Contra Costa Tax

In the vibrant county of Contra Costa, nestled within the beautiful state of California, tax matters are a multifaceted topic that warrants an in-depth exploration. With its diverse population, thriving businesses, and unique geographical features, Contra Costa presents a complex tax scenario that impacts residents, businesses, and investors alike. This comprehensive guide aims to demystify the tax landscape, offering a nuanced understanding of the various taxes levied in the county, their implications, and the strategies one can employ to navigate them effectively.

Understanding the Contra Costa Tax Ecosystem

The tax system in Contra Costa County is intricate, comprising a range of taxes designed to fund essential public services, infrastructure development, and community initiatives. These taxes are levied at various levels, including federal, state, and local authorities, each with its own set of rules and regulations. Understanding this ecosystem is crucial for individuals and businesses operating within the county to ensure compliance and optimize their financial strategies.

Federal Taxes

At the federal level, residents and businesses in Contra Costa are subject to the standard income tax system, with rates determined by the Internal Revenue Service (IRS). This includes personal income taxes, corporate taxes, and various other federal levies such as Social Security and Medicare taxes. The complexity arises from the multitude of tax brackets, deductions, and credits, which require careful consideration to maximize tax efficiency.

State Taxes

California, known for its progressive tax system, imposes a state income tax on individuals and businesses. The state tax rate in Contra Costa is aligned with the rest of California, with additional local taxes coming into play at the county level. These taxes fund a wide range of state services, including education, healthcare, and transportation infrastructure. Understanding the state tax landscape is crucial for residents and businesses to plan their financial strategies accordingly.

Local Taxes

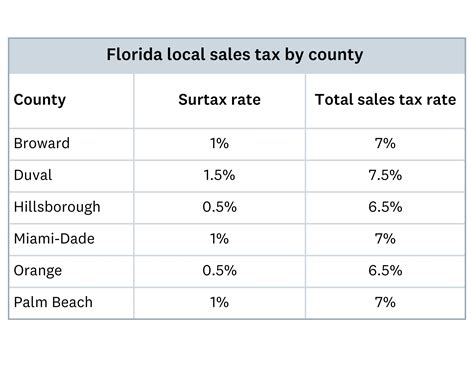

Contra Costa County, like many other counties in California, has its own set of local taxes to support county operations and specific community initiatives. These taxes can include property taxes, sales taxes, and various special assessments. The county’s property tax system, for instance, is based on the assessed value of real estate, with rates varying depending on the location and type of property. Sales taxes, on the other hand, are applied to retail transactions and contribute to the funding of local services.

Navigating the Contra Costa Tax Landscape

Navigating the Contra Costa tax landscape requires a strategic approach and a deep understanding of the various tax regulations. Here are some key considerations and strategies for individuals and businesses operating within the county:

Personal Income Tax Optimization

For individuals, optimizing personal income tax involves understanding the various deductions and credits available. This includes taking advantage of deductions for charitable contributions, mortgage interest, and state and local taxes (SALT). Additionally, individuals can explore tax-efficient investment strategies, such as contributing to tax-advantaged retirement accounts, to minimize their tax liability.

Business Tax Strategies

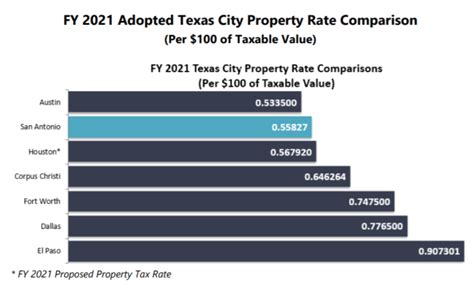

Businesses in Contra Costa face a unique set of tax considerations. Apart from federal and state taxes, they must navigate local taxes and fees. This includes sales taxes on goods and services, property taxes on commercial real estate, and potential business license fees. To optimize their tax position, businesses can consider tax-efficient business structures, such as limited liability companies (LLCs) or corporations, and explore tax incentives offered by the county or state for specific industries or initiatives.

Property Tax Management

Property owners in Contra Costa must navigate the county’s property tax system, which can be complex due to varying assessment values and tax rates. To effectively manage property taxes, owners can stay informed about assessment appeals processes, ensuring their property is accurately valued. Additionally, understanding the county’s tax abatement programs and exemptions can provide opportunities for tax savings.

Sales Tax Compliance

For businesses engaged in retail activities, sales tax compliance is a critical aspect of tax management. This involves understanding the county’s sales tax rates, ensuring proper registration and collection of sales taxes, and timely remittance to the appropriate authorities. Businesses can utilize sales tax software and tools to streamline this process and ensure compliance.

The Impact of Tax Policies on Contra Costa’s Economy

The tax policies in Contra Costa County play a significant role in shaping the local economy. The county’s tax system influences business growth, investment decisions, and the overall financial health of the community. Here’s a deeper look at the impact of tax policies:

Business Attractiveness

A competitive and fair tax system can make Contra Costa an attractive destination for businesses, fostering economic growth and job creation. The county’s tax policies, particularly those aimed at supporting specific industries or providing tax incentives, can encourage businesses to establish or expand their operations within the county. This, in turn, generates revenue and contributes to the overall economic vitality of the region.

Infrastructure Development

Tax revenues play a crucial role in funding essential infrastructure projects, such as road improvements, public transportation systems, and utility upgrades. By investing in these projects, the county can enhance its overall livability and competitiveness, attracting both residents and businesses.

Community Initiatives

Contra Costa’s tax system supports a range of community initiatives, from education and healthcare to environmental conservation and social services. These initiatives contribute to the overall well-being of the community, fostering a sense of belonging and enhancing the county’s reputation as a desirable place to live and work.

Future Implications and Trends

As Contra Costa County continues to evolve, its tax landscape is likely to undergo changes and adaptations. Here are some key trends and future implications to consider:

Technological Advancements

The increasing adoption of digital technologies in tax administration is likely to streamline processes and enhance compliance. This includes the use of online platforms for tax registration, filing, and payment, as well as the integration of data analytics for more efficient tax collection and auditing.

Policy Changes

Tax policies are subject to change, influenced by political shifts and economic conditions. Residents and businesses in Contra Costa should stay informed about potential policy changes, such as tax rate adjustments, new tax initiatives, or the expansion of tax incentives, to ensure they can adapt their financial strategies accordingly.

Economic Development Initiatives

Contra Costa County may continue to explore tax-related initiatives to support economic development and attract investment. This could include targeted tax incentives for specific industries, such as renewable energy or technology, or the establishment of tax-free zones to encourage business growth.

Conclusion

The Contra Costa tax landscape is a complex and dynamic environment that requires a nuanced understanding and strategic approach. By exploring the various taxes levied in the county, understanding their implications, and employing effective tax management strategies, individuals and businesses can navigate this landscape with confidence. As the county continues to evolve, staying informed about tax policies and trends will be crucial for financial success and contributing to the vibrant community of Contra Costa.

FAQ

How can I stay updated on tax policy changes in Contra Costa County?

+

Staying informed about tax policy changes is crucial for tax compliance and financial planning. You can subscribe to newsletters or alerts from the county’s tax department or local news outlets that cover tax-related updates. Additionally, attending community meetings or workshops hosted by the county can provide valuable insights into upcoming tax initiatives or changes.

Are there any tax incentives available for businesses in Contra Costa County?

+

Yes, Contra Costa County offers a range of tax incentives to support business growth and development. These incentives may include tax credits for job creation, research and development activities, or investments in renewable energy. It’s important to consult with a tax professional or review the county’s official website for the latest information on available incentives and eligibility criteria.

What are the key considerations for property owners regarding tax assessments in Contra Costa County?

+

Property owners in Contra Costa County should be aware of the annual tax assessment process and the potential for changes in property values. It’s important to review assessment notices carefully and understand the factors that influence property valuations. If a property owner believes their assessment is inaccurate, they can initiate an appeal process to challenge the assessed value.

How can businesses ensure sales tax compliance in Contra Costa County?

+

Sales tax compliance is essential for businesses operating in Contra Costa County. To ensure compliance, businesses should register with the appropriate tax authorities, collect and remit sales taxes accurately, and maintain proper records. Utilizing sales tax software or working with tax professionals can help streamline this process and minimize the risk of non-compliance.

What resources are available for individuals seeking tax assistance in Contra Costa County?

+

Contra Costa County offers various resources and support for individuals seeking tax assistance. This includes access to tax preparation workshops, free tax filing services for eligible individuals, and assistance from volunteer tax preparers during tax season. Additionally, the county’s tax department website often provides helpful guides and resources to navigate the tax landscape.