Understanding payroll tax meaning: Common questions and solutions

In the labyrinth of modern financial systems, payroll taxes stand as a critical yet often misunderstood pillar of fiscal responsibility. They serve as the financial backbone supporting Social Security, Medicare, and other vital social programs. However, misconceptions abound about their purpose, calculation, and impact on both employers and employees. Demystifying the concept of payroll tax is essential in empowering stakeholders with accurate knowledge, thus fostering more informed decision-making in personal finance and corporate management.

Debunking the Myth: Payroll Tax Is Just a Deduction from Your Salary

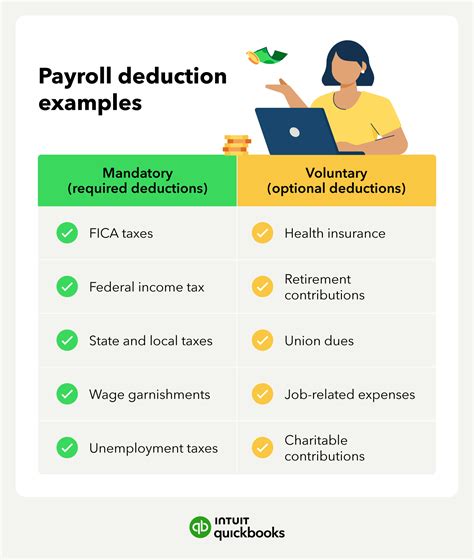

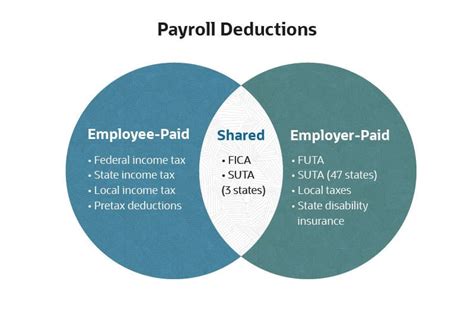

One common misconception is that payroll tax is merely a minor deduction from gross income. In reality, payroll taxes encompass a complex set of contributions that fund enduring social safety nets. These are levied not just on employees but also on employers, effectively doubling the financial input into national welfare programs.

The distinction between payroll tax and income tax also merits clarification. Payroll tax is specifically earmarked for social insurance programs—primarily Social Security and Medicare—while income tax finances a broader array of government functions including defense, infrastructure, and public services. Failing to understand this separation can lead to underestimating the financial commitments involved.

National statistics reveal that payroll taxes, as a percentage of total federal revenue, account for approximately 35%, underscoring their significance in public finance. Recognizing the structural role of these taxes clarifies why they are not trivial but central to societal stability and individual retirement security.

Understanding the Components of Payroll Tax: Debunking Oversimplifications

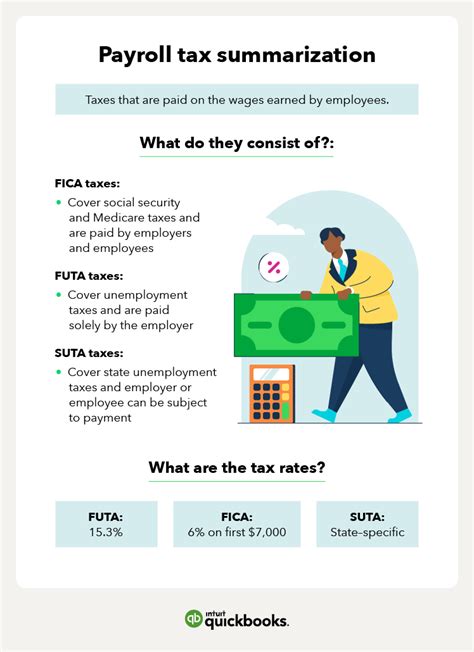

The term ‘payroll tax’ often evokes a simplistic image—just a deduction line on paycheck stubs. Yet, the actual composition involves several specific components, each with distinct legal and economic implications.

Social Security and Medicare Contributions

The quintessential payroll taxes are the Federal Insurance Contributions Act (FICA) taxes, which fund Social Security and Medicare. As of 2023, the combined FICA tax rate stands at 15.3%, split evenly between employees and employers—each paying 7.65%. This division is frequently misunderstood, with many assuming the burden is borne solely by employees or employers alone.

Further, the self-employed pay the full 15.3% under the Self-Employment Contributions Act (SECA), highlighting a different tax structure that often causes confusion among independent contractors. The self-employment tax exemplifies how payroll taxes extend beyond traditional employment into broader economic activities.

| Relevant Category | Substantive Data |

|---|---|

| FICA Tax Rate | 15.3% total, split equally between employer and employee |

| Medicare Additional Tax | 0.9% surtax applies on wages above $200,000 for singles |

Other Payroll-Related Taxes

Beyond FICA, some jurisdictions impose additional levies such as state unemployment taxes, local payroll taxes, or specific industry levies. These are less common but must be considered when assessing the total payroll tax burden.

For example, state unemployment insurance (SUI) taxes vary by state and are typically paid solely by employers, which impacts hiring costs and employment practices. The variety of these taxes demonstrates the myth of uniformity—payroll tax is a multilevel, often complex, web aligning closely with geographic and sectoral factors.

Common Questions About Payroll Tax: Clearing Up Misconceptions

How Is Payroll Tax Calculated and Who Pays It?

The calculation of payroll taxes involves applying fixed percentage rates to the gross wages of employees. For employees, the payroll tax is deducted directly from their paycheck, shown as separate line items for Social Security and Medicare taxes. Employers match these contributions and remit them to the government—costing the employer a significant component of labor expense.

Self-employed individuals pay the full amount as part of their tax filings, which can cause confusion about the actual ‘cost’ of employment from a business perspective. This alignment illustrates that payroll taxes are not merely a personal deduction—they are a fundamental part of the employment cost structure.

| Relevant Category | Substantive Data |

|---|---|

| Wage Base Limit | $160,200 in 2023 for Social Security, capping taxable income |

| Tax Rates | 6.2% for Social Security; 1.45% for Medicare, per party |

Are Payroll Taxes the Same Across Countries?

Instantiation of payroll taxes varies globally, and prematurely assuming a one-size-fits-all approach is misleading. Countries like Denmark and Sweden levy higher payroll taxes but often provide more extensive social benefits. Conversely, in the United States, payroll taxes focus more narrowly on specific social safety programs. Recognizing these differences debunks the misconception that all payroll taxes are uniform or purely burdensome—often, they are investments in social capital, tailored to national policy goals.

Implications of Misconceptions for Workers and Employers

Misunderstanding payroll taxes influences personal financial planning and corporate budgeting. Many employees underestimate the total effective tax rate, leading to unrealistic expectations about take-home pay and disposable income. Conversely, employers underestimate the total labor cost, affecting hiring strategies and wage setting.

This disconnect can hinder financial literacy and strategic planning, especially when considering freelance work, where self-employed individuals face the full tax burden without employer offset. Clarifying these roles aids in accurate wage negotiation and tax compliance.

Key Points

- Payroll tax comprises more than just a paycheck deduction, vital for social programs and funded jointly by employers and employees.

- The split of tax responsibility is a common misconception; understanding the full structure enhances financial literacy.

- Global variations in payroll tax structures reveal diverse social policy approaches, debunking uniformity myths.

- Accurate knowledge about payroll taxes influences personal and corporate financial strategies, promoting transparency and compliance.

- Awareness of components such as social security caps and surtaxes helps in navigating complex tax obligations efficiently.

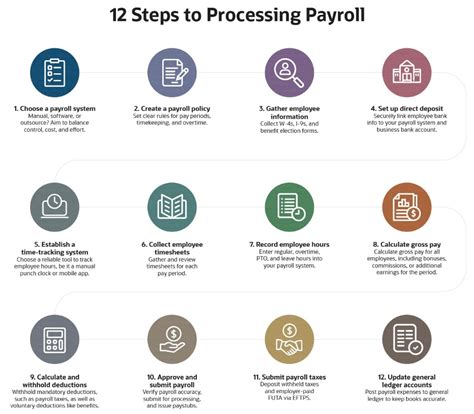

Strategies for Navigating Payroll Tax Complexities in Practice

Taking a nuanced approach to payroll taxes involves strategic planning and informed decision-making. For individual workers, understanding their contribution limits and surtax implications enables more accurate retirement planning and tax filing. For employers, comprehensive awareness of the total payroll tax burden can inform wage structuring, benefit offerings, and compliance practices.

Leveraging tools such as payroll management software, tax advisors, and industry insights can mitigate errors and optimize tax liabilities within legal boundaries. On the policy front, critical analysis of payroll tax reforms—often driven by demographic shifts and economic needs—can prepare stakeholders for proposed changes, avoiding surprises that disrupt financial stability.

Conclusion: Redefining the Narrative Around Payroll Taxes

Dispelling myths about payroll tax reveals them to be complex, multidimensional instruments integral to national social systems. These taxes are not just deductions—they are investments, mandates, and social contracts. When correctly understood, they serve as a foundation for sustainable social welfare, retirement security, and economic stability. As gaps in understanding close, both individuals and industries can navigate the evolving fiscal landscape with clarity and confidence.

What is the main purpose of payroll taxes?

+The primary purpose of payroll taxes is to fund social insurance programs like Social Security and Medicare, providing financial security for retirees, disabled individuals, and the health needs of the aging population.

Are payroll taxes the same in every country?

+No. Different countries have varying structures, rates, and coverage for payroll taxes, often reflecting their social welfare models and fiscal policies.

How can self-employed individuals handle payroll tax obligations?

+Self-employed persons pay the full payroll tax rate through their tax filings dưới the SECA system, necessitating precise estimation and planning to meet obligations without underpayment penalties.

What misconceptions exist about payroll tax caps and surtaxes?

+Many believe payroll taxes apply uniformly without caps or surtaxes; in reality, contributions like Social Security have taxable wage limits, and surtaxes may affect high-income earners, complicating the tax landscape.