How Long To Keep Tax Records

Tax records are an essential part of personal and business finances, and knowing how long to retain them is crucial for compliance and future reference. The duration for keeping tax records can vary depending on factors such as the type of record, tax jurisdiction, and the nature of the business or individual. In this comprehensive guide, we delve into the intricacies of tax record retention, offering expert insights and practical advice to help you navigate this often complex topic.

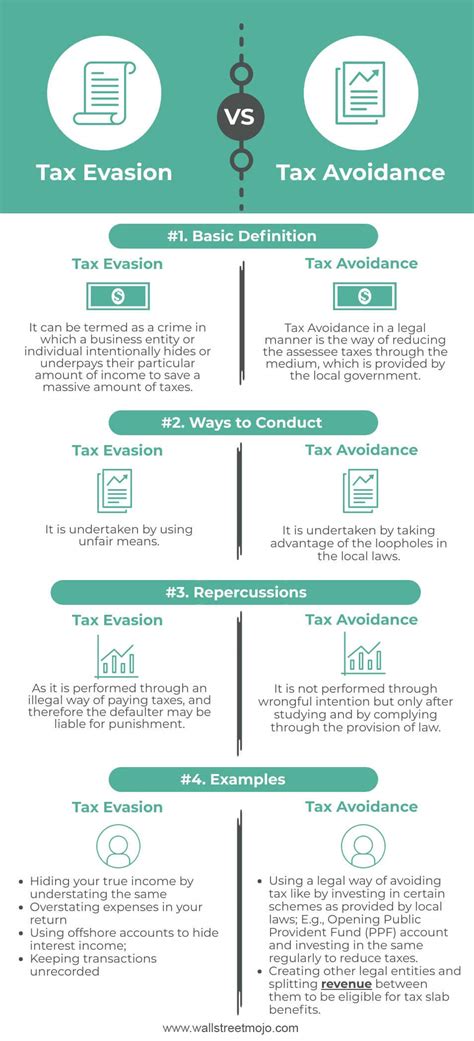

Understanding the Basics of Tax Record Retention

Tax record retention is the practice of keeping financial and tax-related documents for a specific period, as mandated by tax authorities. These records serve as evidence of income, deductions, credits, and other financial activities reported on tax returns. The length of time you should retain these records can vary significantly, and it's important to understand the reasons behind these timelines.

Tax authorities require individuals and businesses to keep records for various reasons. These records are vital for tax audits, which can occur years after filing a return. They also provide a historical perspective on financial activities, which is essential for long-term financial planning and strategic decision-making. Moreover, proper record retention can protect individuals and businesses from potential legal issues and ensure compliance with tax laws.

Tax Record Retention Periods: A Comprehensive Breakdown

The duration for which tax records should be kept can vary based on the type of record and the specific circumstances. Here's a detailed breakdown of common tax record retention periods:

Income Tax Returns and Supporting Documents

For individual tax returns, the Internal Revenue Service (IRS) generally recommends keeping records for three years from the date the return was filed or the due date, whichever is later. This includes all documents supporting income, deductions, and credits claimed on the return. However, for returns involving a substantial error or fraud, the IRS can audit them for up to six years. In cases of fraud, there is no time limit for audits.

For business tax returns, the IRS also recommends a three-year retention period for most records. However, for certain complex returns, such as those involving partnerships, S corporations, and trusts, the IRS may audit them for up to six years. In cases of substantial errors or fraud, the IRS has even more leeway, with no specific time limit.

Employment Taxes

Records related to employment taxes, such as payroll, wage, and tip records, should be kept for at least four years after the date the tax becomes due or is paid, whichever is later. This includes records of federal income tax withheld, social security and Medicare taxes, and federal unemployment (FUTA) tax.

Sales and Excise Taxes

The retention period for sales and excise tax records varies depending on the type of tax. For example, records related to the Retail Sales and Use Tax should be kept for four years from the date the return is filed or the due date, whichever is later. For other excise taxes, such as those on fuel, the retention period can be as long as six years from the date the tax becomes due or is paid.

Property Taxes

Records pertaining to property taxes, including real estate and personal property taxes, should be retained for a period of at least three years from the date the tax is assessed or paid. However, it's worth noting that some jurisdictions may have different retention periods, so it's essential to check with local tax authorities.

Estate and Gift Taxes

Documents related to estate and gift taxes should be kept for a longer period. The IRS recommends retaining these records for seven years from the due date of the return or the date it was filed, whichever is later. This extended period is due to the complex nature of these taxes and the potential for audits to occur many years after the filing.

Specific Record Retention Examples

To provide a more concrete understanding, here are some specific examples of tax records and their recommended retention periods:

| Type of Record | Recommended Retention Period |

|---|---|

| Income Tax Returns (Form 1040) | 3 years |

| Payroll Records (W-2, 1099-MISC) | 4 years |

| Sales Tax Records (Retail Sales Tax Returns) | 4 years |

| Property Tax Assessments and Bills | 3 years |

| Estate Tax Records (Form 706) | 7 years |

Best Practices for Tax Record Management

Effective tax record management is crucial for staying organized and compliant. Here are some best practices to consider:

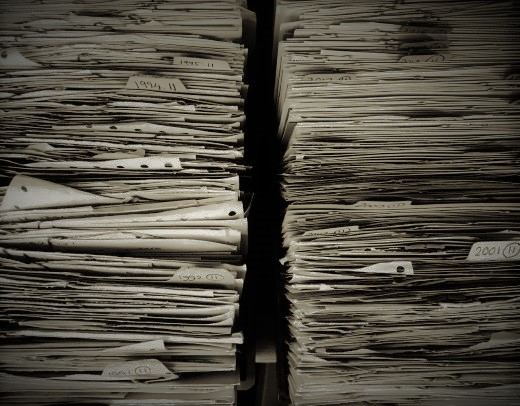

- Digital vs. Physical Records: Many taxpayers opt for digital record-keeping, which offers convenience and ease of access. However, it's essential to ensure digital records are properly backed up and secure. For physical records, consider using fireproof and waterproof storage containers.

- Record Organization: Develop a systematic approach to organizing your tax records. This could involve using a filing system, labeling records, and creating an index or inventory. Ensure that records are easily retrievable when needed.

- Regular Reviews: Periodically review your tax records to ensure they are up-to-date and accurate. This practice can help identify any potential issues or errors before they become major problems.

- Document Retention Policies: For businesses, implementing a formal document retention policy can ensure consistent and compliant record-keeping practices across the organization.

Future Considerations and Potential Changes

Tax record retention guidelines can evolve over time, often in response to changes in tax laws or technological advancements. As such, it’s essential to stay informed about any updates or changes that may impact your record retention practices.

One notable trend is the increasing use of digital record-keeping and the development of secure cloud-based storage solutions. These technologies offer enhanced security and accessibility, making it easier for taxpayers to comply with record retention requirements. Additionally, the IRS and other tax authorities are continually improving their electronic filing and record-keeping systems, further streamlining the tax process.

Conclusion: Expert Insights and Key Takeaways

In conclusion, understanding the intricacies of tax record retention is vital for individuals and businesses alike. By following the recommended retention periods and implementing best practices for record management, you can ensure compliance with tax laws and protect yourself from potential audits and legal issues.

Remember, tax record retention is not a one-size-fits-all practice. It's essential to tailor your approach based on your specific circumstances and the nature of your tax records. Regular reviews, staying informed about changes in tax laws, and seeking professional advice when needed are all key components of effective tax record management.

By adopting a proactive and organized approach to tax record retention, you can minimize stress and ensure a smooth financial journey, whether it's for personal or business purposes.

What happens if I don’t keep my tax records for the recommended duration?

+

Failing to keep tax records for the recommended duration can lead to serious consequences. It may hinder your ability to accurately file your taxes, and if you’re audited, you may face penalties for not providing the necessary documentation. Additionally, it can make it difficult to resolve tax disputes or claim refunds if needed.

Can I dispose of my tax records after the recommended retention period?

+

While you are generally safe to dispose of tax records after the recommended retention period, it’s always a good idea to consult with a tax professional before doing so. In some cases, such as ongoing legal proceedings or potential audits, it may be advisable to keep records for a longer period.

Are there any tax records that should be kept indefinitely?

+

Yes, certain tax records should be kept indefinitely, such as those related to significant assets like real estate, business interests, or long-term investments. These records can be crucial for estate planning, legal disputes, or historical reference.