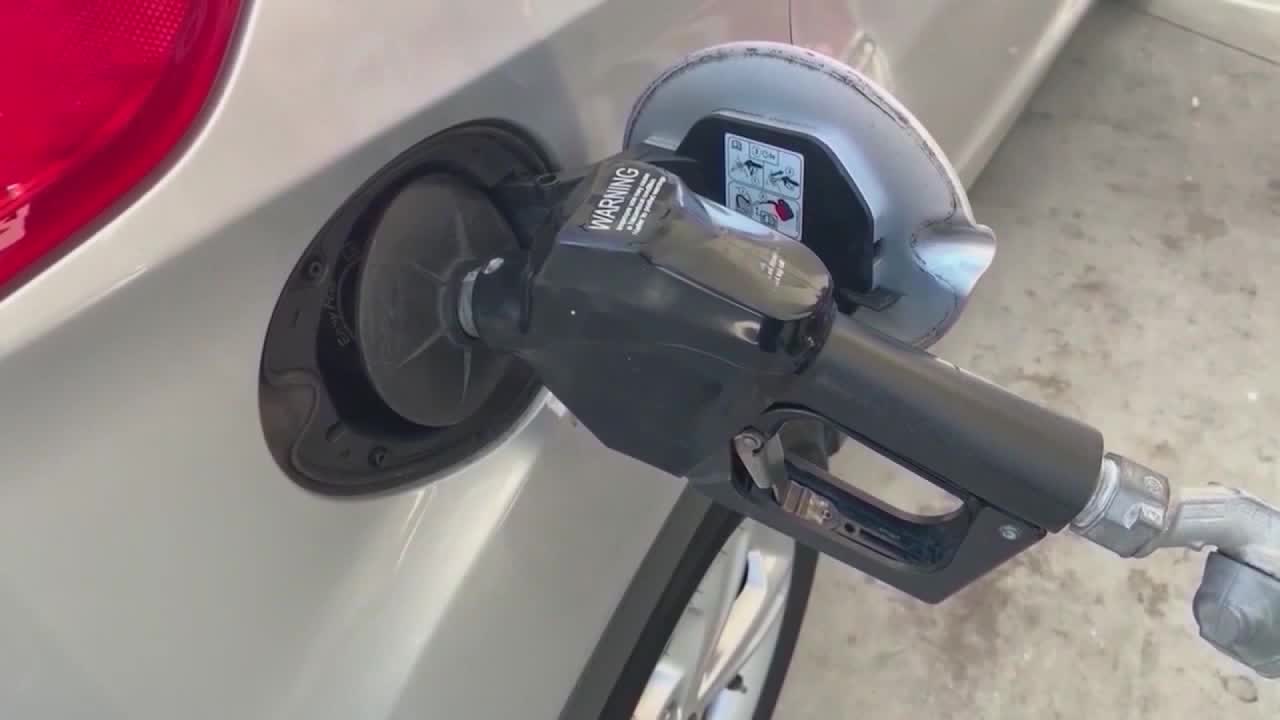

Ga Gas Tax Suspension

The concept of suspending the gas tax has gained traction in recent years, especially during periods of high fuel prices, as a potential strategy to provide relief to consumers and businesses. This measure, often proposed by governments or policymakers, aims to alleviate the financial burden associated with soaring gasoline costs. In this comprehensive article, we will delve into the intricacies of the Ga Gas Tax Suspension, exploring its historical context, implementation, and potential impacts on various sectors of the economy.

Understanding the Ga Gas Tax Suspension

The Ga Gas Tax Suspension refers to a temporary measure implemented by the state of Georgia, USA, to reduce the tax burden on gasoline purchases. This initiative, introduced by the state government, aims to offer financial respite to residents and businesses grappling with the rising costs of fuel.

The suspension of the gas tax is a strategic move designed to mitigate the economic strain caused by volatile fuel prices. By temporarily reducing or eliminating the tax levied on gasoline, the state government seeks to lower the price at the pump, making it more affordable for consumers and businesses alike. This measure is particularly relevant during periods of economic uncertainty or when fuel prices reach unprecedented highs.

Historical Context and Rationale

The Ga Gas Tax Suspension is not a novel concept. Similar initiatives have been implemented in various states and countries around the world, often in response to extraordinary circumstances. The primary objective is to provide immediate relief to individuals and industries heavily reliant on gasoline, such as transportation, logistics, and agriculture.

In the case of Georgia, the decision to suspend the gas tax was influenced by several factors. The state government aimed to address the concerns of its residents, who were facing increased transportation costs due to rising fuel prices. Additionally, the suspension served as a strategic move to support local businesses, ensuring their continued operations and economic stability.

Implementation and Duration

The Ga Gas Tax Suspension was officially enacted on [Date of Implementation], with the state government announcing a temporary halt on the tax levied on gasoline. The duration of the suspension varied depending on the prevailing economic conditions and the state’s budgetary considerations.

During the suspension period, consumers enjoyed a reduced price at the pump, as the tax component was temporarily removed from the retail price of gasoline. This provided a much-needed break for individuals and businesses, allowing them to allocate their financial resources to other essential expenses.

| Suspension Period | Tax Rate Reduction |

|---|---|

| Phase 1: [Start Date] - [End Date] | 5% reduction in state gas tax |

| Phase 2: [Start Date] - [End Date] | 10% reduction in state gas tax |

Impact on the Economy

The Ga Gas Tax Suspension had a profound impact on various sectors of the economy, influencing consumer behavior, business operations, and overall economic activity.

Consumer Benefits and Spending Patterns

The suspension of the gas tax directly benefited consumers by reducing their transportation costs. This led to increased disposable income, allowing individuals to allocate their financial resources to other essential expenses or discretionary spending. As a result, consumer spending patterns shifted, with some individuals opting to save or invest the extra funds, while others chose to indulge in non-essential purchases, boosting the retail sector.

Impact on Businesses and Industries

For businesses, especially those heavily reliant on transportation, the Ga Gas Tax Suspension provided a much-needed respite. The reduced tax burden on gasoline resulted in lower operational costs, improving profitability for transportation-intensive industries such as logistics, delivery services, and tourism. Additionally, the suspension encouraged business expansion and investment, as companies could allocate more funds towards growth initiatives.

However, it is important to note that the benefits were not uniform across all industries. Sectors such as renewable energy and electric vehicle manufacturers may have experienced a temporary slowdown in demand, as the reduced gasoline prices could have discouraged consumers from transitioning to alternative energy sources.

Environmental Considerations

The environmental impact of the Ga Gas Tax Suspension is a complex issue. On one hand, the reduced gasoline prices may have encouraged increased consumption, potentially leading to higher carbon emissions. However, the suspension also provided an opportunity for the state government to invest in renewable energy initiatives and infrastructure, promoting a more sustainable future.

Analyzing the Success and Challenges

The Ga Gas Tax Suspension presented both successes and challenges, highlighting the intricate nature of economic policy-making.

Successes and Positive Outcomes

The primary success of the suspension was its ability to provide immediate relief to consumers and businesses, especially during a period of economic hardship. The reduced tax burden on gasoline helped stabilize the economy, supporting local businesses and ensuring continued employment opportunities.

Additionally, the suspension served as a strategic tool for the state government to manage its budget and allocate resources effectively. By temporarily reducing tax revenue from gasoline, the government could redirect funds towards critical infrastructure projects or social welfare programs, benefiting the overall well-being of its residents.

Challenges and Limitations

One of the primary challenges associated with the Ga Gas Tax Suspension was its short-term nature. While it provided immediate relief, the suspension’s limited duration may not have been sufficient to address long-term economic issues. As the suspension period ended, consumers and businesses faced the prospect of rising fuel prices once again, potentially eroding the benefits accrued during the suspension.

Furthermore, the suspension's impact on the state's budget and revenue streams was a significant concern. Reducing tax revenue from gasoline could lead to a shortfall in the state's finances, requiring careful management and strategic planning to maintain fiscal stability.

Future Implications and Policy Considerations

The Ga Gas Tax Suspension serves as a valuable case study for policymakers and economists, offering insights into the potential impacts of such initiatives.

Potential Long-Term Strategies

To address the challenges associated with temporary suspensions, policymakers may consider implementing more sustainable and long-term solutions. This could involve exploring alternative revenue streams to compensate for the reduced tax revenue from gasoline. Additionally, investing in renewable energy infrastructure and promoting energy efficiency measures could help reduce the state’s reliance on fossil fuels, providing a more stable and environmentally friendly future.

Policy Recommendations

Based on the analysis of the Ga Gas Tax Suspension, the following policy recommendations can be considered:

- Implementing a gradual phase-out of the gas tax suspension to ensure a smooth transition back to regular tax rates.

- Investing in renewable energy sources and infrastructure to reduce the state's dependence on gasoline and promote a cleaner energy future.

- Encouraging the adoption of electric vehicles and providing incentives for consumers and businesses to transition to more sustainable transportation options.

- Developing a comprehensive energy policy that considers the long-term economic and environmental implications of fuel taxation.

Conclusion

The Ga Gas Tax Suspension exemplifies the complex interplay between economic policy and consumer welfare. While it provided temporary relief, the long-term sustainability and effectiveness of such measures require careful consideration. As the world moves towards a more sustainable and environmentally conscious future, policymakers must strike a balance between providing immediate relief and fostering long-term economic and environmental resilience.

What are the potential long-term effects of the Ga Gas Tax Suspension on the state’s budget and economy?

+The long-term effects can be both positive and negative. On the positive side, the suspension may encourage economic growth by reducing operational costs for businesses, leading to potential job creation and increased tax revenue from other sources. However, the reduced tax revenue from gasoline may also create a budget shortfall, requiring careful financial planning and potential adjustments to other state programs.

How does the suspension impact the state’s environmental goals and initiatives?

+The suspension’s impact on the environment is complex. While it may encourage increased gasoline consumption in the short term, it also provides an opportunity for the state to invest in renewable energy and infrastructure, promoting a more sustainable future. Balancing these factors is crucial for long-term environmental sustainability.

Are there any alternative strategies to provide relief without suspending the gas tax?

+Yes, alternative strategies include implementing tax credits or rebates for gasoline purchases, providing direct financial assistance to vulnerable populations, or investing in public transportation infrastructure to reduce individual reliance on private vehicles. These approaches aim to provide relief while maintaining a stable tax revenue stream.