Sales Tax In Ma

Sales tax in Massachusetts is a crucial aspect of the state's revenue generation and plays a significant role in its economic landscape. With a unique tax structure and varying rates across different regions, understanding the intricacies of sales tax in MA is essential for both businesses and consumers alike. In this comprehensive guide, we will delve into the specifics of sales tax in Massachusetts, covering everything from its historical context to its impact on local economies.

A Historical Perspective on Sales Tax in Massachusetts

The implementation of sales tax in Massachusetts dates back to the 1960s, a period marked by economic transformations and growing government expenditure. It was introduced as a means to bolster the state’s financial resources and provide a stable source of revenue for essential public services. Over the decades, the sales tax system in MA has evolved, with rate adjustments and legislative reforms shaping its current structure.

One notable historical milestone was the 1990s sales tax reform, which aimed to simplify the tax system and reduce administrative burdens. This reform consolidated multiple tax rates into a single statewide rate, bringing uniformity to sales tax practices across Massachusetts. However, this reform did not abolish the ability of certain municipalities to levy additional local sales taxes, leading to the diverse tax landscape we see today.

Understanding the Current Sales Tax Structure in MA

As of my last update in January 2023, Massachusetts operates a statewide sales and use tax rate of 6.25%, which is applied to most tangible personal property and certain services. This base rate is a fundamental component of the state’s tax system and is applicable across a wide range of goods and transactions.

However, it's important to note that Massachusetts allows for local option sales taxes, which means certain cities and towns have the authority to impose additional sales taxes on top of the state rate. These local taxes can vary significantly, with some municipalities charging as much as 2.75% extra, bringing the total sales tax rate to a substantial 9% in those areas.

| Locality | Additional Sales Tax Rate |

|---|---|

| Boston | 1.5% |

| Cambridge | 1.25% |

| Somerville | 1.75% |

| Medford | 1.75% |

| Everett | 1.5% |

This diversity in local sales tax rates has a significant impact on the purchasing behavior of consumers and the operational strategies of businesses. For instance, consumers might choose to shop in areas with lower sales tax rates, leading to potential revenue losses for businesses in high-tax areas. On the other hand, businesses might need to adapt their pricing strategies to remain competitive in regions with higher tax rates.

Sales Tax Exemptions and Special Considerations

While the general sales tax rate in Massachusetts is 6.25%, there are several categories of goods and services that are exempt from sales tax. These exemptions are designed to ease the tax burden on certain essential items and services, promote specific industries, or align with social policies.

Food and Groceries

A notable exemption in Massachusetts is the sales tax exemption on most food items. This exemption applies to both prepared and unprepared food, including groceries and certain beverages. However, it’s important to note that this exemption does not cover meals served in restaurants, which are subject to the full sales tax rate.

Clothing and Footwear

Massachusetts offers a sales tax exemption on clothing and footwear items priced under $175. This exemption is a relief for consumers, especially during sales and clearance events, as it allows them to save on essential items without incurring additional tax costs.

Prescription Drugs

Prescription drugs and certain medical devices are exempt from sales tax in Massachusetts. This exemption is in line with the state’s commitment to ensuring access to essential healthcare items without additional financial barriers.

Manufacturing and Industrial Equipment

Sales tax is also waived on manufacturing and industrial equipment, as well as certain raw materials used in production. This exemption is designed to support the state’s industrial sector and promote economic growth by reducing the tax burden on businesses.

Real Estate and Housing

Transactions involving real estate, such as the sale or transfer of land, are generally not subject to sales tax in Massachusetts. Instead, they are subject to a separate property transfer tax, which is administered by the Massachusetts Department of Revenue.

The Impact of Sales Tax on Local Economies

The variation in sales tax rates across different regions in Massachusetts has a profound impact on local economies. Higher sales tax rates can discourage consumer spending, potentially leading to reduced revenue for local businesses and a decline in economic activity. On the other hand, lower tax rates can attract consumers from neighboring areas, boosting local business and creating a competitive advantage.

Furthermore, the revenue generated from sales tax is a significant source of funding for local governments, allowing them to invest in infrastructure, public services, and community development projects. A well-managed sales tax system can thus be a powerful tool for local economic growth and development.

Compliance and Enforcement: A Business Perspective

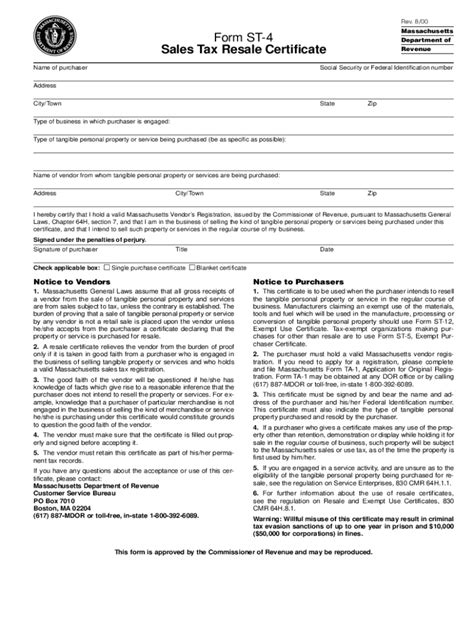

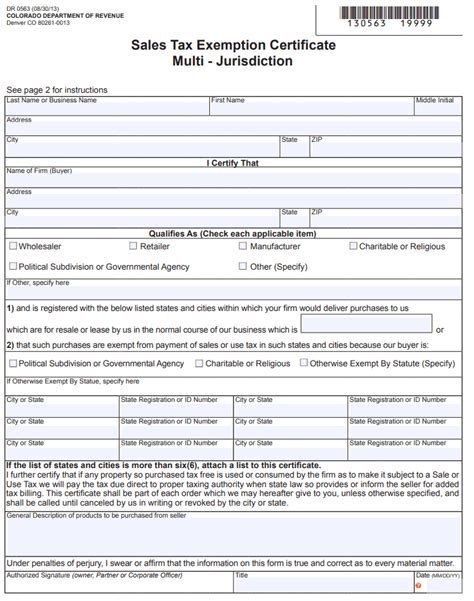

For businesses operating in Massachusetts, understanding and complying with the state’s sales tax regulations is essential. The Massachusetts Department of Revenue provides clear guidelines and resources to assist businesses in their tax obligations, including registration, filing, and remittance processes.

However, navigating the complex sales tax landscape, especially with the addition of local taxes, can be challenging. Businesses must ensure they are aware of their tax obligations in each jurisdiction they operate in and consider the impact of sales tax on their pricing and profitability.

The Department of Revenue conducts regular audits to ensure compliance with sales tax regulations. Non-compliance can result in significant penalties and legal repercussions, highlighting the importance of accurate tax management for businesses.

Future Trends and Potential Reforms

As the economic landscape continues to evolve, so too might the sales tax system in Massachusetts. Potential future trends could include further standardization of sales tax rates to simplify the system and reduce administrative burdens for businesses. Alternatively, there might be moves to expand sales tax exemptions to promote certain industries or reduce the tax burden on specific goods and services.

Additionally, with the rise of e-commerce and online sales, Massachusetts might need to adapt its sales tax regulations to ensure fairness and compliance in the digital marketplace. This could involve implementing economic nexus laws or exploring other strategies to capture revenue from online transactions.

Conclusion: Navigating the Sales Tax Landscape in MA

In conclusion, the sales tax system in Massachusetts is a complex yet essential component of the state’s economic framework. With its unique structure, varying rates, and diverse exemptions, it presents both opportunities and challenges for businesses and consumers alike.

By understanding the intricacies of sales tax in MA, businesses can make informed decisions about their pricing strategies, compliance obligations, and overall market positioning. Consumers, on the other hand, can make more informed choices about their purchases, ensuring they are aware of the tax implications and potential savings.

As Massachusetts continues to adapt and evolve its sales tax system, staying informed and proactive will be key for all stakeholders involved.

How often are sales tax rates updated in Massachusetts?

+Sales tax rates in Massachusetts are typically updated annually, with the changes effective from July 1st each year. These updates are based on legislative decisions and can include changes to the statewide rate or adjustments to local option taxes.

Are there any plans to abolish local option sales taxes in Massachusetts?

+As of my last update, there were no concrete plans to abolish local option sales taxes in Massachusetts. These taxes are a significant source of revenue for local governments and are considered an essential tool for local economic development. However, ongoing discussions and debates about tax reforms are common, and future changes cannot be ruled out.

How can businesses stay updated on sales tax regulations in Massachusetts?

+Businesses can stay informed about sales tax regulations in Massachusetts by regularly checking the Massachusetts Department of Revenue’s website, which provides the latest updates and resources. They can also consider subscribing to relevant industry newsletters or following reputable tax advisory firms for timely updates.