Kansas Vehicle Sales Tax

Understanding the intricacies of vehicle sales tax in Kansas is crucial for both residents and prospective vehicle owners. This article aims to provide a comprehensive guide, exploring the various aspects of Kansas' vehicle sales tax regulations, including rates, exemptions, and unique features, ensuring a transparent and informative resource for all readers.

Navigating Kansas’ Vehicle Sales Tax: A Comprehensive Overview

Kansas, like many other states, imposes a sales tax on vehicle purchases. However, the specifics of this tax can vary, and understanding these nuances is essential for making informed financial decisions. Let’s delve into the world of Kansas vehicle sales tax, uncovering the rates, the factors influencing these rates, and the unique aspects that make it distinct.

The Fundamental Rates: Unraveling the Basics

The base sales tax rate for vehicles in Kansas stands at 5.5%. This rate is applied uniformly across the state, serving as the foundational element for vehicle purchases. However, it’s important to note that this base rate is just the beginning; there are additional components that can influence the overall tax burden.

One key aspect to consider is the varying county-level sales tax rates. While the state imposes a consistent base rate, counties in Kansas are authorized to add supplementary sales tax, creating a diverse landscape of tax rates across the state. For instance, Johnson County, a prominent metropolitan area, levies an additional 1.1% sales tax, bringing the total rate to 6.6%. On the other hand, counties like Chase and Cherokee have opted for lower supplemental rates, resulting in a combined state and county sales tax of 6.2% and 6.1%, respectively.

This variability in county-level taxes underscores the importance of understanding local tax regulations. Prospective vehicle buyers in Kansas should be aware of these disparities to make accurate financial projections and ensure they are not caught off guard by unexpected tax burdens.

Beyond the Basics: Understanding the Complexity

While the base rate and county supplements provide a foundational understanding, the true complexity of Kansas vehicle sales tax lies in the myriad of additional factors that can influence the overall tax liability. These factors can significantly impact the final tax amount, making it crucial for buyers to be well-informed.

One such factor is the weight of the vehicle. In Kansas, vehicles weighing over 10,000 pounds are subject to an additional 1.5% sales tax. This weight-based tax is a unique feature of Kansas' vehicle sales tax regulations, adding a layer of complexity to the tax calculation process. For instance, a truck weighing 12,000 pounds would attract a 7% sales tax, consisting of the base rate (5.5%), county supplement (1.1%), and the weight-based tax (1.5%).

Furthermore, Kansas also imposes a $75.00 title fee for vehicles purchased from a dealer and a $35.00 registration fee for each registration year. These fees, though not directly related to the sales tax, contribute to the overall cost of vehicle ownership in the state. Understanding these additional costs is vital for buyers to make comprehensive financial plans.

| Category | Actual Data |

|---|---|

| Base Sales Tax Rate | 5.5% |

| Average County Supplement | Varies by County (e.g., 1.1% in Johnson County) |

| Weight-Based Tax | 1.5% for Vehicles over 10,000 pounds |

| Title Fee | $75.00 for Dealer Purchases |

| Registration Fee | $35.00 per Registration Year |

Exemptions and Special Considerations: Navigating the Nuances

Kansas’ vehicle sales tax regulations also include a range of exemptions and special considerations that can reduce the tax burden for certain individuals or circumstances. These exemptions are designed to provide relief to specific segments of the population or promote certain types of vehicle purchases.

One notable exemption is for disabled veterans. Kansas offers a full sales tax exemption for vehicles purchased by honorably discharged disabled veterans. This exemption extends to the first $20,000 of the purchase price, providing a significant financial benefit to those who have served the country. To avail of this exemption, veterans must present their DD Form 214 (Certificate of Release or Discharge from Active Duty) and a valid Kansas driver's license.

Additionally, Kansas also exempts certain types of vehicles from the sales tax. This includes school buses, certain ambulances, and motorcycles purchased by law enforcement officers. These exemptions are designed to promote safety and support essential services within the state.

For individuals with disabilities, Kansas provides a sales tax exemption for vehicles modified for their specific needs. This exemption extends to the cost of modifications, ensuring that individuals with disabilities can access vehicles that cater to their unique requirements without an additional tax burden.

Furthermore, Kansas also offers a sales tax exemption for the purchase of a new vehicle by a resident who is relocating to the state. This exemption is designed to encourage individuals to move to Kansas, fostering economic growth and development.

These exemptions and special considerations highlight the nuanced nature of Kansas' vehicle sales tax regulations. Understanding these provisions is essential for individuals who may be eligible for tax relief, ensuring they can maximize the benefits provided by the state.

Looking Ahead: The Future of Kansas’ Vehicle Sales Tax

As with any tax regulation, the landscape of Kansas’ vehicle sales tax is subject to change. The state’s tax policies are influenced by a multitude of factors, including economic trends, political decisions, and societal needs. Staying informed about these potential changes is crucial for both individuals and businesses operating within the state.

One potential area of change is the state's focus on encouraging electric vehicle (EV) adoption. With the increasing global emphasis on sustainability and the reduction of carbon emissions, Kansas may consider implementing tax incentives or rebates for EV purchases. These incentives could take the form of reduced sales tax rates, credits, or grants, encouraging residents to transition to more environmentally friendly vehicles.

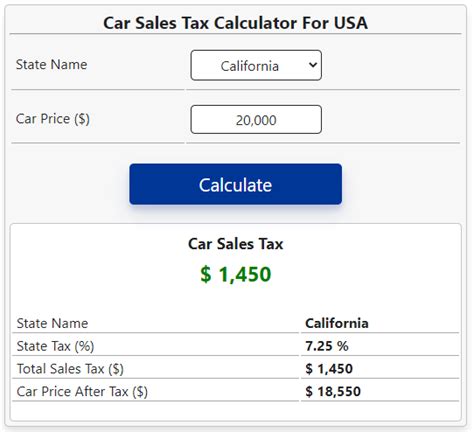

Additionally, the state may also explore options to simplify the tax calculation process, especially for online vehicle purchases. With the rise of e-commerce, ensuring a seamless and transparent tax experience for online vehicle buyers is becoming increasingly important. Kansas could implement standardized tax calculators or provide clearer guidelines to ensure consumers understand their tax obligations from the outset.

Furthermore, the state might also consider adjusting the weight-based tax to align with modern vehicle trends. As the average vehicle weight increases due to advancements in safety features and technology, the current weight threshold of 10,000 pounds may need reevaluation. Adjusting this threshold could ensure that the tax remains fair and relevant in the context of modern vehicles.

In conclusion, Kansas' vehicle sales tax regulations are a complex yet essential aspect of vehicle ownership within the state. Understanding the base rates, county supplements, weight-based taxes, and various exemptions is crucial for making informed financial decisions. As the state continues to evolve and adapt to changing circumstances, staying informed about potential changes to tax regulations is vital for individuals and businesses alike.

What is the base sales tax rate for vehicles in Kansas?

+The base sales tax rate for vehicles in Kansas is 5.5%.

Are there any county-level variations in the sales tax rate in Kansas?

+Yes, counties in Kansas are authorized to add supplementary sales tax, resulting in varying rates across the state. For instance, Johnson County levies an additional 1.1% sales tax, while other counties like Chase and Cherokee have lower supplemental rates.

How does the weight of a vehicle impact the sales tax in Kansas?

+Vehicles weighing over 10,000 pounds are subject to an additional 1.5% sales tax in Kansas. This weight-based tax adds complexity to the tax calculation process.