Sales Tax Rate In Chicago Il

In the bustling city of Chicago, nestled within the state of Illinois, the sales tax landscape is a fascinating one. Understanding the sales tax rate in this vibrant metropolis is crucial for both businesses and consumers alike. Chicago, known for its iconic architecture, vibrant culture, and diverse population, has a sales tax system that plays a significant role in its economic ecosystem. This article delves into the specifics of Chicago's sales tax rate, its impact on the local economy, and the intricacies of how it is calculated and applied.

Navigating Chicago’s Sales Tax Structure

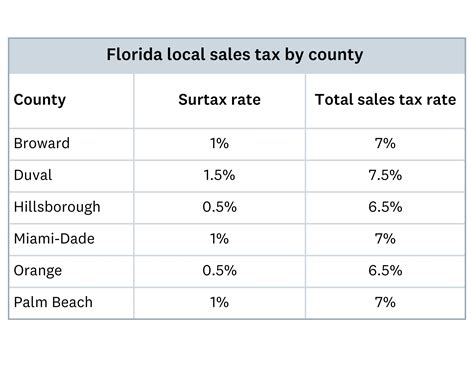

The sales tax rate in Chicago is not a one-size-fits-all scenario. It is a complex system that varies based on several factors, including the type of goods or services being sold, the location of the sale, and the tax status of the buyer. Let’s break down these variables to gain a clearer understanding.

The Basics of Chicago’s Sales Tax Rate

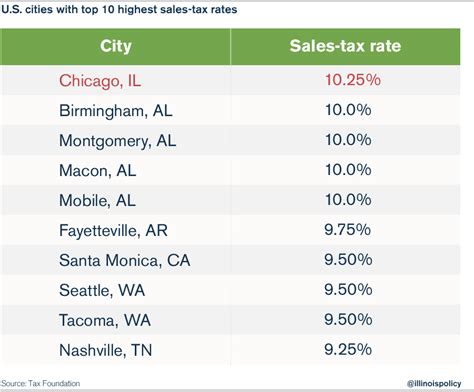

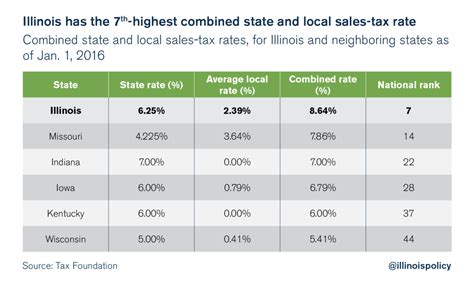

As of the latest available information, the standard sales tax rate in Chicago stands at 10.25%. This rate is a combination of the state sales tax rate, which is 6.25%, and the city’s additional sales tax, which is 4%. This city-specific tax is an essential revenue source for Chicago’s government, funding various public services and infrastructure projects.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Chicago City Tax | 4% |

| Total Sales Tax | 10.25% |

However, it's important to note that this is a general rate and certain goods and services may be subject to different tax rates. For instance, certain essential items like groceries and medications are often taxed at a reduced rate or may even be exempt from sales tax.

Variations and Exemptions

Chicago’s sales tax structure is not uniform across all goods and services. Certain categories, such as prescription drugs, certain medical devices, and some food items, are exempt from sales tax. Additionally, there are specific provisions for businesses, such as the Resale Certificate, which allows businesses to purchase goods without paying sales tax when the items will be resold.

Furthermore, the sales tax rate can also vary based on the location of the sale. While the city of Chicago has a standard rate of 10.25%, neighboring municipalities and counties may have their own additional sales taxes, resulting in varying rates across the metropolitan area.

Calculating Sales Tax: A Practical Example

Let’s illustrate the calculation of sales tax with a practical example. Imagine you’re purchasing a new laptop in Chicago, which costs $1000. Here’s how the sales tax would be calculated:

- First, apply the state sales tax: $1000 x 6.25% = $62.50.

- Next, add the city sales tax: $62.50 + ($1000 x 4%) = $62.50 + $40 = $102.50.

- So, the total sales tax for this purchase would be $102.50, making your laptop purchase amount to $1102.50.

This example demonstrates how the sales tax rate in Chicago is applied to the cost of goods, impacting the final price paid by consumers.

Impact on Local Economy

The sales tax rate in Chicago has a significant impact on the local economy. It serves as a primary source of revenue for the city, funding critical services like education, public safety, and infrastructure development. Additionally, it influences consumer behavior, with some shoppers opting to make purchases outside the city to avoid the higher sales tax rate.

For businesses, the sales tax rate can be a critical factor in pricing strategies and overall profitability. It also plays a role in the decision-making process for potential investors and entrepreneurs considering setting up operations in Chicago.

The Future of Sales Tax in Chicago

As with any tax system, Chicago’s sales tax rates are subject to change. Economic conditions, legislative decisions, and shifts in consumer behavior can all influence future adjustments. While it is challenging to predict exact future rates, one can anticipate that the sales tax system will continue to evolve to meet the changing needs of the city and its residents.

Staying informed about sales tax rates and their potential fluctuations is crucial for both businesses and consumers operating within Chicago's dynamic economy. Regularly reviewing official sources and keeping an eye on local news can provide valuable insights into any upcoming changes.

Conclusion

In conclusion, the sales tax rate in Chicago is a complex yet integral part of the city’s economic fabric. It influences pricing, consumer behavior, and revenue generation for the local government. Understanding this system is essential for anyone conducting business or making significant purchases within the city. As Chicago continues to thrive and evolve, its sales tax structure will remain a key factor in shaping its economic future.

Are there any sales tax holidays in Chicago?

+Yes, Chicago, along with the rest of Illinois, observes specific sales tax holidays. These are designated days when certain categories of goods, often back-to-school items, are exempt from sales tax. These holidays are typically announced in advance and can be a great opportunity for shoppers to save.

How do I calculate sales tax for online purchases delivered to Chicago?

+For online purchases delivered to Chicago, the sales tax is typically calculated based on the destination of the goods. This means the sales tax rate of the city where the goods are delivered applies. You can use online calculators or consult with a tax professional to ensure accuracy.

Are there any sales tax exemptions for tourists visiting Chicago?

+Currently, there are no specific sales tax exemptions for tourists in Chicago. However, certain goods, as mentioned earlier, are exempt from sales tax regardless of the buyer’s status. It’s always advisable to check with local authorities or tax professionals for the most up-to-date information.