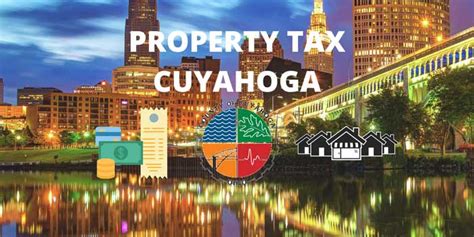

Cuyahoga Property Tax

Understanding Cuyahoga County's property tax system is essential for homeowners and investors alike. With a complex assessment process and varying tax rates, it can be a daunting task to navigate. In this comprehensive guide, we will delve into the intricacies of the Cuyahoga Property Tax, providing valuable insights and expert analysis to help you make informed decisions regarding your property.

The Basics of Cuyahoga Property Tax

Cuyahoga County, located in the state of Ohio, operates under a unique property tax system. This system is designed to ensure fair and equitable taxation of properties within the county. Let’s break down the key components of the Cuyahoga Property Tax.

Assessment Process

The Cuyahoga County Auditor’s Office is responsible for assessing the value of properties for tax purposes. This assessment is crucial as it determines the tax liability for each property owner. The process involves evaluating factors such as location, property type, improvements, and market conditions. The auditor’s office strives to maintain accuracy and fairness in their assessments, ensuring that properties are taxed based on their true value.

One notable aspect of the assessment process is the triennial reappraisal. This means that every three years, the auditor's office conducts a comprehensive reappraisal of all properties in the county. This reappraisal aims to keep property values up-to-date and adjust tax rates accordingly. During the reappraisal period, property owners can expect to receive a new tax valuation notice, reflecting the updated assessed value of their property.

Tax Rates and Calculations

The property tax rate in Cuyahoga County is expressed as millage, which represents the tax amount per thousand dollars of assessed value. The tax rate is determined by various taxing authorities, including the county, cities, school districts, and special districts. Each of these entities has the authority to set their own tax rates, resulting in varying rates across the county.

To calculate the property tax liability, the assessed value of the property is multiplied by the applicable tax rate. For example, if a property has an assessed value of $200,000 and the tax rate is 2.5 mills, the annual property tax would be $500. It's important to note that the tax rate can change annually, as taxing authorities may adjust their budgets and revenue requirements.

Tax Bills and Payment Options

Property owners in Cuyahoga County receive tax bills twice a year, typically in January and July. These bills outline the amount owed, the due dates, and payment options. The Cuyahoga County Treasurer’s Office is responsible for collecting property taxes and ensuring timely payments.

Cuyahoga County offers a variety of payment methods to accommodate different preferences. Property owners can choose to pay their taxes online, by mail, or in person at designated payment locations. Additionally, the county provides the option of enrolling in the Escrow Program, where property taxes are paid through the mortgage company as part of the monthly mortgage payment. This program simplifies the tax payment process for homeowners.

Property Tax Rates and Variations

One of the unique aspects of the Cuyahoga Property Tax is the variation in tax rates across different municipalities and school districts within the county. These variations are influenced by a range of factors, including the cost of providing local services and the budget requirements of each taxing authority.

To illustrate the rate variations, let's consider a few examples. The city of Cleveland, being the largest municipality in the county, typically has higher tax rates compared to smaller cities. This is due to the increased cost of providing services and infrastructure to a larger population. On the other hand, rural areas with lower population densities may have lower tax rates, as the cost of providing services is relatively lower.

Furthermore, school districts play a significant role in determining property tax rates. Cuyahoga County is home to numerous school districts, each with their own tax rates. These rates are set based on the funding needs of the district, including operational costs, teacher salaries, and facility maintenance. As a result, property owners within different school districts may experience varying tax rates.

Comparative Analysis

To provide a clearer picture of the tax rate variations, here’s a table comparing the tax rates of select municipalities and school districts within Cuyahoga County:

| Municipality/School District | Tax Rate (Mills) |

|---|---|

| Cleveland | 3.75 |

| Beachwood | 2.80 |

| Brecksville-Broadview Heights City School District | 4.25 |

| Strongsville City School District | 3.25 |

| Independence | 2.60 |

As evident from the table, there is a considerable range in tax rates across different areas within Cuyahoga County. Property owners should be mindful of these variations when considering property purchases or assessing their tax liabilities.

Tax Relief Programs and Exemptions

Cuyahoga County recognizes the financial burden that property taxes can pose, especially for certain groups of individuals. To alleviate this burden, the county offers various tax relief programs and exemptions. These initiatives aim to provide support to eligible property owners and ensure that they can continue to afford their homes.

Homestead Exemption

The Homestead Exemption is a valuable program offered by Cuyahoga County. It provides eligible homeowners with a reduction in their property taxes. To qualify for the Homestead Exemption, property owners must meet specific criteria, such as being a permanent resident of Ohio, owning and occupying the property as their primary residence, and having a total household income below a certain threshold.

The Homestead Exemption offers a reduction in the assessed value of the property, resulting in lower tax liability. This exemption is particularly beneficial for senior citizens, veterans, and individuals with disabilities, as it provides them with financial relief and helps them maintain homeownership.

Senior Citizen Tax Abatement

Cuyahoga County also implements the Senior Citizen Tax Abatement program, which offers tax relief to eligible senior citizens. To qualify for this program, individuals must be at least 65 years old, have owned and occupied the property as their primary residence for at least three years, and meet certain income and asset limits.

The Senior Citizen Tax Abatement provides a reduction in the taxable value of the property, resulting in lower property taxes. This program aims to support senior citizens in maintaining their independence and staying in their homes as they age.

Veterans’ Exemptions

Cuyahoga County extends its support to veterans through various tax exemptions. Eligible veterans may qualify for a partial or full exemption from property taxes based on their military service and disability status. These exemptions recognize the sacrifices made by veterans and provide them with financial relief.

Veterans who have a service-connected disability of 100% or are receiving VA compensation for a disability may be eligible for a full exemption. Additionally, veterans with a service-connected disability of at least 50% may qualify for a partial exemption. It is important for veterans to consult the Cuyahoga County Auditor's Office to determine their eligibility and apply for these valuable exemptions.

Appealing Property Assessments

In some cases, property owners may disagree with the assessed value of their property as determined by the Cuyahoga County Auditor’s Office. If this is the case, they have the right to appeal the assessment and request a review. The appeals process provides an opportunity for property owners to challenge the assessed value and potentially reduce their tax liability.

Reasons for an Appeal

There are several valid reasons why a property owner may choose to appeal their assessment. These reasons include:

- The assessed value is significantly higher than the property's actual market value.

- The property has unique characteristics or conditions that were not considered in the assessment.

- There are errors or inaccuracies in the property's records, such as incorrect square footage or lot size.

- The property has recently undergone improvements or renovations that were not reflected in the assessment.

The Appeals Process

To initiate an appeal, property owners must file a written notice of appeal with the Cuyahoga County Board of Revision. This notice should include a detailed explanation of the reasons for the appeal, along with any supporting documentation or evidence. It is crucial to provide accurate and compelling arguments to increase the chances of a successful appeal.

Once the appeal is filed, the Board of Revision will schedule a hearing date. During the hearing, property owners have the opportunity to present their case and provide evidence to support their appeal. The Board will carefully review the submitted information and make a decision based on the available evidence.

It is important to note that appealing an assessment can be a complex process, and it is recommended to seek professional assistance or guidance from a tax consultant or attorney who specializes in property tax matters. They can provide valuable advice and increase the likelihood of a favorable outcome.

Conclusion: Navigating Cuyahoga Property Tax

Understanding the intricacies of the Cuyahoga Property Tax is crucial for property owners and investors. From the assessment process to tax rates and relief programs, this comprehensive guide has provided valuable insights into the county’s property tax system. By familiarizing yourself with these aspects, you can make informed decisions and navigate the tax landscape effectively.

Remember, staying informed and proactive is key. Regularly review your property's assessed value, keep track of tax rate changes, and take advantage of the available tax relief programs if you are eligible. Additionally, if you have concerns about your property's assessment, don't hesitate to explore the appeals process. It is your right to ensure fair and accurate taxation.

As you embark on your property ownership journey in Cuyahoga County, keep in mind that the property tax system, while complex, is designed to support the community and provide essential services. By understanding your rights and responsibilities, you can contribute to the vitality of the county while managing your tax obligations effectively.

How often are property tax rates updated in Cuyahoga County?

+

Property tax rates in Cuyahoga County are typically updated annually. Taxing authorities, such as cities and school districts, may adjust their rates based on their budget requirements and revenue needs.

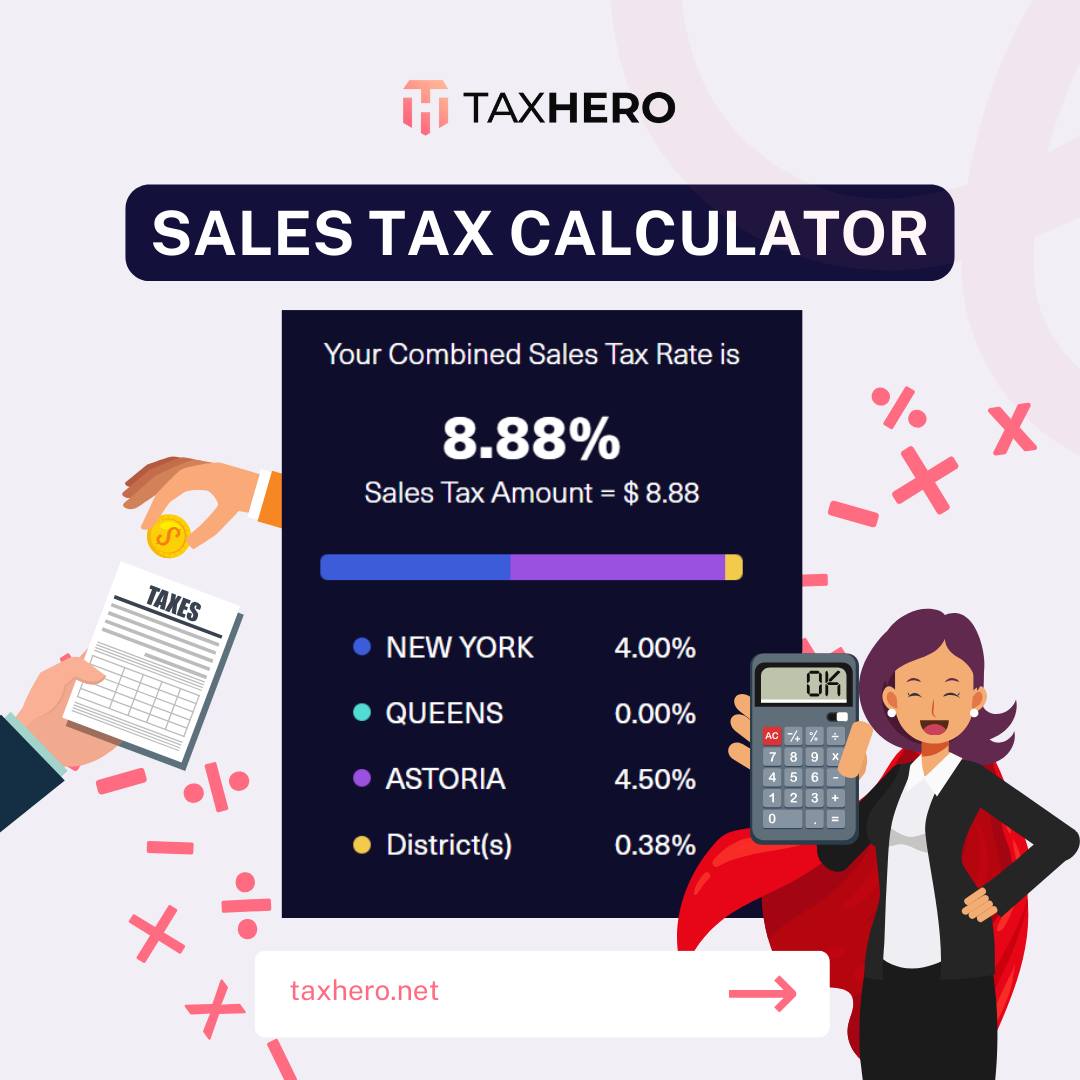

Are there any online tools available to estimate my property tax liability?

+

Yes, the Cuyahoga County Auditor’s Office provides an online tax estimator tool. This tool allows property owners to input their property’s assessed value and view an estimate of their tax liability based on the current tax rates. It’s a convenient way to get a rough estimate of your taxes.

Can I pay my property taxes online?

+

Absolutely! Cuyahoga County offers an online payment system through the Cuyahoga County Treasurer’s Office website. You can pay your property taxes securely and conveniently using a credit card, debit card, or electronic check. It’s a quick and efficient way to fulfill your tax obligations.

What happens if I fail to pay my property taxes on time?

+

If you fail to pay your property taxes by the due date, penalties and interest may be applied to your account. It’s important to stay current with your tax payments to avoid additional fees and potential legal consequences. The Cuyahoga County Treasurer’s Office can provide information on late payment policies and options.