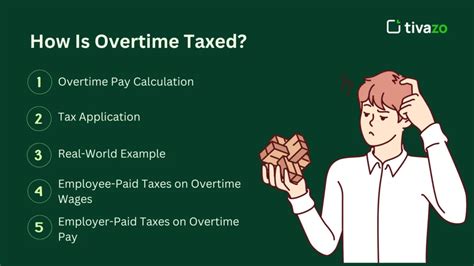

Is Overtime Taxed More

Understanding the tax implications of overtime work is crucial for both employees and employers. This comprehensive guide aims to shed light on the topic, providing clarity on whether overtime pay is taxed differently from regular wages and exploring the various factors that influence tax calculations for additional hours worked. As tax laws can vary based on jurisdiction, this article will focus on the United States tax system, offering insights into how overtime pay is treated within this specific context.

The Taxation of Overtime: A Comprehensive Overview

In the United States, the tax treatment of overtime pay is a nuanced subject, influenced by a range of factors including federal and state regulations, employment status, and the specific overtime policies of individual employers. While overtime pay is subject to taxation, it is not necessarily taxed at a higher rate compared to regular wages.

Federal Tax Implications

At the federal level, the Internal Revenue Service (IRS) treats overtime pay as regular taxable income. This means that overtime earnings are subject to the same federal income tax rates as regular wages. However, the calculation of federal income tax liability for overtime pay can be more complex due to the potential impact on the employee’s overall tax bracket.

For instance, consider an employee who typically earns $50,000 annually and is in the 22% federal income tax bracket. If they work 10 hours of overtime at $25 per hour, their additional earnings would be $250. However, this extra income could push them into the 24% tax bracket for the year, resulting in a higher overall tax liability.

State Tax Considerations

State tax laws also play a significant role in the taxation of overtime pay. While some states follow the federal model and treat overtime earnings as regular income, others have unique regulations. For example, certain states have separate tax brackets or rates specifically for overtime pay, which can lead to a higher tax burden for these additional hours.

Additionally, states may have different rules regarding the calculation of overtime itself. For instance, some states may require overtime to be calculated based on a daily or weekly basis, rather than the more common method of considering hours worked beyond a standard 40-hour workweek.

Employment Status and Tax Withholding

An employee’s tax situation can also be influenced by their employment status. For instance, salaried employees may have a different tax treatment for overtime compared to hourly workers. Salaried employees, especially those earning a high salary, may have a more complex tax situation due to the potential impact of overtime on their overall tax liability.

Furthermore, the tax withholding process can vary based on employment status. Some employers may choose to withhold taxes at a higher rate for overtime pay to ensure that employees do not face a significant tax bill at the end of the year. This practice, known as "flat rate" withholding, can provide a more accurate reflection of the employee's actual tax liability, especially if they are in a higher tax bracket due to their overtime earnings.

Overtime Policies and Employer Practices

Employer practices and overtime policies can further impact the tax treatment of overtime pay. For instance, some employers may offer a “comp time” system, where employees are given time off in lieu of overtime pay. While this practice can be advantageous for employees in terms of flexibility, it may also have tax implications, as the value of the time off could be considered taxable income.

Additionally, employers may choose to provide overtime pay as a "bonus" or "premium pay," which can have different tax consequences. Bonus payments, for example, may be subject to additional tax considerations, such as being included in the employee's W-2 form as part of their total earnings for the year.

| Factor | Impact on Overtime Taxation |

|---|---|

| Federal Tax Brackets | Overtime pay can push employees into higher tax brackets, resulting in a higher overall tax liability. |

| State Tax Laws | Some states have specific tax rates or brackets for overtime pay, which can increase the tax burden. |

| Employment Status | Salaried employees may face a more complex tax situation due to the impact of overtime on their overall earnings. |

| Overtime Policies | Employer practices, such as "comp time" or bonus payments, can have tax implications and should be considered when planning overtime work. |

Real-World Examples and Case Studies

To illustrate the impact of overtime taxation, let’s explore some real-world scenarios and case studies.

Scenario 1: Hourly Employee in a High-Tax State

Consider an hourly employee in a state with a progressive tax system, where tax rates increase as income rises. This employee typically earns 15 per hour for a 40-hour workweek, resulting in an annual income of 31,200. If they work 10 hours of overtime at 20 per hour, their additional earnings would be 200. However, due to the state’s progressive tax system, this extra income could push them into a higher tax bracket, resulting in a tax rate of 7% for their overtime earnings, compared to the 5% tax rate for their regular wages.

Scenario 2: Salaried Employee with a Bonus Structure

A salaried employee earns 60,000 annually and is offered a bonus structure for overtime work. The employer decides to pay overtime at a rate of time and a half, which is common in many industries. If this employee works 20 hours of overtime at a rate of 37.50 per hour (1.5 times their regular rate of 25 per hour), their additional earnings would be 750. This bonus payment, when added to their regular salary, could push them into a higher tax bracket for the year, resulting in a higher overall tax liability.

Scenario 3: “Comp Time” and its Tax Implications

Some employers offer “comp time” as an alternative to overtime pay. In this scenario, an employee works 10 hours of overtime and is given the option to take time off in lieu of overtime pay. While this practice can provide flexibility, it may also have tax implications. The value of the time off could be considered taxable income, and the employee may need to pay taxes on this “comp time” benefit.

Expert Insights and Recommendations

Understanding the tax implications of overtime work is essential for both employees and employers. Here are some key takeaways and recommendations based on the insights provided in this article:

- Employees should be aware of how overtime pay can affect their overall tax liability. It's crucial to understand the potential impact on tax brackets and consider the tax implications of different overtime policies, such as "comp time" or bonus payments.

- Employers should ensure that their overtime policies are in line with tax regulations. This includes being mindful of the potential impact on employees' tax brackets and considering the tax treatment of different overtime practices, such as bonus payments or "comp time."

- Tax professionals can provide valuable guidance on the tax implications of overtime work. Consulting with a tax expert can help employees and employers navigate the complexities of tax laws and ensure compliance with regulations.

- Stay informed about changes in tax laws and regulations. Tax laws can evolve, and it's important for both employees and employers to stay updated on any modifications that could impact the taxation of overtime pay.

- Consider the impact of overtime on overall financial planning. For employees, understanding the tax implications of overtime can be a crucial part of financial planning. For employers, offering competitive overtime pay and clear policies can help attract and retain talent.

Conclusion

In conclusion, the taxation of overtime pay is a complex topic influenced by various factors, including federal and state tax laws, employment status, and employer policies. While overtime pay is generally taxed at the same rate as regular wages, the potential impact on tax brackets and the unique regulations of different states can lead to a higher tax burden for these additional hours.

By understanding the nuances of overtime taxation, both employees and employers can make informed decisions regarding overtime work and ensure compliance with tax regulations. This comprehensive guide aims to provide a clear overview of the topic, offering valuable insights and recommendations for navigating the tax implications of overtime pay in the United States.

How are overtime earnings taxed at the federal level in the United States?

+Overtime earnings are taxed as regular income at the federal level, subject to the same tax rates as regular wages. However, overtime pay can impact an employee’s overall tax bracket, potentially leading to a higher tax liability.

Do all states treat overtime pay the same way for tax purposes?

+No, state tax laws vary. Some states follow the federal model, while others have specific tax rates or brackets for overtime pay, which can result in a higher tax burden for these additional hours.

How does employment status affect the taxation of overtime pay?

+Employment status can impact tax calculations. Salaried employees, especially those with high earnings, may face a more complex tax situation due to the potential impact of overtime on their overall tax liability.

What are the tax implications of “comp time” for overtime work?

+“Comp time” can have tax implications as the value of the time off could be considered taxable income. Employees should be aware of this when choosing between overtime pay and “comp time.”