City Of Sacramento Sales Tax

The sales tax in the City of Sacramento, California, is an essential component of the city's revenue stream and a key consideration for both residents and businesses operating within its boundaries. The tax is a percentage-based levy applied to the sale of goods and services, contributing significantly to the city's overall economic health and infrastructure development.

This article aims to provide a comprehensive guide to the City of Sacramento's sales tax, exploring its rates, applicability, collection process, and the benefits it brings to the community. By understanding the intricacies of this tax, businesses can navigate their financial obligations effectively, while residents can make informed decisions about their purchases and the impact on their local economy.

Understanding Sacramento’s Sales Tax Structure

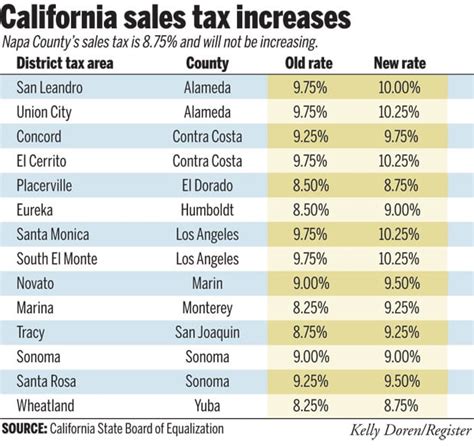

Sacramento’s sales tax comprises both state and local components, with the state tax rate serving as the foundation upon which additional local taxes are layered. As of [Current Date], the combined sales tax rate in Sacramento stands at [Combined Rate]%, which includes the California state sales tax of [State Rate]% and a local sales tax of [Local Rate]%.

The local sales tax is further divided into a city sales tax of [City Rate]% and a special district tax of [Special District Rate]%, allocated to specific purposes such as transportation infrastructure or environmental initiatives. This nuanced structure ensures that the tax revenue is directed toward various essential services and projects, catering to the diverse needs of Sacramento's residents and businesses.

Sales Tax Exemptions and Special Considerations

While the sales tax in Sacramento applies to a broad range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. For instance, certain groceries and prescription drugs are exempt from sales tax, providing a much-needed financial relief to Sacramento’s residents. Additionally, certain types of industrial machinery and equipment used in manufacturing processes are also exempt, encouraging economic growth and development.

Furthermore, Sacramento offers a sales tax holiday during specific periods, typically around major shopping events like back-to-school or Black Friday. During these periods, certain items such as clothing, school supplies, and electronics are exempt from sales tax, encouraging consumer spending and providing a temporary boost to the local economy.

| Category | Sales Tax Treatment |

|---|---|

| Groceries | Exempt |

| Prescription Drugs | Exempt |

| Clothing (during sales tax holiday) | Exempt |

| School Supplies (during sales tax holiday) | Exempt |

| Industrial Machinery | Exempt |

The Impact of Sales Tax on Sacramento’s Economy

The sales tax in Sacramento plays a pivotal role in the city’s economic landscape, providing a steady stream of revenue for essential services and infrastructure projects. This revenue is crucial for maintaining the city’s public transportation systems, parks, and recreational facilities, as well as funding vital community programs and initiatives.

Investing in Community Development

A significant portion of the sales tax revenue is allocated towards community development projects, which encompass a wide range of initiatives aimed at enhancing the quality of life for Sacramento’s residents. These projects include the renovation and maintenance of public spaces, support for local arts and culture, and the development of affordable housing initiatives.

For instance, the Sacramento Arts Commission receives funding through sales tax revenue, enabling it to support and promote local artists, organize community art events, and foster an appreciation for the arts among Sacramento's residents. Similarly, the Sacramento Housing and Redevelopment Agency utilizes sales tax funds to develop and rehabilitate housing for low- and moderate-income families, contributing to the city's social and economic equity.

Supporting Local Businesses and Job Creation

The sales tax also plays a crucial role in fostering a business-friendly environment within Sacramento, which in turn drives economic growth and job creation. A portion of the sales tax revenue is dedicated to business assistance programs, offering resources and support to local entrepreneurs and small businesses.

These programs can include start-up grants, business development workshops, and technical assistance to help businesses navigate the complexities of starting and growing a business. By supporting local businesses, Sacramento ensures a vibrant and resilient economy, which not only benefits the business owners but also creates job opportunities for residents, contributing to the overall prosperity of the city.

Compliance and Collection Process

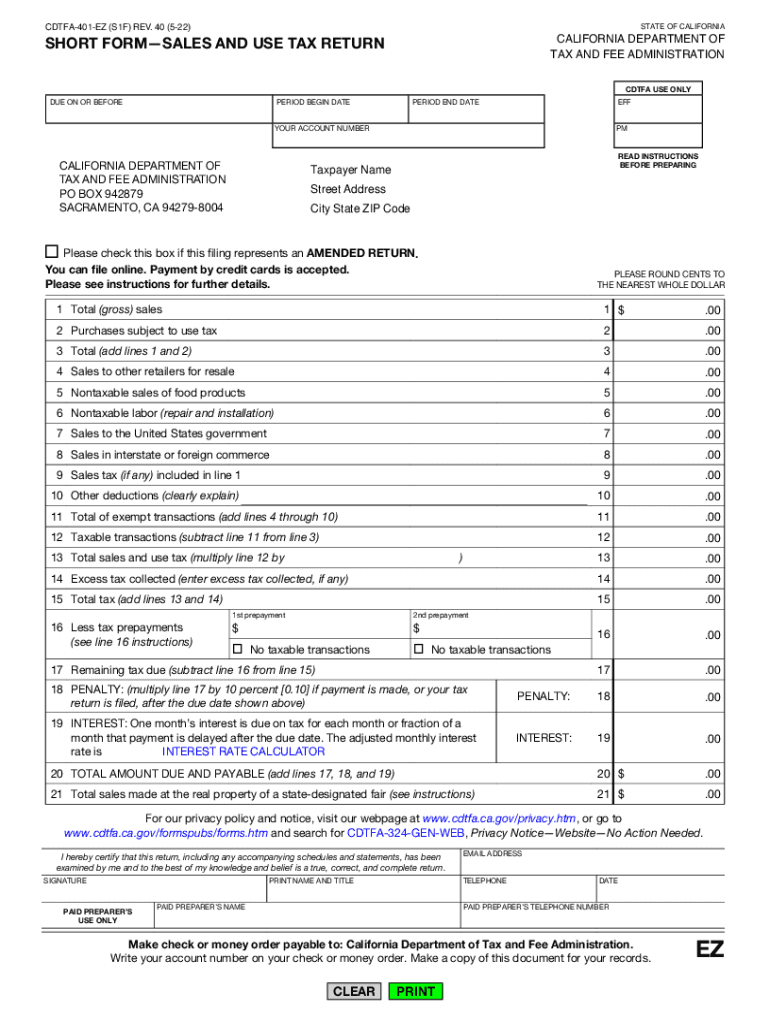

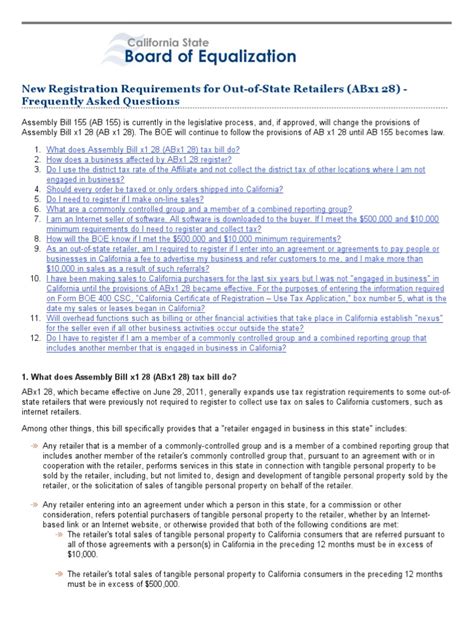

Ensuring compliance with Sacramento’s sales tax regulations is a critical responsibility for businesses operating within the city. The California Department of Tax and Fee Administration (CDTFA) is the primary authority overseeing sales tax collection and compliance.

Registration and Reporting

Businesses are required to register for a seller’s permit with the CDTFA, which authorizes them to collect and remit sales tax on behalf of the state and local governments. This registration process involves providing detailed information about the business, its location, and the types of goods and services it offers.

Once registered, businesses must collect sales tax from customers at the point of sale, adding the tax to the purchase price of the goods or services. The collected tax must then be remitted to the CDTFA on a regular basis, typically on a monthly or quarterly basis, depending on the business's sales volume and tax liability.

Audits and Enforcement

The CDTFA conducts periodic sales tax audits to ensure compliance and identify any instances of non-compliance or tax evasion. These audits involve a thorough examination of a business’s sales records, tax returns, and financial statements to verify the accuracy of reported sales and tax payments.

In cases of non-compliance, the CDTFA has the authority to impose penalties and interest on the outstanding tax liability, which can significantly increase the total amount owed. Therefore, it is imperative for businesses to maintain accurate records, report sales tax accurately, and remit payments promptly to avoid any legal and financial repercussions.

Future Implications and Potential Changes

As Sacramento’s economy continues to evolve and adapt to changing circumstances, the sales tax landscape may also undergo transformations to meet emerging needs and challenges.

Potential Rate Adjustments

While the current sales tax rate in Sacramento is carefully calibrated to balance the needs of the community and the competitiveness of local businesses, there may be occasions when rate adjustments are considered.

For instance, if the city faces increased financial pressures due to rising costs or unforeseen circumstances, such as a natural disaster or a significant decline in revenue from other sources, the sales tax rate might be temporarily increased to generate additional funds. Conversely, if the economy is particularly robust and the city has a surplus, the rate might be lowered to provide a boost to consumer spending and business growth.

Technological Innovations in Tax Collection

The world of tax collection is also evolving with the advent of new technologies, and Sacramento is likely to embrace these innovations to streamline the tax collection process and enhance compliance.

One potential development is the implementation of sales tax automation software, which can integrate with a business's accounting systems to automatically calculate, collect, and remit sales tax. This technology not only reduces the administrative burden on businesses but also minimizes the risk of errors and non-compliance.

Community Engagement and Tax Reform

Lastly, as Sacramento’s community continues to grow and diversify, there may be calls for tax reform to ensure that the sales tax system remains fair and equitable for all residents and businesses.

Community engagement and public consultations could play a vital role in shaping future tax policies, ensuring that any changes reflect the needs and values of Sacramento's diverse population. This inclusive approach to tax reform can foster a sense of ownership and trust in the tax system, encouraging greater compliance and a stronger sense of community.

What happens if a business fails to register for a seller’s permit or collect sales tax correctly?

+Businesses that fail to register or collect sales tax correctly may face significant penalties and interest charges. The California Department of Tax and Fee Administration (CDTFA) has the authority to impose these penalties, which can quickly escalate the total amount owed. Therefore, it is crucial for businesses to understand their sales tax obligations and seek professional guidance if needed.

Are there any sales tax incentives or rebates available for businesses in Sacramento?

+While there may be specific sales tax incentives or rebates available for certain industries or under special circumstances, these are relatively rare. The primary focus of sales tax in Sacramento is on ensuring a fair and equitable system for all businesses and consumers. However, it is always advisable for businesses to stay informed about any potential incentives or rebates that may be applicable to their operations.

How does Sacramento’s sales tax compare to other major cities in California or the United States?

+Sacramento’s sales tax rate is generally in line with other major cities in California, although there can be slight variations due to local taxes. When compared to other states in the United States, California’s sales tax rate, including local taxes, is on the higher end of the spectrum. However, it’s important to note that sales tax rates can vary significantly across different states, with some having no sales tax at all.