Property Tax Richland County

Property taxes are an essential component of local government funding, influencing the financial stability and development of communities. Richland County, South Carolina, is no exception, with its property tax system playing a pivotal role in supporting various public services and infrastructure. Understanding the intricacies of Richland County's property tax landscape is crucial for residents, businesses, and investors alike, as it impacts their financial obligations and contributes to the overall economic health of the region.

The Fundamentals of Richland County’s Property Tax System

Richland County’s property tax system is a well-established mechanism that serves as a primary source of revenue for the county government. The tax is levied on both real estate and personal property, ensuring a comprehensive approach to funding public services.

Taxable Property

The term “taxable property” in Richland County encompasses a broad range of assets. Real estate, including residential, commercial, and industrial properties, is a significant portion of the taxable base. Additionally, personal property, such as vehicles, boats, and business equipment, is subject to taxation. The county’s assessment process ensures that all property owners contribute fairly to the community’s financial needs.

Assessment and Valuation

The assessment process is a critical step in determining property tax obligations. Richland County employs a team of professional assessors who are responsible for evaluating the value of each property. This valuation is based on a variety of factors, including the property’s location, size, age, and condition. The assessed value serves as the foundation for calculating the tax liability, ensuring that the tax burden is distributed equitably among property owners.

Tax Rates and Calculations

Richland County’s property tax rate is established annually by the county council, taking into consideration the financial needs of the community and the prevailing economic conditions. The tax rate is expressed in mills, with one mill representing one dollar of tax for every $1,000 of assessed property value. To calculate the property tax, the assessed value is multiplied by the tax rate, resulting in the tax liability for the property owner.

| Year | Tax Rate (Mills) |

|---|---|

| 2023 | 107.5 |

| 2022 | 106.0 |

| 2021 | 104.5 |

Exemptions and Discounts

Richland County offers a range of exemptions and discounts to certain property owners, aimed at providing financial relief and encouraging specific behaviors. For instance, senior citizens, disabled veterans, and low-income homeowners may qualify for exemptions that reduce their taxable property value. Additionally, the county provides a homestead exemption, which offers a tax break to homeowners who use their property as their primary residence.

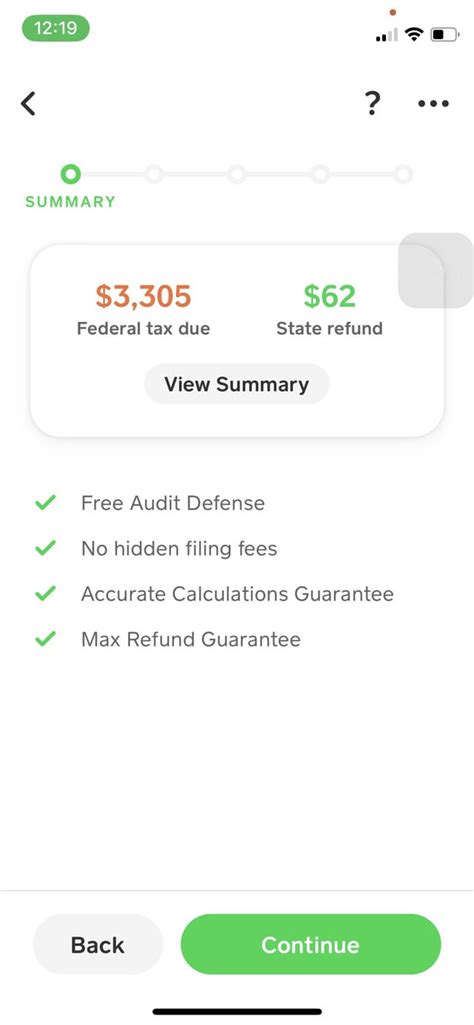

Payment Options and Due Dates

Richland County offers several convenient payment options for property taxes. Property owners can choose to pay in full by a specific due date, typically in the fall, or opt for a payment plan that allows for installments. Online payment portals, mobile apps, and traditional methods like checks and money orders are accepted, ensuring flexibility for taxpayers.

The Impact of Property Taxes on Richland County’s Economy

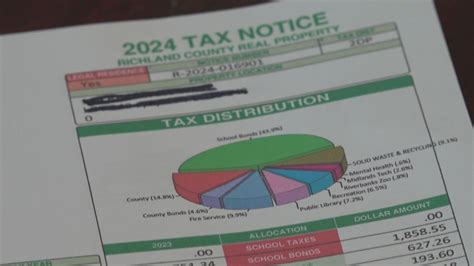

Property taxes play a vital role in shaping Richland County’s economic landscape. The revenue generated from these taxes funds essential public services, such as education, public safety, healthcare, and infrastructure development. By investing in these areas, Richland County enhances its appeal as a desirable place to live, work, and do business, thereby fostering economic growth and attracting new residents and businesses.

Funding Education and Community Initiatives

A significant portion of Richland County’s property tax revenue is dedicated to supporting the local education system. This funding ensures that schools have the resources needed to provide quality education, fostering a skilled workforce and contributing to the county’s long-term economic prosperity. Additionally, property taxes contribute to community initiatives, such as recreational programs, cultural events, and environmental projects, enriching the quality of life for residents.

Infrastructure Development and Maintenance

Property taxes are a crucial source of funding for Richland County’s infrastructure projects. The revenue is used to maintain and upgrade roads, bridges, public transportation systems, and utilities. Well-maintained infrastructure not only improves the day-to-day lives of residents but also attracts businesses and investors, further boosting the county’s economic growth.

Supporting Public Safety and Emergency Services

Richland County’s property taxes also play a vital role in funding public safety and emergency services. These funds support the operations of the county’s police and fire departments, ensuring the safety and well-being of residents. Furthermore, property taxes contribute to the county’s emergency response capabilities, including disaster preparedness and recovery efforts.

Challenges and Opportunities in Richland County’s Property Tax Landscape

While Richland County’s property tax system is well-structured and serves the community effectively, it is not without its challenges. Rising property values, economic fluctuations, and changing community needs present ongoing issues that the county must navigate.

Addressing Rising Property Values

As Richland County experiences economic growth and development, property values often rise. This can lead to an increase in tax liabilities for property owners, potentially impacting their financial stability. The county must carefully balance the need for revenue with the financial well-being of its residents and businesses, ensuring that tax rates remain fair and manageable.

Economic Fluctuations and Their Impact

Economic downturns and recessions can significantly affect Richland County’s property tax revenue. During such periods, property values may decline, leading to a decrease in tax revenue. The county must have robust financial planning and budgeting strategies in place to navigate these challenges, ensuring that essential services are not compromised.

Adapting to Changing Community Needs

Community needs and priorities evolve over time, and Richland County’s property tax system must adapt to meet these changing demands. This includes investing in emerging areas such as renewable energy initiatives, affordable housing, and technology infrastructure. By staying agile and responsive, the county can ensure that its tax revenue is allocated effectively to meet the needs of its residents and businesses.

Best Practices and Innovations in Property Tax Management

Richland County is committed to implementing best practices and innovative strategies to enhance its property tax management system. These initiatives aim to improve efficiency, transparency, and taxpayer experience, ensuring that the county remains a leader in effective tax administration.

Implementing Technology for Efficiency

Richland County has embraced technology to streamline its property tax processes. Online platforms and mobile apps allow taxpayers to access their account information, view tax bills, and make payments conveniently. Additionally, the county utilizes data analytics and artificial intelligence to improve the accuracy and efficiency of its assessment processes, ensuring that property values are determined fairly and consistently.

Enhancing Taxpayer Communication and Education

Effective communication is key to a successful property tax system. Richland County prioritizes taxpayer education, providing clear and accessible information about tax rates, assessment processes, and payment options. The county utilizes a variety of communication channels, including its website, social media platforms, and community outreach programs, to ensure that taxpayers are well-informed and engaged.

Promoting Transparency and Accountability

Transparency and accountability are vital aspects of a fair and effective property tax system. Richland County strives to maintain open lines of communication with taxpayers, providing regular updates on tax policies, budget allocations, and expenditure reports. By fostering transparency, the county builds trust with its residents and businesses, ensuring that tax revenue is used efficiently and responsibly.

The Future of Property Taxes in Richland County

As Richland County continues to grow and evolve, its property tax system will play an increasingly vital role in shaping the community’s future. The county’s commitment to innovation, efficiency, and taxpayer well-being positions it well to meet the challenges and opportunities that lie ahead.

Sustainable Growth and Development

Richland County’s property tax revenue is a key driver of sustainable growth and development. The county’s investment in infrastructure, education, and community initiatives attracts new businesses and residents, fostering a vibrant and resilient local economy. By continuing to allocate tax revenue strategically, Richland County can ensure that its growth is balanced and sustainable, benefiting current and future generations.

Addressing Equity and Fairness Concerns

Equity and fairness are essential considerations in any tax system. Richland County recognizes the importance of ensuring that its property tax system treats all taxpayers fairly and equitably. The county is committed to ongoing assessment of its tax policies and practices, ensuring that exemptions and discounts are accessible to those who need them and that tax rates are set at appropriate levels.

Collaborative Approach to Community Development

Richland County understands the value of collaboration in driving community development. The county actively engages with stakeholders, including residents, businesses, and community organizations, to gather input and feedback on tax policies and community initiatives. By working together, Richland County can develop tax strategies that align with the community’s needs and aspirations, fostering a sense of ownership and shared responsibility.

How are property taxes calculated in Richland County?

+Property taxes in Richland County are calculated by multiplying the assessed value of the property by the current tax rate, expressed in mills. The assessed value is determined by professional assessors based on factors like location, size, and condition. The tax rate is set annually by the county council and can vary from year to year.

Are there any exemptions or discounts available for property taxes in Richland County?

+Yes, Richland County offers various exemptions and discounts to certain property owners. These include exemptions for senior citizens, disabled veterans, and low-income homeowners. Additionally, a homestead exemption is available for homeowners who use their property as their primary residence. These exemptions and discounts aim to provide financial relief to eligible taxpayers.

What payment options are available for property taxes in Richland County?

+Richland County offers several payment options for property taxes. Taxpayers can choose to pay in full by a specific due date or opt for a payment plan that allows for installments. Online payment portals, mobile apps, checks, and money orders are accepted, providing flexibility and convenience for taxpayers.