Mo Tax Return Status

In the realm of financial management and tax obligations, keeping track of one's tax return status is an essential aspect of financial responsibility. For individuals and businesses alike, understanding the intricacies of the tax system and the various statuses of tax returns is crucial. This article aims to provide a comprehensive guide to the Mo Tax Return Status, shedding light on the processes, timelines, and potential outcomes involved.

Understanding Mo Tax Return Status

The Mo Tax Return Status refers to the official classification and processing stage of a submitted tax return. It provides an overview of the progress made by the tax authorities in evaluating and processing an individual’s or entity’s tax return. This status can offer valuable insights into the current stage of the tax return journey, from initial submission to final approval or rejection.

In the context of Mo Tax Return Status, it is essential to note that the process can vary depending on several factors, including the complexity of the return, the accuracy of the information provided, and the efficiency of the tax administration system. Therefore, understanding the potential stages and outcomes of the Mo Tax Return Status is vital for taxpayers to manage their expectations and take appropriate actions.

Key Stages of Mo Tax Return Status

The Mo Tax Return Status undergoes several distinct stages, each with its own set of implications and potential outcomes. These stages can provide taxpayers with a clear understanding of where their tax return stands in the processing pipeline.

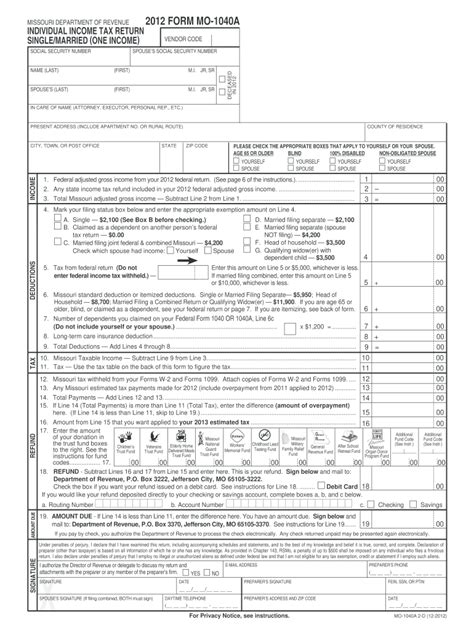

- Submission: This is the initial stage where the taxpayer submits their tax return to the relevant tax authority. It marks the beginning of the evaluation process and sets the timeline for subsequent stages.

- Receipt: Once the tax return is submitted, the tax authority acknowledges its receipt. This stage indicates that the tax return has been successfully received and is now in the system for further processing.

- Processing: During this stage, the tax authority actively evaluates the submitted tax return. It involves a thorough review of the provided information, calculations, and supporting documents. The processing stage can vary in duration depending on the complexity of the return.

- Review: After the initial processing, the tax return undergoes a comprehensive review by tax experts or auditors. This stage ensures that the return complies with tax regulations and that all necessary information is accurately provided. It is a critical step in identifying any potential errors or discrepancies.

- Acceptance: If the tax return passes the review stage successfully, it is accepted by the tax authority. This acceptance indicates that the tax return meets all the necessary criteria and is deemed compliant with tax regulations. It is a positive outcome, signaling the completion of the tax return process.

- Rejection: In some cases, the tax return may be rejected if it fails to meet the required standards or contains significant errors or omissions. Rejection prompts the taxpayer to resubmit the return with the necessary corrections or additional information.

- Amendments: If amendments are required, the taxpayer must make the necessary changes and resubmit the tax return. This stage allows taxpayers to rectify any issues identified during the review process.

- Finalization: Once all amendments are made and the tax return is accepted, it is finalized. This stage signifies the completion of the tax return process, and the taxpayer can expect to receive their tax refund or payment accordingly.

It is important to note that the specific stages and terminology may vary depending on the tax jurisdiction and the tax authority involved. However, the general principles and outcomes remain consistent across different tax systems.

| Stage | Description |

|---|---|

| Submission | Taxpayer submits tax return. |

| Receipt | Tax authority acknowledges receipt of the return. |

| Processing | Tax return undergoes initial evaluation. |

| Review | Comprehensive review by tax experts. |

| Acceptance | Tax return meets all criteria and is approved. |

| Rejection | Tax return fails to meet requirements and is rejected. |

| Amendments | Taxpayer corrects errors and resubmits. |

| Finalization | Tax return is completed and finalized. |

Timelines and Expectations

The timelines associated with the Mo Tax Return Status can vary significantly depending on several factors. While some jurisdictions may process tax returns within a matter of days or weeks, others may take several months, especially for complex returns or during peak tax seasons.

It is essential for taxpayers to be aware of the expected timelines for their specific tax jurisdiction. This knowledge allows them to plan their financial strategies accordingly and manage their expectations regarding tax refunds or payments.

Factors Influencing Timelines

Several factors can impact the duration of the Mo Tax Return Status process:

- Complexity of the Tax Return: Tax returns with complex financial structures, multiple income sources, or extensive deductions may require more time for evaluation and processing.

- Tax Authority's Efficiency: The efficiency and capacity of the tax authority's processing system play a significant role in determining the timeline. Well-organized and technologically advanced tax administrations tend to process returns more swiftly.

- Peak Tax Seasons: During periods of high tax return volume, such as the annual tax filing season, the processing time may increase as tax authorities manage a surge in submissions.

- Errors or Omissions: Tax returns with errors or missing information may require additional time for clarification or amendment, delaying the overall process.

- Audit Scrutiny: In certain cases, tax returns may undergo additional scrutiny or audit, which can extend the processing time.

Taxpayers should be mindful of these factors and plan their tax return submissions accordingly. Submitting returns early, providing accurate and complete information, and staying updated on tax authority guidelines can help expedite the Mo Tax Return Status process.

Monitoring Mo Tax Return Status

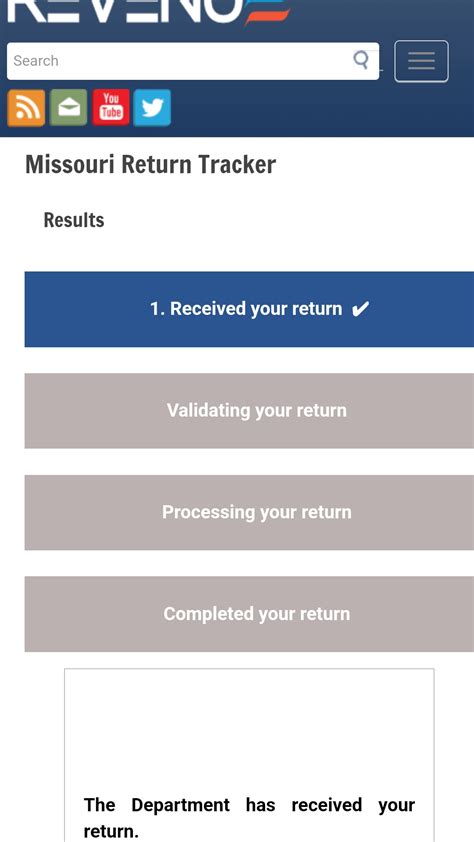

Staying informed about the Mo Tax Return Status is crucial for taxpayers to track the progress of their tax returns and take appropriate actions if needed. Fortunately, tax authorities provide various channels and tools to monitor the status, offering convenience and transparency.

Online Portals and Apps

Many tax authorities have developed online portals or mobile applications that allow taxpayers to access their tax return status and other relevant information. These digital platforms provide real-time updates, enabling taxpayers to track the progress of their returns from submission to finalization.

Online portals often offer additional features, such as the ability to upload supporting documents, make amendments, or view tax payment or refund details. They serve as a centralized hub for taxpayers to manage their tax obligations efficiently.

In-Person or Phone Support

For taxpayers who prefer more traditional methods or require assistance, tax authorities typically provide dedicated phone lines or in-person support services. Trained professionals can assist with queries regarding the Mo Tax Return Status, providing personalized guidance and support.

In-person support may be particularly beneficial for taxpayers facing complex tax situations or those who require clarification on specific aspects of their tax returns.

Email or Postal Notifications

Tax authorities often send email or postal notifications to taxpayers regarding significant updates or changes to their tax return status. These notifications can include information such as acceptance, rejection, or the need for further action.

Taxpayers should ensure that their contact details are up-to-date with the tax authority to receive these important notifications promptly. Regularly checking email inboxes or physical mailboxes can help taxpayers stay informed about their Mo Tax Return Status.

Addressing Common Challenges

Despite the best intentions and efforts, taxpayers may encounter challenges or issues during the Mo Tax Return Status process. Understanding these potential challenges and knowing how to address them is essential for a smooth tax return journey.

Error Corrections and Amendments

Errors or omissions in tax returns are not uncommon and can occur due to various reasons, such as human error, misinterpretation of tax regulations, or changing circumstances. When errors are identified, taxpayers must take prompt action to correct them.

Tax authorities typically provide guidance on the amendment process, including the necessary steps and any supporting documentation required. It is crucial to address errors promptly to avoid potential penalties or delays in processing.

Handling Delays

Delays in the Mo Tax Return Status process can be frustrating, especially when taxpayers are eagerly awaiting their tax refunds or payment. While some delays are unavoidable due to the complexity of the tax system, taxpayers can take certain measures to minimize the impact.

Staying informed about the expected timelines, monitoring the status regularly, and providing accurate and complete information can help reduce the likelihood of delays. Additionally, taxpayers can reach out to tax authorities for updates or clarifications if the delay extends beyond the anticipated timeframe.

Audits and Scrutiny

In some cases, tax returns may undergo additional scrutiny or be selected for an audit. Audits are a standard part of the tax system and are conducted to ensure compliance with tax regulations. While audits can be a daunting prospect, taxpayers should understand their rights and responsibilities during this process.

Taxpayers are entitled to receive clear communication from the tax authority regarding the audit process, including the reasons for the audit and any supporting documentation required. It is crucial to cooperate fully with the tax authority during an audit, providing all necessary information and addressing any concerns raised.

Future Implications and Strategies

The Mo Tax Return Status process provides valuable insights into the current state of an individual’s or entity’s tax obligations. However, it is essential to consider the long-term implications and develop strategies to optimize tax planning and compliance.

Optimizing Tax Planning

Understanding the Mo Tax Return Status and its outcomes can help taxpayers identify areas for improvement in their tax planning strategies. By analyzing the strengths and weaknesses of their tax returns, taxpayers can make informed decisions to optimize their financial positions and minimize tax liabilities.

Tax professionals can provide valuable guidance in this regard, offering tailored strategies to maximize tax benefits and ensure compliance with relevant regulations.

Long-Term Compliance

Maintaining long-term tax compliance is crucial for individuals and businesses alike. The Mo Tax Return Status process serves as a reminder of the importance of accurate and timely tax filing. Taxpayers should prioritize compliance to avoid potential penalties, audits, or legal repercussions.

Staying informed about tax regulations, seeking professional advice when needed, and maintaining proper record-keeping practices are essential components of long-term tax compliance.

Utilizing Technology

In today’s digital age, technology plays a significant role in simplifying tax processes and enhancing efficiency. Taxpayers can leverage various software tools and applications to streamline their tax return preparation, filing, and monitoring.

From tax preparation software that automates calculations and generates tax returns to online portals that provide real-time status updates, technology offers a range of benefits for taxpayers. Embracing these tools can help taxpayers save time, reduce errors, and improve overall tax management.

Conclusion

The Mo Tax Return Status is a critical aspect of an individual’s or entity’s financial journey, offering insights into the progress and outcome of their tax return. By understanding the various stages, timelines, and potential challenges, taxpayers can navigate the tax system with confidence and take proactive measures to ensure a smooth process.

From monitoring the status online to addressing errors promptly, taxpayers have the power to influence the Mo Tax Return Status and shape their financial future. With the right strategies, tools, and support, taxpayers can optimize their tax planning, maintain compliance, and make informed decisions to achieve their financial goals.

As the tax landscape continues to evolve, staying informed and adapting to changing regulations is essential. By embracing technology, seeking professional guidance, and staying proactive, taxpayers can ensure a positive Mo Tax Return Status and a secure financial future.

How often should I check my Mo Tax Return Status?

+It is recommended to check your Mo Tax Return Status regularly, especially during the initial processing stages. Monitoring the status allows you to stay updated and take prompt action if any issues arise. However, frequent checks may not be necessary once the return has been accepted or finalized.

What should I do if my tax return is rejected?

+If your tax return is rejected, carefully review the rejection notice and identify the reasons for rejection. Make the necessary corrections or provide the required information, and resubmit your tax return. It is important to address the issues promptly to avoid further delays.

How can I minimize the risk of errors in my tax return?

+To minimize errors, ensure that you have all the necessary information and supporting documents before submitting your tax return. Double-check your calculations and consider using tax preparation software or seeking professional assistance to verify the accuracy of your return. Regularly updating your records and staying informed about tax regulations can also help reduce errors.

Are there any penalties for late tax return submissions?

+Yes, most tax jurisdictions impose penalties for late tax return submissions. The penalties can vary depending on the jurisdiction and the extent of the delay. It is important to adhere to the filing deadlines to avoid penalties and ensure timely compliance.

Can I appeal a tax return rejection decision?

+In certain cases, taxpayers may have the right to appeal a tax return rejection decision. The appeal process varies depending on the tax jurisdiction and the specific reasons for rejection. It is advisable to seek professional advice and carefully review the tax authority’s guidelines to understand the appeal process and your rights.