Laffer Curve Tax

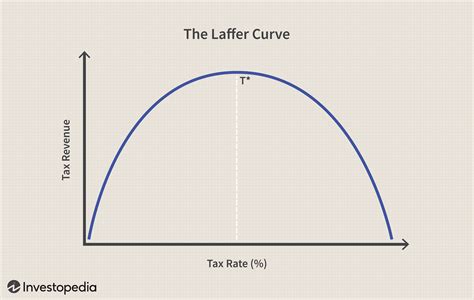

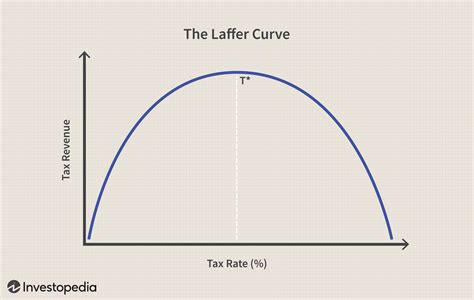

The Laffer Curve, a fundamental concept in economics, has captivated scholars, policymakers, and the general public alike for decades. This intriguing theory, proposed by Arthur Laffer, explores the intricate relationship between tax rates and government revenue, offering a unique perspective on fiscal policy. As we delve into the intricacies of this concept, we'll uncover its historical roots, the mathematical foundations, and its profound implications for modern economies.

The Laffer Curve: A Historical Perspective

The origins of the Laffer Curve can be traced back to the 1970s, a period marked by intense debate over the role of taxation in economic growth. Arthur Laffer, an American economist, introduced this concept as a visual representation of the relationship between tax rates and government revenue. It gained prominence during the Reagan administration, influencing fiscal policies and sparking a global discourse on tax structures.

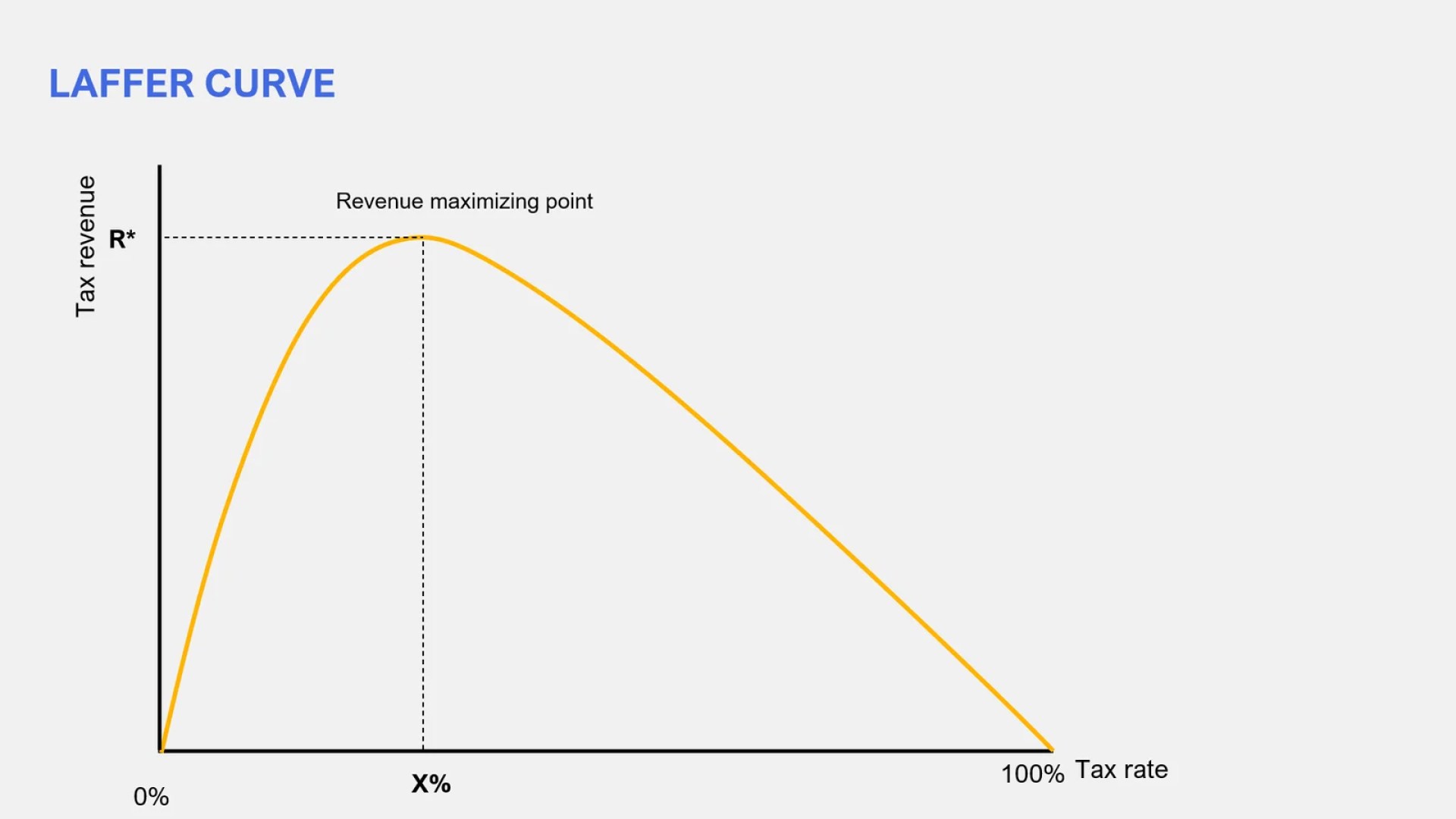

The idea behind the Laffer Curve is simple yet profound: as tax rates increase, government revenue initially rises, but only up to a certain point. Beyond this threshold, further increases in tax rates lead to a decline in government revenue. This concept challenges the conventional belief that higher tax rates always yield higher government revenue.

Mathematical Underpinnings of the Laffer Curve

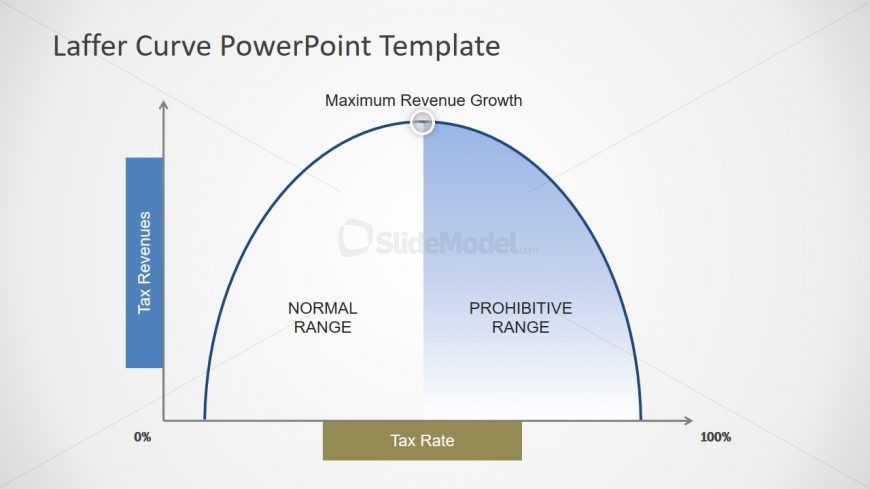

At its core, the Laffer Curve is a graphical representation of a simple mathematical relationship. It plots tax rates on the x-axis and government revenue on the y-axis. The curve, often depicted as an inverted U-shape, illustrates the varying levels of revenue generated at different tax rates.

The mathematical formula that underpins the Laffer Curve is: Revenue = Tax Rate * Tax Base. Here, the Tax Base represents the total economic activity subject to taxation. As tax rates increase, the revenue initially rises due to the larger tax base. However, beyond a certain point, the higher tax rates start to discourage economic activity, leading to a reduction in the tax base and, consequently, a decline in revenue.

| Tax Rate | Revenue |

|---|---|

| 10% | $100 million |

| 20% | $180 million |

| 30% | $240 million |

| 40% | $280 million |

| 50% | $300 million |

| 60% | $280 million |

Implications for Fiscal Policy

The Laffer Curve has profound implications for fiscal policy-making. It challenges the notion that governments can simply raise taxes to boost revenue. Instead, it highlights the need for a careful balance between tax rates and economic incentives.

Proponents of the Laffer Curve argue that lowering tax rates can stimulate economic growth, as lower taxes encourage investment, entrepreneurship, and overall economic activity. This, in turn, can lead to a larger tax base and potentially higher government revenue, even with lower tax rates. This theory gained popularity during the Reagan administration, which implemented significant tax cuts, believing that it would boost economic growth and increase government revenue over time.

Real-World Examples

The impact of the Laffer Curve theory can be seen in various real-world scenarios. For instance, the United States experienced significant economic growth during the Reagan years, often attributed to the tax cuts implemented based on Laffer Curve principles. Similarly, several countries, such as Estonia and Russia, have adopted flat tax systems, citing the Laffer Curve as a justification for their fiscal policies.

Criticisms and Counterarguments

While the Laffer Curve has its advocates, it also faces criticism. Critics argue that the curve’s effectiveness depends heavily on the context and assumptions made. They suggest that the curve may not accurately reflect reality, especially in complex modern economies with diverse tax structures and multiple tax rates.

Additionally, critics point out that the Laffer Curve's focus on tax rates neglects other crucial factors influencing economic growth, such as government spending, regulation, and market conditions. They argue that a comprehensive approach to fiscal policy should consider these factors alongside tax rates to achieve sustainable economic growth.

The Future of Fiscal Policy and the Laffer Curve

As economies evolve and become more complex, the Laffer Curve continues to be a subject of intense debate and research. While it remains a powerful tool for understanding the relationship between tax rates and government revenue, its application in practice is nuanced and context-dependent.

The future of fiscal policy may see a more holistic approach, where the Laffer Curve is considered alongside other economic theories and empirical evidence. This could lead to more nuanced tax policies that balance revenue generation with economic incentives, ensuring sustainable growth and prosperity.

Conclusion

The Laffer Curve stands as a testament to the intricate interplay between taxation and economic growth. Its historical significance and mathematical elegance have made it a cornerstone of economic discourse. As we navigate the complexities of modern economies, the Laffer Curve continues to offer valuable insights, challenging us to rethink traditional assumptions and embrace a more nuanced understanding of fiscal policy.

What is the Laffer Curve and how does it work?

+The Laffer Curve is a graphical representation of the relationship between tax rates and government revenue. It suggests that as tax rates increase, government revenue initially rises but only up to a certain point. Beyond this threshold, further increases in tax rates lead to a decline in government revenue.

What are the implications of the Laffer Curve for fiscal policy?

+The Laffer Curve challenges the notion that higher tax rates always yield higher government revenue. It suggests that there is an optimal tax rate where government revenue is maximized. This implies that policymakers should carefully consider tax rates to balance revenue generation and economic incentives.

How has the Laffer Curve influenced real-world fiscal policies?

+The Laffer Curve has been a key influence in tax policies around the world. For example, it was a central argument for tax cuts during the Reagan administration in the United States. Several countries, such as Estonia and Russia, have also adopted flat tax systems based on Laffer Curve principles.