Florida Car Sales Tax

Understanding the intricacies of Florida's car sales tax is crucial for anyone considering a vehicle purchase in the Sunshine State. The state's unique tax structure, coupled with its diverse automotive market, makes it essential to delve into the specifics to ensure a smooth and informed transaction.

The Florida Car Sales Tax: A Comprehensive Overview

When it comes to buying a car in Florida, one of the key considerations is the sales tax, which can significantly impact the overall cost of the vehicle. Florida, known for its vibrant car culture and diverse range of automotive options, has a sales tax system that differs from many other states.

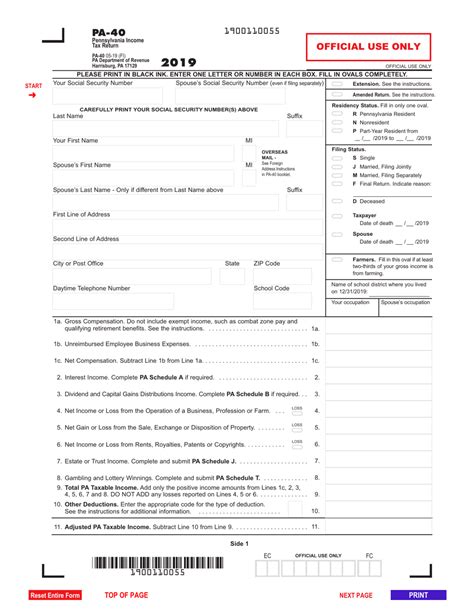

The Florida Department of Revenue is responsible for administering and collecting the state's sales tax, including that on vehicle purchases. This tax is applied to the purchase price of the vehicle, including any additional fees and charges, such as dealer preparation fees and destination charges.

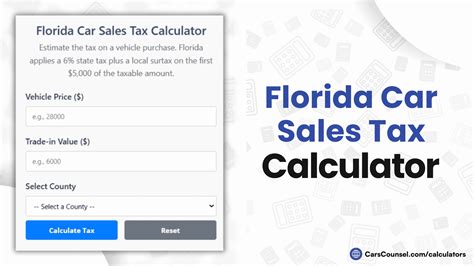

The state sales tax rate in Florida is currently set at 6%, which is applied uniformly across the state. However, it's important to note that local governments in Florida are authorized to levy an additional discretionary sales surtax. These local surtaxes can vary from county to county, with rates ranging from 0% to 1.5%. This means that the total sales tax rate on a vehicle purchase can differ depending on the county where the purchase is made.

How the Florida Car Sales Tax Works

When buying a car in Florida, the sales tax is typically calculated and added to the purchase price by the dealer. The dealer will collect the tax on behalf of the state and local governments and remit it to the appropriate tax authorities.

For example, if you purchase a car in a county with a 1% local surtax, the total sales tax rate would be 7% (6% state tax + 1% local surtax). This tax is calculated based on the total purchase price, including any options, add-ons, and dealer fees. It's important to carefully review the breakdown of the sales tax on your purchase agreement to ensure accuracy.

In addition to the sales tax, Florida also imposes a title transfer fee, which is charged when you register your vehicle. This fee is typically around $75.75 for most passenger vehicles and is used to cover the costs of issuing a new title and registering the vehicle.

| Florida Sales Tax Rates | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Sales Surtax (maximum) | 1.5% |

| Total Maximum Sales Tax | 7.5% |

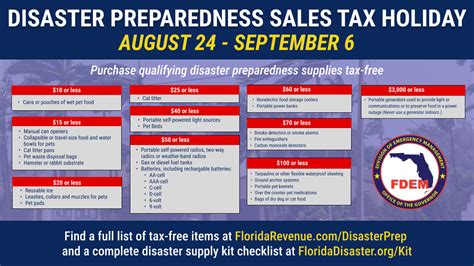

Exemptions and Special Cases

Like many other states, Florida offers certain exemptions and special considerations when it comes to sales tax on vehicle purchases. These exemptions can provide significant savings for eligible individuals and organizations.

Military Personnel and Veterans: Active-duty military personnel and veterans are exempt from paying sales tax on vehicles purchased in Florida. This exemption extends to both new and used vehicles, making it a substantial benefit for those who have served or are currently serving in the military.

Disabled Individuals: Florida provides a sales tax exemption for individuals with disabilities who purchase vehicles equipped with special modifications to accommodate their disability. This exemption applies to the cost of the vehicle and the cost of the modifications, offering a significant savings for those who require specialized transportation.

Government Entities: Government agencies and certain non-profit organizations are also exempt from paying sales tax on vehicle purchases in Florida. This includes state, county, and municipal governments, as well as qualifying non-profit organizations that meet specific criteria.

Calculating Your Sales Tax

To estimate the sales tax you’ll owe on your vehicle purchase, you can use the following formula:

Sales Tax = Purchase Price × (State Tax Rate + Local Surtax Rate)

For example, if you're buying a car in a county with a 1% local surtax, the calculation would be as follows:

Sales Tax = Purchase Price × (0.06 + 0.01) = Purchase Price × 0.07

This means that for every $1,000 of the purchase price, you'll pay $70 in sales tax (0.07 × $1,000 = $70). It's a good idea to calculate the sales tax yourself to ensure you understand the cost breakdown and to compare it with the dealer's calculations.

Tips for Navigating Florida’s Car Sales Tax

Here are some tips to help you navigate the Florida car sales tax process smoothly:

- Research local sales tax rates in the county where you plan to purchase the vehicle. This information is typically available on the county's official website or through the Florida Department of Revenue.

- Understand the specific qualifications and documentation required for any tax exemptions you may be eligible for. This will ensure a smoother process when claiming your exemption.

- Review your purchase agreement carefully, especially the breakdown of the sales tax. Ensure that the dealer has accurately calculated the tax based on your county's specific rate.

- Consider negotiating the purchase price of the vehicle to potentially lower your overall sales tax liability. Every dollar saved on the purchase price can translate into savings on the sales tax.

- If you're purchasing a used car from a private seller, understand that you'll typically be responsible for paying the sales tax on the purchase price when you register the vehicle.

Future Implications and Considerations

Florida’s car sales tax structure, while relatively straightforward, can have a significant impact on the affordability of vehicle purchases for residents and those relocating to the state. As Florida’s automotive market continues to evolve, with a growing emphasis on electric and hybrid vehicles, it will be interesting to see if the state’s tax policies adapt to encourage the adoption of more environmentally friendly options.

Additionally, as the state's population continues to grow and diversify, the demand for different types of vehicles and the associated tax revenues will likely influence future tax policies. Whether it's adjusting tax rates, introducing new exemptions, or exploring innovative ways to generate revenue from vehicle sales, Florida's car sales tax landscape is one to watch.

FAQ

What is the current state sales tax rate in Florida for car purchases?

+

The current state sales tax rate in Florida for car purchases is 6%.

Can I negotiate the sales tax on my car purchase in Florida?

+

No, the sales tax is a mandatory charge set by the state and local governments, and it cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which will directly impact the amount of sales tax you owe.

Are there any exemptions from paying sales tax on car purchases in Florida?

+

Yes, Florida offers certain exemptions, including for active-duty military personnel and veterans, individuals with disabilities who require specialized vehicle modifications, and government entities and certain non-profit organizations.

Do I need to pay sales tax when purchasing a used car from a private seller in Florida?

+

When purchasing a used car from a private seller in Florida, you are typically responsible for paying the sales tax on the purchase price when you register the vehicle. This is a common requirement for used car purchases in many states.

How can I find out the local sales tax rate in my county in Florida for car purchases?

+

You can find the local sales tax rate in your county in Florida by visiting the Florida Department of Revenue’s website or contacting your county’s tax office. They will be able to provide you with the specific rate applicable to your county.