Ny Sales Tax

In the bustling state of New York, where commerce thrives and business opportunities abound, understanding the intricacies of sales tax is paramount for both businesses and consumers alike. New York's sales tax system, while essential for funding vital public services and infrastructure, can be complex and ever-evolving, necessitating a deep dive into its mechanisms and implications.

Unraveling the Complexities of New York Sales Tax

New York State, renowned for its diverse economy and bustling cities, implements a comprehensive sales tax system to generate revenue for critical public services and infrastructure development. This tax, levied on the sale of goods and certain services, varies across the state, influenced by factors such as location, the nature of the transaction, and the type of item sold.

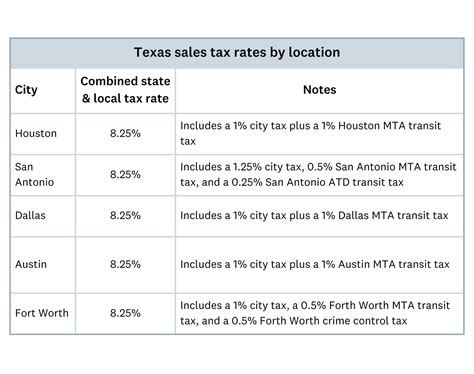

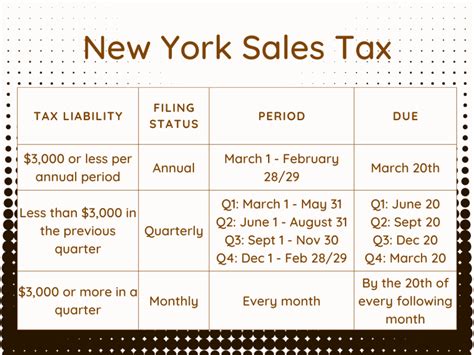

The sales tax rate in New York State is not a uniform figure but rather a variable percentage that fluctuates depending on the specific locality. This variation is a result of the state's unique structure, where counties and cities are authorized to establish their own additional tax rates, layering onto the state's baseline rate. As of the latest information available, the state sales tax rate stands at 4%, with counties and cities adding supplemental rates that can push the total sales tax rate to as high as 8.875% in certain areas.

To provide a more detailed breakdown, let's delve into the sales tax rates of some prominent New York counties and cities. In the bustling metropolis of New York City, for instance, the sales tax rate stands at 8.875%, which includes the state rate of 4%, a 4.5% city rate, and an additional 0.375% surcharge for the Metropolitan Commuter Transportation District. Conversely, in the rural county of Hamilton, the sales tax rate is significantly lower at 7.75%, comprising the state rate and a 3.75% county rate.

| County/City | Sales Tax Rate |

|---|---|

| New York City | 8.875% |

| Nassau County | 8.625% |

| Suffolk County | 8.625% |

| Westchester County | 8.375% |

| Albany County | 8.00% |

| Erie County | 8.00% |

| Monroe County | 8.00% |

| Hamilton County | 7.75% |

It's crucial to note that these rates are subject to change and should be verified with the latest information from official sources. The sales tax landscape in New York is dynamic, often influenced by legislative decisions and economic considerations, necessitating regular updates to ensure compliance and accuracy.

Understanding Sales Tax Exemptions

While sales tax is a broad-based tax applicable to most retail transactions, certain items and situations are exempt. New York State offers a range of exemptions, which can be broadly categorized into three main types: exemptions for specific goods, exemptions for specific industries, and exemptions for specific entities.

Exemptions for specific goods include essential items like food products, clothing, and footwear below a certain price threshold. Certain services, such as medical and healthcare services, legal services, and educational services, are also exempt from sales tax. Additionally, exemptions exist for specific industries, such as agriculture, manufacturing, and research and development, where sales tax may not apply to certain transactions or inputs.

Nonprofit organizations and government entities often enjoy tax-exempt status for their purchases, provided they possess a valid tax-exempt certificate. This certificate serves as proof of their eligibility for exemption and must be presented to the vendor to facilitate the tax-free transaction.

Sales Tax Collection and Remittance

The responsibility for collecting and remitting sales tax falls on the seller, who acts as an agent for the state. This entails calculating the applicable tax on each taxable transaction, adding it to the sale price, and collecting it from the buyer. The collected sales tax must then be remitted to the state on a regular basis, typically monthly or quarterly, depending on the business’s sales volume and filing frequency.

For businesses with multiple locations or online operations, sales tax compliance can be complex. They must ensure they collect and remit sales tax accurately for each jurisdiction in which they have a nexus, or a substantial connection. This includes both the state and local levels, as the sales tax rate can vary significantly across different counties and cities within New York State.

Sales Tax Filing and Compliance

Compliance with sales tax regulations is crucial for businesses to avoid penalties and maintain a good standing with tax authorities. This involves accurate record-keeping of all sales transactions, including the breakdown of taxable and exempt sales, as well as the calculation and remittance of the appropriate sales tax amounts.

Businesses are required to register with the New York State Department of Taxation and Finance and obtain a Certificate of Authority, which allows them to collect and remit sales tax. They must also file sales tax returns on a regular basis, reporting their taxable sales and remitting the corresponding tax amounts. Failure to comply with these obligations can result in penalties, interest charges, and potential legal consequences.

To facilitate compliance, the Department of Taxation and Finance offers resources and guidance, including online filing and payment options, tax rate lookup tools, and publications detailing sales tax regulations and exemptions. Businesses are encouraged to stay informed about any changes to sales tax laws and regulations, as well as to seek professional advice if needed to ensure accurate and timely compliance.

The Impact of Sales Tax on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in New York State. For businesses, sales tax represents an additional cost that must be factored into their pricing strategies and cash flow management. It can also impact their competitive position, especially when compared to businesses located in jurisdictions with lower sales tax rates.

Consumers, on the other hand, bear the brunt of sales tax directly through increased prices. This can influence their purchasing decisions, especially for high-value items or when comparing prices across different jurisdictions. However, sales tax also provides benefits to consumers in the form of improved public services and infrastructure, which can enhance the overall quality of life and economic development in the state.

Future Outlook and Potential Changes

The landscape of sales tax in New York State is subject to change, driven by various factors such as economic conditions, political decisions, and technological advancements. As the state continues to evolve and adapt to new challenges, the sales tax system may undergo modifications to ensure its effectiveness and fairness.

One potential area of change is the increasing focus on remote sales and e-commerce. With the growth of online shopping, states are exploring ways to collect sales tax from out-of-state sellers, particularly those with significant economic presence in the state. This could lead to new regulations and compliance requirements for online businesses, impacting both their operations and the prices faced by consumers.

Additionally, there is ongoing discussion about the fairness and impact of sales tax on different segments of society. Some advocate for reforms to make the tax system more progressive, potentially by exempting certain essential items or providing tax credits to low-income individuals. Such changes could alter the dynamics of sales tax in New York, shifting the burden and benefiting certain populations.

As New York State navigates these challenges and opportunities, it is crucial for businesses and consumers to stay informed about any changes to the sales tax system. By understanding the evolving landscape, they can adapt their strategies and make informed decisions to navigate the complexities of sales tax in New York effectively.

What is the sales tax rate in New York State?

+The sales tax rate in New York State varies by location, with the state rate set at 4%. Counties and cities may add supplemental rates, resulting in a total sales tax rate ranging from 4% to 8.875%.

Are there any sales tax exemptions in New York State?

+Yes, New York State offers a range of sales tax exemptions, including exemptions for specific goods like food and clothing, certain services like medical and educational services, and exemptions for specific industries like agriculture and manufacturing.

Who is responsible for collecting and remitting sales tax in New York State?

+The responsibility for collecting and remitting sales tax falls on the seller, who acts as an agent for the state. Sellers must collect the applicable tax from buyers and remit it to the state on a regular basis.

How often do businesses need to file sales tax returns in New York State?

+The filing frequency for sales tax returns depends on the business’s sales volume. Generally, businesses with higher sales volumes are required to file more frequently, typically on a monthly or quarterly basis. Lower-volume businesses may file on a semi-annual or annual basis.

What are the potential future changes to the sales tax system in New York State?

+Potential future changes to the sales tax system in New York State may include reforms to address the impact of e-commerce and remote sales, as well as efforts to make the tax system more progressive by exempting certain items or providing tax credits to low-income individuals.