Preliminary Tax Definition

In the realm of financial management and accounting, understanding the intricacies of taxation is paramount. Among the myriad tax-related terms, the concept of preliminary tax stands out as a critical element in the fiscal landscape. This article aims to delve into the depths of preliminary tax, shedding light on its definition, purpose, calculation, and implications for individuals and businesses alike. By unraveling the complexities surrounding preliminary tax, we can better comprehend its role in the broader context of financial planning and compliance.

The Concept of Preliminary Tax

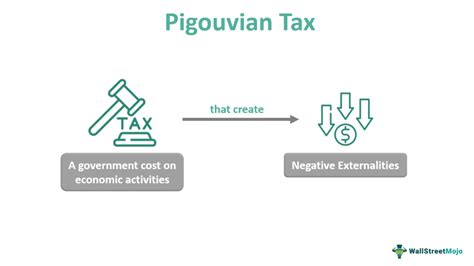

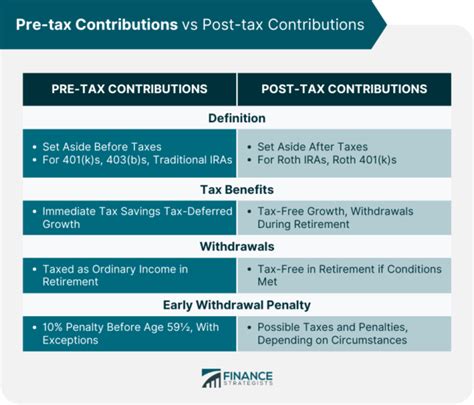

Preliminary tax, also known as prepayment tax or advance tax, is a financial mechanism employed by governments and tax authorities to ensure a steady inflow of tax revenue throughout the fiscal year. It serves as an advance payment system, whereby taxpayers are required to make periodic payments toward their estimated annual tax liability before the end of the tax year. This system is designed to provide a more stable and predictable revenue stream for governments, facilitating better financial planning and management.

The implementation of preliminary tax is a strategic move by tax authorities to mitigate the potential impact of large tax payments at the end of the year, which can strain both individual and business finances. By spreading the tax burden over multiple installments, taxpayers gain a measure of financial flexibility and can more effectively manage their cash flow. Moreover, preliminary tax payments help taxpayers stay compliant with tax regulations and avoid potential penalties for late or incomplete payments.

Calculation and Assessment of Preliminary Tax

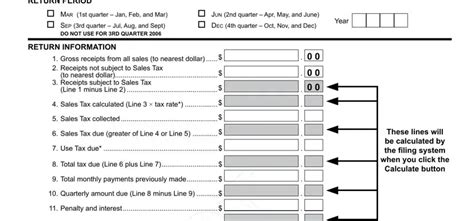

The calculation of preliminary tax involves a series of steps and considerations, aimed at determining an individual’s or a business’s estimated tax liability for the current tax year. Tax authorities often provide specific guidelines and formulas for taxpayers to estimate their annual tax obligation, taking into account various factors such as income, deductions, and applicable tax rates.

Taxpayers typically begin by assessing their previous year's tax liability, which serves as a starting point for estimating the current year's obligation. This initial estimate is then adjusted based on anticipated changes in income, deductions, or tax laws. The resulting amount is divided into equal installments, which the taxpayer must pay at regular intervals throughout the year. These intervals are predetermined by the tax authority and may vary depending on the taxpayer's status and the jurisdiction's regulations.

For instance, in a country like Xenia, the tax authority might require individuals to make quarterly preliminary tax payments, while businesses might be subjected to monthly or semi-annual payments. The specific schedule and calculation methodology can differ significantly between jurisdictions, underscoring the importance of understanding local tax regulations.

| Jurisdiction | Preliminary Tax Schedule |

|---|---|

| Country A | Quarterly payments for individuals, monthly for businesses |

| Region B | Semi-annual payments for all taxpayers |

| Territory C | Annual payments, with an option for quarterly installments |

Factors Influencing Preliminary Tax Calculation

- Income Level: Higher income generally results in higher preliminary tax obligations.

- Deductions and Exemptions: Taxpayers can lower their preliminary tax payments by claiming eligible deductions and exemptions.

- Tax Rate Changes: Fluctuations in tax rates can significantly impact the preliminary tax calculation.

- Previous Year’s Tax Liability: This serves as a baseline for estimating the current year’s obligation.

- Personal or Business Circumstances: Life events or business changes can affect tax liability and preliminary tax payments.

Compliance and Implications

Compliance with preliminary tax regulations is essential to avoid penalties and maintain a positive relationship with tax authorities. Failure to make timely payments or underestimating tax liability can result in fines, interest charges, and even legal repercussions. Taxpayers are encouraged to carefully review their financial situation, estimate their tax obligations accurately, and adhere to the prescribed payment schedule.

Moreover, preliminary tax payments provide taxpayers with an opportunity to review their financial strategies and make necessary adjustments. By regularly assessing their tax liability, individuals and businesses can identify areas for improvement, such as optimizing deductions, exploring tax-efficient investment options, or restructuring their financial portfolios. This proactive approach to tax management can lead to significant savings and better overall financial health.

Benefits of Preliminary Tax for Taxpayers

- Financial Planning: Spreads the tax burden, aiding in better financial management.

- Compliance: Ensures taxpayers stay in line with tax regulations, avoiding penalties.

- Cash Flow Management: Allows for more effective management of cash flow throughout the year.

- Strategic Financial Decisions: Provides an opportunity to review and optimize financial strategies.

- Peace of Mind: Helps taxpayers avoid the stress of large, lump-sum tax payments.

Challenges and Considerations

While preliminary tax offers several advantages, it also presents certain challenges and considerations. For instance, taxpayers with fluctuating income or those facing economic uncertainties might struggle to accurately estimate their tax liability, leading to potential underpayment or overpayment issues. Additionally, the administrative burden of making periodic payments and keeping track of changing tax laws can be significant, especially for small businesses or individuals with complex financial situations.

Future Outlook and Innovations

As tax systems evolve, there is a growing emphasis on simplifying tax processes and enhancing taxpayer convenience. Many jurisdictions are exploring digital platforms and online tools to facilitate preliminary tax payments, making the process more accessible and efficient. Additionally, the integration of artificial intelligence and machine learning in tax software is expected to revolutionize tax estimation and compliance, providing more accurate predictions and real-time insights for taxpayers.

Furthermore, there is a global trend towards harmonizing tax systems and regulations, aimed at reducing complexities and improving international tax compliance. This movement could lead to more standardized preliminary tax systems, making it easier for taxpayers with cross-border operations to navigate the tax landscape.

Potential Future Developments

- Digital Tax Platforms: Online portals for streamlined preliminary tax payments and management.

- AI-Assisted Tax Estimation: Machine learning algorithms for more precise tax liability predictions.

- Global Tax Harmonization: Standardized preliminary tax systems for international taxpayers.

- Real-Time Tax Compliance: Instant updates and adjustments based on changing tax laws.

- Tax Education Initiatives: Programs to enhance taxpayer understanding of preliminary tax systems.

Conclusion

Preliminary tax is a critical component of modern tax systems, designed to promote financial stability and compliance for both taxpayers and governments. By understanding the definition, calculation, and implications of preliminary tax, individuals and businesses can navigate the tax landscape more effectively. As tax systems continue to evolve, staying informed about changes and leveraging innovative tools will be key to successful tax management and compliance.

How often do I need to make preliminary tax payments?

+

The frequency of preliminary tax payments varies by jurisdiction. Some countries require quarterly payments, while others may have monthly or semi-annual schedules. It’s crucial to consult your local tax authority or seek professional advice to understand the specific requirements for your region.

Can I adjust my preliminary tax payments if my financial situation changes?

+

Yes, if your financial circumstances undergo significant changes, you may be eligible to adjust your preliminary tax payments. This could include situations like a change in income, deductions, or tax laws. However, it’s essential to consult with a tax professional or the tax authority to ensure you comply with the necessary procedures and avoid penalties.

What happens if I miss a preliminary tax payment deadline?

+

Missing a preliminary tax payment deadline can result in penalties, interest charges, and potential legal consequences. It’s crucial to stay on top of your payment schedule and seek assistance if you anticipate difficulties making a payment. Many tax authorities offer payment plans or extensions, but timely communication is key to avoiding penalties.