Nyc Mansion Tax

The concept of the Mansion Tax in New York City has sparked considerable interest and debate within the real estate industry and among prospective homebuyers. As one of the most populous and sought-after metropolitan areas in the world, New York City implements various tax policies to manage its real estate market and generate revenue for the city's operations and development. The Mansion Tax is a unique and significant aspect of this landscape, impacting both buyers and sellers of high-value properties. This article aims to delve into the intricacies of the NYC Mansion Tax, exploring its history, purpose, calculation methods, and its implications for the city's real estate market.

Understanding the NYC Mansion Tax

The NYC Mansion Tax, officially known as the Mansion Tax Law, is a transfer tax imposed on the sale of residential properties exceeding a certain value threshold. It is a one-time tax payable at the time of purchase and is distinct from the annual property taxes that homeowners pay based on their property’s assessed value.

The Mansion Tax was introduced in New York City in 1989 as a means to generate additional revenue for the city's budget and to mitigate the potential negative impacts of an overheated real estate market. It targets the sale of luxury properties, aiming to ensure that those who can afford high-end real estate contribute proportionally more to the city's fiscal health.

Purpose and Rationale

The primary purpose of the Mansion Tax is to create a more equitable tax system in New York City, ensuring that the owners of high-value properties contribute a fair share to the city’s revenue stream. This tax is designed to address concerns about the concentration of wealth and to promote a more balanced distribution of the costs of city services.

Additionally, the Mansion Tax serves as a tool for the city to manage its real estate market. By imposing a tax on the sale of high-value properties, the city can influence the pace of luxury property sales, potentially preventing an excessive surge in prices that could lead to market instability.

Historical Context

The Mansion Tax has evolved since its inception in 1989. Initially, the tax was imposed on properties sold for $1 million or more. Over time, the threshold has been adjusted to keep pace with the city’s dynamic real estate market. As property values increased, so did the threshold, ensuring that the tax remained relevant and effective.

For instance, in 2009, the threshold was temporarily lowered to $1 million to provide a boost to the city's real estate market during the global financial crisis. This move was intended to encourage the sale of high-value properties, which had become stagnant due to the economic downturn. The threshold was then adjusted back to its original level as the market recovered.

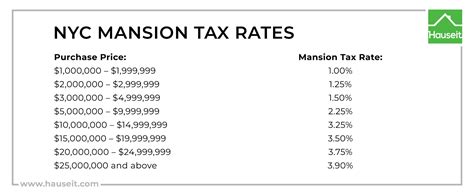

Calculation and Thresholds

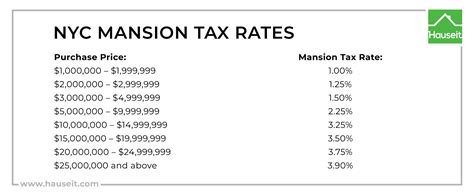

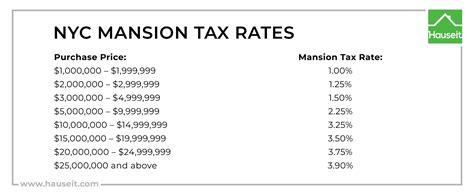

The calculation of the NYC Mansion Tax is straightforward: it is applied as a percentage of the property’s sale price, with the rate increasing as the value of the property rises.

As of [Current Year], the Mansion Tax thresholds and corresponding tax rates are as follows:

| Sale Price Range | Tax Rate |

|---|---|

| $2,000,000 - $2,499,999 | 1.25% |

| $2,500,000 - $2,999,999 | 1.50% |

| $3,000,000 - $4,999,999 | 1.75% |

| $5,000,000 - $9,999,999 | 2.25% |

| $10,000,000 - $19,999,999 | 2.50% |

| $20,000,000 and above | 3.90% |

For example, if a property is sold for $3.5 million, the Mansion Tax would be calculated as follows: $3.5 million x 1.75% = $61,250.

It's important to note that the Mansion Tax is in addition to other transfer taxes and closing costs associated with a real estate transaction in New York City. These additional taxes and fees can significantly increase the overall cost of purchasing a property.

Exemptions and Special Cases

While the Mansion Tax applies to most residential property sales above the specified thresholds, there are certain exemptions and special cases to consider.

One notable exemption is for co-operative apartment buildings (co-ops). The Mansion Tax does not apply to the sale of shares in a co-op, as these are not considered real property transactions. Instead, co-ops are subject to their own set of transfer taxes and fees.

Additionally, certain types of transfers, such as those involving certain types of trusts or estates, may also be exempt from the Mansion Tax. It's crucial for buyers and sellers to consult with legal and tax professionals to understand the specific applicability of the Mansion Tax in their unique circumstances.

Impact on the Real Estate Market

The introduction and subsequent adjustments to the NYC Mansion Tax have had a notable impact on the city’s real estate market, influencing buyer behavior and market dynamics.

Buyer Behavior

The Mansion Tax has led to a shift in buyer behavior, particularly among those purchasing high-value properties. Buyers often factor the Mansion Tax into their purchase decisions, considering it as an additional cost to be accounted for. This can influence their negotiation strategies and willingness to pay certain prices.

Some buyers may choose to structure their purchases in a way that minimizes the Mansion Tax. For instance, they might consider purchasing multiple properties under the threshold or negotiating the sale price to just below the threshold, thus reducing the tax liability.

Market Dynamics

The Mansion Tax has also impacted the overall dynamics of the real estate market in New York City. By imposing a tax on high-value property sales, the city has created an additional barrier for buyers, which can slow down the pace of luxury property transactions. This can lead to a more stable market, preventing rapid price increases that could otherwise occur in an overheated market.

However, the Mansion Tax can also create a perception of added complexity and cost in the luxury real estate market, potentially deterring some buyers who may view the tax as an unnecessary burden. This could lead to a slight shift in market demand, with buyers favoring properties just below the threshold or opting for less expensive alternatives.

Comparative Analysis with Other Markets

The NYC Mansion Tax is a unique feature of New York City’s real estate landscape. While other cities and jurisdictions may have their own transfer taxes and luxury property taxes, the Mansion Tax stands out for its progressive rate structure and its focus on high-value residential properties.

For instance, in San Francisco, there is a Transfer Tax that applies to all real estate transactions, with the rate varying based on the property's sale price. However, this tax is not as progressive as the NYC Mansion Tax, as it does not increase significantly with higher property values.

In London, a Stamp Duty Land Tax is imposed on the purchase of properties, with the rate depending on the purchase price. While this tax also targets high-value properties, it is calculated differently and does not have the same progressive rate structure as the NYC Mansion Tax.

The comparative analysis highlights the uniqueness of the NYC Mansion Tax and its role in shaping the city's real estate market dynamics.

Future Implications and Potential Adjustments

As the real estate market in New York City continues to evolve, the Mansion Tax is likely to remain a significant factor in the city’s fiscal and real estate policies. The tax has proven effective in generating revenue and managing the market, but it may also require periodic adjustments to maintain its relevance and effectiveness.

Potential Adjustments

One potential adjustment to the Mansion Tax could involve modifying the threshold levels. As property values continue to rise, the threshold may need to be increased to ensure that the tax remains applicable to a significant portion of luxury property sales. Conversely, during periods of economic downturn, the threshold could be lowered temporarily to stimulate the market, similar to the adjustment made in 2009.

Another potential adjustment could involve modifying the tax rates. The current rate structure is progressive, but it may be beneficial to explore alternative rate structures or introduce additional thresholds to more finely tune the tax's impact on different segments of the luxury real estate market.

Impact on Affordability

The Mansion Tax’s impact on affordability is an important consideration. While the tax is designed to create a more equitable tax system, it also adds to the overall cost of purchasing a luxury property. This can potentially make it more challenging for certain buyers, particularly those with limited financial resources, to enter the luxury real estate market.

To address this, policymakers may need to consider additional measures to promote affordability in the luxury segment. This could involve the development of targeted incentives or programs to assist buyers who wish to purchase high-value properties but may struggle to meet the increased costs associated with the Mansion Tax.

Expert Insights and Recommendations

According to industry experts, the NYC Mansion Tax is a crucial component of the city’s real estate landscape, offering both benefits and challenges.

Real estate professionals recommend that buyers and sellers carefully consider the impact of the Mansion Tax when planning their transactions. This includes seeking professional advice to understand the tax's applicability and potential strategies to minimize its impact while remaining compliant with the law.

Navigating the Tax Landscape

Navigating the complex tax landscape of New York City, including the Mansion Tax, requires a strategic approach. Buyers and sellers should work closely with experienced real estate agents and tax professionals who can provide guidance on the tax’s implications and potential strategies to optimize their transactions.

For buyers, this may involve exploring alternative financing options, negotiating sale prices, or considering properties just below the Mansion Tax thresholds. Sellers, on the other hand, may need to factor the Mansion Tax into their pricing strategies and be prepared to educate prospective buyers about the tax's applicability and potential impact.

The Role of Real Estate Professionals

Real estate agents play a crucial role in helping clients navigate the complexities of the NYC Mansion Tax. They can provide valuable insights into the local market, advise on potential strategies to mitigate the tax’s impact, and ensure that buyers and sellers are well-informed about their obligations and options.

Additionally, real estate professionals can assist in structuring transactions to comply with the Mansion Tax regulations while also considering other transfer taxes and closing costs. This holistic approach ensures that buyers and sellers can make informed decisions and optimize their real estate transactions in New York City.

Conclusion

The NYC Mansion Tax is a vital component of the city’s real estate landscape, serving both fiscal and market management purposes. While it has its complexities and challenges, it also offers benefits, including a more equitable tax system and a more stable real estate market. As the real estate market continues to evolve, the Mansion Tax will likely remain a key factor in shaping the city’s real estate dynamics, influencing buyer behavior, and contributing to the city’s revenue stream.

For buyers and sellers, understanding the Mansion Tax and its implications is crucial for successful real estate transactions in New York City. By staying informed and working with experienced professionals, they can navigate the tax landscape effectively and make well-informed decisions that align with their financial goals and market realities.

What is the purpose of the NYC Mansion Tax?

+The NYC Mansion Tax is designed to generate additional revenue for the city’s budget and promote a more equitable tax system. It targets the sale of high-value residential properties, ensuring that those who can afford luxury real estate contribute proportionally more to the city’s fiscal health.

How is the Mansion Tax calculated?

+The Mansion Tax is calculated as a percentage of the property’s sale price, with the rate increasing as the value of the property rises. The specific thresholds and corresponding tax rates are determined by the city’s tax regulations and may be subject to periodic adjustments.

Are there any exemptions to the Mansion Tax?

+Yes, there are certain exemptions and special cases. For example, the sale of shares in a co-op apartment building is not subject to the Mansion Tax. Additionally, certain types of transfers involving trusts or estates may also be exempt. It’s important to consult with legal and tax professionals to understand the specific applicability in each case.

How does the Mansion Tax impact buyer behavior?

+The Mansion Tax can influence buyer behavior by adding an additional cost to the purchase of a luxury property. Buyers often factor this tax into their negotiation strategies and may choose to structure their purchases in a way that minimizes the tax liability. This can impact the pace and dynamics of luxury property transactions.

What are the potential future adjustments to the Mansion Tax?

+Potential future adjustments to the Mansion Tax may include modifying the threshold levels or tax rates. This could involve increasing the threshold to maintain the tax’s relevance as property values rise or lowering the threshold temporarily to stimulate the market during economic downturns. Additionally, policymakers may explore alternative rate structures or introduce additional thresholds to fine-tune the tax’s impact.