Colorado Real Estate Taxes

Colorado's real estate landscape is diverse, ranging from vibrant cities like Denver and Boulder to picturesque mountain towns and vast rural areas. Understanding the intricacies of property taxes is crucial for both residents and prospective buyers. This comprehensive guide delves into the nuances of Colorado real estate taxes, offering a detailed analysis of tax rates, assessment processes, and strategies to optimize your financial obligations.

Navigating Colorado’s Real Estate Tax Landscape

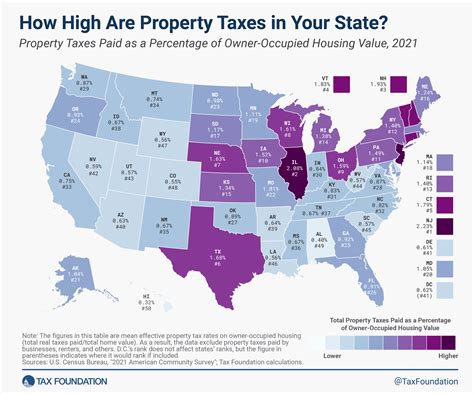

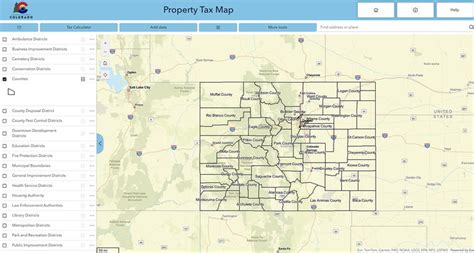

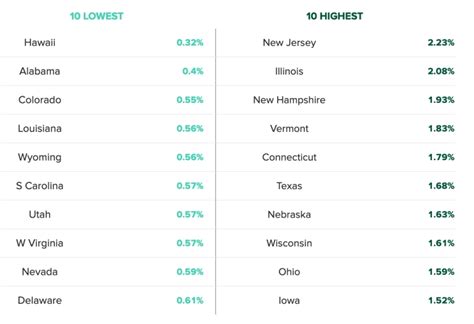

Colorado employs a unique approach to property taxation, with taxes primarily calculated based on the assessed value of a property. This value is determined through a systematic assessment process conducted by county assessors. The resulting assessment is a key factor in determining the annual tax burden for property owners.

The tax rate, known as the mill levy, varies across counties and even within districts, as it's influenced by factors such as school districts, special districts, and municipal governments. This variation in mill levies can lead to significant differences in tax obligations for similar properties located in different areas.

For instance, consider the hypothetical case of a residential property in Denver County. With an assessed value of $500,000 and a mill levy of 50 mills, the annual property tax would amount to $2,500. In contrast, a similar property in a neighboring county with a lower mill levy of 40 mills would result in a tax bill of $2,000.

| County | Assessed Value ($) | Mill Levy (mills) | Annual Property Tax ($) |

|---|---|---|---|

| Denver | 500,000 | 50 | 2,500 |

| Adjacent County | 500,000 | 40 | 2,000 |

Understanding Assessment Values

The assessment process in Colorado is conducted every odd-numbered year. County assessors are responsible for determining the actual value of properties, which is then multiplied by an assessment rate to arrive at the assessed value. The assessment rate is typically 7.15% for residential properties and 29% for commercial properties.

For example, if a residential property is valued at $600,000, the assessed value would be calculated as follows: $600,000 x 0.0715 = $43,050. This assessed value, $43,050, forms the basis for tax calculations.

It's important to note that assessment values can be challenged if property owners believe they are inaccurate. This process, known as property tax assessment appeal, allows for a review and potential adjustment of the assessed value.

Tax Exemptions and Relief Programs

Colorado offers a range of tax exemptions and relief programs to alleviate the financial burden on specific categories of property owners. These include:

- Senior Citizen Exemption: Eligible seniors can receive a property tax exemption of up to $200,000 on their primary residence.

- Veterans Exemption: Disabled veterans and surviving spouses may be eligible for a property tax exemption of up to $6,000.

- Agriculture Exemption: Properties used for agricultural purposes may qualify for a lower assessment rate, reducing the tax burden.

- Disability Exemption: Individuals with disabilities can apply for a property tax freeze, ensuring their taxes remain unchanged until they sell the property.

These exemptions and relief programs are designed to provide financial support to specific groups and encourage certain land uses, making them an essential aspect of Colorado's real estate tax landscape.

Strategies for Managing Real Estate Taxes

Navigating Colorado’s real estate tax system effectively requires a strategic approach. Here are some key strategies:

- Research and Compare Mill Levies: Before purchasing property, research and compare mill levies across different counties and districts. This can help identify areas with more favorable tax rates.

- Understand Assessment Processes: Stay informed about assessment schedules and processes. This knowledge can assist in identifying potential errors or discrepancies in your property's assessment.

- Explore Tax Relief Programs: Evaluate your eligibility for tax exemptions and relief programs. Consulting with tax professionals or county assessors can guide you through the application process.

- Consider Property Upgrades Strategically: Major improvements to your property can increase its assessed value. Plan upgrades with an eye on potential tax implications.

- Appeal Assessment Values: If you believe your property's assessed value is inaccurate, consider filing an assessment appeal. This process can lead to a reduction in your tax liability.

Conclusion

Colorado’s real estate tax landscape is intricate, influenced by a range of factors including property values, assessment rates, and mill levies. Understanding these elements is essential for both homeowners and investors. By staying informed and employing strategic tax management practices, property owners can effectively navigate Colorado’s tax system and optimize their financial obligations.

Frequently Asked Questions

How often are property taxes assessed in Colorado?

+

Property taxes in Colorado are assessed every odd-numbered year. This means assessments occur in years ending with an odd number, such as 2021, 2023, and so on. The assessed value determined in these years forms the basis for tax calculations for the following two years.

Can I appeal my property’s assessed value?

+

Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate. The process involves submitting an appeal to the county assessor’s office, providing supporting evidence, and potentially attending a hearing to present your case. It’s advisable to consult with a tax professional or seek guidance from the assessor’s office to ensure a successful appeal.

Are there any tax relief programs for homeowners in Colorado?

+

Colorado offers a range of tax relief programs to assist homeowners. These include exemptions for seniors, veterans, and individuals with disabilities, as well as programs for agricultural properties. Each program has specific eligibility criteria, and it’s recommended to consult with the county assessor’s office or a tax professional to determine your eligibility and understand the application process.