Lake Tax Collector

In the tranquil realm of lakeside communities, an essential yet often overlooked role is that of the Lake Tax Collector. This position holds significant importance in maintaining the balance between residential tranquility and fiscal responsibility. Let's delve into the world of lake tax collection, exploring its intricacies, responsibilities, and the impact it has on the serene environment it serves.

The Role and Responsibilities of a Lake Tax Collector

The Lake Tax Collector is a vital figure in any lakefront community, responsible for ensuring the smooth operation of local governance and the maintenance of essential services. Their role extends beyond mere tax collection, encompassing a range of critical duties that contribute to the overall well-being of the lake’s residents.

Tax Assessment and Collection

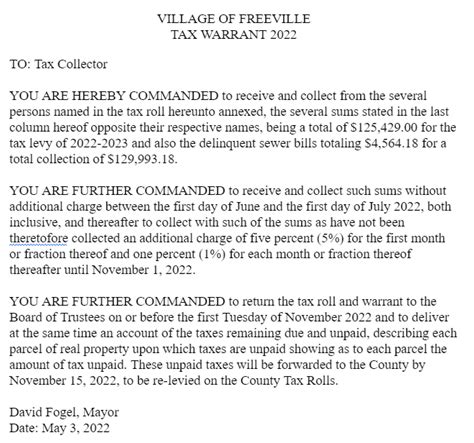

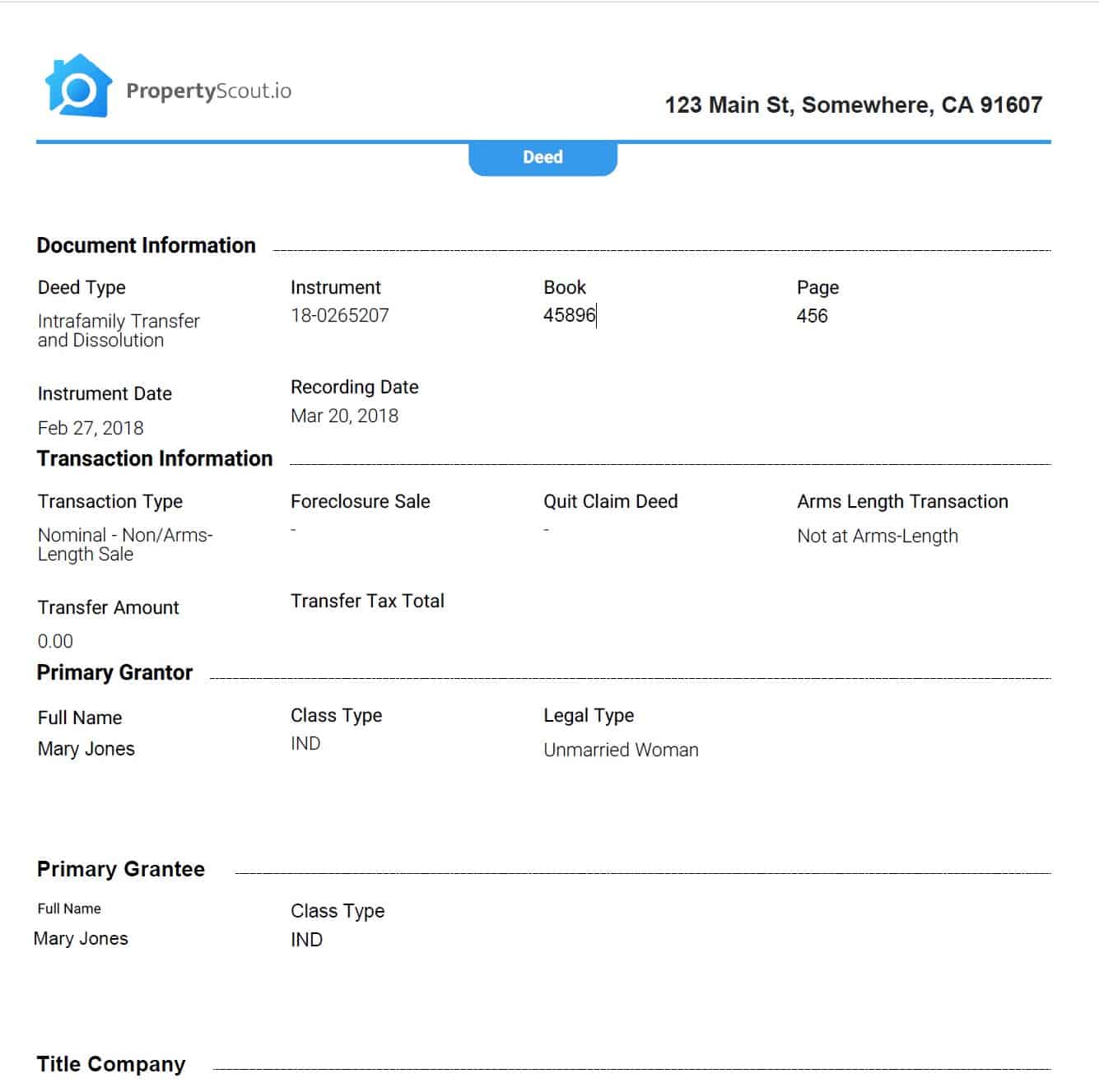

At the core of their responsibilities, Lake Tax Collectors are tasked with assessing and collecting taxes from property owners within the lake’s jurisdiction. This process involves evaluating the value of each property, taking into account factors such as location, size, and any unique features. The accuracy of these assessments is crucial, as it directly impacts the revenue generated for the community.

Lake Tax Collectors employ a range of methods to ensure fair and accurate assessments. They may utilize aerial imagery, conduct site visits, and analyze market trends to determine the true value of each property. This data is then used to calculate the appropriate tax rate, ensuring that each resident contributes their fair share to the community's upkeep.

| Lake Name | Average Property Value | Tax Rate |

|---|---|---|

| Lake Serenity | $500,000 | 2.5% |

| Lakeview Estates | $750,000 | 3% |

| Tranquil Waters | $400,000 | 2% |

Once the assessments are complete, the Lake Tax Collector initiates the collection process. This involves sending out tax bills, receiving payments, and managing any delinquent accounts. The collected funds are then distributed to various community departments, including law enforcement, emergency services, and public works, ensuring that the lakefront community thrives and remains a desirable place to live.

Community Engagement and Education

Beyond the numerical aspects of their role, Lake Tax Collectors play a crucial part in fostering community engagement and understanding. They are often the face of local government, interacting directly with residents and addressing their concerns and queries.

Educating residents about the importance of taxes and their role in community development is a key aspect of their responsibilities. Lake Tax Collectors may host town hall meetings, attend community events, and publish informative materials to ensure that residents are aware of their financial obligations and the benefits that their contributions bring.

By fostering a sense of community and transparency, Lake Tax Collectors help build trust and encourage active participation in local governance. This, in turn, leads to a more cohesive and satisfied community, where residents feel invested in the success and well-being of their lakefront haven.

Conflict Resolution and Appeals

In their role as tax collectors, conflicts and disputes are inevitable. Property owners may have differing opinions on the assessed value of their properties or may face financial difficulties that impact their ability to pay. In such situations, the Lake Tax Collector steps in as a mediator, offering guidance and, when necessary, facilitating appeals.

The Lake Tax Collector's office often serves as a hub for dispute resolution, where residents can voice their concerns and seek clarification or adjustments to their tax assessments. This process ensures that every resident is treated fairly and that any issues are addressed in a timely and professional manner.

The Impact on Lakeside Communities

The role of the Lake Tax Collector extends far beyond the collection of taxes. Their work directly influences the quality of life within the community, shaping the very fabric of the lakefront environment.

Infrastructure and Development

The funds generated through tax collection are a vital source of revenue for local infrastructure projects and community development. Lake Tax Collectors play a pivotal role in ensuring that these funds are allocated efficiently and effectively, contributing to the overall growth and prosperity of the lakefront area.

From the maintenance of roads and bridges to the development of recreational facilities and public spaces, the Lake Tax Collector's office has a hand in shaping the physical landscape of the community. Their work ensures that residents can enjoy a high quality of life, with access to essential services and amenities that enhance their daily experiences.

| Project | Estimated Cost | Funding Source |

|---|---|---|

| Lakefront Park Renovation | $250,000 | Property Taxes |

| Bridge Repair and Expansion | $150,000 | Tax Revenue |

| Community Center Construction | $350,000 | Property Tax Contributions |

Environmental Stewardship

Lakefront communities are often nestled in environmentally sensitive areas, and the Lake Tax Collector’s office plays a crucial role in promoting sustainable practices and protecting the natural environment.

Through the allocation of funds, Lake Tax Collectors support initiatives aimed at preserving the lake's ecosystem and promoting eco-friendly practices. This may include funding for water quality monitoring, wildlife conservation efforts, and the implementation of sustainable waste management systems.

By fostering a culture of environmental stewardship, the Lake Tax Collector's office ensures that the lakefront community thrives in harmony with its natural surroundings, preserving the beauty and ecological balance for generations to come.

The Future of Lake Tax Collection

As technology advances and societal needs evolve, the role of the Lake Tax Collector is also undergoing transformations. The future of lake tax collection is likely to be shaped by innovative approaches and a deeper integration of technology into daily operations.

Digital Transformation

The move towards digital tax collection and management is already underway, with many lakefront communities embracing online platforms and mobile applications for tax-related services. This shift not only enhances convenience for residents but also streamlines the collection process, reducing administrative burdens.

Lake Tax Collectors can leverage digital tools to improve accuracy in assessments, automate billing processes, and provide real-time updates to residents. This digital transformation not only improves efficiency but also opens up opportunities for data-driven decision-making, enabling better allocation of resources and more targeted community development initiatives.

Community Engagement in the Digital Age

In an era where digital connectivity is paramount, Lake Tax Collectors can harness the power of social media and online platforms to enhance community engagement. By utilizing these tools, they can reach a wider audience, provide timely updates, and foster a sense of community even in the virtual realm.

Online town hall meetings, virtual community forums, and digital educational resources can all contribute to a more informed and involved citizenry. This digital engagement not only improves transparency but also empowers residents to actively participate in the governance and development of their lakefront community.

Collaborative Governance

The future of lake tax collection may also see a shift towards more collaborative governance models. By fostering partnerships between the Lake Tax Collector’s office, local government bodies, and community organizations, a more holistic approach to community development can be achieved.

Through collaborative efforts, resources can be pooled, and initiatives can be designed with a broader perspective, addressing not just fiscal responsibilities but also the social, environmental, and cultural needs of the community. This collaborative governance approach has the potential to create a more resilient and sustainable lakefront community, where the interests of all stakeholders are considered and respected.

What are the qualifications required to become a Lake Tax Collector?

+Becoming a Lake Tax Collector typically requires a combination of educational background and relevant experience. A degree in finance, accounting, or a related field is often preferred. Additionally, prior experience in tax assessment, collection, or local government administration can be beneficial. Strong organizational skills, attention to detail, and excellent communication abilities are also essential for this role.

How often are tax assessments conducted by Lake Tax Collectors?

+The frequency of tax assessments can vary depending on local regulations and community needs. Some lakefront communities may conduct assessments annually, while others may opt for biennial or triennial assessments. The decision is often based on factors such as property value fluctuations, community development projects, and the need for accurate revenue projections.

Are there any tax relief programs available for lakefront property owners?

+Yes, many lakefront communities offer tax relief programs to support certain segments of the population, such as senior citizens, veterans, or low-income residents. These programs may provide reduced tax rates, exemptions, or deferred payment options. It’s advisable for property owners to inquire about such programs and explore eligibility criteria to take advantage of any available benefits.