File State Taxes Only

For individuals and businesses, the process of filing state taxes can often be a complex and daunting task, especially when it comes to navigating the unique requirements and regulations of each state. In the United States, tax obligations vary greatly across different states, leading many taxpayers to opt for the convenience of filing state taxes only, without considering the potential benefits and drawbacks of this approach.

This comprehensive guide aims to delve into the world of state-only tax filing, shedding light on its advantages, limitations, and the crucial factors taxpayers should consider before making this decision. By understanding the intricacies of state tax laws and exploring real-world examples, we will provide an expert analysis to help taxpayers make informed choices regarding their tax strategies.

Understanding State-Only Tax Filing

State-only tax filing refers to the practice of submitting tax returns exclusively to the state tax authorities, bypassing the federal tax system. While this approach simplifies the tax filing process by eliminating the need to comply with federal regulations, it also comes with a set of unique considerations that taxpayers must be aware of.

Each state in the US has its own tax laws, rates, and deadlines, which can differ significantly from federal guidelines. By choosing to file state taxes only, taxpayers are essentially opting out of the federal tax system, which has its own set of benefits, such as tax credits, deductions, and refund opportunities that may not be available at the state level.

Advantages of State-Only Filing

State-only tax filing can offer several advantages, particularly for taxpayers with straightforward financial situations and those who wish to minimize their tax obligations.

- Simplicity and Reduced Complexity: By focusing solely on state tax regulations, taxpayers can streamline their filing process, avoiding the intricate web of federal tax codes and requirements. This simplicity can be especially beneficial for small businesses and individuals with simple income structures.

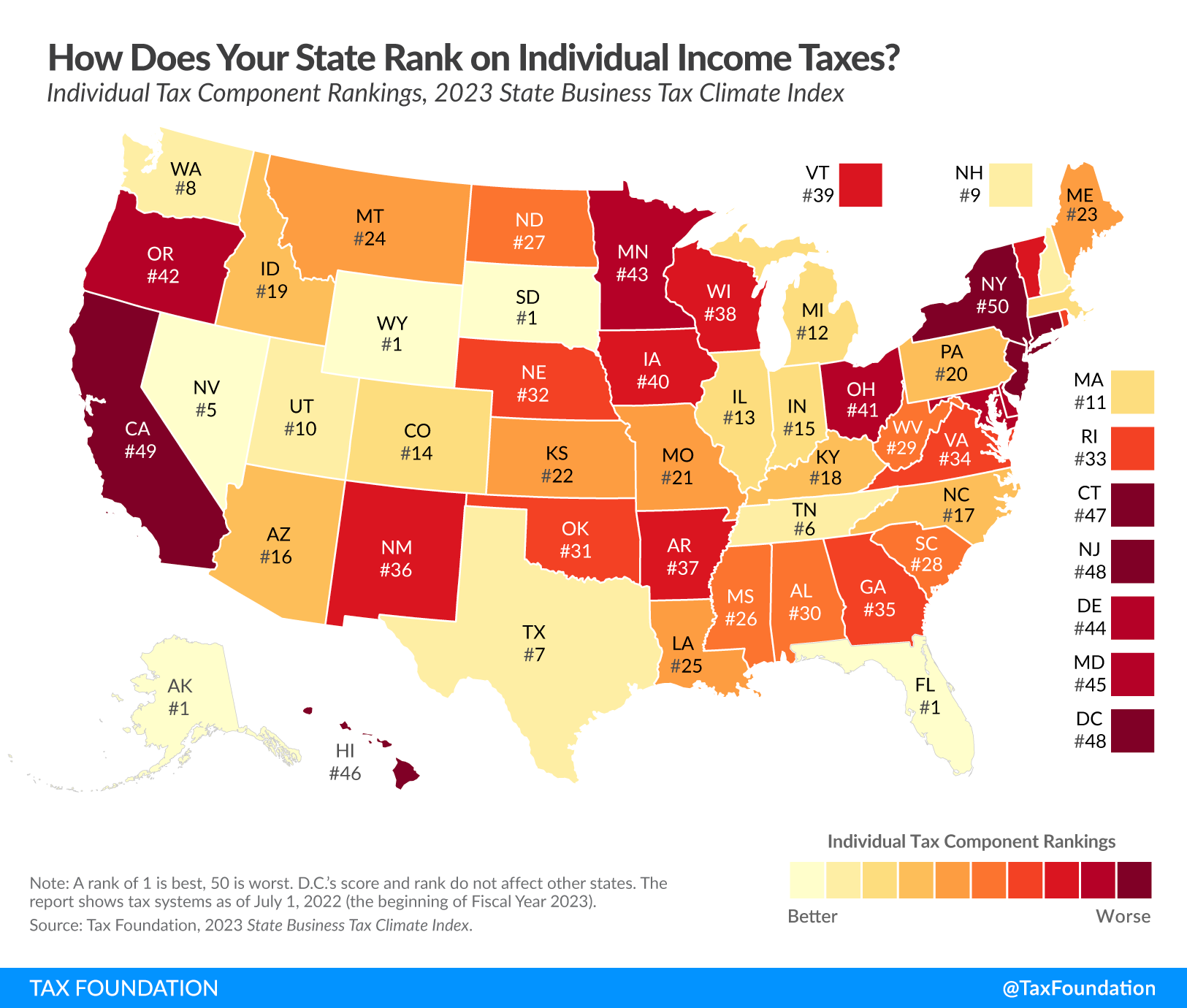

- Lower Tax Rates: Some states have more favorable tax rates compared to the federal government. Filing state taxes only may result in a lower overall tax liability, especially for taxpayers residing in states with no income tax or lower tax brackets.

- Faster Refunds: In certain cases, filing state taxes only can lead to quicker refund processing. State tax authorities often have faster turnaround times for processing returns and issuing refunds, which can be advantageous for taxpayers in need of prompt financial relief.

Limitations and Considerations

While state-only tax filing may offer certain benefits, it also comes with limitations and potential drawbacks that taxpayers should carefully consider.

- Limited Tax Benefits: One of the most significant drawbacks of filing state taxes only is the loss of access to federal tax benefits. Taxpayers may miss out on valuable deductions, credits, and incentives, such as the Child Tax Credit, Education Credits, or Business Tax Incentives, which can significantly reduce their overall tax burden.

- Complex State Laws: Although state tax laws may be simpler in some respects, they can still be complex and challenging to navigate. Each state has its own set of rules, regulations, and tax forms, requiring taxpayers to stay updated and well-informed to ensure compliance.

- Potential Penalties: Failing to comply with state tax laws can result in significant penalties and interest charges. Taxpayers must ensure they understand the specific requirements and deadlines of their state to avoid costly mistakes.

Case Studies: State-Only Tax Filing in Action

To illustrate the real-world implications of state-only tax filing, let's explore a few case studies:

Case Study 1: Small Business Owner in Texas

John, a small business owner in Texas, opts for state-only tax filing due to the state's favorable tax environment. With no state income tax and a flat tax rate for sales and use taxes, John's business enjoys a lower tax burden. By focusing solely on state tax compliance, John simplifies his tax obligations and saves on accounting fees associated with federal tax preparation.

Case Study 2: Remote Worker in California

Emily, a remote worker based in California, faces a unique challenge. California's state tax laws require residents to pay taxes on all income earned within the state, regardless of where the work was performed. Emily, who works remotely for a company based in another state, must file state taxes in California to comply with these regulations. While it adds complexity to her tax situation, she benefits from California's progressive tax system, which offers tax breaks for low- and middle-income earners.

Case Study 3: Retiree in Florida

Michael, a retiree residing in Florida, chooses to file state taxes only due to the state's reputation as a tax haven for retirees. Florida has no state income tax, which significantly reduces Michael's tax liability. By focusing solely on state tax compliance, Michael can enjoy a more straightforward tax filing process and potentially save on taxes compared to other states with higher income tax rates.

Performance Analysis and Future Implications

State-only tax filing can be a viable strategy for certain taxpayers, but it's essential to analyze its performance and consider the potential future implications.

Performance Analysis

| State | Tax Rate | Filing Simplicity | Potential Savings |

|---|---|---|---|

| Texas | Flat Rate (Sales and Use Tax) | High | Moderate |

| California | Progressive | Moderate | Varies |

| Florida | No Income Tax | High | Significant |

As the table illustrates, the performance of state-only tax filing varies depending on the state and the taxpayer's financial situation. States like Texas and Florida offer more favorable tax rates and simpler filing processes, making state-only filing an attractive option. However, states like California, with its progressive tax system, may require a more nuanced approach to maximize savings.

Future Implications

The decision to file state taxes only should be made with an eye towards the future. Tax laws and regulations are subject to change, and taxpayers should stay informed about potential updates that could impact their tax strategies. For instance, states may introduce new tax incentives or change their tax rates, which could affect the attractiveness of state-only filing.

Additionally, taxpayers should consider the potential impact of state-only filing on their federal tax obligations in the future. If circumstances change and taxpayers need to file federal taxes again, they may face challenges in catching up with missed deductions, credits, and other benefits that were not utilized during their state-only filing period.

Expert Insights and Recommendations

Navigating the complexities of state-only tax filing requires a strategic approach and a thorough understanding of one's financial situation. Here are some expert insights and recommendations to consider:

- Evaluate Your Financial Situation: Before opting for state-only tax filing, thoroughly assess your income, deductions, and tax obligations. Consider factors such as your income level, family size, and any potential tax credits or deductions you may be eligible for. This evaluation will help you determine if state-only filing is the most beneficial strategy for your unique circumstances.

- Stay Informed About State Tax Laws: State tax laws are subject to change, and it's crucial to stay updated on any modifications that could impact your tax obligations. Regularly review state tax guidelines and consult with tax professionals to ensure you are aware of any new regulations or incentives that may affect your tax strategy.

- Consider Professional Tax Advice: The decision to file state taxes only should not be taken lightly, especially if you have complex financial situations or significant assets. Consulting with a qualified tax professional can provide valuable insights and guidance tailored to your specific needs. They can help you navigate the intricacies of state tax laws and ensure you make the most advantageous choices.

- Weigh the Pros and Cons: While state-only tax filing may offer simplicity and potential savings, it also comes with limitations. Carefully weigh the advantages against the potential drawbacks, such as missing out on federal tax benefits. Consider your long-term financial goals and make a decision that aligns with your overall financial strategy.

Frequently Asked Questions

Can I file state taxes only if I have no income from that state?

+It depends on the state’s tax laws. Some states, like Texas and Florida, have no income tax, so you may only need to file state taxes if you have income sources within the state. However, states like California require residents to pay taxes on all income earned within the state, regardless of where the work was performed.

Are there any penalties for filing state taxes only and not federal taxes?

+Yes, failing to file federal taxes when required can result in penalties and interest charges. It’s essential to understand your federal tax obligations and ensure you comply with them to avoid potential legal issues.

Can I switch between state-only and federal tax filing each year?

+It’s generally recommended to maintain consistency in your tax filing approach. Switching between state-only and federal tax filing each year can lead to complications and potential penalties. Consult with a tax professional to determine the best long-term strategy for your financial situation.

What are some common state tax benefits that I may miss out on if I file state taxes only?

+State tax benefits vary widely, but common examples include state-specific tax credits for education, childcare, or energy efficiency, as well as deductions for certain expenses like mortgage interest or state sales taxes. These benefits can significantly reduce your tax liability, so it’s important to consider them when deciding on your tax filing strategy.