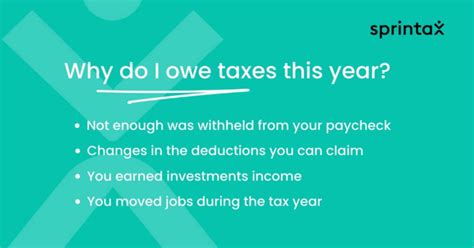

Owe Tax Due To Change Of Job Reddit

Tax obligations are an essential aspect of any financial situation, and understanding your tax liabilities when changing jobs is crucial to ensure compliance and avoid potential penalties. This comprehensive guide, based on real-life scenarios and expert insights, will navigate you through the process of managing tax debts when transitioning between employment opportunities.

Navigating Tax Obligations with a Job Change

When you change jobs, your tax situation can become more complex, especially if you have tax debts from a previous employer. It's important to approach this transition with a clear understanding of your tax responsibilities to avoid any unnecessary complications.

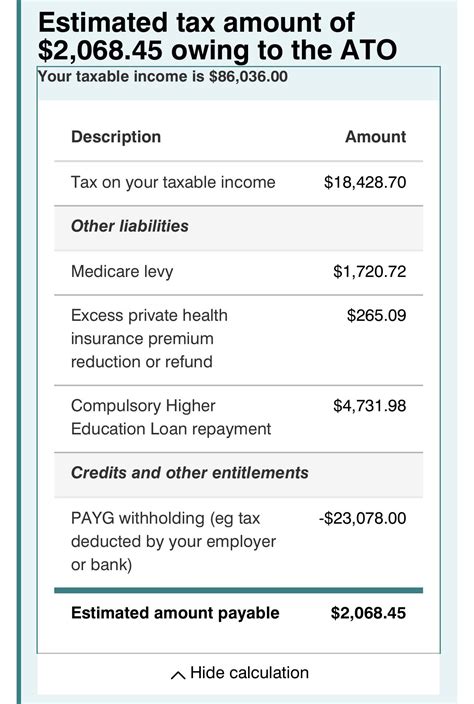

Identifying Tax Liabilities

Firstly, it's crucial to identify any outstanding tax liabilities you may have from your previous employment. This includes understanding the type of tax debt, such as federal income tax, state taxes, or payroll taxes. Obtain a detailed breakdown of your tax obligations from your previous employer's payroll or accounting department. This information will help you assess the extent of your tax debt and plan your next steps accordingly.

For instance, imagine you worked for a company that faced financial difficulties, resulting in non-payment of payroll taxes. In this scenario, you might find yourself owing taxes to the Internal Revenue Service (IRS) or your state tax authority.

Communication and Transparency

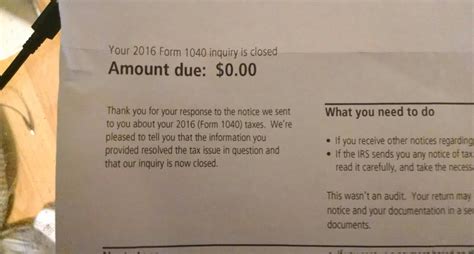

Open and honest communication is key when dealing with tax debts. Reach out to the relevant tax authorities, such as the IRS or your state's tax department, to discuss your situation. Explain your circumstances, including your recent job change, and inquire about available options for resolving your tax debt. Tax authorities often provide various payment plans and settlement agreements to help taxpayers manage their obligations.

Consider the case of an individual who inherited a family business but discovered it had significant tax debts. By engaging with the tax authorities early on, they were able to negotiate a suitable repayment plan, ensuring they could focus on the business's operations without the burden of immediate, full repayment.

Prioritizing Tax Payments

When changing jobs, it's essential to prioritize your tax payments. Ensure that any agreed-upon tax payments or installments are made on time to avoid further penalties and interest accumulation. Consider setting up automatic payments or reminders to stay on top of your obligations. Remember, consistent and timely payments demonstrate your commitment to resolving your tax debt.

| Tax Type | Payment Priority |

|---|---|

| Federal Income Tax | High - Ensure timely payments to avoid penalties and interest. |

| State Taxes | Medium - Prioritize based on state regulations and potential penalties. |

| Payroll Taxes | High - These taxes are often mandatory and have severe consequences for non-payment. |

Seeking Professional Advice

If your tax debt situation is complex or you're unsure about the best course of action, seeking professional advice is advisable. Tax professionals, such as Certified Public Accountants (CPAs) or tax attorneys, can provide tailored guidance based on your specific circumstances. They can help you navigate the tax code, understand your rights, and develop a comprehensive strategy to manage your tax obligations.

For instance, a small business owner with a growing company might benefit from the expertise of a tax professional to ensure they're complying with all tax regulations and maximizing potential tax benefits.

Exploring Tax Relief Options

Tax authorities offer various relief programs to assist taxpayers facing financial hardships. These programs may include Offer in Compromise (OIC), Currently Not Collectible (CNC) status, or penalty abatement. Each program has specific eligibility criteria, so it's essential to understand which options are available to you and how to apply for them.

Consider the scenario of a recent college graduate who changed jobs but is struggling to repay student loans and tax debts. An Offer in Compromise might be a suitable option, allowing them to settle their tax debt for less than the full amount owed.

Maintaining Financial Discipline

Managing tax debts requires financial discipline. Create a budget that accommodates your tax payments and ensures you're living within your means. Avoid accumulating additional debt, as this can complicate your financial situation further. Consider cutting back on non-essential expenses to free up funds for your tax obligations.

For example, a family with a new mortgage might need to adjust their spending habits to prioritize tax payments and avoid any potential default on their mortgage.

Long-Term Planning

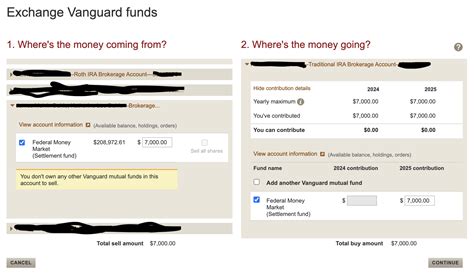

Tax debts can have long-term implications, so it's crucial to plan for the future. Once you've resolved your immediate tax obligations, focus on building an emergency fund to cover unexpected expenses. Additionally, consider contributing to tax-advantaged retirement accounts to maximize your savings and minimize your tax burden over time.

A couple planning for retirement might benefit from maximizing their contributions to tax-deferred accounts, such as 401(k)s or IRAs, to reduce their taxable income and save for the future.

Stay Informed and Proactive

Stay informed about tax laws and regulations that might impact your situation. Tax codes can change, and staying up-to-date ensures you're aware of any new opportunities or obligations. Additionally, remain proactive in your tax planning. Regularly review your financial situation and adjust your strategies as needed to ensure you're on track with your tax obligations.

For instance, a business owner might need to stay informed about tax law changes to ensure they're taking advantage of all available deductions and credits.

Frequently Asked Questions

What should I do if I receive a tax levy or wage garnishment due to a previous job’s tax debt?

+

If you receive a tax levy or wage garnishment, it’s important to act promptly. Contact the tax authority immediately to discuss your options. You may be able to request a levy release or negotiate a different repayment plan. Seeking professional tax advice can also be beneficial in these situations.

Can I negotiate my tax debt with the IRS or state tax authorities?

+

Yes, tax authorities often have programs and processes in place to help taxpayers resolve their debts. You can negotiate payment plans, request penalty abatements, or even explore options like an Offer in Compromise. It’s essential to communicate your situation honestly and work collaboratively with the tax authorities.

Are there any tax benefits or deductions I can claim when changing jobs?

+

Yes, there are potential tax benefits associated with job changes. For instance, moving expenses might be deductible if you relocate for a new job. Additionally, certain job-related expenses, such as professional development or licensing fees, could be eligible for deductions. Consult a tax professional to explore all available deductions.

How long do tax debts typically remain on my record, and can they affect my credit score?

+

Tax debts can remain on your record for an extended period, typically 10 years from the date they were assessed. They can also impact your credit score, especially if you have unpaid debts or have had tax liens filed against you. It’s crucial to resolve your tax debts promptly to minimize their long-term impact.

What happens if I ignore my tax debt after changing jobs?

+

Ignoring your tax debt can lead to severe consequences. Tax authorities may impose additional penalties, interest, and even criminal charges in extreme cases. It’s essential to address your tax obligations promptly to avoid these potential outcomes.