City Of Parma Tax

Welcome to an in-depth exploration of the City of Parma's tax landscape, a topic of great interest to residents and businesses alike. Parma, Ohio, situated in Cuyahoga County, is known for its vibrant community, rich history, and diverse economic landscape. The city's tax system plays a crucial role in shaping its economic environment and the lives of its residents.

This comprehensive guide aims to shed light on the various aspects of the City of Parma's tax system, providing an insightful and detailed analysis. From property taxes to income tax rates and business-specific considerations, we will delve into the specifics, offering a clear understanding of Parma's tax obligations and their implications.

Unraveling the City of Parma’s Tax System

The tax system in Parma is a multifaceted structure, designed to support the city’s operations and infrastructure development while ensuring fairness and transparency. Let’s break down the key components and explore their implications.

Property Taxes: A Pillar of Parma’s Revenue

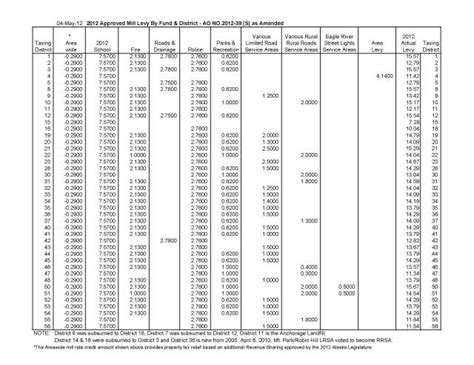

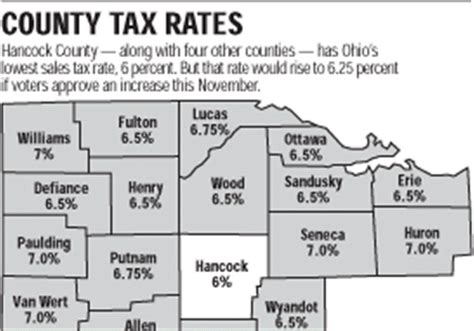

Property taxes form a significant portion of the City of Parma’s revenue stream. These taxes are assessed on real estate properties within the city limits, including residential, commercial, and industrial properties. The tax rate is determined by the Cuyahoga County Auditor and is applied uniformly across the county.

For the year 2023, the effective property tax rate in Parma is 2.46%, which is calculated as the millage rate of 100.56 divided by 4080 (the number of mills in one percent). This rate is applied to the assessed value of a property to determine the annual tax liability.

For instance, consider a residential property in Parma with an assessed value of $150,000. The property tax for this home would be calculated as follows:

| Assessed Value | $150,000 |

|---|---|

| Effective Tax Rate | 2.46% |

| Property Tax | $3,690 |

It's important to note that the assessed value of a property is not necessarily its market value. In Parma, properties are typically assessed at 35% of their estimated market value. So, in the above example, the property's estimated market value would be $428,571 (150,000 / 0.35). This assessment is crucial as it determines the tax liability for the property owner.

Property taxes in Parma are collected by the Cuyahoga County Treasurer, who is responsible for billing and collecting taxes on behalf of the city and other taxing districts within the county. These taxes are a vital source of revenue for the city, funding essential services like public safety, education, and infrastructure development.

Income Taxes: A Snapshot of Parma’s Earnings

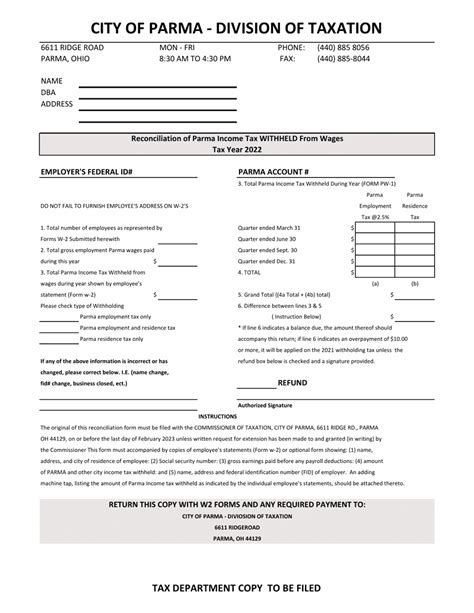

In addition to property taxes, the City of Parma levies an income tax on the earnings of its residents and businesses. This tax is a critical revenue source for the city, supporting its various operations and initiatives.

As of 2023, the income tax rate in Parma is set at 2.0% for residents and businesses. This rate is applied to the net profits or earnings of individuals and businesses operating within the city limits. It's important to note that Parma's income tax is in addition to federal and state income taxes, creating a cumulative tax burden.

For instance, consider a resident of Parma who earns an annual salary of $60,000. The income tax liability for this individual would be calculated as follows:

| Annual Income | $60,000 |

|---|---|

| Income Tax Rate | 2.0% |

| Income Tax Liability | $1,200 |

Businesses operating in Parma, whether sole proprietorships, partnerships, or corporations, are also subject to the 2.0% income tax rate. This tax is calculated based on the net profits of the business for the tax year.

Parma's income tax system is designed to be fair and equitable, ensuring that all residents and businesses contribute to the city's prosperity. The tax revenue generated is a crucial part of the city's budget, funding essential services and driving economic development initiatives.

Business Taxes: Supporting Parma’s Economic Engine

The City of Parma recognizes the vital role that businesses play in its economic ecosystem. To support and encourage business growth, Parma offers a range of tax incentives and programs tailored to businesses operating within its boundaries.

One notable tax incentive is the Business Enterprise Tax Credit, which offers a 50% tax credit on income taxes for businesses that create new jobs within the city. This credit is available for up to 5 years, providing a significant incentive for businesses to invest in Parma's workforce and economy.

Additionally, Parma offers a Business Retention and Expansion Program, designed to support existing businesses in their growth and expansion plans. This program provides a range of resources and incentives, including tax abatements, to help businesses thrive and create more opportunities for the community.

For instance, a manufacturing business in Parma that plans to expand its operations and create 20 new jobs could be eligible for a significant tax credit under the Business Enterprise Tax Credit program. This credit could substantially reduce the business's tax liability, providing a strong incentive for the expansion.

Special Assessments and Fees: Funding City Projects

In addition to the taxes mentioned above, the City of Parma may impose special assessments and fees to fund specific projects or services. These assessments and fees are typically tied to a particular benefit received by the taxpayer, such as improved infrastructure or enhanced services.

For example, a sidewalk repair program may be funded through a special assessment levied on the properties adjacent to the repaired sidewalks. This assessment is based on the perceived benefit of the improved sidewalks to the property owners.

Similarly, the city may charge user fees for specific services, such as trash collection or recycling programs. These fees are designed to cover the costs of providing these services to residents and businesses.

It's important for residents and businesses to understand these special assessments and fees, as they contribute to the overall tax burden in Parma. These funds are crucial for maintaining and improving the city's infrastructure and services, ensuring a high quality of life for its residents and a competitive environment for businesses.

The Impact of Parma’s Tax System: A Comprehensive Analysis

The City of Parma’s tax system is a complex interplay of various taxes, incentives, and assessments, each designed to serve a specific purpose. Let’s explore the broader implications and impacts of this tax landscape on Parma’s residents, businesses, and overall economic health.

Residential Tax Burden: A Balancing Act

For residents of Parma, the tax system presents a unique set of considerations. The combination of property and income taxes can significantly impact household budgets, especially for those on fixed incomes or with limited financial means.

The effective property tax rate, currently at 2.46%, can be a substantial expense for homeowners, particularly those with higher-valued properties. This tax is often a fixed cost, impacting the overall affordability of homeownership in Parma.

On the other hand, the income tax rate of 2.0% is relatively moderate compared to some other cities in the region. This rate, while still a significant consideration, provides a more flexible tax burden as it is applied to earnings, allowing residents to adjust their tax liability through strategic financial planning.

To illustrate, consider a retired couple living in Parma with a fixed income of $40,000 per year. Their property tax liability, assuming an assessed value of $100,000, would be $2,460 annually. This represents a significant portion of their income, highlighting the importance of managing property taxes effectively.

For working residents, the income tax provides an opportunity for tax planning. Strategies such as maximizing tax-advantaged retirement contributions or taking advantage of tax deductions and credits can help reduce the overall tax burden. Understanding and utilizing these strategies can significantly impact a resident's financial well-being.

Business Growth and Tax Incentives

The City of Parma’s tax system is carefully designed to foster business growth and development. The tax incentives and programs, such as the Business Enterprise Tax Credit and the Business Retention and Expansion Program, are strategic tools to attract and retain businesses.

These incentives provide a significant advantage to businesses operating in Parma, offering a competitive edge in terms of tax liability. For instance, the 50% tax credit on income taxes for job creation can substantially reduce a business's tax burden, making Parma an attractive location for business expansion.

Furthermore, the city's focus on supporting existing businesses through the Business Retention and Expansion Program demonstrates a commitment to long-term economic growth. By offering resources and incentives for businesses to thrive, Parma ensures a robust and resilient business community.

The impact of these incentives is evident in Parma's thriving business landscape. The city's economic development efforts have led to a diverse and vibrant business ecosystem, contributing to job creation and economic prosperity.

Infrastructure Development and Tax Revenue

The tax revenue generated by the City of Parma plays a crucial role in funding essential services and infrastructure development. From public safety and education to road maintenance and recreational facilities, tax dollars are invested in enhancing the quality of life for residents and creating a competitive business environment.

Property taxes, in particular, are a significant source of revenue for these initiatives. The funds collected are distributed to various departments and agencies, ensuring that the city's infrastructure and services are well-maintained and up-to-date.

For instance, the sidewalk repair program, funded through special assessments, ensures that Parma's sidewalks are safe and accessible for all residents. This program not only improves the city's aesthetics but also enhances the overall safety and mobility of the community.

Similarly, user fees for services like trash collection and recycling contribute to the city's efforts to maintain a clean and environmentally conscious community. These fees allow the city to provide these essential services at a reasonable cost, ensuring a high standard of living for residents.

Future Outlook: Navigating Parma’s Tax Landscape

As the City of Parma continues to evolve and grow, its tax system will play a pivotal role in shaping its future. The careful management and strategic use of tax revenue will be crucial in maintaining a vibrant community and a competitive business environment.

Tax Policy and Economic Development

The city’s tax policies will continue to be a key driver of economic development. By offering competitive tax rates and incentives, Parma can attract new businesses and encourage existing businesses to expand. This influx of investment will create jobs, boost the local economy, and contribute to the city’s overall prosperity.

Furthermore, the city's commitment to supporting businesses through programs like the Business Retention and Expansion Program will be vital in ensuring the long-term success and sustainability of Parma's business community. By providing resources and incentives, the city can help businesses navigate challenges and seize opportunities, fostering a resilient and innovative business ecosystem.

Tax Equity and Community Well-Being

Ensuring tax equity will be a critical focus for Parma’s leadership. The city must strive to create a tax system that is fair and balanced, considering the needs and abilities of all residents and businesses. This includes regular reviews and adjustments to tax rates and incentives to ensure they remain competitive and equitable.

Additionally, the city should explore strategies to mitigate the tax burden on lower-income residents and businesses. This could involve targeted tax relief programs or initiatives to enhance financial literacy and tax planning resources for residents. By doing so, Parma can ensure that its tax system supports the financial well-being and stability of its community.

Infrastructure Investment and Tax Revenue

The effective utilization of tax revenue for infrastructure investment will be a key priority for Parma. As the city continues to grow and develop, its infrastructure needs will evolve. The city must strategically allocate tax revenue to ensure that its infrastructure remains modern, efficient, and capable of supporting a growing population and economy.

This includes investing in transportation networks, green spaces, and recreational facilities to enhance the quality of life for residents. Additionally, the city should focus on sustainable infrastructure practices, ensuring that its investments are environmentally conscious and future-proof.

Conclusion: A Comprehensive Tax Strategy for Parma’s Success

The City of Parma’s tax system is a critical component of its economic and community development strategy. By offering a balanced and competitive tax landscape, Parma can attract businesses, support its residents, and fund essential services and infrastructure.

As Parma navigates the complexities of its tax system, it must remain committed to transparency, fairness, and innovation. By continually reviewing and adjusting its tax policies, the city can ensure that its tax system remains a powerful tool for economic growth and community well-being.

This comprehensive guide has provided an in-depth look at Parma's tax landscape, offering insights and strategies for residents and businesses alike. As we move forward, let's continue to explore and discuss the implications and opportunities presented by Parma's tax system, shaping a brighter and more prosperous future for our community.

How often are property tax assessments conducted in Parma?

+

Property tax assessments in Parma are typically conducted every three years. However, significant changes to a property, such as additions or improvements, may trigger a reassessment outside of this cycle.

Are there any tax incentives for renewable energy projects in Parma?

+

Yes, Parma offers a Property Tax Abatement program for residential and commercial properties that install renewable energy systems. This program provides a 100% tax abatement on the increased property value resulting from the installation of these systems.

What is the process for appealing a property tax assessment in Parma?

+

If you believe your property tax assessment is inaccurate, you can file an appeal with the Cuyahoga County Board of Revision. The process involves submitting documentation to support your claim, and a hearing may be scheduled to review your appeal.