Stanislaus County Tax

Welcome to an in-depth exploration of the Stanislaus County Tax system, where we delve into the intricacies of this crucial aspect of local governance. Stanislaus County, nestled in the heart of California, boasts a vibrant community and a unique tax structure that plays a pivotal role in its development and services. In this article, we will unravel the various facets of this tax system, shedding light on its components, benefits, and impact on the local economy and residents.

Understanding the Stanislaus County Tax Landscape

Stanislaus County, with its rich agricultural heritage and diverse industries, employs a comprehensive tax system to support its infrastructure, education, and public services. This system, though often complex, is designed to ensure fairness and efficiency, contributing significantly to the county’s prosperity.

The Core Components of Stanislaus County Tax

The Stanislaus County tax structure is a blend of various tax types, each serving a specific purpose. These include:

- Property Taxes: One of the primary sources of revenue, property taxes in Stanislaus County are assessed based on the value of real estate properties, including residential, commercial, and agricultural lands. These taxes are essential for funding local schools, fire protection, and other vital services.

- Sales and Use Taxes: Retail sales within the county are subject to sales tax, which contributes to the county’s general fund. Additionally, the use tax is applied to goods purchased outside the county but used or stored within Stanislaus County, ensuring fairness and generating additional revenue.

- Business Taxes: Businesses operating within the county are required to pay various taxes, such as business license taxes, payroll taxes, and gross receipts taxes. These taxes support the local economy and provide resources for community development and business incentives.

- Vehicle License Fees: Stanislaus County residents are required to pay an annual vehicle license fee, which is calculated based on the vehicle’s value and type. These fees contribute to the county’s transportation infrastructure and road maintenance.

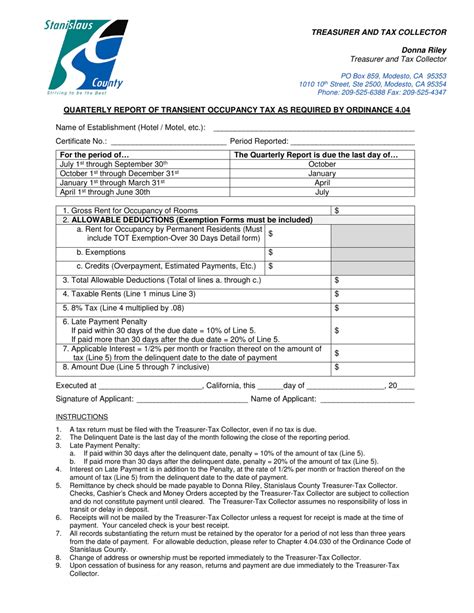

- Hotel and Lodging Taxes: A tax is imposed on transient occupancy, benefiting the tourism industry and generating funds for tourism promotion and community events.

Tax Benefits and Incentives

Stanislaus County offers a range of tax benefits and incentives to encourage economic growth and community development. These include:

- Enterprise Zone Incentives: Businesses operating within designated Enterprise Zones can benefit from tax credits, sales tax exemptions, and other incentives to promote job creation and investment.

- Property Tax Exemptions: Certain properties, such as those owned by non-profit organizations or used for affordable housing, may be eligible for partial or full property tax exemptions, promoting community development and social services.

- Small Business Assistance: The county provides support and resources to small businesses, including tax workshops, consulting services, and access to financing programs, to help them navigate the tax system and thrive.

| Tax Type | Rate (As of 2023) |

|---|---|

| Property Tax | 1.15% |

| Sales Tax | 7.75% |

| Hotel Occupancy Tax | 12% |

| Vehicle License Fee | 1.15% of Vehicle Value |

Tax Collection and Administration

The efficient collection and administration of taxes are vital to the success of any tax system. In Stanislaus County, this process is overseen by dedicated tax agencies and departments, ensuring transparency, accuracy, and compliance.

The Role of the Tax Collector’s Office

The Tax Collector’s Office is responsible for the assessment, collection, and disbursement of various taxes within the county. This office plays a crucial role in:

- Property Tax Assessment: Conducting annual assessments of property values to ensure fair and accurate taxation.

- Tax Billing: Generating and sending tax bills to property owners and businesses, providing clear and concise information on tax amounts and due dates.

- Collection and Disbursement: Efficiently collecting taxes and distributing the funds to the appropriate departments and agencies, ensuring the timely delivery of services.

- Taxpayer Assistance: Offering support and resources to taxpayers, including answering queries, providing payment plans, and offering online payment options for convenience.

Compliance and Enforcement

To maintain a fair and equitable tax system, Stanislaus County employs a range of compliance and enforcement measures, including:

- Audits: Regular audits are conducted to ensure taxpayers are compliant with tax laws and regulations, identifying potential issues and ensuring accurate reporting.

- Penalties and Interest: Late payments or non-compliance with tax regulations may result in penalties and interest charges, encouraging timely payments and adherence to tax laws.

- Appeal Process: Taxpayers have the right to appeal tax assessments or other tax-related decisions. The county provides a fair and transparent appeal process, allowing taxpayers to voice their concerns and seek resolution.

The Impact of Stanislaus County Tax

The Stanislaus County tax system is a crucial pillar of the local economy, funding a range of essential services and initiatives. The revenue generated from taxes is allocated to various sectors, ensuring the well-being and development of the community.

Funding Vital Services

Tax revenue in Stanislaus County is directed towards a multitude of public services, including:

- Education: A significant portion of property taxes goes towards funding local schools, ensuring quality education for the county’s youth.

- Public Safety: Taxes contribute to the county’s fire protection services, law enforcement, and emergency response teams, ensuring the safety and security of residents.

- Infrastructure: Revenue from vehicle license fees and other taxes is used to maintain and improve roads, bridges, and other transportation infrastructure, benefiting commuters and businesses.

- Health and Social Services: The county’s tax system supports healthcare facilities, social services, and community programs, addressing the needs of vulnerable populations and promoting public health.

Economic Development and Community Growth

The Stanislaus County tax system plays a pivotal role in fostering economic growth and community development. By offering incentives and supporting local businesses, the county attracts investment and creates job opportunities, contributing to a thriving local economy.

Community Engagement and Transparency

Stanislaus County strives for transparency and community engagement in its tax system. Regular public meetings, budget hearings, and community forums allow residents to voice their concerns, provide feedback, and actively participate in the decision-making process.

Conclusion

In conclusion, the Stanislaus County tax system is a complex yet effective framework, designed to support the county’s growth and development while ensuring fairness and transparency. Through a blend of various tax types, incentives, and efficient administration, the county collects and allocates resources to fund vital services, promote economic prosperity, and enhance the quality of life for its residents.

Frequently Asked Questions

What is the average property tax rate in Stanislaus County?

+

The average property tax rate in Stanislaus County is 1.15% as of 2023. This rate is applied to the assessed value of properties, which is determined annually by the county assessor’s office.

Are there any tax breaks or incentives for senior citizens or veterans in Stanislaus County?

+

Yes, Stanislaus County offers property tax exemptions and reduced tax rates for qualifying senior citizens and disabled veterans. These exemptions can significantly reduce the tax burden for eligible individuals, providing much-needed financial relief.

How often are property taxes assessed in the county?

+

Property taxes in Stanislaus County are assessed annually. The county assessor’s office conducts regular assessments to determine the value of properties, which forms the basis for calculating property taxes.

Can I pay my taxes online in Stanislaus County?

+

Absolutely! Stanislaus County offers convenient online payment options for various taxes, including property taxes, vehicle license fees, and business taxes. Taxpayers can access their accounts and make payments securely through the county’s official website.

What happens if I fail to pay my taxes on time in Stanislaus County?

+

Late payments in Stanislaus County may result in penalties and interest charges. The county’s tax collector’s office is responsible for enforcing timely payments and can take legal action in cases of prolonged non-payment, including placing liens on properties or initiating tax sales.