Idaho Vehicle Sales Tax

The Idaho vehicle sales tax is an essential aspect of the state's revenue system, impacting every vehicle purchase made within its borders. This tax, calculated as a percentage of the vehicle's sale price, contributes significantly to the state's budget, funding vital services and infrastructure development. In this article, we delve into the intricacies of Idaho's vehicle sales tax, exploring its rates, calculation methods, and implications for both residents and non-residents. By understanding this tax, buyers can make more informed decisions and navigate the vehicle purchasing process with confidence.

Understanding the Idaho Vehicle Sales Tax

Idaho, like many other states, imposes a sales tax on the purchase of vehicles, including cars, trucks, motorcycles, and recreational vehicles. This tax is a crucial revenue source for the state, aiding in the maintenance and improvement of its road network, public transportation, and other essential services. The vehicle sales tax rate in Idaho is determined by the type of vehicle and its intended use, offering varying rates for different categories.

Vehicle Sales Tax Rates in Idaho

Idaho’s vehicle sales tax rates are structured based on the type of vehicle and its intended use. The state imposes a standard sales tax rate of 6% on the purchase of most vehicles, including cars, trucks, and SUVs. This rate is applicable for vehicles primarily used for personal, family, or household purposes.

However, for certain specialized vehicles, the tax rate can vary. For example, recreational vehicles (RVs) used for recreational or personal purposes are subject to a 2% sales tax rate. This distinction in tax rates aims to encourage the purchase of recreational vehicles, promoting tourism and outdoor activities in Idaho.

Additionally, vehicles purchased for commercial use, such as those used in businesses or for hire, may be eligible for different tax treatments. These vehicles are often subject to a 5.4% sales tax rate, providing a slight advantage over the standard rate for businesses.

| Vehicle Type | Sales Tax Rate |

|---|---|

| Cars, Trucks, SUVs (Personal Use) | 6% |

| Recreational Vehicles (RV) | 2% |

| Commercial Vehicles | 5.4% |

Calculation of Vehicle Sales Tax

The calculation of the vehicle sales tax in Idaho is relatively straightforward. The tax is typically computed based on the vehicle’s purchase price, including any additional fees and charges. For example, if a resident purchases a new car for $30,000, the sales tax would be calculated as follows:

For personal use vehicles (cars, trucks, SUVs):

- Tax Rate: 6%

- Tax Amount: $30,000 x 0.06 = $1,800

Thus, the total cost of the vehicle, including sales tax, would be $31,800.

For commercial vehicles, the calculation is similar, but the tax rate is 5.4%:

- Tax Rate: 5.4%

- Tax Amount: $30,000 x 0.054 = $1,620

In this case, the total cost, including sales tax, would be $31,620.

Exemptions and Special Considerations

Idaho offers certain exemptions and special considerations for vehicle sales tax. One notable exemption is for vehicles purchased by qualifying disabled individuals. These individuals may be eligible for a sales tax exemption on the purchase of a vehicle equipped with special modifications to accommodate their disability. This exemption is designed to provide equitable access to transportation for those with special needs.

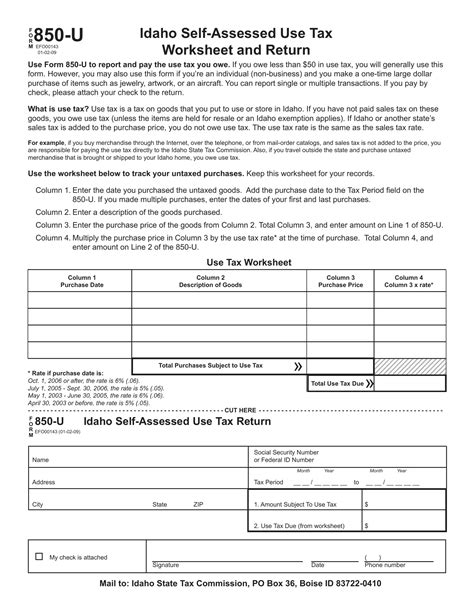

Additionally, Idaho has provisions for residents who purchase vehicles in other states. If a resident purchases a vehicle out-of-state and registers it in Idaho, they may be required to pay use tax. This use tax is calculated similarly to the sales tax, ensuring that all vehicle purchases are taxed fairly, regardless of where they are made.

The Impact of Vehicle Sales Tax on Idaho Residents

The vehicle sales tax in Idaho has a significant impact on the state’s residents, affecting their purchasing power and financial planning. For many individuals, the purchase of a vehicle is a substantial investment, and the added sales tax can significantly increase the overall cost. Understanding the tax implications can help buyers make informed decisions and potentially negotiate better deals with dealerships.

Financial Planning and Budgeting

When planning a vehicle purchase, Idaho residents must consider the sales tax as a significant component of the overall expense. For example, a resident planning to purchase a new car for 25,000</strong> should budget for an additional <strong>1,500 in sales tax at the standard 6% rate. This added cost can influence the choice of vehicle, financing options, and overall financial strategy.

Negotiating and Saving Strategies

Knowledge of the vehicle sales tax rates can empower buyers to negotiate better deals with dealerships. Dealers often have flexibility in pricing, and understanding the tax implications can help buyers negotiate a lower purchase price or additional benefits, such as extended warranties or service packages. Additionally, buyers can explore financing options that offer tax advantages, such as leasing or purchasing through special financing programs.

Impact on Used Vehicle Sales

The vehicle sales tax also affects the market for used vehicles in Idaho. When purchasing a used car, the sales tax is typically calculated based on the vehicle’s purchase price, which can vary depending on the vehicle’s age, condition, and market value. This variability can make the sales tax on used vehicles more unpredictable, and buyers should be mindful of this when negotiating a purchase price.

Comparative Analysis: Idaho vs. Other States

A comparative analysis of vehicle sales tax rates across states can provide valuable insights into Idaho’s position and potential advantages or disadvantages for its residents.

Regional Variations

Vehicle sales tax rates vary significantly across the United States, with some states imposing higher rates and others opting for lower rates or no sales tax on vehicles. Idaho’s 6% standard sales tax rate for personal use vehicles places it in the middle range compared to other states. For instance, neighboring states like Oregon and Washington have no sales tax on vehicles, while Utah has a 5.95% rate, slightly lower than Idaho.

Advantages and Disadvantages

Idaho’s vehicle sales tax rate can offer both advantages and disadvantages for its residents. On the one hand, the 6% rate is relatively competitive, providing a balance between generating revenue for the state and keeping the cost of vehicle ownership manageable. This can be especially beneficial for residents who frequently purchase new vehicles.

However, the higher rate compared to some neighboring states may incentivize residents to make vehicle purchases across state lines, potentially reducing revenue for Idaho. Additionally, for residents who rarely purchase new vehicles, the sales tax can represent a significant expense, impacting their overall financial health.

The Future of Idaho’s Vehicle Sales Tax

As Idaho’s economy and transportation needs evolve, the vehicle sales tax will likely undergo changes and adaptations to meet these new demands. The state may consider adjusting tax rates, introducing new incentives, or modifying tax structures to encourage certain behaviors, such as the purchase of electric vehicles or the use of public transportation.

Potential Tax Reform

Tax reform is a continuous process, and Idaho may explore options to streamline its vehicle sales tax system. This could involve simplifying tax rates, introducing flat rates for all vehicle types, or implementing tax breaks for environmentally friendly vehicles. Such reforms aim to make the tax system more efficient and equitable while promoting sustainable transportation practices.

Incentives for Sustainable Transportation

With a growing focus on environmental sustainability, Idaho may introduce incentives to encourage the adoption of electric vehicles (EVs) and other green transportation options. This could take the form of reduced sales tax rates for EVs or rebates and incentives for installing charging infrastructure. These initiatives would not only benefit the environment but also attract investment in sustainable transportation technologies.

Implications for Idaho’s Economy

The vehicle sales tax plays a crucial role in Idaho’s economy, funding essential services and infrastructure. As the state’s needs evolve, the tax system may need to adapt to ensure it remains a reliable source of revenue. Any changes to the vehicle sales tax rates or structures could have significant implications for Idaho’s budget and its ability to provide quality public services.

Conclusion: Navigating Idaho’s Vehicle Sales Tax

Understanding Idaho’s vehicle sales tax is a crucial step for residents and prospective buyers. The tax, though a significant expense, is a necessary contribution to the state’s economy and the maintenance of its infrastructure. By familiarizing themselves with the rates, exemptions, and calculation methods, buyers can make informed decisions, negotiate better deals, and plan their finances more effectively.

As Idaho continues to evolve, so too will its vehicle sales tax system. Staying informed about any changes or reforms is essential for buyers to ensure they are aware of their rights and responsibilities. With this knowledge, Idaho residents can navigate the vehicle purchasing process with confidence, contributing to a thriving state economy and a well-maintained transportation network.

How often are Idaho’s vehicle sales tax rates reviewed and updated?

+

Idaho’s vehicle sales tax rates are typically reviewed and updated annually to align with the state’s budgetary needs and economic conditions. These reviews ensure that the tax rates remain fair and generate sufficient revenue for essential services.

Are there any online resources to calculate the vehicle sales tax in Idaho accurately?

+

Yes, the Idaho State Tax Commission provides an online sales tax calculator that allows residents to estimate the sales tax on a vehicle purchase. This tool is a valuable resource for budgeting and financial planning.

What happens if I purchase a vehicle out-of-state and bring it to Idaho for registration?

+

If you purchase a vehicle out-of-state and bring it to Idaho for registration, you will likely be required to pay use tax. This tax is calculated similarly to the sales tax and ensures that all vehicle purchases are taxed fairly, regardless of where they are made.

Are there any tax incentives for purchasing electric vehicles in Idaho?

+

As of my last update, Idaho does not offer specific tax incentives for purchasing electric vehicles. However, it’s advisable to check with the Idaho State Tax Commission or a tax advisor for the most current information, as policies may change.

Can I negotiate the vehicle sales tax with dealerships in Idaho?

+

While the sales tax rate is set by the state and cannot be negotiated, dealerships may offer incentives or discounts on the vehicle’s purchase price, which can indirectly reduce the overall tax amount. Negotiating with dealerships is a common practice and can result in significant savings.