S C State Tax Refund Status

The South Carolina Department of Revenue (SCDOR) offers various ways for taxpayers to check the status of their tax refund. Understanding the process and the available options can help taxpayers stay informed and ensure a smooth experience. This guide provides an in-depth look at how to check your S C State Tax Refund Status, covering all the essential details and offering practical tips.

Understanding the SCDOR Tax Refund Process

The South Carolina Department of Revenue processes tax returns and issues refunds to eligible taxpayers. The department aims to issue refunds within 30 days of receiving complete and accurate returns. However, several factors can impact the processing time, including the method of filing, payment status, and any potential issues with the return.

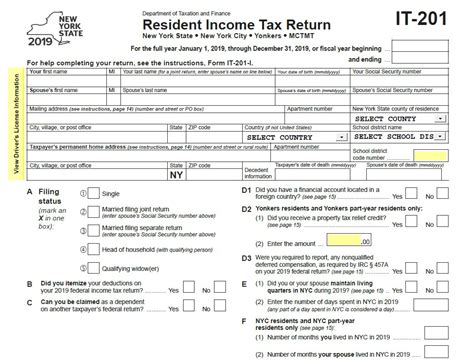

Taxpayers can choose from different filing methods, each with its own processing timeline. Electronic filing, for instance, often results in faster refunds compared to paper returns. The SCDOR encourages taxpayers to file electronically, offering a convenient and secure way to submit tax information.

Electronic Filing and Refund Anticipation

Electronic filing has become the preferred method for many taxpayers due to its speed and efficiency. When taxpayers e-file their tax returns, the SCDOR can process the information more quickly, leading to faster refund issuance. The department works closely with authorized electronic return originators (EROs) to ensure a secure and accurate filing process.

Taxpayers can anticipate receiving their refunds within a shorter timeframe when filing electronically. The SCDOR aims to issue refunds within 14 business days after receiving the return. However, it's important to note that this timeline can vary based on the complexity of the return and other factors.

Paper Returns and Extended Processing Times

For taxpayers who prefer or need to file a paper return, the processing time can be longer. The SCDOR processes paper returns in the order they are received, and the department encourages taxpayers to allow additional time for these returns to be processed. While the department aims for a 30-day turnaround, it’s not uncommon for paper returns to take longer, especially during peak tax season.

Taxpayers should ensure their paper returns are complete and accurate to avoid any delays. Any errors or missing information can extend the processing time, as the SCDOR may need to correspond with the taxpayer to clarify or correct the return.

Checking Your S C State Tax Refund Status

The SCDOR provides several convenient ways for taxpayers to check the status of their tax refund. These options offer real-time information, ensuring taxpayers can stay informed about the progress of their refund.

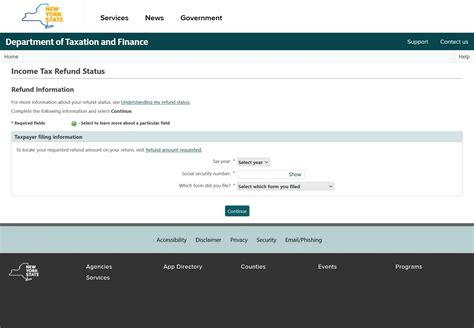

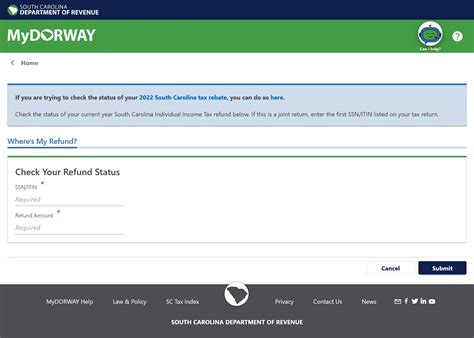

Online Refund Status Check

The SCDOR’s website offers an online refund status tool, allowing taxpayers to check the status of their refund quickly and easily. To use this tool, taxpayers will need their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) and the exact amount of their refund. This information can be found on their tax return, providing a secure way to verify their identity.

The online refund status tool provides up-to-date information, showing the current status of the refund. Taxpayers can check their refund status at any time, offering convenience and peace of mind. The tool updates regularly, reflecting the progress of the refund through the various stages of processing.

Telephone Refund Status Inquiry

For taxpayers who prefer a more personal approach, the SCDOR offers a telephone refund status inquiry service. Taxpayers can call the department’s toll-free number to speak with a representative who can provide real-time refund status information.

The telephone inquiry service is available during regular business hours, and taxpayers will need to provide their SSN or ITIN and other identifying information to verify their identity. The representative can provide details about the refund, including the current stage of processing and any potential delays.

Mail-In Refund Status Request

While less common, taxpayers can also request a refund status update by mail. This option is ideal for taxpayers who may not have access to online resources or prefer a more traditional approach. Taxpayers should send a written request, including their name, address, SSN or ITIN, and the tax year for which they are requesting the refund status.

The SCDOR will respond to mail-in refund status requests within 30 days. While this option is not as immediate as the online or telephone methods, it still provides taxpayers with a reliable way to stay informed about their refund.

Potential Refund Delays and Troubleshooting

While the SCDOR aims to process refunds promptly, several factors can lead to delays. Understanding these potential delays can help taxpayers navigate any issues and ensure their refund is processed accurately.

Common Reasons for Refund Delays

Some of the most common reasons for refund delays include errors or discrepancies in the tax return, missing or incomplete information, and issues with the taxpayer’s identity verification. The SCDOR may need to correspond with the taxpayer to resolve these issues, extending the processing time.

Additionally, taxpayers who claim certain tax credits or deductions may experience longer processing times. These credits and deductions often require additional review to ensure accuracy and compliance with state tax laws. While these reviews are necessary to maintain the integrity of the tax system, they can add time to the refund process.

Troubleshooting Refund Issues

If taxpayers encounter issues with their refund, such as a delay or an unexpected change in status, there are several steps they can take to troubleshoot the problem.

First, taxpayers should verify their identity and the accuracy of their tax return. Double-checking the information on the return can help identify any errors or discrepancies that may have caused a delay. Taxpayers should also ensure they have provided complete and accurate identifying information when checking their refund status.

If the issue persists, taxpayers can contact the SCDOR's taxpayer assistance line for further assistance. The department's representatives can provide detailed information about the status of the refund and offer guidance on resolving any issues. Taxpayers should have their tax return and any correspondence from the SCDOR readily available when contacting the department.

Future Enhancements and Improvements

The SCDOR is committed to continuously improving its tax refund processes and services. The department is exploring new technologies and streamlined procedures to enhance the taxpayer experience and reduce processing times.

Modernizing Tax Refund Processes

The SCDOR recognizes the importance of keeping up with technological advancements to improve efficiency and convenience for taxpayers. The department is actively working on implementing new systems and processes to enhance the accuracy and speed of tax refund processing.

One area of focus is improving the electronic filing system. The SCDOR aims to make e-filing more accessible and user-friendly, encouraging more taxpayers to choose this method. By streamlining the e-filing process, the department can reduce errors and expedite refund issuance.

Expanding Refund Status Options

The SCDOR understands the value of providing taxpayers with multiple ways to check their refund status. The department is exploring additional options, such as text message updates and mobile app notifications, to offer taxpayers even more convenience and flexibility.

These new channels would provide real-time updates on refund status, allowing taxpayers to stay informed without having to log in to the SCDOR's website or call the department. By expanding the ways taxpayers can receive refund status updates, the SCDOR aims to enhance the overall taxpayer experience.

Conclusion: A Commitment to Taxpayer Service

The South Carolina Department of Revenue is dedicated to providing excellent service to taxpayers, including offering convenient ways to check the status of their tax refund. By understanding the refund process, taxpayers can make informed decisions about their filing method and stay updated on the progress of their refund.

The SCDOR's online, telephone, and mail-in refund status options provide taxpayers with the information they need to navigate the tax refund process effectively. Additionally, the department's commitment to modernizing its processes and expanding refund status options ensures taxpayers can expect a seamless and efficient experience in the future.

By staying informed and utilizing the available resources, taxpayers can ensure a smooth tax refund process, receiving their refunds promptly and accurately.

What if I don’t receive my tax refund within the expected timeframe?

+

If you don’t receive your tax refund within the expected timeframe, it’s important to check the status of your refund using the SCDOR’s online tool or by calling the taxpayer assistance line. There may be a delay due to various reasons, such as errors on your tax return or additional reviews required for certain tax credits. If you still don’t receive your refund after a reasonable time, you can contact the SCDOR for further assistance and guidance.

Can I track my tax refund status using my smartphone or mobile device?

+

Yes, you can track your tax refund status using your smartphone or mobile device. The SCDOR’s online refund status tool is mobile-friendly, allowing you to check your refund status on the go. Simply visit the SCDOR’s website on your mobile browser and enter the required information to access your refund status.

How can I ensure my tax return is processed accurately and quickly?

+

To ensure your tax return is processed accurately and quickly, it’s essential to file your return completely and accurately. Double-check your tax return for any errors or missing information before submitting it. Additionally, consider filing electronically, as it is faster and more secure than filing a paper return. By following these steps, you can help expedite the refund process and reduce the likelihood of delays.

What should I do if I receive a notice or letter from the SCDOR regarding my tax refund?

+

If you receive a notice or letter from the SCDOR regarding your tax refund, it’s important to carefully review the correspondence. The notice may provide specific instructions or request additional information from you. Respond promptly to any requests, providing the necessary documentation or clarification. If you have any questions or concerns, contact the SCDOR’s taxpayer assistance line for further guidance.