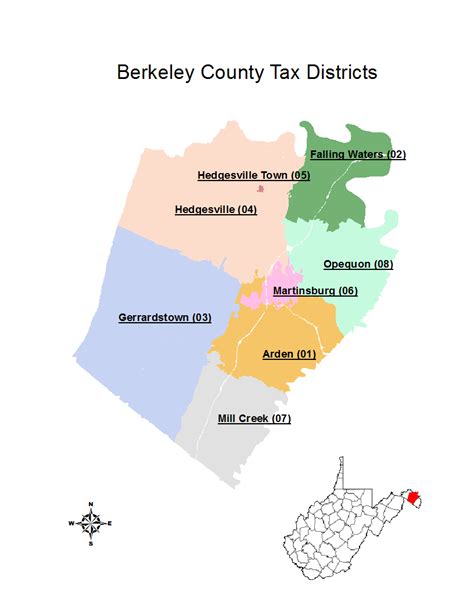

Berkeley County Wv Tax Records

When it comes to understanding tax records, particularly in Berkeley County, West Virginia, it is essential to delve into the specifics of property taxes, assessment processes, and the role of the Berkeley County Assessor's Office. This article aims to provide a comprehensive guide, exploring these aspects in detail and offering valuable insights for property owners and those interested in the county's tax landscape.

Understanding Property Taxes in Berkeley County

Property taxes are a significant source of revenue for local governments, including Berkeley County. These taxes are levied on real estate properties, such as homes, land, and commercial buildings, and play a crucial role in funding essential public services and infrastructure.

In Berkeley County, the property tax system is designed to ensure fairness and transparency. The tax rate is set annually by the County Commission and is applied uniformly to all properties within the county. This rate is typically expressed as a percentage of the property's assessed value.

The assessed value of a property is determined through a comprehensive assessment process conducted by the Berkeley County Assessor's Office. This office is responsible for appraising the value of all taxable properties within the county, ensuring that the tax burden is distributed equitably among property owners.

Assessment Process: A Step-by-Step Guide

The property assessment process in Berkeley County involves several key steps, each aimed at ensuring accuracy and fairness.

- Data Collection: Assessors gather detailed information about each property, including its physical characteristics, such as size, location, improvements, and any recent renovations or additions. This data forms the basis for the property's valuation.

- Market Analysis: Assessors analyze recent sales and market trends in the area to determine the fair market value of similar properties. This helps in establishing a benchmark for the property's assessed value.

- Appraisal Techniques: Various appraisal methods are employed, such as the cost approach, income approach, and sales comparison approach, to arrive at a precise valuation. These techniques consider factors like the property's replacement cost, potential rental income, and recent sales of comparable properties.

- Notification and Review: Once the assessed value is determined, property owners are notified of the assessed value and tax liability. Owners have the right to review and appeal the assessment if they believe it is inaccurate or unfair.

- Final Assessment: After any appeals have been resolved, the final assessed value is recorded, and the property tax bill is generated based on this value and the current tax rate.

Tax Record Accessibility and Online Resources

Berkeley County recognizes the importance of transparency and ease of access to tax records. To facilitate this, the county provides an online platform where property owners and interested parties can access a wealth of information related to property taxes.

The Berkeley County Assessor's website offers a comprehensive search tool, allowing users to lookup property tax records by address, parcel number, or owner's name. These records provide detailed information, including the property's assessed value, tax rate, and the calculated tax amount.

Additionally, the website provides valuable resources such as tax maps, property appraisal guidelines, and instructions for filing tax appeals. It also includes contact information for the Assessor's Office, enabling taxpayers to reach out with any inquiries or concerns.

| Resource | Description |

|---|---|

| Property Tax Search | An online tool to lookup tax records by address, parcel number, or owner. |

| Tax Maps | Interactive maps displaying property boundaries and tax information. |

| Appraisal Guidelines | Detailed guidelines on how properties are assessed and valued. |

| Appeal Process | Instructions and resources for filing tax appeals. |

Tax Rates and Revenue Distribution

The tax rate in Berkeley County is determined by the County Commission, taking into account the budget requirements of various local government entities, including schools, fire departments, and other essential services.

The tax rate is expressed as a percentage, and it is applied uniformly to all properties within the county. For example, if the tax rate is set at 0.8%, it means that for every $1,000 of assessed value, the property owner would owe $8 in property taxes.

The revenue generated from property taxes is distributed among these local government entities based on predetermined formulas. This ensures that the tax revenue is utilized effectively to provide quality services to the community.

Impact of Tax Rates on Property Owners

While property taxes are an essential source of revenue for the county, they also have a direct impact on property owners. Higher tax rates can result in increased financial obligations for homeowners and businesses.

To mitigate the potential burden, Berkeley County employs a progressive tax system. This means that properties with higher assessed values may be subject to slightly lower tax rates, providing a measure of relief for those with more valuable properties.

Additionally, the county offers various exemptions and deductions to eligible property owners. These include homestead exemptions for primary residences and tax deductions for certain improvements or renovations that increase the property's energy efficiency or accessibility.

Future Outlook and Tax Reforms

As Berkeley County continues to grow and develop, the property tax landscape is expected to evolve as well. The county is committed to ensuring that the tax system remains fair, efficient, and responsive to the needs of the community.

In recent years, there has been a growing emphasis on technological advancements to enhance the tax assessment and collection processes. The implementation of digital tools and online platforms has improved accuracy, transparency, and accessibility for taxpayers.

Furthermore, Berkeley County is actively exploring potential tax reforms to address emerging challenges and ensure long-term sustainability. These reforms may include reevaluating the tax rate structure, exploring alternative revenue streams, and implementing measures to promote economic development while maintaining a stable tax base.

Key Takeaways and Recommendations

For property owners in Berkeley County, staying informed about property taxes is crucial. Here are some key recommendations:

- Regularly review your property tax records and ensure the assessed value accurately reflects your property's current condition and market value.

- Take advantage of online resources provided by the Berkeley County Assessor's Office to stay updated on tax rates, assessment processes, and any relevant changes.

- Explore potential exemptions and deductions you may be eligible for to reduce your tax burden.

- Engage with local government representatives and attend public meetings to stay involved in the tax reform process and voice your concerns or suggestions.

Conclusion

Understanding the intricacies of Berkeley County’s tax records and the property tax system is essential for property owners and community members alike. By exploring the assessment process, tax rates, and available resources, individuals can make informed decisions and actively participate in the local tax landscape.

As Berkeley County continues to thrive, a transparent and efficient tax system will be pivotal in sustaining the community's growth and development. With a commitment to fairness, transparency, and technological innovation, the county is well-positioned to navigate the evolving tax landscape.

How often are properties reassessed in Berkeley County?

+Properties in Berkeley County are typically reassessed every four years. However, certain events, such as significant improvements or renovations, may trigger an earlier reassessment.

What happens if I disagree with my property’s assessed value?

+If you believe your property’s assessed value is inaccurate, you have the right to file an appeal with the Berkeley County Board of Equalization and Review. The appeal process involves submitting evidence and attending a hearing to present your case.

Are there any tax relief programs for seniors or veterans in Berkeley County?

+Yes, Berkeley County offers tax relief programs for eligible seniors and veterans. These programs provide reduced tax rates or exemptions based on specific criteria, such as age, disability, or military service. It’s recommended to contact the Assessor’s Office for more information.