Car Sale Tax

Car sales tax is a significant consideration when purchasing a vehicle, as it can significantly impact the overall cost and financial planning for car buyers. This article aims to provide an in-depth analysis of car sale tax, offering valuable insights for individuals navigating the complex world of automotive purchases. We will delve into the intricacies of car sale tax, exploring its various aspects, implications, and strategies to ensure an informed and financially sound decision-making process.

Understanding Car Sale Tax

Car sale tax, also known as vehicle sales tax, is a mandatory fee levied on the purchase of a new or used car. It is an essential revenue stream for governments, contributing to the overall tax system and public services. The tax is typically calculated as a percentage of the vehicle’s purchase price, and it can vary significantly depending on the jurisdiction and specific tax regulations.

The complexity of car sale tax lies in its diverse nature across different regions. Each state, county, or municipality may have its own set of rules and rates, making it crucial for buyers to understand the specific tax requirements in their area. Failure to comply with these regulations can lead to legal consequences and additional financial burdens.

To navigate this landscape effectively, car buyers must familiarize themselves with the following key aspects of car sale tax:

- Tax Rates and Calculations: Understanding the applicable tax rate and how it is calculated is essential. Some jurisdictions may have a flat rate, while others may use a progressive scale based on the vehicle's value.

- Exemptions and Deductions: Certain vehicles or circumstances may qualify for tax exemptions or deductions. For instance, electric or hybrid vehicles often enjoy reduced tax rates to encourage environmentally friendly choices.

- Registration and Titling Fees: In addition to sales tax, buyers should be aware of other associated fees, such as registration and titling costs. These fees are often paid concurrently with the sales tax and can further impact the overall expense.

- Timing and Payment Options: The timing of tax payment can vary. Some states require payment at the time of purchase, while others allow for deferred payment plans. Understanding these options can help buyers manage their cash flow effectively.

- Online vs. In-Person Purchases: The method of purchase can influence tax obligations. Online purchases may involve different tax considerations compared to in-person transactions, so it's essential to research and plan accordingly.

The Impact of Car Sale Tax on Consumers

Car sale tax has a direct and substantial impact on consumers, affecting their financial decisions and overall experience in the automotive market. Here’s a closer look at how it influences various aspects of car ownership:

Budgeting and Financial Planning

Car sale tax plays a pivotal role in determining the overall cost of a vehicle. When budgeting for a car purchase, buyers must account for not only the sticker price but also the additional tax expense. This can significantly increase the total outlay, especially for high-value vehicles.

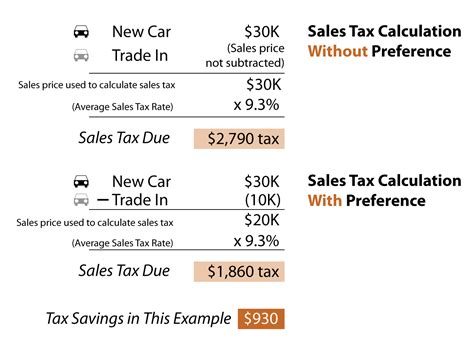

Consider the following example: A buyer plans to purchase a car with a base price of $30,000. If the applicable sales tax rate is 7%, the tax amount would be $2,100. Thus, the total cost of the vehicle would be $32,100, a substantial increase from the initial budget.

Value for Money and Negotiation Strategies

The presence of car sale tax influences buyers’ perceptions of value for money. A higher tax rate can make a vehicle appear less affordable, even if its base price remains competitive. As a result, buyers often negotiate and compare offers across different dealerships to find the best deal, considering not just the vehicle’s price but also the associated tax implications.

For instance, a buyer might opt for a slightly higher-priced vehicle from a dealer offering a lower tax rate, as it could result in a more favorable overall cost.

Incentives and Rebates

Car manufacturers and dealerships often use incentives and rebates to attract customers. These offers can offset the impact of sales tax, making vehicles more accessible. Buyers should be vigilant in seeking out such promotions, as they can significantly reduce the total expense.

Alternative Purchase Options

The burden of car sale tax may prompt buyers to explore alternative purchasing options. For example, leasing a vehicle instead of buying it outright can sometimes be a more cost-effective choice, especially for those who don’t intend to keep the car for an extended period.

Strategies for Navigating Car Sale Tax

Navigating the complexities of car sale tax requires a strategic approach. Here are some key strategies to consider when preparing for a vehicle purchase:

Research Local Tax Rates and Regulations

Understanding the specific tax rates and regulations in your area is fundamental. Research the applicable sales tax for vehicles and any potential exemptions or deductions. This knowledge will help you estimate the tax accurately and plan your budget accordingly.

For instance, if you reside in a state with a higher sales tax rate, you might consider purchasing a vehicle in a neighboring state with a lower rate, provided the difference in tax expense outweighs the additional travel costs.

Explore Tax-Saving Opportunities

Seek out tax-saving opportunities to reduce the overall tax burden. These may include taking advantage of incentives, rebates, or tax credits offered by manufacturers or government programs. Staying informed about such opportunities can significantly impact your total expense.

Consider the example of a state-sponsored program offering a tax credit for the purchase of electric vehicles. By opting for an eligible vehicle, buyers can reduce their tax liability, making the purchase more affordable and environmentally conscious.

Timing Your Purchase

The timing of your vehicle purchase can influence the tax you pay. Some jurisdictions offer tax breaks or incentives during specific periods, such as tax-free weekends or holiday sales. Planning your purchase to align with these events can result in significant savings.

Additionally, consider the impact of timing on your financial situation. For instance, purchasing a vehicle at the end of a financial year may allow you to claim tax deductions or utilize year-end discounts.

Negotiate with Dealers

When negotiating with dealerships, consider not just the vehicle’s price but also the tax implications. Dealers often have flexibility in negotiating the final price, which can indirectly impact the tax amount. Aim for a comprehensive deal that takes into account both the base price and the associated tax.

For example, a dealer might offer a discounted price on a vehicle, which, when combined with a lower sales tax rate, results in a more attractive overall package.

Conclusion: Empowering Consumers

Car sale tax is a critical aspect of the automotive purchasing process, influencing buyers’ decisions and experiences. By understanding the intricacies of car sale tax, consumers can make informed choices, optimize their financial strategies, and navigate the market effectively.

This article has provided a comprehensive guide to car sale tax, offering valuable insights and strategies for buyers. By staying informed and proactive, individuals can ensure that their vehicle purchases are not only satisfying but also financially sound.

How is car sale tax calculated?

+Car sale tax is typically calculated as a percentage of the vehicle’s purchase price. The specific rate varies depending on the jurisdiction, and it may be a flat rate or a progressive scale based on the vehicle’s value. It’s essential to check the applicable rate in your area to estimate the tax accurately.

Are there any tax exemptions for car purchases?

+Yes, certain vehicles or circumstances may qualify for tax exemptions or deductions. For example, electric or hybrid vehicles often enjoy reduced tax rates to encourage environmentally friendly choices. Additionally, some states offer tax breaks for specific vehicle types or purchases made during certain periods.

Can I negotiate the car sale tax amount with the dealer?

+The car sale tax amount is generally set by the government and cannot be directly negotiated with the dealer. However, when negotiating the vehicle’s price, keep in mind that a lower purchase price can indirectly reduce the tax amount. Aim for a comprehensive deal that considers both the base price and the associated tax implications.

Are there any online resources to help calculate car sale tax?

+Yes, there are several online calculators and tools available that can help estimate the car sale tax based on your location and the vehicle’s purchase price. These resources can provide a quick and convenient way to get an estimate of the tax you may owe. However, it’s always recommended to verify the information with official sources or consult a tax professional for accurate calculations.