Dave Ramsey Taxes

Dave Ramsey is a well-known personal finance expert and advocate for financial literacy. With a mission to empower individuals to take control of their financial lives, his teachings and principles have helped countless people achieve financial freedom and stability. As tax season approaches, it's only natural for individuals who follow Dave Ramsey's principles to wonder how his philosophy aligns with tax strategies and planning.

In this comprehensive guide, we will delve into the world of Dave Ramsey and taxes, exploring his tax-related principles, strategies, and how they can be applied to your financial journey. By understanding Dave Ramsey's approach to taxes, you can make informed decisions and optimize your financial well-being.

Understanding Dave Ramsey’s Philosophy

Dave Ramsey’s financial philosophy is centered around a set of core principles that guide individuals towards financial independence and security. These principles are designed to help people break free from debt, build wealth, and establish a solid financial foundation. While his teachings cover a wide range of financial topics, including budgeting, investing, and retirement planning, taxes play a crucial role in achieving long-term financial success.

The Baby Steps: A Comprehensive Guide to Financial Freedom

Dave Ramsey’s Baby Steps is a well-structured roadmap that outlines the steps individuals should take to achieve financial freedom. These steps provide a clear path to follow, ensuring that you are making progress towards your financial goals. When it comes to taxes, Dave Ramsey’s approach aligns with his overall philosophy, focusing on minimizing tax liabilities and maximizing financial growth.

| Dave Ramsey's Baby Steps | Description |

|---|---|

| Step 1: Emergency Fund | Build a starter emergency fund of $1,000 to cover unexpected expenses. |

| Step 2: Debt Snowball | List your debts from smallest to largest and focus on paying them off using the debt snowball method. |

| Step 3: Full Emergency Fund | Save up to 3-6 months of expenses for a fully funded emergency fund. |

| Step 4: Invest 15% of Income | Allocate 15% of your income towards retirement investments, such as a 401(k) or Roth IRA. |

| Step 5: College Funding | Save for your children's college education if applicable. |

| Step 6: Pay Off Home Early | Accelerate your mortgage payments to pay off your home early. |

| Step 7: Build Wealth and Give | Continue investing and building wealth while giving back to causes you care about. |

Key Principle: The Debt Snowball

One of Dave Ramsey's most famous principles is the Debt Snowball method. This strategy involves listing your debts from smallest to largest, regardless of interest rates, and focusing on paying off the smallest debts first. By achieving small wins early on, individuals gain motivation and momentum to tackle larger debts. While the Debt Snowball may not always be the most mathematically efficient approach, it is a powerful psychological tool that helps individuals stay motivated and consistent in their journey towards becoming debt-free.

Dave Ramsey’s Tax Strategies

Dave Ramsey understands that taxes are an inevitable part of life and financial planning. His tax strategies are designed to help individuals minimize their tax liabilities and maximize their financial growth. Here are some key principles and strategies that align with Dave Ramsey’s philosophy:

1. Maximize Retirement Contributions

One of the primary ways to reduce your taxable income and grow your wealth is by maximizing contributions to tax-advantaged retirement accounts. Dave Ramsey encourages individuals to contribute the maximum allowed to their 401(k) plans or individual retirement accounts (IRAs). By doing so, you can take advantage of tax deductions or tax-deferred growth, depending on the type of account you choose.

- 401(k) Plans: Contribute up to the annual limit, which is currently $20,500 for those under 50 and $27,000 for those aged 50 and above. Many employers also offer matching contributions, so be sure to take full advantage of this benefit.

- Traditional IRA: You can contribute up to $6,000 per year ($7,000 if you're 50 or older) to a Traditional IRA. Contributions may be tax-deductible, depending on your income and whether you or your spouse has access to a workplace retirement plan.

- Roth IRA: A Roth IRA allows you to contribute after-tax dollars, but the growth and withdrawals in retirement are tax-free. The annual contribution limit is the same as a Traditional IRA.

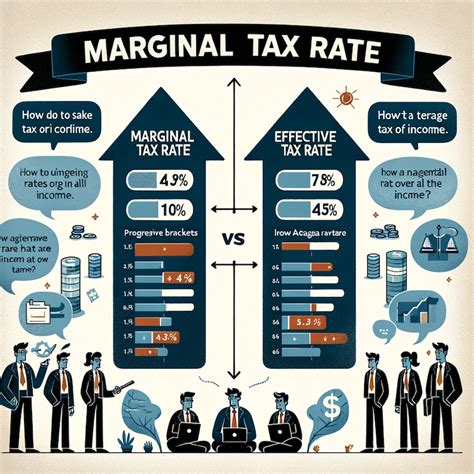

2. Understand Tax Brackets and Strategies

Tax brackets play a crucial role in determining your tax liability. Dave Ramsey emphasizes the importance of understanding your tax bracket and employing strategies to keep yourself in a lower tax bracket. By optimizing your income and deductions, you can reduce your taxable income and minimize the impact of taxes on your finances.

For example, if you anticipate a significant income increase in the following year, you might consider making additional retirement contributions or charitable donations to lower your taxable income and stay in a lower tax bracket.

3. Take Advantage of Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability. Dave Ramsey encourages individuals to take advantage of these opportunities by understanding the available credits and deductions and ensuring they qualify for them. Some common tax credits and deductions include:

- Child Tax Credit: If you have qualifying children, you may be eligible for a credit of up to $2,000 per child.

- Education Credits: The American Opportunity Credit and the Lifetime Learning Credit can reduce your tax liability if you or your dependents are enrolled in higher education.

- Student Loan Interest Deduction: You may be able to deduct up to $2,500 in student loan interest payments made during the tax year.

- Charitable Contributions: If you donate to qualified charities, you can deduct the value of your contributions from your taxable income.

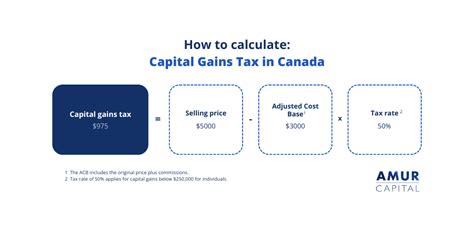

4. Consider Tax-Efficient Investing

When investing, Dave Ramsey suggests considering tax-efficient strategies to minimize the impact of taxes on your investment returns. This can include:

- Tax-Efficient Mutual Funds: Choose mutual funds that minimize capital gains distributions, as these can trigger tax liabilities.

- Tax-Loss Harvesting: If you have investments that have lost value, selling them and realizing the loss can offset capital gains and reduce your tax liability.

- Roth Accounts: While contributions to a Roth IRA are made with after-tax dollars, the growth and withdrawals in retirement are tax-free, making it an attractive option for tax-efficient investing.

Real-Life Success Stories

Many individuals who have embraced Dave Ramsey’s principles and strategies have achieved remarkable financial success. Let’s explore a few real-life success stories that showcase the impact of Dave Ramsey’s teachings, including his approach to taxes:

Sarah’s Journey to Financial Freedom

Sarah, a 35-year-old teacher, struggled with debt and felt overwhelmed by her financial situation. She decided to follow Dave Ramsey’s Baby Steps and started by creating a budget and building an emergency fund. Sarah then tackled her debts using the Debt Snowball method, paying off her credit cards and small loans within a year.

As she progressed through the Baby Steps, Sarah focused on maximizing her retirement contributions. She contributed the maximum allowed to her 401(k) plan and opened a Roth IRA, taking advantage of the tax-free growth. By understanding her tax bracket and optimizing her deductions, Sarah was able to keep more of her hard-earned money.

Today, Sarah is debt-free, has a substantial retirement savings, and feels financially secure. She attributes her success to Dave Ramsey's principles and the power of understanding and managing her taxes effectively.

John’s Tax-Efficient Investing Strategy

John, a 45-year-old entrepreneur, wanted to ensure his investments grew efficiently while minimizing tax liabilities. He followed Dave Ramsey’s advice on tax-efficient investing and made the following strategic moves:

- John contributed the maximum amount to his 401(k) plan, taking advantage of the tax deferral. He also opened a Roth IRA, understanding the long-term benefits of tax-free growth.

- He carefully selected tax-efficient mutual funds, minimizing capital gains distributions and reducing his tax burden.

- John practiced tax-loss harvesting, selling underperforming investments to offset capital gains and reduce his tax liability.

By implementing these strategies, John was able to grow his investments significantly while keeping his tax obligations in check. His disciplined approach to taxes, guided by Dave Ramsey's principles, has allowed him to build a substantial retirement nest egg.

Dave Ramsey’s Approach to Tax Preparation

When it comes to tax preparation, Dave Ramsey advocates for a proactive and informed approach. He encourages individuals to take control of their taxes and understand the process thoroughly. Here are some key points to consider:

1. Keep Good Records

Maintaining organized financial records is essential for accurate tax preparation. Dave Ramsey suggests keeping track of all your income, expenses, deductions, and credits. This includes saving receipts, tracking mileage for business purposes, and documenting charitable contributions.

2. Understand Tax Forms

Familiarize yourself with the various tax forms and what they entail. Common forms include:

- Form 1040: The primary tax return form for individuals.

- W-2: Wage and tax statement provided by your employer.

- 1099-MISC: Used to report miscellaneous income, such as freelance work or rental income.

- Schedule A: Used to itemize deductions, including medical expenses, state taxes, and charitable contributions.

3. Consider Tax Software or Professionals

While Dave Ramsey encourages individuals to educate themselves about taxes, he also understands that tax laws can be complex. If you feel overwhelmed or have a complex financial situation, consider using tax software or hiring a professional tax preparer. They can help ensure accuracy and take advantage of all available deductions and credits.

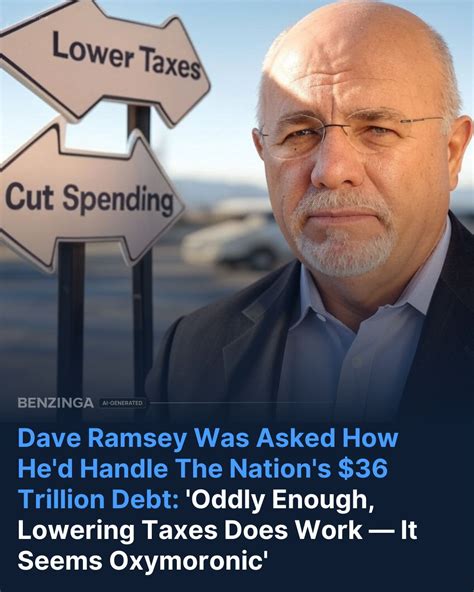

The Future of Taxes: Dave Ramsey’s Perspective

As tax laws and regulations continue to evolve, Dave Ramsey remains proactive in staying updated and guiding his followers. Here are some insights into Dave Ramsey’s perspective on the future of taxes:

1. Adapting to Tax Law Changes

Tax laws are subject to change, and Dave Ramsey emphasizes the importance of staying informed about these changes. He encourages individuals to seek reliable sources of information and consult professionals when needed. By adapting to tax law changes, individuals can continue to optimize their financial strategies and minimize tax liabilities.

2. The Impact of Tax Reform

Major tax reforms, such as the Tax Cuts and Jobs Act of 2017, can significantly impact individuals’ tax situations. Dave Ramsey advises his followers to analyze how these reforms affect their specific financial circumstances. He encourages individuals to assess their tax brackets, deductions, and credits to ensure they are making the most of the new tax landscape.

3. Long-Term Financial Planning

Dave Ramsey emphasizes the importance of long-term financial planning, including tax planning. By considering taxes as an integral part of your financial strategy, you can make informed decisions about retirement planning, investing, and wealth accumulation. Understanding the tax implications of your financial moves can help you achieve your long-term goals more effectively.

Conclusion

Dave Ramsey’s principles and strategies, including his approach to taxes, provide a solid foundation for individuals seeking financial freedom and stability. By understanding and applying his teachings, you can optimize your financial journey and minimize the impact of taxes on your wealth. Remember, taxes are an inevitable part of life, but with the right strategies and mindset, you can navigate them successfully and achieve your financial goals.

How does Dave Ramsey’s philosophy align with tax planning strategies?

+Dave Ramsey’s philosophy emphasizes financial freedom and stability. His tax strategies focus on minimizing tax liabilities and maximizing financial growth. By understanding tax brackets, maximizing retirement contributions, and taking advantage of tax credits and deductions, individuals can align their tax planning with Dave Ramsey’s principles.

What is the Debt Snowball method, and how does it relate to taxes?

+The Debt Snowball is a strategy where individuals list their debts from smallest to largest and focus on paying off the smallest debts first. While it may not always be the most mathematically efficient approach, it provides psychological motivation. By paying off debts, individuals reduce their taxable income and can optimize their tax situation.

How can I maximize my retirement contributions for tax advantages?

+To maximize retirement contributions, contribute the maximum allowed to your 401(k) plan or IRA. Take advantage of employer matching contributions if available. Additionally, consider opening a Roth IRA for tax-free growth and withdrawals in retirement.

What are some common tax credits and deductions I should be aware of?

+Common tax credits include the Child Tax Credit and education credits. Deductions include student loan interest payments, charitable contributions, and medical expenses. Understanding these credits and deductions can help you reduce your taxable income and optimize your tax situation.