Riverside Property Tax

Welcome to this comprehensive guide on Riverside Property Tax, a critical aspect of homeownership and real estate investment in the vibrant city of Riverside, California. This article aims to demystify the process of property taxation, providing an in-depth understanding of how it works and its implications for Riverside residents and investors.

Understanding Riverside Property Tax: An In-Depth Exploration

Riverside Property Tax is an essential component of the city’s financial landscape, playing a crucial role in funding public services, infrastructure development, and community projects. It is a levy imposed on real estate properties within the city limits, with the amount owed determined by the assessed value of the property and the applicable tax rates.

The process of property tax assessment in Riverside involves a meticulous evaluation of each property's characteristics, including its size, location, improvements, and market value. This assessment is conducted by the Riverside County Assessor's Office, which utilizes a combination of market data, sales comparisons, and physical inspections to determine the fair market value of each property.

Property Tax Rates and Assessments

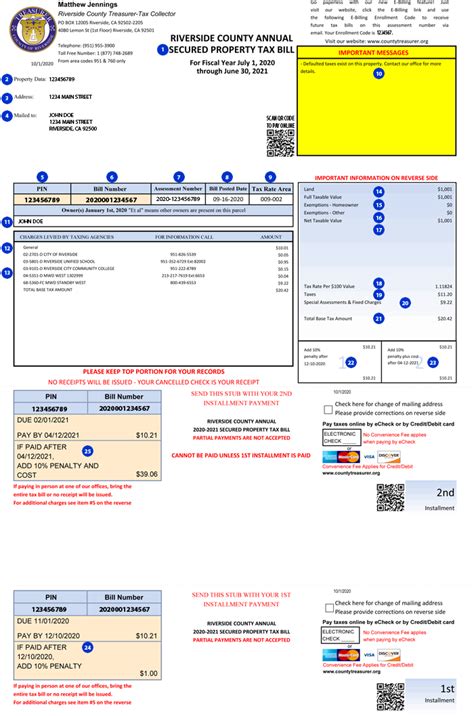

The property tax rate in Riverside is set annually by the city’s governing body, taking into account the financial needs of various public services and the overall economic climate. The tax rate is expressed as a percentage of the property’s assessed value and is typically divided into two components: the general tax rate and any applicable special assessments.

| Assessment Type | Description |

|---|---|

| General Tax Rate | The primary tax rate used to fund essential city services, such as police, fire protection, and general administration. |

| Special Assessments | Additional charges imposed to fund specific public improvements or services that directly benefit a particular area or property, such as street lighting, flood control, or park maintenance. |

For the current fiscal year, the general tax rate in Riverside stands at 1.08%, while special assessments can vary depending on the specific improvements or services in a given area. It's important to note that these rates are subject to change annually and may be influenced by factors such as budget requirements and state-mandated tax limitations.

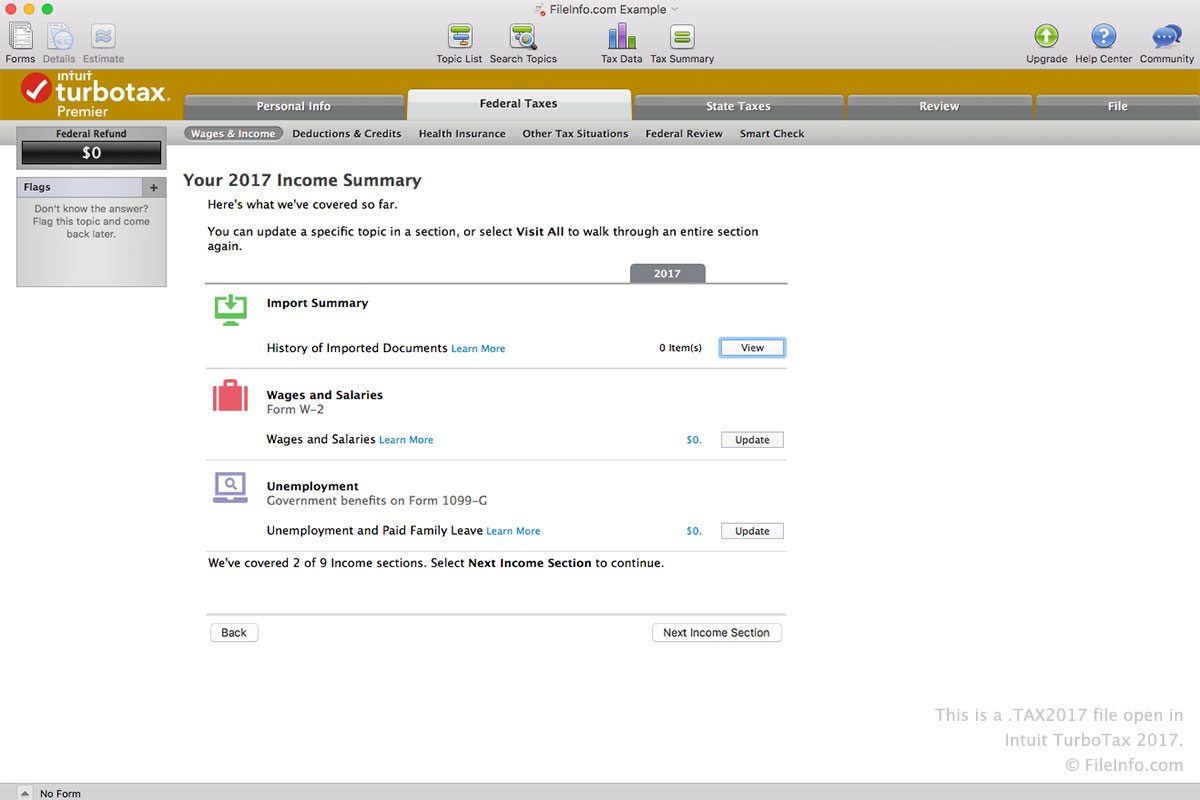

Property Tax Bills and Payment Options

Property owners in Riverside receive an annual tax bill detailing the assessed value of their property, the applicable tax rates, and the total amount due. This bill is typically sent out in the fall, with payment due by December 10th of each year. Failure to pay by the due date may result in penalties and interest charges, and in extreme cases, a lien on the property.

To make paying property taxes more manageable, Riverside offers various payment options. Property owners can choose to pay their taxes in full by the due date or opt for a convenient installment plan, allowing them to make two payments, one in February and the other in April. Additionally, online payment platforms and automatic payment arrangements are available, providing flexibility and ease of payment.

Appealing Property Tax Assessments

In certain circumstances, property owners may feel that their tax assessment is inaccurate or unfair. Riverside provides a process for appealing property tax assessments, allowing homeowners and investors to dispute the assessed value of their property. The appeal process is managed by the Riverside County Assessment Appeals Board, which reviews evidence and makes determinations on a case-by-case basis.

Common reasons for appealing a property tax assessment include discrepancies in the assessed value compared to recent sales of similar properties, errors in the property's physical characteristics, or significant changes in the property's condition since the last assessment. It's important to note that the appeal process can be complex and may require the assistance of a professional tax consultant or attorney.

The Impact of Property Taxes on Riverside’s Real Estate Market

Property taxes play a significant role in shaping Riverside’s real estate market, influencing both buyer behavior and investment strategies. The predictability and stability of property tax rates can encourage long-term investment and foster a sense of security among homeowners.

For buyers, understanding the property tax implications is crucial when considering a home purchase. The tax burden can significantly impact a property's overall affordability, especially for first-time homebuyers or those on a tight budget. Real estate agents and financial advisors often factor in property taxes when helping clients determine their purchasing power and long-term financial planning.

From an investment perspective, property taxes are a key consideration when evaluating the potential returns on rental properties or real estate development projects. Investors must carefully assess the tax implications, including any potential tax benefits or incentives, to ensure the financial viability of their ventures.

Strategies for Managing Property Tax Burden

While property taxes are a necessary contribution to the community, homeowners and investors can employ various strategies to manage their tax burden effectively. One common approach is to take advantage of any available tax deductions or credits, such as those for homeowners who occupy their property as their primary residence or for certain energy-efficient improvements.

Additionally, staying informed about changes in property tax rates and assessment practices can help property owners anticipate and plan for potential increases. Being proactive in maintaining and improving one's property can also influence its assessed value, potentially leading to a more favorable tax assessment.

The Future of Riverside Property Tax: Trends and Implications

As Riverside continues to grow and evolve, the landscape of property taxation is likely to undergo changes and adaptations. The city’s commitment to sustainable development, infrastructure improvements, and community enhancement projects will undoubtedly influence future tax policies and rates.

One emerging trend is the increasing focus on equitable property taxation, ensuring that the tax burden is distributed fairly across different types of properties and income levels. This may involve reevaluating assessment practices to account for factors such as a property's environmental impact, social benefits, or its contribution to the local economy.

Additionally, as technology advances, the process of property tax assessment and collection may become more efficient and transparent. The integration of digital tools and data analytics could enhance the accuracy and timeliness of assessments, leading to a more responsive and dynamic tax system.

Conclusion

Understanding Riverside Property Tax is essential for both residents and investors in the city’s dynamic real estate market. By comprehending the assessment process, tax rates, and payment options, property owners can navigate the taxation landscape with confidence and make informed decisions about their financial obligations.

As Riverside continues to thrive and evolve, staying abreast of changes in property taxation will be crucial for homeowners and investors alike. With a proactive approach and a keen eye on emerging trends, property owners can effectively manage their tax burden and contribute to the vibrant community of Riverside.

How often are property tax assessments conducted in Riverside?

+Property tax assessments in Riverside are typically conducted every two years, with the Riverside County Assessor’s Office conducting physical inspections and utilizing market data to determine property values. However, in certain circumstances, such as significant property improvements or changes in ownership, reassessments may occur more frequently.

Are there any tax breaks or exemptions available for Riverside homeowners?

+Yes, Riverside offers several tax breaks and exemptions to eligible homeowners. These include the Homeowner’s Exemption, which provides a reduction in the assessed value of a primary residence, and the Senior Citizen’s Exemption, which offers a tax reduction for homeowners aged 65 and older. Additionally, veterans and disabled individuals may qualify for specific tax exemptions.

What happens if I miss the property tax payment deadline in Riverside?

+Missing the property tax payment deadline can result in penalties and interest charges. If the delinquency persists, the county may place a tax lien on the property, which could eventually lead to a tax sale if the taxes remain unpaid. It is crucial to stay informed about payment deadlines and take advantage of the available payment options to avoid such consequences.