Maryland State Tax Brackets

When it comes to understanding the tax landscape in Maryland, delving into the state's tax brackets is crucial for individuals and businesses alike. These brackets play a significant role in determining the tax liabilities and provide insight into the state's fiscal policies. In this comprehensive guide, we will explore the intricacies of Maryland's tax brackets, offering a detailed analysis of the rates, income thresholds, and the impact they have on taxpayers.

Maryland’s Progressive Tax System

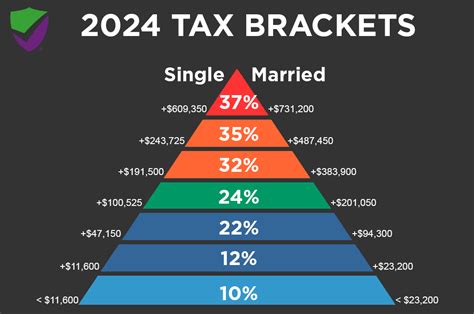

Maryland operates on a progressive tax system, which means that as taxable income increases, taxpayers move into higher tax brackets with correspondingly higher tax rates. This system ensures that those with higher incomes contribute a larger proportion of their earnings towards state revenue. Let’s take a closer look at how this system works in practice.

Tax Brackets and Rates for 2023

The Maryland tax brackets for the 2023 tax year consist of five income brackets, each with its own tax rate. These brackets are adjusted annually to account for inflation and changes in the state’s fiscal policies. Here’s a breakdown of the tax brackets and the corresponding tax rates for the current tax year:

| Tax Bracket | Tax Rate | Income Thresholds (Single Filers) | Income Thresholds (Married Filing Jointly) |

|---|---|---|---|

| 1 | 2% | $0 - $1,000 | $0 - $1,500 |

| 2 | 3% | $1,001 - $2,000 | $1,501 - $3,000 |

| 3 | 4% | $2,001 - $3,000 | $3,001 - $4,500 |

| 4 | 4.75% | $3,001 - $100,000 | $4,501 - $150,000 |

| 5 | 5.75% | Above $100,000 | Above $150,000 |

It's important to note that these brackets and rates are subject to change, so taxpayers should refer to the most recent tax guidelines issued by the Maryland Comptroller's Office for the most accurate and up-to-date information.

Impact on Taxpayers

Maryland’s progressive tax system means that individuals with lower incomes pay a smaller percentage of their earnings in taxes compared to those with higher incomes. This system aims to promote fairness and ensure that the tax burden is distributed equitably across different income levels. For example, a single filer with an annual income of $2,500 would fall into the third tax bracket, paying a tax rate of 4% on their income.

On the other hand, high-income earners, such as a married couple filing jointly with a combined annual income of $200,000, would be subject to the highest tax bracket, paying a tax rate of 5.75% on the portion of their income above $150,000.

Tax Bracket Adjustments and Inflation

To maintain the integrity of the progressive tax system, Maryland regularly adjusts its tax brackets to account for inflation. These adjustments ensure that taxpayers are not inadvertently pushed into higher tax brackets solely due to the effects of inflation on their income.

For instance, in 2022, the state implemented a tax bracket update that increased the income thresholds for each bracket, effectively shielding taxpayers from an unintended increase in their tax liabilities due to rising prices. This adjustment is crucial in ensuring that taxpayers' purchasing power and standard of living are not disproportionately affected by tax bracket creep.

Maryland’s Approach to Tax Policy

Maryland’s tax policies reflect the state’s commitment to balancing revenue generation with fairness and economic growth. By maintaining a progressive tax system, the state aims to promote economic stability and support social programs and infrastructure projects that benefit all residents.

Additionally, Maryland offers various tax credits and deductions that can further reduce an individual's tax liability. These incentives are designed to encourage specific behaviors, such as investing in renewable energy or supporting local businesses. For instance, the Maryland Clean Energy Credit provides a credit for homeowners who install solar panels or other clean energy systems, promoting sustainability and reducing the tax burden for those who invest in green technologies.

The Impact of Maryland’s Tax Brackets on Local Businesses

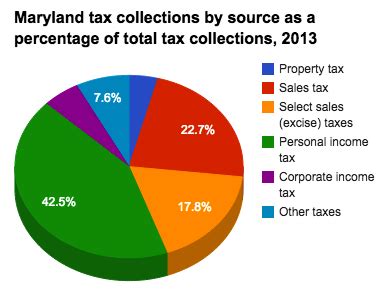

While the focus of tax brackets often centers on individual taxpayers, it’s equally important to examine their impact on local businesses. Maryland’s tax system extends beyond personal income taxes to include corporate taxes, sales taxes, and various business-specific levies.

Corporate Tax Brackets

For corporations and other business entities, Maryland employs a flat tax rate structure, currently set at 8.25%. This rate applies to the taxable income of C-corporations, S-corporations, partnerships, and limited liability companies (LLCs). Unlike the progressive tax system for individuals, the corporate tax rate remains consistent regardless of the entity’s income level.

However, it's important to note that Maryland offers a corporate income tax credit for certain businesses, particularly those engaged in research and development activities. This credit can significantly reduce the effective tax rate for qualifying companies, making Maryland an attractive destination for innovation-focused enterprises.

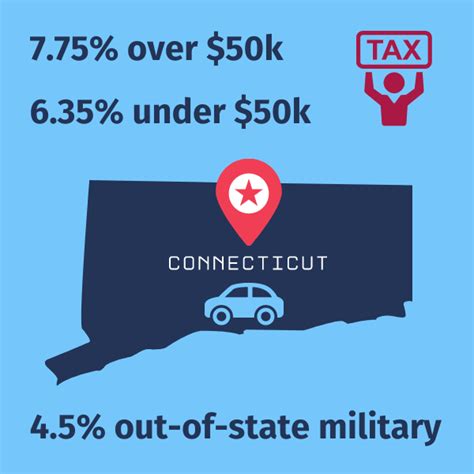

Sales and Use Taxes

In addition to income taxes, businesses operating in Maryland must also navigate the state’s sales and use tax landscape. The general sales tax rate in Maryland is 6%, which applies to most retail sales of tangible personal property and certain services. However, there are numerous exemptions and special tax rates for specific industries and goods.

For instance, Maryland offers a reduced sales tax rate of 3% for certain food items, making groceries more affordable for residents. Additionally, there are special tax provisions for construction materials, machinery, and equipment, which can significantly impact the tax obligations of construction and manufacturing businesses.

Other Business Taxes and Incentives

Maryland’s tax system for businesses extends beyond income and sales taxes. The state levies various other taxes, including property taxes, estate taxes, and inheritance taxes, all of which can impact the financial health of local businesses.

However, to attract and support businesses, Maryland also offers a range of tax incentives and programs. For example, the Maryland Enterprise Zone (MEZ) Program provides tax credits and other benefits to businesses that invest and create jobs in designated economically distressed areas. This program aims to stimulate economic growth and development in specific regions of the state.

Furthermore, Maryland provides tax credits for businesses that hire and retain employees with specific skills or backgrounds. The Workforce Development and Job Creation Tax Credit is one such example, offering credits to businesses that employ individuals with disabilities, veterans, and other targeted groups.

Conclusion: Navigating Maryland’s Tax Landscape

Understanding Maryland’s tax brackets is crucial for individuals and businesses alike, as it directly impacts their financial obligations and planning. The state’s progressive tax system for individuals, combined with a flat corporate tax rate and a complex sales tax structure, creates a unique fiscal environment.

For taxpayers, staying informed about tax bracket adjustments and taking advantage of available tax credits and deductions can significantly impact their overall tax liability. Similarly, businesses must navigate a range of taxes and incentives to optimize their financial strategies and contribute to the state's economic growth.

Whether you're an individual taxpayer, a business owner, or a financial professional, keeping abreast of Maryland's tax policies and brackets is essential for effective financial management and compliance. By staying informed, taxpayers and businesses can make informed decisions, optimize their tax strategies, and contribute to the vibrant economic landscape of Maryland.

What is the highest income tax bracket in Maryland for 2023?

+The highest income tax bracket in Maryland for 2023 is 5.75%, applicable to incomes above 100,000 for single filers and above 150,000 for married couples filing jointly.

Are there any tax credits available in Maryland for individuals?

+Yes, Maryland offers various tax credits, including the Maryland Clean Energy Credit for homeowners who invest in renewable energy systems, and credits for individuals with low to moderate incomes.

How often are Maryland’s tax brackets adjusted?

+Maryland’s tax brackets are typically adjusted annually to account for inflation and changes in the state’s fiscal policies. These adjustments are announced by the Maryland Comptroller’s Office and are effective for the upcoming tax year.

What is the corporate tax rate in Maryland for 2023?

+The corporate tax rate in Maryland for 2023 is 8.25%, which applies to the taxable income of various business entities, including C-corporations, S-corporations, partnerships, and LLCs.

Are there any sales tax exemptions in Maryland for specific industries or goods?

+Yes, Maryland offers sales tax exemptions for a range of industries and goods, including construction materials, certain food items, and machinery. These exemptions can significantly impact the tax obligations of businesses operating in these sectors.