Louisiana State Tax Refund

When it comes to financial matters, understanding the intricacies of state taxes and refunds is essential. Louisiana, known for its vibrant culture and diverse economy, has a unique tax system that residents and businesses should be familiar with. This comprehensive guide will delve into the world of Louisiana state tax refunds, offering an in-depth analysis of the process, key considerations, and strategies to maximize your refund.

Understanding Louisiana State Taxes

Louisiana’s tax system is a complex interplay of individual and business taxes, with various rates and exemptions. The state imposes an individual income tax, ranging from 2% to 6%, depending on income brackets. Additionally, Louisiana has a corporate income tax, a sales and use tax, and a variety of other taxes, such as the severance tax on natural resources.

The individual income tax is a significant source of revenue for the state, with residents filing their tax returns annually. The Louisiana Department of Revenue (LDR) is responsible for collecting and processing these taxes, ensuring compliance with state laws.

Key Tax Rates and Exemptions

- The state’s income tax rates vary, with a progressive system that considers different income levels. For instance, income up to 12,500 is taxed at 2%, while income above 50,000 is subject to the highest rate of 6%.

- Louisiana offers several tax exemptions, including a homestead exemption for property taxes and a tax-free weekend for certain purchases.

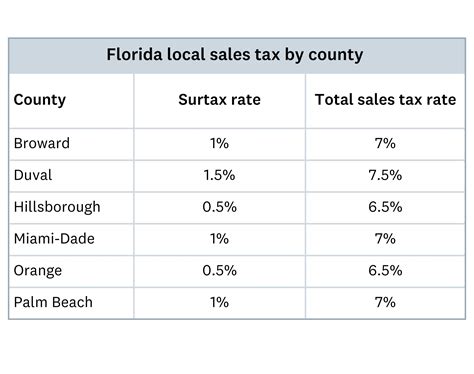

- Businesses operating in Louisiana must navigate a range of taxes, including corporate income tax, franchise tax, and sales tax. The sales tax rate varies across parishes, with a state-wide rate of 4.45% and additional local taxes.

| Tax Type | Rate |

|---|---|

| Individual Income Tax | 2% - 6% |

| Corporate Income Tax | 6% |

| Sales and Use Tax | Varies by Parish (State-wide: 4.45%) |

The Process of Obtaining a Louisiana State Tax Refund

Securing a state tax refund in Louisiana involves a systematic process that begins with accurate tax filing and concludes with a refund, if applicable. Here’s a step-by-step guide to navigating this process efficiently.

Filing Your Tax Return

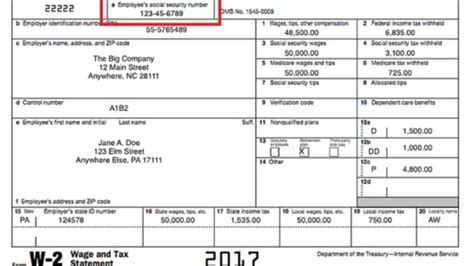

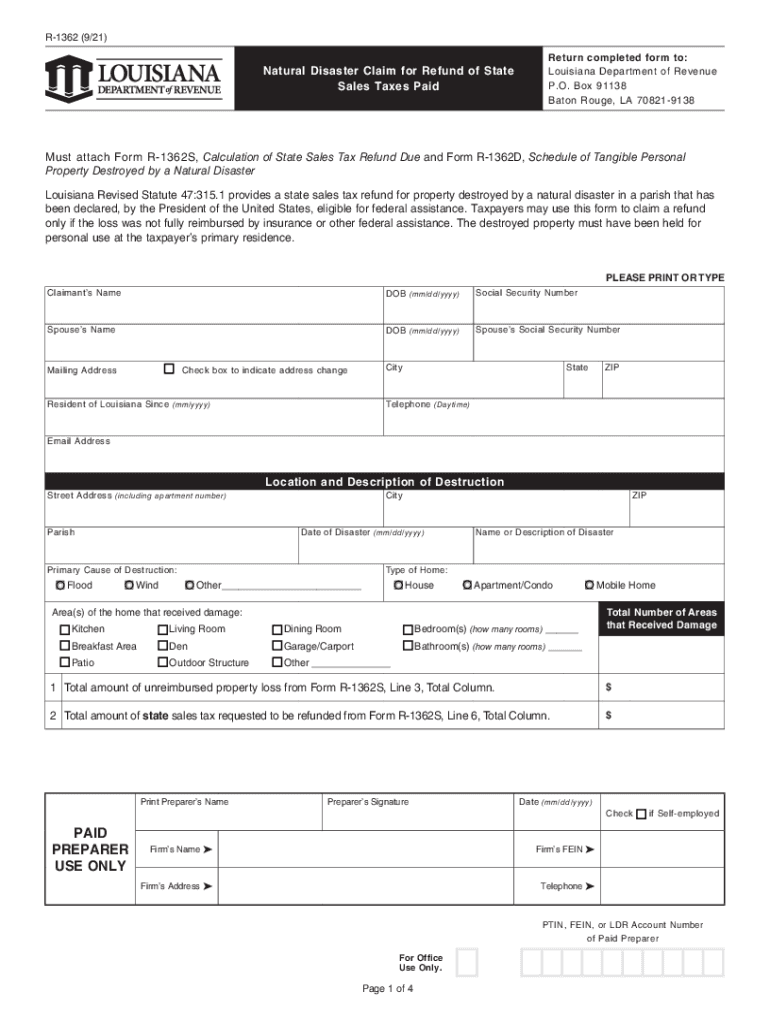

The first step towards a potential refund is filing your tax return accurately and on time. Louisiana residents typically use Form R-1 to report their income and calculate their tax liability. This form considers various deductions and credits, which can significantly impact the final tax amount.

When filing, it's crucial to ensure all income sources are accounted for, including wages, investments, and any other taxable income. Misreporting or omitting income can lead to penalties and delays in processing your refund.

Identifying Potential Refunds

After filing your return, the LDR processes your information to determine if you are eligible for a refund. This process involves a thorough review of your reported income, deductions, and credits. If the LDR finds that you’ve overpaid your taxes, you become eligible for a refund.

Common scenarios leading to overpayment include changes in income, deductions for specific expenses (e.g., medical costs, education), or tax credits such as the Earned Income Tax Credit (EITC) or Child Tax Credit.

Claiming Your Refund

If you are due a refund, the LDR will issue it via your preferred method of payment, typically a direct deposit or a check. It’s essential to ensure your contact and banking information is accurate to avoid delays in receiving your refund.

For those who are eligible for tax credits, such as the EITC, it's important to understand the criteria and documentation required to claim these credits. This can significantly increase your refund amount.

Monitoring Your Refund Status

Once you’ve filed your return and claimed your refund, it’s natural to want to track its progress. The LDR provides online tools and resources to check the status of your refund. By using your unique tax identification number, you can access real-time updates on the processing of your refund.

In some cases, refunds may be delayed due to issues with the return, such as errors or missing information. Staying informed about the status of your refund can help you address any potential issues promptly.

Maximizing Your Louisiana State Tax Refund

Optimizing your Louisiana state tax refund involves strategic planning and an understanding of the various deductions, credits, and exemptions available. Here are some key strategies to consider:

Utilizing Deductions and Credits

Louisiana offers a range of deductions and credits that can reduce your taxable income or provide a direct reduction in your tax liability. Some of these include:

- Medical and Dental Expenses: Deductions for unreimbursed medical expenses that exceed a certain threshold can reduce your taxable income.

- Education Credits: Louisiana provides tax credits for eligible education expenses, helping to offset the cost of higher education.

- Child and Dependent Care Credit: This credit can assist with the cost of childcare, allowing working parents to claim a portion of their expenses.

Strategic Tax Planning

Engaging in strategic tax planning can help you optimize your refund. This involves understanding your income sources, expenses, and the timing of certain transactions. For instance, delaying certain expenses until the new tax year or accelerating income into the current year can impact your tax liability.

Working with a tax professional or using tax preparation software can provide valuable insights and ensure you're maximizing your deductions and credits.

Staying Informed About Changes

Louisiana’s tax laws and regulations are subject to change, so staying informed is crucial. The LDR regularly updates its website with any changes to tax rates, deductions, and credits. Being aware of these changes can help you adjust your tax planning strategies accordingly.

Additionally, keeping track of federal tax law changes is essential, as these can impact state tax laws and the availability of certain deductions or credits.

Real-World Examples and Success Stories

Understanding the impact of these strategies in real-world scenarios can provide valuable insights. Here are a few examples of how Louisianans have successfully maximized their state tax refunds:

Case Study 1: Education Credits

Sarah, a recent college graduate, utilized the Louisiana Tuition Assistance Program (LTAP) credit to offset her higher education expenses. By claiming this credit, she reduced her taxable income, resulting in a significant refund that helped her pay off her student loans.

Case Study 2: Medical Expenses

John, a self-employed individual, faced substantial medical expenses due to a health condition. By itemizing his deductions and claiming the unreimbursed medical expense deduction, he was able to reduce his taxable income, leading to a larger refund that helped cover his ongoing healthcare costs.

Case Study 3: Strategic Planning

Emily, a business owner, worked closely with her accountant to implement strategic tax planning. By deferring certain business expenses and timing her income strategically, she minimized her tax liability. This proactive approach resulted in a substantial refund, which she reinvested into her business, fueling its growth.

Future Implications and Considerations

As Louisiana’s tax landscape continues to evolve, it’s essential to stay informed and adaptable. Here are some key considerations for the future:

Potential Tax Reform

Louisiana, like many states, is subject to ongoing discussions and proposals for tax reform. These reforms can impact tax rates, deductions, and credits. Staying informed about these potential changes can help you adjust your tax strategies accordingly.

Economic Factors

Economic conditions, such as inflation and changes in the job market, can impact tax refunds. For instance, during periods of high inflation, the value of deductions and credits may decrease relative to the overall tax burden. Understanding these economic factors can help you make informed decisions about your tax planning.

Technological Advancements

The use of technology in tax preparation and filing is constantly evolving. Online tools and software can make the process more efficient and accurate. Staying updated with these advancements can streamline your tax refund process and reduce the risk of errors.

Conclusion

Louisiana’s state tax refund process offers an opportunity for residents and businesses to reclaim overpaid taxes and maximize their financial resources. By understanding the state’s tax system, utilizing deductions and credits, and engaging in strategic tax planning, individuals can optimize their refunds. Staying informed about changes and adapting to evolving tax landscapes is key to ensuring continued financial success.

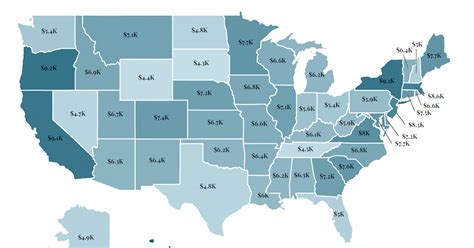

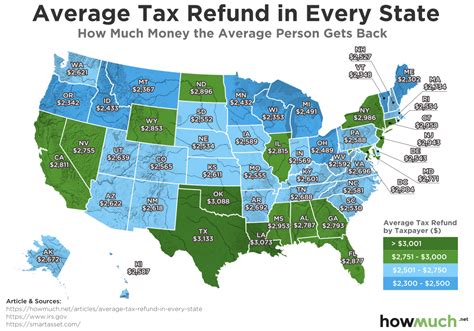

What is the average Louisiana state tax refund amount?

+The average refund amount varies each year and is influenced by factors such as income levels and tax credits claimed. In recent years, the average refund has been around 600 to 800.

How long does it typically take to receive a Louisiana state tax refund?

+The processing time for refunds can vary. If you file electronically and choose direct deposit, you may receive your refund within 2-3 weeks. However, refunds can take longer if there are issues with your return or if you file a paper return.

Are there any specific tax credits unique to Louisiana that I should be aware of?

+Yes, Louisiana offers several state-specific tax credits, including the Louisiana Film and Digital Media Tax Credit, the Enterprise Zone Tax Credit, and the Louisiana Millennium Trust Credit. These credits can significantly impact your tax liability and are worth exploring if you qualify.

Can I check the status of my Louisiana state tax refund online?

+Absolutely! The LDR provides an online refund status tool on its website. You can check the status of your refund by entering your Social Security Number or Individual Taxpayer Identification Number (ITIN) and your date of birth.

What should I do if I think there’s an error in my Louisiana state tax refund amount?

+If you believe there’s an error in your refund amount, it’s important to contact the LDR as soon as possible. They can guide you through the process of correcting any errors and issuing a revised refund if necessary.