San Francisco Sale Tax

In the vibrant city of San Francisco, California, sales tax plays a crucial role in the economic landscape, impacting both businesses and consumers alike. With its unique location and thriving business environment, understanding the intricacies of San Francisco's sales tax regulations is essential for anyone conducting commercial activities within the city limits. This article aims to provide a comprehensive guide to San Francisco's sales tax, offering valuable insights into its rates, applicable goods and services, collection processes, and potential exemptions.

Understanding San Francisco’s Sales Tax Structure

San Francisco’s sales tax system is a complex interplay of state, county, and city taxes, each contributing to the overall tax burden on consumers. As of [insert date], the current sales tax rate in San Francisco is [X]%, which is comprised of several components.

State Sales Tax

California imposes a state-wide sales and use tax, which forms the foundation of the sales tax structure. As of [insert date], the state sales tax rate is [Y]%. This rate is applied uniformly across the state, including San Francisco.

County Sales Tax

On top of the state sales tax, San Francisco County imposes an additional sales tax. This county tax rate is currently set at [Z]%, further contributing to the overall sales tax burden in the city.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | [Y]% |

| County Sales Tax | [Z]% |

| City Sales Tax | [T]% |

City Sales Tax

San Francisco, being a major city with significant infrastructure and service needs, imposes its own sales tax to fund various city initiatives and programs. The city sales tax rate is currently [T]%, bringing the total sales tax rate in San Francisco to [X]%.

Goods and Services Subject to Sales Tax

The sales tax in San Francisco applies to a wide range of goods and services. However, it’s important to note that certain items and transactions are exempt from sales tax. Understanding these exemptions is crucial for both businesses and consumers to navigate the tax landscape effectively.

Taxable Goods

Sales tax is typically applied to tangible personal property, including clothing, electronics, furniture, and groceries. Additionally, sales tax extends to certain services, such as restaurant meals, haircuts, and entertainment events. These taxable items contribute to the city’s revenue stream, funding essential public services and infrastructure development.

Exemptions and Special Cases

While the majority of goods and services are subject to sales tax, certain items are exempt. For instance, prescription medications, most groceries, and educational materials are often exempt from sales tax. Additionally, specific transactions, such as purchases made by government entities or nonprofit organizations, may also be exempt from sales tax. It’s crucial for businesses to stay informed about these exemptions to ensure compliance and avoid unnecessary tax burdens.

Sales Tax Collection and Remittance

The process of collecting and remitting sales tax in San Francisco is a critical responsibility for businesses operating within the city. Understanding the procedures and deadlines for sales tax collection ensures smooth operations and compliance with tax regulations.

Point of Sale Collection

Businesses are required to collect sales tax at the point of sale, which means adding the applicable tax rate to the purchase price of taxable goods and services. This ensures that the tax is collected directly from the consumer at the time of purchase. Businesses are then responsible for remitting this collected tax to the appropriate tax authorities.

Registration and Remittance

To comply with sales tax regulations, businesses must register with the California Department of Tax and Fee Administration (CDTFA). This registration process involves obtaining a seller’s permit, which authorizes the business to collect and remit sales tax. Once registered, businesses are required to remit the collected sales tax to the CDTFA on a regular basis, typically on a monthly or quarterly basis, depending on the business’s sales volume.

Online Sales and Remote Sellers

With the rise of e-commerce, online sales have become a significant aspect of San Francisco’s retail landscape. Remote sellers, even those located outside California, are often required to collect and remit sales tax on transactions made with San Francisco consumers. This ensures that online businesses contribute to the city’s tax revenue, even if they do not have a physical presence within the city.

Sales Tax Exemptions and Special Programs

San Francisco, like many other cities, offers various sales tax exemptions and special programs to support specific industries, promote economic development, and encourage certain behaviors. These exemptions and programs can provide significant savings for businesses and consumers alike.

Manufacturer’s Exemption

San Francisco, in an effort to promote manufacturing and industrial activities within the city, offers a manufacturer’s exemption. This exemption allows manufacturers to purchase certain raw materials and equipment without paying sales tax. This incentive aims to attract and support manufacturing businesses, contributing to the city’s economic diversity.

Tourism Promotion Programs

The city recognizes the significant contribution of tourism to its economy and, as such, offers special programs to promote tourism-related activities. For instance, certain tourism-related services, such as hotel stays and tour packages, may be subject to a reduced sales tax rate, making San Francisco an even more attractive destination for travelers.

Small Business Incentives

San Francisco is committed to supporting small businesses, which are the backbone of many local economies. As such, the city offers various incentives and programs to ease the tax burden on small businesses. These may include reduced sales tax rates, tax credits, or simplified registration and reporting processes. These initiatives aim to encourage entrepreneurship and support the growth of local businesses.

Sales Tax Audits and Compliance

Maintaining compliance with sales tax regulations is crucial for businesses operating in San Francisco. Non-compliance can result in significant penalties and legal consequences. Therefore, businesses must stay informed about their tax obligations and implement robust internal controls to ensure accurate tax collection and reporting.

Sales Tax Audits

The California Department of Tax and Fee Administration (CDTFA) has the authority to conduct sales tax audits on businesses to ensure compliance. These audits can be random or triggered by suspicious activities or discrepancies in tax returns. During an audit, the CDTFA examines a business’s sales tax records, including sales invoices, purchase orders, and tax returns, to verify the accuracy of reported sales and collected taxes.

Penalties and Consequences

Businesses found to be non-compliant with sales tax regulations may face a range of penalties, including fines, interest charges, and even criminal charges in cases of intentional tax evasion. Additionally, non-compliance can result in the revocation of the business’s seller’s permit, effectively prohibiting the business from conducting further sales activities in San Francisco.

Tips for Compliance

To ensure compliance, businesses should establish a robust sales tax management system. This includes regularly reviewing sales tax rates and applicable exemptions, accurately calculating and collecting sales tax, and maintaining detailed records of all sales transactions. Additionally, staying informed about any changes to sales tax regulations and seeking professional advice when necessary can help businesses navigate the complex world of sales tax compliance.

Future Outlook and Potential Changes

The sales tax landscape in San Francisco is subject to change, influenced by various factors such as economic conditions, political decisions, and technological advancements. As the city continues to evolve, it’s important to stay updated on any potential modifications to sales tax rates, exemptions, and collection processes.

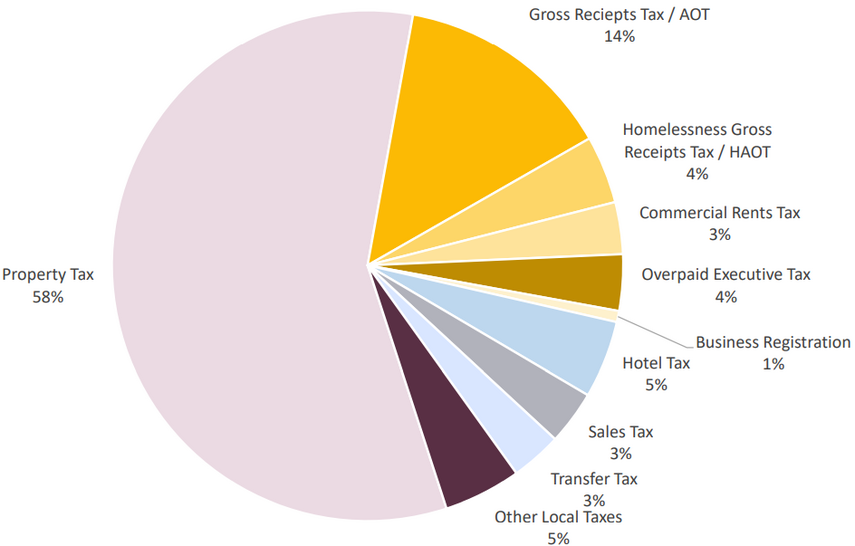

Economic Impact of Sales Tax

The sales tax in San Francisco plays a significant role in funding essential city services and infrastructure projects. As the city’s economy fluctuates, the sales tax revenue can be impacted. During periods of economic growth, increased consumer spending can lead to higher sales tax collections, benefiting the city’s budget. Conversely, economic downturns can result in reduced sales tax revenue, posing challenges for the city’s financial planning.

Political and Legislative Changes

Sales tax rates and regulations are often subject to political and legislative considerations. Local governments may propose changes to sales tax rates or introduce new exemptions to support specific industries or address emerging needs. Staying informed about any proposed changes and engaging in the legislative process can help businesses and consumers understand and prepare for potential alterations to the sales tax landscape.

Technological Advancements

The rapid advancement of technology, particularly in the realm of e-commerce, has brought about significant changes to the sales tax collection process. Online platforms and digital payment systems have made it easier for businesses to collect and remit sales tax, ensuring compliance even in the digital realm. As technology continues to evolve, businesses must adapt their sales tax management systems to stay in line with these advancements.

What is the current sales tax rate in San Francisco?

+As of [insert date], the current sales tax rate in San Francisco is [X]%. This rate includes state, county, and city sales taxes.

Are there any sales tax exemptions in San Francisco?

+Yes, San Francisco, like many other jurisdictions, offers various sales tax exemptions. These include exemptions for prescription medications, certain groceries, and educational materials. Additionally, specific transactions, such as those made by government entities or nonprofit organizations, may also be exempt.

How often do businesses need to remit sales tax in San Francisco?

+The frequency of sales tax remittance depends on the business’s sales volume. Typically, businesses with higher sales volumes are required to remit sales tax on a monthly basis, while those with lower sales volumes may be able to remit on a quarterly basis. It’s important for businesses to consult with the California Department of Tax and Fee Administration (CDTFA) to determine their specific remittance schedule.

What happens if a business fails to comply with sales tax regulations in San Francisco?

+Non-compliance with sales tax regulations can result in significant penalties and legal consequences. Businesses found to be non-compliant may face fines, interest charges, and even criminal charges in cases of intentional tax evasion. Additionally, the business’s seller’s permit may be revoked, prohibiting further sales activities in San Francisco.

Are there any resources available to help businesses understand and comply with San Francisco’s sales tax regulations?

+Yes, the California Department of Tax and Fee Administration (CDTFA) provides extensive resources and guidance to help businesses understand their sales tax obligations. This includes detailed information on registration, tax rates, exemptions, and compliance requirements. Businesses can also seek professional advice from tax consultants or attorneys specializing in sales tax matters.