment methods, including credit cards, debit cards, and electronic checks. You'll need to provide the necessary payment details during the renewal process.

- Receive Confirmation: After a successful renewal, you'll receive a confirmation email and a new registration certificate. Keep these documents for your records and future reference.

What to Do If You Miss the Deadline

If you realize that you’ve missed the business tax renewal deadline, it’s crucial to take immediate action to minimize any potential penalties. Here’s what you should do:

- Contact the Department of Finance: Reach out to the City's Department of Finance as soon as possible. They can guide you on the next steps and help you understand any penalties or late fees that may apply.

- Submit a Late Renewal: You'll likely be required to complete a late renewal application and pay any outstanding taxes, along with any applicable penalties. The City may have specific forms or procedures for late renewals.

- Update Your Records: Once your late renewal is processed, ensure that you update your business records and files with the new registration details. This includes updating any contracts or agreements that rely on your business tax registration.

Common Challenges and Solutions

While the City of LA Business Tax Renewal process is generally straightforward, there may be some common challenges that business owners encounter. Here are some potential issues and solutions:

- Difficulty in Determining Tax Liability: If you're unsure about your business's tax liability, consider consulting with a tax professional or accountant. They can help you understand the applicable tax rates and any potential exemptions you may qualify for.

- Technical Issues with the Online Portal: In rare cases, the online renewal portal may experience technical glitches. If you encounter such issues, try clearing your browser's cache and cookies or using a different browser. If the problem persists, contact the City's IT support or help desk for assistance.

- Lost or Misplaced Registration Certificate: If you've lost your business tax registration certificate, you can request a replacement through the City's website. You'll need to provide basic business information and pay a small fee for the replacement certificate.

Stay Informed and Updated

The business tax landscape can evolve over time, with changes in tax rates, regulations, or renewal procedures. It’s essential to stay informed about any updates or announcements made by the City of Los Angeles.

The City's official website, LA City, is a valuable resource for business owners. It provides up-to-date information on tax rates, renewal deadlines, and any relevant news or notifications. Additionally, consider subscribing to their email newsletters or following their social media accounts to receive timely updates.

The Importance of Compliance

Ensuring compliance with the City of LA Business Tax Renewal process is not just a legal requirement; it’s a critical aspect of maintaining your business’s reputation and standing within the community.

By staying compliant, you contribute to the local economy, support essential city services, and demonstrate your commitment to ethical business practices. Moreover, timely renewal can help avoid unnecessary complications, such as late fees, penalties, or even legal repercussions.

In conclusion, the City of LA Business Tax Renewal process is a necessary step for any business operating within the city limits. By understanding the requirements, deadlines, and renewal procedures, you can efficiently manage this administrative task and focus on growing your business in the vibrant Los Angeles marketplace.

What happens if I don’t renew my business tax on time?

+Failing to renew your business tax on time can result in late fees and penalties. Additionally, your business may face legal consequences, including potential suspension or revocation of your business license.

Are there any exemptions for certain types of businesses?

+Yes, some businesses may be exempt from the City of LA Business Tax. This includes certain agricultural businesses, manufacturers, and some professional services. It’s essential to review the official guidelines or consult with a tax professional to determine your eligibility.

Can I renew my business tax early, before the renewal period begins?

+While the official renewal period typically begins in the spring, businesses can renew their tax early as long as they have received their renewal notice. However, it’s advisable to wait for the official renewal period to take advantage of any updates or improvements to the online renewal process.