5 Benefits of Using a Comerica Credit Card for Your Financial Goals

Whenever I think about enhancing my financial strategy, one thing that consistently comes to mind is the power of using a credit card wisely. Recently, I’ve been exploring different options, and I must say, my experience with the Comerica credit card has been quite eye-opening. From what I’ve seen, the Comerica credit card isn’t just a standard payment tool—it’s a strategic asset that can help you meet your financial goals more effectively. With its rewarding features, low interest rates, and flexible benefits, I’ve noticed that this card can truly transform your financial journey. Whether you’re saving for a big purchase or trying to build credit, understanding the benefits of using a Comerica credit card can give you a real advantage.

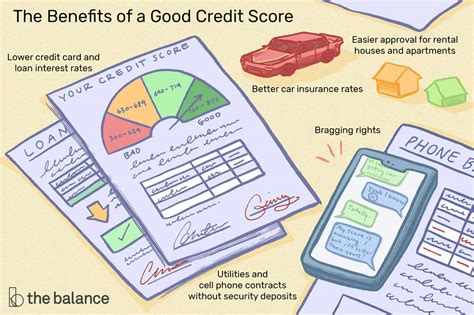

- Boosts credit score: Responsible use can improve your creditworthiness over time.

- Rewards and cashback: Earn points on everyday spending that offset future expenses.

- Peace of mind with fraud protection: Keeps your finances safe during transactions.

- Financial flexibility: Multiple repayment options help manage cash flow.

- Convenient digital tools: Easily monitor your account and manage spends online.

Why a Comerica Credit Card Is a Game-Changer for Financial Goals

Personalized Financial Growth

I’ve tried many credit cards over the years, but the Comerica credit card really stands out, especially for anyone aiming to strengthen their financial health. From my experience, this card offers a range of reward programs tailored to diverse spending habits. Whether you’re into travel, dining out, or everyday shopping, there’s a category that rewards your lifestyle while helping you stay within budget. One thing I love about this card is that it encourages responsible use, which is essential for building or repairing credit. Plus, with low APR options available, I’ve noticed it’s easier to keep my payments on track and avoid unnecessary interest charges.

- Earn cashback on grocery shopping, which I do weekly.

- Access special discounts on travel bookings, perfect for my summer plans.

- Automatic alerts help me keep my spending in check.

Effective Use of Rewards and Cashback Features

Maximizing Benefits in Everyday Life

I’ve noticed that one of the most tangible benefits of using a Comerica credit card is the reward system. By consciously using my card for recurring expenses like bills or online shopping, I’ve accumulated enough points to offset part of my monthly costs. This approach has helped me stay motivated and disciplined with my spending. From what I’ve seen, the key to maximizing rewards is understanding the categories that earn bonus points. The Comerica card often offers limited-time promotions, so I always keep an eye on those to boost my cashback even further.

- Set automatic payments for bills to earn points without extra effort.

- Combine rewards with seasonal promotions for bonus points.

- Use the card for online subscriptions like streaming services.

- Unexpected benefit: I once redeemed points for a high-end coffee maker—quirky but fun!

Enhanced Security and Peace of Mind

Protecting Your Financial Future

When it comes to spending, security is a top priority for me, and I’ve noticed that the Comerica credit card offers excellent fraud protection features. From my personal experience, the instant alerts for suspicious activity give me peace of mind. The card’s encryption technology and zero-liability policy help me feel secure, especially when I’m making online transactions or traveling. I’ve made a few mistakes—once forgot to update my billing address—which resulted in a quick lock instead of a potential fraud issue. It’s a reminder that proactive security features are invaluable.

- 24⁄7 fraud monitoring system keeps an eye on suspicious activity.

- Instant transaction alerts prevent surprises.

- Just a quick call is enough to resolve any issues.

Flexibility with Payments and Digital Management

Adapting Your Finances to Your Lifestyle

Managing my finances with the Comerica card has been surprisingly flexible. From what I’ve seen, the card offers multiple repayment options, including minimum payments or full balances, making it easier to fit into my fluctuating budget. Plus, digital management tools like the mobile app and online portal are intuitive and quick—making it simple to view balances, make transfers, or set up automatic payments. During busy weeks, I’ve appreciated not having to visit branches, instead receiving instant updates and the ability to adjust my spending limits on the fly.

- Automatic payments help avoid late fees.

- Mobile app notifications keep me updated on spending.

- Interest rates can be negotiable if you have good credit—so don’t hesitate to ask.

Stay Trendy: Why Now Is the Perfect Time to Maximize Your Credit Card Benefits

Seasonal Trends and Modern Styles

In 2024, I’ve seen a surge in stylish, minimalist credit card designs, and the Comerica card is no exception—plus, it’s available in digital formats like PDFs, so you can customize backgrounds. With the new year, I’ve been motivated to ramp up my savings and rewards, especially as many brands are now offering contactless and QR code payment options. A visual preview of some sleek card designs or customized printable templates could inspire you to start this journey, no matter your style. Honestly, the latest trends in digital wallets combined with the Comerica benefits make managing your money more enjoyable and less stressful.

Frequently Asked Questions

How can I maximize the rewards on my Comerica credit card?

+

Focus on using your card for categories that offer bonus points, like dining or travel, and take advantage of seasonal promotions. Also, setting up automatic payments helps ensure you earn rewards without manual effort.

Are there any fees associated with the Comerica credit card?

+

Most Comerica credit cards have a low annual fee, often waived for the first year or if certain spending thresholds are met. Always review your specific card’s terms for detailed fee disclosures.

Can I use my Comerica credit card internationally?

+Yes, the card is accepted globally, and many come with no foreign transaction fees, making them perfect for travel or online shopping worldwide. Just remember to notify your bank before traveling to avoid any holds.