Property Taxes Jacksonville Fl

Property taxes are a significant aspect of homeownership, and understanding how they work and what factors influence them is crucial for homeowners and prospective buyers alike. In this article, we will delve into the world of property taxes in Jacksonville, Florida, exploring the various components, rates, and strategies to manage these financial obligations effectively.

The Landscape of Property Taxes in Jacksonville

Jacksonville, nestled in the sunny state of Florida, boasts a vibrant real estate market and a diverse range of properties. With its stunning beaches, thriving business districts, and picturesque neighborhoods, it’s no wonder that property ownership is a popular choice for many. However, along with the perks of homeownership come the responsibilities, and property taxes are a key consideration.

Property taxes in Jacksonville, like in many other jurisdictions, serve as a primary source of revenue for local governments, contributing to essential services such as education, infrastructure, and public safety. These taxes are typically calculated based on the assessed value of a property and are an annual obligation for homeowners.

Understanding the Assessment Process

The assessment of property value is a crucial step in determining the tax liability for homeowners in Jacksonville. The process involves several key components:

Market Value and Assessment Ratios

The first step in assessing property taxes is determining the market value of a property. This value reflects the current real estate market conditions and is influenced by factors such as location, size, amenities, and recent sales of similar properties in the area. Once the market value is established, it is subjected to an assessment ratio, which is a percentage applied to the market value to derive the assessed value.

In Jacksonville, the assessment ratio is set at 10% for most properties. This means that the assessed value is typically 10% of the market value. For example, if a property's market value is determined to be $300,000, the assessed value would be $30,000.

Assessment Exemptions and Special Considerations

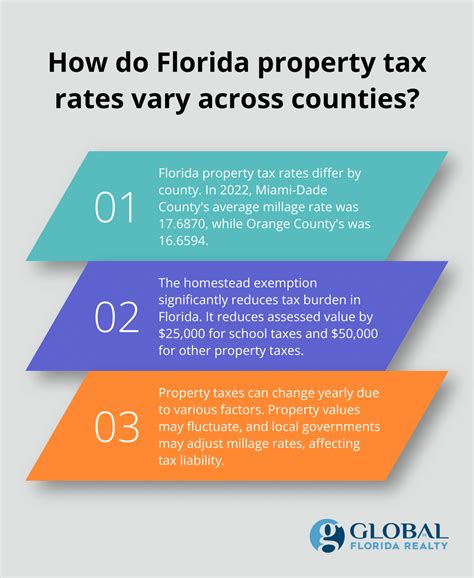

It’s important to note that certain properties may be eligible for assessment exemptions or special considerations. For instance, homestead properties, which are primary residences owned and occupied by the homeowner, may be entitled to a homestead exemption. This exemption reduces the assessed value of the property, resulting in lower property taxes.

Additionally, properties with certain agricultural or conservation designations may also be eligible for special assessment considerations. These exemptions or special assessments aim to promote specific goals, such as encouraging agricultural activities or preserving natural habitats.

Calculating Property Taxes

Once the assessed value of a property is determined, the actual property tax amount is calculated. This process involves applying a millage rate, which is a tax rate expressed in mills, to the assessed value.

Millage Rates and Taxable Values

In Jacksonville, the millage rate is set by the local government and varies depending on the specific location within the city. The rate is typically expressed in mills per thousand of the assessed value. For instance, if the millage rate is set at 10 mills, it means that for every 1,000 of assessed value, 10 in property taxes is owed.

To illustrate, let's consider a property with an assessed value of $30,000 and a millage rate of 10 mills. The property tax calculation would be as follows:

| Assessed Value | Millage Rate | Property Tax |

|---|---|---|

| $30,000 | 10 mills | $300 |

Therefore, the property owner would owe $300 in property taxes for that specific year.

Taxable Value and Homestead Exemptions

It’s important to understand that the taxable value of a property may differ from the assessed value due to the homestead exemption mentioned earlier. This exemption reduces the taxable value, which is the value upon which property taxes are calculated. As a result, properties with homestead exemptions may have lower property tax obligations.

For example, if a property with an assessed value of $30,000 qualifies for a $20,000 homestead exemption, the taxable value would be reduced to $10,000. Using the same millage rate of 10 mills, the property tax calculation would be as follows:

| Taxable Value | Millage Rate | Property Tax |

|---|---|---|

| $10,000 | 10 mills | $100 |

In this case, the property owner would owe $100 in property taxes, benefiting from the homestead exemption.

Strategies for Managing Property Taxes

Property taxes can be a significant expense for homeowners, and implementing effective strategies can help manage these costs. Here are some approaches to consider:

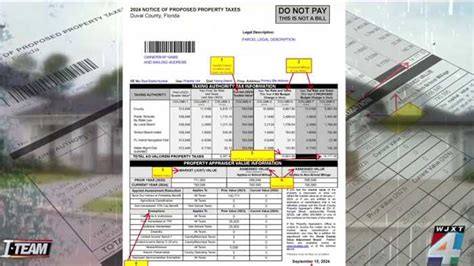

Understanding Assessment Notices

Property owners in Jacksonville receive annual assessment notices that provide details about their property’s assessed value and the corresponding property taxes. These notices are an essential tool for understanding the tax obligations and identifying any potential errors or discrepancies. It is crucial to review these notices carefully and reach out to the appropriate authorities if any concerns arise.

Appealing Assessments

If a property owner believes that their property’s assessed value is inaccurate or higher than it should be, they have the right to appeal the assessment. This process typically involves providing evidence, such as recent sales of similar properties or professional appraisals, to support the claim. Successful appeals can lead to a reduction in the assessed value, resulting in lower property taxes.

Utilizing Exemptions and Credits

As mentioned earlier, homestead exemptions and other special considerations can significantly impact property tax obligations. It is essential for homeowners to explore and understand the various exemptions and credits they may be eligible for. Consulting with tax professionals or local authorities can help identify applicable exemptions and ensure that homeowners take full advantage of these opportunities.

Property Improvements and Maintenance

Maintaining and improving a property can not only enhance its market value but also potentially influence its assessed value. While property improvements do not guarantee a reduction in assessed value, they can contribute to a more accurate assessment and potentially lead to lower property taxes over time. Regular maintenance and updates can help ensure that a property’s value is properly reflected in the assessment process.

The Impact of Property Taxes on the Local Community

Property taxes play a vital role in funding essential services and initiatives within the local community. The revenue generated from these taxes supports:

- Education: Property taxes contribute to the funding of local schools, ensuring that students have access to quality education and resources.

- Public Safety: A portion of property taxes goes towards maintaining a robust police force, fire department, and emergency services, keeping the community safe and secure.

- Infrastructure Development: Property taxes help finance road improvements, public transportation, and other infrastructure projects, enhancing the overall quality of life for residents.

- Community Services: From parks and recreational facilities to libraries and cultural centers, property taxes support the development and maintenance of these community amenities.

Future Implications and Considerations

As the real estate market in Jacksonville continues to evolve, it is essential for homeowners and prospective buyers to stay informed about property tax trends and potential changes. Here are some key considerations for the future:

Market Fluctuations

The real estate market is subject to fluctuations, and changes in property values can impact property taxes. During periods of economic growth and rising property values, homeowners may experience an increase in their property tax obligations. Conversely, during economic downturns or stagnant markets, property values may decrease, potentially leading to lower property taxes.

Local Government Initiatives

Local governments often implement initiatives and programs aimed at managing property taxes and supporting homeowners. These initiatives may include tax relief programs, assessment freeze periods, or adjustments to millage rates. Staying informed about such initiatives can help homeowners navigate potential challenges and take advantage of available benefits.

Community Engagement

Active participation in community affairs and engagement with local government representatives can provide valuable insights into property tax matters. Attending town hall meetings, joining community associations, and staying connected with local news and developments can empower homeowners to advocate for their interests and influence property tax policies.

Conclusion

Property taxes in Jacksonville, Florida, are an essential component of homeownership, funding vital services and contributing to the overall well-being of the community. By understanding the assessment process, calculation methods, and available strategies, homeowners can effectively manage their property tax obligations. Additionally, staying informed about market trends, local initiatives, and community developments enables homeowners to make informed decisions and actively participate in shaping their community’s future.

How often are property taxes assessed in Jacksonville, FL?

+Property taxes in Jacksonville, FL, are typically assessed annually. Homeowners receive assessment notices detailing their property’s assessed value and corresponding tax obligations for the upcoming year.

Can I appeal my property’s assessed value in Jacksonville?

+Yes, property owners in Jacksonville have the right to appeal their property’s assessed value if they believe it is inaccurate or excessive. The appeal process involves providing evidence to support the claim and may result in a reduction of the assessed value.

What are some common exemptions or credits available in Jacksonville for property taxes?

+Jacksonville offers various exemptions and credits to eligible homeowners, including the homestead exemption, which reduces the taxable value of a primary residence. Other credits may be available for seniors, veterans, and properties with certain conservation or agricultural designations.

How can I stay informed about property tax initiatives and changes in Jacksonville?

+To stay informed about property tax initiatives and changes in Jacksonville, homeowners can subscribe to local news sources, attend community meetings, and engage with local government representatives. Additionally, online resources and property tax websites can provide valuable updates and information.