Kansas Income Tax Calculator

The Kansas income tax system is an essential component of the state's revenue generation and plays a crucial role in funding public services, infrastructure, and various state programs. Understanding how the Kansas income tax system works and how to calculate your tax liability is vital for individuals and businesses operating within the state. In this comprehensive guide, we will delve into the intricacies of the Kansas income tax calculator, providing you with the tools and knowledge to navigate this complex yet essential financial aspect of living and working in Kansas.

Understanding the Kansas Income Tax Structure

The Kansas Department of Revenue administers the state’s income tax system, which operates on a graduated tax rate structure. This means that as your income increases, the tax rate you are subject to also increases. This progressive tax system aims to ensure that higher-income earners contribute a larger proportion of their income towards state revenue.

Kansas income tax rates are divided into four tax brackets, each with its own rate. These brackets are adjusted annually to account for inflation and changes in the cost of living. As of the 2023 tax year, the Kansas income tax rates are as follows:

| Tax Bracket (Income Range) | Tax Rate |

|---|---|

| 0 - $23,800 | 2.9% |

| $23,801 - $54,400 | 4.45% |

| $54,401 - $89,600 | 5.3% |

| $89,601 and above | 5.7% |

It's important to note that these tax rates apply to your taxable income, which is your total income minus any deductions, exemptions, and credits you may be eligible for. Understanding these deductions and credits is key to optimizing your tax liability.

Deductions and Credits

Kansas offers a range of deductions and credits to help reduce your taxable income and, consequently, your tax liability. These include:

- Standard Deduction: Kansas offers a standard deduction that reduces your taxable income. For the 2023 tax year, the standard deduction is $2,700 for single filers and $5,400 for married couples filing jointly.

- Personal Exemptions: You may also be eligible for personal exemptions, which reduce your taxable income further. Personal exemptions are available for yourself, your spouse, and any eligible dependents you claim.

- Itemized Deductions: If your eligible expenses exceed the standard deduction, you may opt for itemized deductions. This includes deductions for medical expenses, charitable contributions, state and local taxes, and mortgage interest, among others.

- Tax Credits: Kansas offers a variety of tax credits, such as the Earned Income Tax Credit (EITC), Child and Dependent Care Credit, and various education credits. These credits directly reduce your tax liability, making them highly valuable for eligible taxpayers.

By understanding and maximizing these deductions and credits, you can potentially lower your taxable income and minimize your Kansas income tax liability.

Using the Kansas Income Tax Calculator

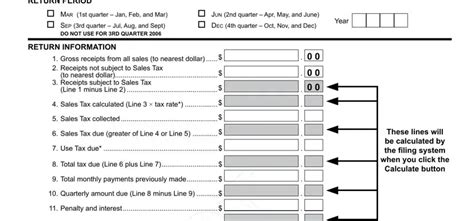

The Kansas income tax calculator is a valuable tool that simplifies the process of determining your tax liability. It takes into account your income, deductions, and tax credits to provide an estimate of the amount of income tax you owe to the state. Here’s a step-by-step guide on how to use the Kansas income tax calculator effectively:

Step 1: Gather Your Income Information

Before using the calculator, ensure you have all your income details ready. This includes your total income from all sources, such as wages, salaries, self-employment income, interest and dividends, and any other taxable income.

Step 2: Calculate Your Adjusted Gross Income (AGI)

Your Adjusted Gross Income is your total income minus any deductions or adjustments allowed by the IRS. This figure is crucial as it determines your tax bracket and the applicable tax rate.

Step 3: Determine Your Deductions and Credits

Use the calculator to input your eligible deductions and credits. This includes the standard deduction, personal exemptions, itemized deductions (if applicable), and any tax credits for which you qualify. Ensure you have all the necessary documentation and information to support these deductions and credits.

Step 4: Calculate Your Taxable Income

Subtract your total deductions and credits from your Adjusted Gross Income to determine your taxable income. This figure is the basis for calculating your Kansas income tax liability.

Step 5: Apply the Tax Rates

Using the tax rates provided by the Kansas Department of Revenue, apply the appropriate tax rate to your taxable income. Remember, the tax rate depends on which bracket your taxable income falls into.

Step 6: Calculate Your Tax Liability

Once you’ve applied the tax rates, the calculator will provide you with an estimate of your total Kansas income tax liability. This figure represents the amount of income tax you owe to the state for the current tax year.

Step 7: Review and Adjust

Review the calculated tax liability and compare it with your previous tax returns or estimates. If there are significant differences, consider reviewing your income, deductions, and credits to ensure accuracy. You may need to make adjustments to ensure you are optimizing your tax position.

Tips for Optimizing Your Kansas Income Tax Position

Understanding the Kansas income tax system and using the calculator effectively are essential, but there are additional strategies you can employ to optimize your tax position and potentially reduce your liability:

- Maximize Deductions: Review all eligible deductions and ensure you are claiming all those that apply to your situation. This includes maximizing contributions to retirement accounts, such as 401(k)s or IRAs, which can reduce your taxable income.

- Explore Tax Credits: Kansas offers a range of tax credits that can significantly reduce your tax liability. Research and understand the eligibility criteria for these credits and ensure you meet the requirements to claim them.

- Consider Tax-Efficient Investments: Certain investments, such as municipal bonds, can provide tax-free income, reducing your taxable income and potentially lowering your tax liability.

- Review Tax Strategies with a Professional: Complex tax situations may require expert advice. Consider consulting a tax professional or accountant who can provide personalized strategies to optimize your tax position.

- Stay Informed on Tax Law Changes: Tax laws can evolve, and staying updated on any changes can help you take advantage of new deductions or credits or plan for any potential impacts on your tax liability.

Frequently Asked Questions

How often are Kansas income tax rates updated?

+

Kansas income tax rates are typically updated annually to account for inflation and cost of living adjustments. The Kansas Department of Revenue announces the new rates each year, usually before the start of the new tax season.

Are there any special tax rates for certain types of income in Kansas?

+

Yes, Kansas has specific tax rates for certain types of income, such as interest and dividends, which are subject to a flat rate of 5.7%. Additionally, passive income from partnerships, S corporations, and trusts is taxed at a flat rate of 4.8%.

Can I claim deductions for state and local taxes paid in Kansas?

+

Yes, you can claim a deduction for state and local taxes paid, including income taxes, sales taxes, and property taxes. However, there are limitations, and it’s best to consult with a tax professional to ensure you are claiming these deductions correctly.

Are there any tax incentives for businesses operating in Kansas?

+

Yes, Kansas offers various tax incentives for businesses, including tax credits for research and development, job creation, and investments in certain industries. The specific incentives and requirements vary, so it’s beneficial to consult with a business tax specialist.

What happens if I owe more taxes than I can afford to pay?

+

If you find yourself in a situation where you owe more taxes than you can afford to pay, it’s important to contact the Kansas Department of Revenue promptly. They may offer payment plans or other options to help you manage your tax liability. Seeking professional tax advice can also be beneficial in such situations.