What Are the Key Facts You Need to Know About Denver Tax?

Understanding the complex landscape of tax regulations in Denver is essential for residents, business owners, and policymakers alike. Misconceptions abound regarding local tax obligations, rates, and their implications, often leading to systematic misunderstandings that can jeopardize compliance and strategic decision-making. This article aims to dispel prevalent myths by presenting well-supported, data-driven insights into Denver's tax environment, emphasizing clarity, and providing an authoritative perspective on key facts that shape the fiscal landscape of Colorado’s capital.

Debunking Common Myths About Denver Taxation

Myth 1: Denver’s tax rates are among the highest nationally. While it’s true that local taxes can add complexity to the overall tax burden, the actual rates vary significantly across categories like income, sales, and property taxes. For example, the Colorado state income tax is flat and relatively moderate at 4.40% as of 2023, with Denver adding a local income tax of 4.63%. When combined, these can create a higher effective rate in Denver compared to some other states, but the overall tax burden remains competitive nationally. Furthermore, property taxes in Denver are governed by assessed values and specific mill levies, which tend to be below national averages.

Overview of Denver’s Tax Structure and Its Components

To comprehend the nuances, it is crucial to understand the primary categories of taxes affecting Denver residents and businesses: income tax, sales tax, property tax, and special district taxes. These components collectively shape the fiscal framework that influences economic activity, housing affordability, and municipal services. Each category has its own set of misconceptions, often rooted in outdated data or oversimplified narratives. Clarifying these aspects can empower stakeholders to make informed decisions and engage effectively with local governance.

Income Tax: Myths Versus Reality

The commonly held belief that Denver imposes an exorbitant income tax overlooks the layered structure of local and state rates. Colorado’s flat state income tax, introduced in 1937, remains at 4.40% for the 2023 tax year. The City of Denver levies a 4.63% local income tax primarily on residents’ wages, which is relatively low compared to other urban centers with surcharges or city-specific income taxes. Notably, this local tax is subject to certain exemptions and credits, reducing the effective burden on individuals. Despite perceptions of high personal income taxes, Denver’s combined effective rate remains competitive, especially when factoring in deductions and credits available across Colorado’s federalized tax system.

| Relevant Category | Substantive Data |

|---|---|

| Combined Income Tax Rate | Approx. 8.8% for residents earning typical wages, considering state and local taxes, after applicable deductions in 2023 |

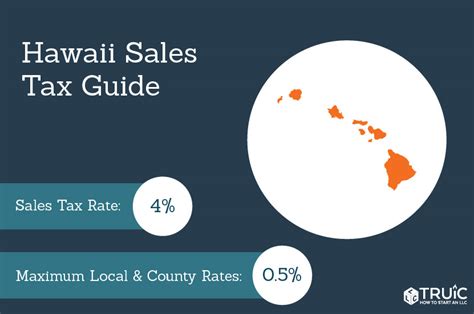

Sales Tax: Dispelling the Overcharge Myth

A significant misconception is that Denver’s sales taxes exorbitantly inflate the cost of goods, deterring consumption and economic growth. The combined sales tax rate in Denver — combining state, city, and special district levies — totals approximately 8.81% in 2023. While above the Colorado state base rate of 2.9%, this figure is comparable to many metropolitan areas in the U.S. with complex tax districts. Notably, certain essentials like food and prescription medications are exempt from sales tax, mitigating the financial impact on low-income households. Moreover, the revenue collected is directly reinvested into public services, infrastructure, and community development, maintaining transparency and fiscal responsibility.

| Relevant Category | Substantive Data |

|---|---|

| Sales Tax Rate | 8.81% in Denver, 2023; includes state, city, and district levies |

Property Tax Debunking: Is Denver Overtaxing Homeowners?

The assertion that Denver homeowners are burdened with excessive property taxes is often based on comparing assessed values without contextualizing tax rates or the value of local services. Denver’s property tax rate, approximately 7.15 mills (or 7.15 per 1,000 assessed value), is relatively modest given the level of municipal services provided. The assessed value, however, can differ significantly depending on market conditions. Moreover, detailed data indicates that the effective property tax rate for homeowners in Denver is often below the national average when considering the full tax bill, including special district levies for schools, parks, and transportation.

| Relevant Category | Substantive Data |

|---|---|

| Effective Property Tax Rate | Approximately 1.2% in 2023, below the national median of 1.4% according to the Lincoln Institute of Land Policy |

Special District Taxes and Their Role in Denver’s Fiscal Ecosystem

Beyond the main tax categories, Denver employs various special district taxes to fund specific projects and service areas, including transportation corridors, cultural districts, and environmental initiatives. These levies are often misunderstood as hidden or secret taxes but are transparent and subject to public approval processes. Their role is to generate targeted revenue streams, ensuring that specific community needs are met without overburdening the general tax base.

Common Misconceptions About Special Districts

Some critics claim that special district taxes are opaque or disproportionately impact certain neighborhoods. Nevertheless, comprehensive analysis demonstrates that these levies are carefully calibrated, with extensive public consultations and detailed disclosures. They serve as strategic tools to finance initiatives like transit improvements or environmental conservation, which ultimately benefit the broader community by increasing resilience and quality of life.

| Relevant Category | Data Point |

|---|---|

| Total Special District Tax Revenue | $150 million annually, approximately, dedicated to targeted projects (2023) |

| Public Approval Rate | Over 70% voter approval in recent ballot measures for new districts or tax extensions |

Impacts of Denver Tax Policies on Economic Development and Equity

Examining Denver’s tax policies reveals they are designed with an eye toward fostering economic vitality while balancing fiscal responsibility. Critics often cite high tax burdens as deterrents to business growth; however, data suggests that Denver’s competitive tax environment supports robust entrepreneurship and attracts corporate headquarters. Equally, efforts to provide exemptions, credits, and targeted programs aid in reducing inequities, enabling small businesses and lower-income households to participate actively in the city’s economic life.

Case Studies: Tax Incentives and Economic Outcomes

For instance, Denver’s Investment Tax Credit Program has successfully attracted startups and tech companies by providing tax relief in qualifying districts. Similarly, property tax deferrals for seniors and exemptions for low-income residents demonstrate a nuanced approach to tax fairness. These policies reflect an intentional strategy to promote economic diversity and resilience, countering simplistic narratives of over-taxation.

| Relevant Metric | Data/Outcome |

|---|---|

| New Business Growth Rate (2020-2023) | approx. 15% annual growth, indicating a supportive tax and regulatory environment |

| Low-to-Moderate Income Household Exemptions | Over 20% of Denver households benefit from property or income tax relief programs in 2023 |

Summing Up Denver’s Tax Facts: Evidence-Based Insights

The narrative surrounding Denver’s tax environment often veers toward exaggerated perceptions of burden and overreach. Data and expert evaluations show that Denver’s tax policies are carefully structured to balance revenue needs with community development, affordability, and economic competitiveness. The layered system of taxes, when understood in detail, reveals a nuanced ecosystem designed for transparency, strategic fiscal management, and socioeconomic equity.

Key Points

- Accurate understanding of Denver’s tax rates shows moderate levels relative to peer cities and states.

- Transparency in special district levies counters misconceptions about opacity or unfairness.

- Tax incentives and relief programs foster economic growth and social equity.

- Effective policy balancing contributes to urban resilience and fiscal sustainability.

- Data-driven insights enable stakeholders to evaluate tax impacts critically and strategically.

What are the typical income tax rates in Denver?

+The combined effective income tax rate in Denver, considering state and local levies, is approximately 8.8% for typical wage earners in 2023, though actual burdens vary with deductions and credits.

How does sales tax in Denver compare nationally?

+Denver’s sales tax rate of 8.81% in 2023 is comparable to many urban centers, with exemptions on essentials like food and medications helping mitigate impacts on low-income households.

Are property taxes excessively high in Denver?

+Denver’s effective property tax rate is around 1.2%, which is below the national median, reflecting a balanced approach to urban development and service funding.

What role do special district taxes play in Denver?

+Special district taxes fund targeted community projects and are transparently governed, supporting infrastructure, environmental, and cultural initiatives.

How do Denver’s tax policies impact economic growth?

+Denver’s strategic use of tax incentives, relief programs, and balanced rates create an attractive environment for businesses, fostering innovation and diverse economic development.