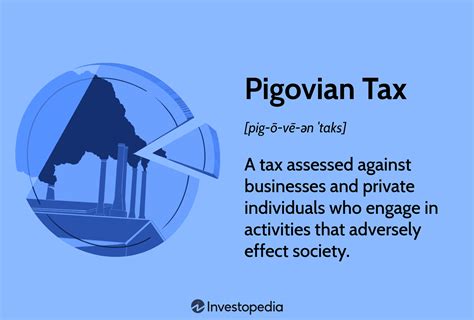

Pigovian Tax

The concept of a Pigovian tax, also known as a Pigouvian tax, is an intriguing economic tool designed to address market failures and promote efficient resource allocation. This tax, named after the British economist Arthur Cecil Pigou, has gained significant attention in recent years as policymakers and economists seek innovative solutions to various societal and environmental challenges.

In the realm of economics, market failures occur when the free market, left to its own devices, fails to allocate resources efficiently, leading to undesirable outcomes such as pollution, congestion, or negative externalities. Pigovian taxes aim to correct these market distortions by internalizing the costs of such externalities, thereby incentivizing individuals and businesses to make more socially responsible choices.

Understanding Pigovian Taxes

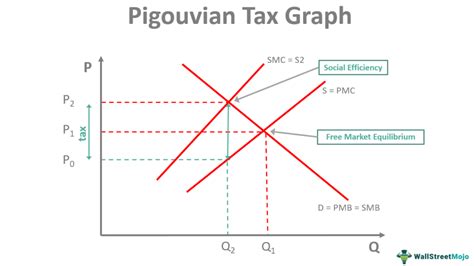

A Pigovian tax is a type of corrective tax imposed on activities or transactions that generate negative externalities. Negative externalities are costs or impacts that are not fully reflected in the price of a good or service, yet affect third parties. A classic example is environmental pollution, where the costs of pollution (e.g., health issues, environmental degradation) are borne by society as a whole, not just the polluters.

Pigovian taxes are designed to address these external costs by making the polluter or the creator of the negative externality pay for the harm caused. By imposing a tax proportional to the harm, the tax aims to discourage the undesirable activity and encourage more environmentally and socially conscious behavior.

For instance, consider a factory that emits harmful pollutants into the air. A Pigovian tax on the factory's emissions would make the factory bear the cost of its pollution, encouraging it to adopt cleaner production methods or invest in pollution control technologies. This tax aims to internalize the external cost of pollution, making the factory's decision-making more aligned with the social costs and benefits.

Key Principles and Applications

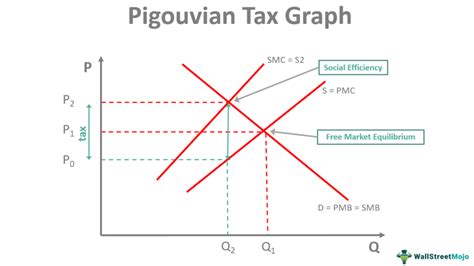

Principle of Efficiency

Pigovian taxes are rooted in the principle of efficiency, which suggests that resources are allocated most efficiently when the social costs and benefits of an activity are considered. By imposing a tax that reflects the social cost of an activity, the tax encourages individuals and firms to make choices that are more in line with societal well-being.

Applications in Environmental Policy

One of the most prominent applications of Pigovian taxes is in environmental policy. Carbon taxes, for example, are a form of Pigovian tax designed to reduce greenhouse gas emissions and combat climate change. By taxing the carbon content of fuels, these taxes encourage a shift towards cleaner energy sources and energy-efficient practices.

Similarly, Pigovian taxes can be applied to address issues like water pollution, noise pollution, and even waste management. For instance, a tax on water usage during times of drought can encourage water conservation, while a tax on noisy vehicles or equipment can incentivize the use of quieter, more environmentally friendly alternatives.

Health and Social Policy

Pigovian taxes are not limited to environmental issues. They can also be used in health and social policy to address negative externalities in these domains. For example, taxes on unhealthy foods or beverages can discourage their consumption, leading to improved public health outcomes. Similarly, taxes on activities with high social costs, such as gambling or certain types of entertainment, can generate revenue for social welfare programs.

Optimal Tax Rate

Determining the optimal tax rate for a Pigovian tax is crucial to its effectiveness. The tax rate should be set to equal the marginal social cost of the activity being taxed. This ensures that the tax internalizes the full cost of the negative externality, providing the right incentive for behavior change without being overly burdensome.

| Activity | Marginal Social Cost | Optimal Pigovian Tax Rate |

|---|---|---|

| Carbon Emissions | $50 per ton of CO2 | $50 per ton of CO2 |

| Water Usage during Drought | $20 per cubic meter | $20 per cubic meter |

| Unhealthy Food Consumption | $10 per unit | $10 per unit |

Advantages and Challenges

Advantages of Pigovian Taxes

- Efficient Resource Allocation: Pigovian taxes encourage efficient use of resources by internalizing external costs.

- Incentives for Behavior Change: They provide a financial incentive for individuals and firms to reduce negative externalities.

- Revenue Generation: These taxes can generate significant revenue for governments, which can be used for public goods or to reduce other taxes.

- Environmental and Social Benefits: By discouraging harmful activities, Pigovian taxes can lead to improved environmental quality and public health.

Challenges and Considerations

- Difficulty in Measuring External Costs: Determining the exact magnitude of external costs can be complex and controversial.

- Distributional Effects: Pigovian taxes can have regressive effects, disproportionately affecting low-income individuals who may struggle to absorb the tax burden.

- Administrative Challenges: Implementing and enforcing Pigovian taxes can be administratively complex, especially for activities with widespread participation.

- Political Feasibility: Some Pigovian taxes may face political resistance, particularly from industries that stand to lose from the tax.

Real-World Examples

Carbon Taxes

Carbon taxes are perhaps the most well-known example of Pigovian taxes in action. Many countries, including Sweden, Norway, and Canada, have implemented carbon taxes to reduce greenhouse gas emissions and encourage the transition to cleaner energy sources. These taxes have been effective in reducing carbon emissions and promoting the adoption of renewable energy technologies.

Congestion Charges

Congestion charges, such as those implemented in London and Singapore, are another form of Pigovian tax. By charging a fee for driving in congested areas during peak hours, these taxes aim to reduce traffic congestion and encourage the use of public transport or alternative modes of transportation.

Pollution Taxes

Various forms of pollution taxes are used to address different environmental challenges. For instance, taxes on plastic bags or single-use plastics aim to reduce plastic waste and encourage the use of reusable alternatives. Similarly, taxes on hazardous waste disposal can incentivize proper waste management practices.

The Future of Pigovian Taxation

As societies become more aware of the environmental and social costs of certain activities, Pigovian taxes are likely to play an increasingly important role in policy-making. The potential for these taxes to address market failures and promote sustainable development is significant.

However, the successful implementation of Pigovian taxes requires careful consideration of economic, social, and political factors. It is essential to ensure that these taxes are designed and implemented in a way that is fair, efficient, and aligned with societal goals. Further research and analysis are needed to refine the theory and practice of Pigovian taxation, making it a more effective tool for addressing market failures and promoting sustainable development.

What are some examples of negative externalities that could be addressed with Pigovian taxes?

+Negative externalities that could be addressed include environmental pollution (air, water, and land pollution), congestion (traffic and urban crowding), noise pollution, and social costs such as those associated with gambling or excessive alcohol consumption.

How are the optimal tax rates for Pigovian taxes determined?

+The optimal tax rate for a Pigovian tax is typically set to equal the marginal social cost of the activity being taxed. This requires careful estimation of the social cost, which can be complex and may involve economic modeling and data analysis.

Are there any alternative approaches to addressing negative externalities besides Pigovian taxes?

+Yes, there are alternative approaches such as regulation, subsidies, and market-based mechanisms like cap-and-trade systems. The choice of approach depends on the specific externality, the policy goals, and the political and economic context.