What Is Sales Tax In California

California's sales tax system is an essential aspect of the state's revenue generation and plays a significant role in its economic landscape. With a diverse range of goods and services, understanding the intricacies of sales tax in California is crucial for both businesses and consumers alike. In this comprehensive guide, we will delve into the specifics of sales tax, covering its rates, applicability, exemptions, and the impact it has on the Golden State's economy.

Unraveling the Complexities of Sales Tax in California

Sales tax in California is a consumption tax levied on the sale of goods and some services within the state. It is a critical component of the state's tax structure, contributing significantly to its overall revenue. The tax is collected by businesses and remitted to the California Department of Tax and Fee Administration (CDTFA), which oversees its administration and enforcement.

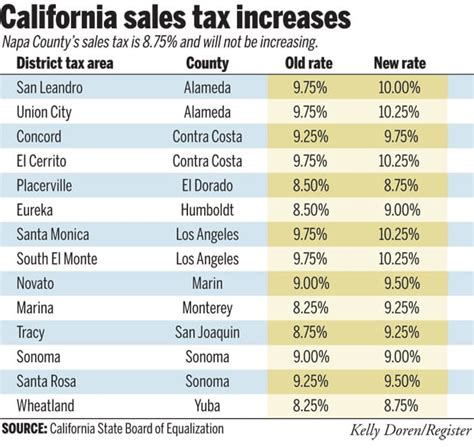

One unique aspect of California's sales tax is its multi-level structure. The state has a base sales tax rate, which is applied uniformly across the state. However, local jurisdictions, including cities and counties, have the authority to impose additional sales taxes on top of the state rate. This results in varying sales tax rates across different regions of California.

California Sales Tax Rates: A Complex Landscape

As of the most recent data available, the statewide sales and use tax rate in California stands at 7.25%. This base rate is applied to most retail transactions within the state. However, as mentioned earlier, local jurisdictions have the authority to levy additional taxes, leading to a complex patchwork of sales tax rates across California.

| County | Sales Tax Rate |

|---|---|

| Alameda County | 9.25% |

| Los Angeles County | 10.25% |

| San Diego County | 8.75% |

| Orange County | 8.25% |

| Sacramento County | 8.5% |

These examples showcase the variability in sales tax rates across different counties in California. It is important for businesses and consumers to be aware of these local variations to ensure compliance and accurate tax calculations.

Exemptions and Special Considerations in California Sales Tax

California's sales tax system is not a one-size-fits-all approach. There are several categories of goods and services that are exempt from sales tax, either partially or entirely. These exemptions are designed to encourage certain economic activities and provide relief to specific industries and consumers.

- Groceries and essential food items are exempt from sales tax in California. This exemption aims to alleviate the tax burden on basic necessities and ensure that food remains affordable for all residents.

- Clothing and footwear are exempt from sales tax up to a certain value. This exemption benefits consumers, especially those with limited means, by reducing the cost of essential clothing items.

- Certain services, such as professional services like legal and medical advice, are exempt from sales tax. This exemption recognizes the unique nature of these services and their importance to the state's economy.

- Sales tax is also not applied to prescription medications and medical devices. This exemption ensures that healthcare remains accessible and affordable for Californians in need.

It is crucial for businesses to stay informed about these exemptions to avoid unintended non-compliance and potential legal issues. The CDTFA provides detailed guidelines and resources to help businesses navigate these complexities.

The Impact of Sales Tax on California's Economy

Sales tax is a vital source of revenue for California, contributing significantly to the state's budget and funding various public services and infrastructure projects. The tax is used to support education, healthcare, transportation, and other essential government functions.

However, the variability in sales tax rates across the state can have implications for businesses and consumers. Higher sales tax rates in certain regions may incentivize consumers to shop in areas with lower rates, impacting local businesses. Conversely, lower sales tax rates can attract shoppers from neighboring areas, boosting local economies.

Additionally, the complexity of California's sales tax system can present challenges for businesses, especially those operating in multiple jurisdictions. Ensuring accurate tax calculations and compliance can be a daunting task, requiring careful attention to detail and potentially specialized tax software or expertise.

Frequently Asked Questions

How often do sales tax rates change in California?

+Sales tax rates can change periodically in California, typically as a result of local ballot measures or legislative actions. It is important to stay updated on these changes, as they can impact your business's tax obligations.

Are there any special sales tax holidays in California?

+Yes, California does observe certain sales tax holidays. These are designated periods when specific categories of goods, such as clothing or school supplies, are exempt from sales tax. These holidays provide an opportunity for consumers to save on essential items.

How can businesses ensure accurate sales tax calculations?

+Businesses can utilize tax software or consult with tax professionals to ensure accurate sales tax calculations. Staying informed about changing tax rates and regulations is crucial for compliance and avoiding potential penalties.

What happens if a business fails to remit sales tax?

+Failure to remit sales tax can result in penalties and interest charges. The CDTFA has a range of enforcement measures to ensure compliance, and businesses are encouraged to address any tax issues promptly to avoid legal consequences.

Understanding California’s sales tax system is essential for businesses and consumers alike. With its multi-level structure and varying rates, staying informed and compliant is crucial. By navigating the complexities and leveraging available resources, businesses can effectively manage their tax obligations while contributing to the vibrant economy of the Golden State.